OGFJ100P company update

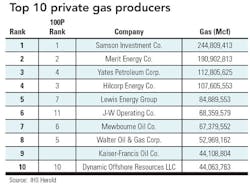

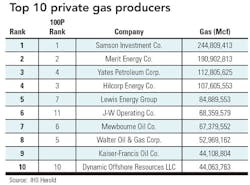

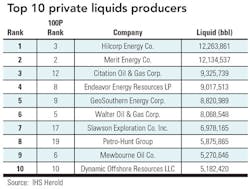

Independent research firm IHS Herold Inc. has provided OGFJ with updated production data for our periodic ranking of US-based private E&P companies. The rankings provided by IHS are based on operated production only within the United States.

Acquisitions

A large deal took place in the private sector since the January installment of the OGFJ100P. Greenwood Village, Colorado-based Cordillera Energy Partners III LLC agreed to be acquired by Houston-based Apache Corp. for $2.85 billion.

Privately-held Cordillera ranks No. 82 in this installment of the OGFJ100P with substantial operations that include approximately 254,000 net acres in the Granite Wash, Tonkawa, Cleveland, and Marmaton plays in western Oklahoma and the Texas Panhandle.

In addition to the 254,000 net acres in liquids-rich plays in the Anadarko Basin, Cordillera offers net production of 18,000 barrels of oil equivalent per day, proved reserves of 71.5 million boe, and 14,000 potential drilling locations.

The sellers, including EnCap Investments, other institutional investors and Cordillera management will receive approximately $600 million in Apache common stock subject to customary lock-up provisions. The balance of the consideration, $2.25 billion, will be funded with debt.

"This transaction presents a tremendous opportunity for Apache to combine the Cordillera assets with its legacy western Anadarko Basin position, creating a platform for a multi-decade development program in some of the most economic, oil- and liquids-rich gas targets in the onshore United States," said George H. Solich, Cordillera's president and CEO. "The combination is an excellent outcome for the Cordillera shareholders. We are taking a meaningful amount of the consideration in Apache shares, reflecting our confidence that the quality of the asset base will continue to yield economic growth in production and cash flow for years to come."

Cordillera will continue to acquire acreage in the area on Apache's behalf through closing, which is expected to occur on April 30.

This is the third iteration of Cordillera Energy Partners, led by George H. Solich, president and CEO, and his senior management team. Cordillera III was formed in March 2007 with equity capitalization from EnCap Investments LP and 20 institutional and individual investors. Upon completion of the transition, the Cordillera team plans to form another domestic venture.

Jefferies & Company Inc. and JP Morgan Securities LLC acted as financial advisors to Cordillera on this transaction, while Andrews Kurth LLP and Thompson & Knight LLP acted as the company's legal advisors.

In another large transaction, privately-held Dynamic Offshore Resources LLC agreed in February to be acquired by SandRidge Energy Inc. for $1.275 billion consisting of roughly $680 million in cash and nearly 74 million shares of SandRidge common stock valued at $8.02 per share.

Houston-based Dynamic Offshore comes in at No. 10 in total production in this month's installment of the OGFJ100P as well as No. 10 for both gas and liquids production. These oil rich assets will add reserves, production, and cash flow at an attractive valuation to SandRidge, whose three-year plan is to triple EBITDA and double oil production while lowering its debt to EBITDA ratio.

Dynamic operates primarily in water depths of less than 300 feet and with production numbers at the time of the acquisition announcement coming in close to 25 Mboed. The company's year-end 2011 proved reserves were reported as 62.5 MMboe and valued at nearly $1.9 billion using SEC net present value discounted at 10% (PV-10). Of these reserves, 80% of the value and the quantity are proved developed. Approximately 50% of Dynamic's current production and proved reserves consists of oil.

Tom L. Ward, chairman and CEO of SandRidge, commented, "The value of this acquisition will be evident immediately in our results. We are acquiring these assets for less than PV-10 of the proved developed reserves and at just over $50,000 per flowing barrel. Additionally, we expect these operations to contribute significant free cash flow in excess of the anticipated annual drilling and recompletion capital budget of $200 million."

Dynamic is represented by Vinson & Elkins LLP. The transaction is expected to close during the second quarter of 2012.

Click here to download the pdf of the "2011 Year-to-date production ranked by BOE"

Click here to download the pdf of the "2011 Year-to-date production - alphabetical listing"

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com