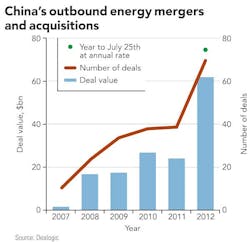

Since 2007, China has been steadily increasing its outbound energy mergers and acquisitions as a way to shore up oil and gas assets and grow the expertise needed to develop its own vast reserves of shale gas and other unconventional reserves. The latest move is a $15 billion deal to acquire Nexen, a company knee-deep in tar sands assets and the expertise to get it, and other unconventional hydrocarbons, out of the ground.

However, a growing number of lawmakers are asking the US government to halt approval of Chinese National Offshore Oil Corporation’s (CNOOC) takeover of Nexen Inc.

As one can find in many a press release regarding pending transactions, the news about CNOOC Ltd.’s $15.1 billion offer for Canada’s Nexen came with a disclaimer: completion of the transaction is subject to customary closing conditions.

The deal, if approved, would mark the biggest foreign acquisition ever by a Chinese company and prove no small feat for the company forced to abandon its $18.5 billion bid for California-based Unocal after opposition from US lawmakers in 2005.

While the Nexen board has already granted its approval and Canadians and other industry observers believe the deal will close, regulatory challenges by relevant authorities in the US may cause a bump along the way. Roughly 10% of Nexen’s assets are in the US Gulf of Mexico (GOM), subjecting the deal to US approval.

One such authority is the Committee on Foreign Investment in the United States (CFIUS), of which US Treasury Secretary Timothy Geithner is chairman. CFIUS is charged with reviewing deals involving the sale of US interests to foreign firms as a matter of national security.

On July 27, days after the deal was announced, Senator Charles Schumer of New York sent a letter to Geithner asking him to withhold approval of the acquisition as a way of pressuring China "to consent to economic reforms it has resisted for years.

"At some point, we have to put our foot down over China’s refusal to play by the rules of free trade, Schumer continued.

Then, a second legislator, Representative Edward Markey of Massachusetts echoed Schumer’s request to put the would-be record breaking deal on ice.

Referring to royalty relief offered to oil companies by the US Interior Department when energy prices were remarkably lower, Markey contends that Nexen owes large sums of money for 32 million barrels of oil and 34 million cubic feet of natural gas drilled in the GOM through 2012, and that unless China agrees to pay the royalties, the US government should block the deal, Reuters reported July 30.

"Giving valuable American resources away to wealthy multi-national corporations is wasteful, but giving valuable American resources away to a foreign government is far worse: it has the potential to directly undermine American economic and national security, wrote Markey in his letter to Geithner.

The review by CFIUS is expected to take 75 days once all of the transaction details are gathered.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.