Current state of the capital markets

Bill Boyar, Boyar Miller, Houston

Cliff Atherton, GulfStar Group, Houston

With the ink on the 2012 election returns beginning to dry, many people are questioning what will be the impact of President Barack Obama's reelection and unchanged control of the Senate and House of Representatives on the energy industry capital markets. What lies ahead in the public capital markets for private equity and M&A? What can we expect from the providers of senior and mezzanine debt? These questions lie at the root of any conversations about growth in the energy sector in 2013.

Public capital markets

The public capital markets have not been favorable for the large-cap diversified energy companies over the last 18 months, and with the continuation of Obama's policies, there is not much reason for optimism. Stock price performance for selected large-cap diversifieds, mid- and small-cap service companies, and land drillers have declined precipitously over the past 18 months. The only sectors that have had stable stock price performance during this period are the large- and mid-cap manufacturers. With the current price of oil and gas and the sliding rig count, these trends will likely continue into Obama's second term.

Capital raised in the public markets reflects similar conditions. In the E&P sector during 2012, companies raised a total of $3 billion in nine total transactions, as compared to $3.3 billion in 20 transactions during 2011. Only one oilfield service company raised capital in 2012, as compared to 2011, during which three companies raised an aggregate of $380 million.

The real action took place in midstream master limited partnerships (MLPs), which raised $1.5 billion in 2012 and $4.35 billion in 2011. However, without considering the $2.8 billion offering by Kinder Morgan in 2011, there were only six transactions for a total of $1.5 billion. No upstream MLPs raised public market capital in 2012. This trend can be expected to continue in 2013: limited availability of capital in the public market for energy companies other than midstream MLPs.

Private equity

The substantial overhang of uninvested private equity commitments has driven substantial private equity activity and will likely continue to do so over the next 12 months. With more than $400 billion of capital, representing approximately $1 trillion of transaction capacity, available to PE firms at risk of losing commitments, sponsors are actively seeking investment opportunities. These include upstream, midstream, downstream, and service, with a recent shift in focus from upstream to midstream and downstream deals.

Healthy companies with strong management teams are attractive targets for private equity investors looking to get capital invested. And while public company enterprise values have declined from 2011 to 2012, multiples for middle-market companies and enterprise values have held steady. And for companies in the $100-250 million range, multiples and enterprise values have actually slightly increased from 2011 to 2012. This has resulted somewhat from the pressure on PE sponsors to get capital invested, combined with the substantial increase in the competition for deals. As a result it appears as though 2013 will continue to be an attractive time to sell or recapitalize middle market companies by accessing private equity.

M&A

The falling rig count, the slight decline in oil prices and the continued softness in natural gas prices is causing a slowdown in E&P activity. The recent surge of drilling activity in areas where there is no transportation infrastructure has redirected investment activity to midstream and away from upstream and services. In fact, according to a recent PwC report, 55% of all M&A deals in the second quarter of this year were midstream deals, with a total value of $15.8 billion (out of a total of $28.5 billion). This is up 200% compared to the second quarter of 2011.

Senior and mezzanine debt

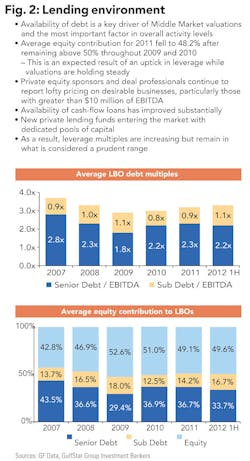

The availability of senior and mezzanine debt continues to be the key driver of overall transaction activity, and is particularly crucial for valuations in middle-market deals. Senior lenders are managing regulatory pressure and tight credit requirements. Senior debt to EBITDA multiples ratio has been in the range of approximately 2.2 times for the past three years, and is likely to remain at that level for the foreseeable future.

In the first half of 2012, mezzanine debt multiples have risen above 1.0 times EBITDA for the first time since 2010. The combined average debt multiple of approximately 3.3 times EBITDA leaves an equity requirement of about 40% to 50%. With such a significant equity requirement, there is serious pressure on private equity and strategic investors to meet sellers' expectations in terms of enterprise value and achieving targeted returns.

Because of the intense regulatory pressure and domestic and global economic conditions, commercial banks have been reluctant to extend credit supported primarily by cash flow to anyone other than large-cap public companies with strong, liquid balance sheets. Middle-market borrowers must typically have strong balance sheets with liquidity and substantial tangible assets sufficient to obtain and support market priced senior debt. These dynamics have paved the way for private, non-regulated, debt funds to enter the market with dedicated capital pools. As a result, leverage multiples are holding up and cash-flow loans are becoming more readily available.

Conclusion

Coming out of an aggressive political campaign and heading into President Obama's second term, the energy capital markets as we know them today are interestingly enough either tepid or robust depending on the sector. The public markets will likely remain weak, with depressed stock prices and limited access to the public equity and debt markets. Continuing fiscal and monetary policy problems confronting the second administration will likely translate into a weaker dollar and higher oil prices. To the extent that public capital is accessible, most of the opportunities will lie in financing midstream assets and the development of domestic oil resources.

While the public markets are likely to be weak, private equity firms will continue to look for companies and management teams to support in the development of unconventional liquids plays and the capitalization of midstream and downstream opportunities.

The M&A markets (and particularly the middle market) can also be expected to be strong going into 2013, as public companies and private equity funds invest the large pools of capital they have stockpiled over the past three to four years.

Finally, the debt markets will remain open but characterized by conservative underwriting and regulatory pressure. Credit, while available, will likely be accessible only for those companies with strong balance sheets, liquidity, and hard assets. It will be an interesting time for the capital markets with Congress and the White House wrestling with the deficit, expiring tax cuts, and looming mandatory expense reductions. Without a clear energy policy, 2013 will be a challenge for the energy capital markets. OGFJ

About the authors

Bill Boyar is founder and former chairman of Boyar Miller, a Houston-based law firm. His practice focuses on representing the various parties involved in the acquisition, disposition, capitalization, and financing of assets and businesses on a national and international level. He has served as lead counsel on numerous complex, multi-party acquisitions and project financings.

Cliff Atherton has more than 25 years of experience in corporate finance and investment banking. He joined GulfStar Group, a middle market investment bank, in 1995 and since that time has completed numerous corporate finance assignments for business owners. Most of his transactions have involved the sale or recapitalization of private companies. He has a generalist investment banking background that includes significant recent experience representing upstream and downstream energy service companies and related manufacturing companies.