MANAGING PORTFOLIOS: Balance and diversification reduce risk

Two fundamental risk reduction principles of portfolio management established long ago in pioneering work on optimizing performance from stock portfolios are balance and diversification. These principles cannot be ignored by the petroleum asset portfolio manager, whose understanding of their implications is critical to asset management and risk reduction.

David A. Wood

Consultant

Lincoln, England

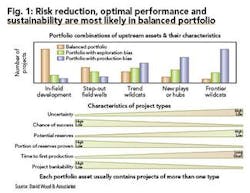

Balanced upstream portfolios include asset projects of different types. They require the lower risk production and in-field development projects to provide production and near-term cash flow, but more of the higher risk step-out and exploration projects in order to replace reserves for longer-term growth.

Figure 1 illustrates conceptually three hypothetical portfolios with different asset project combinations in the upper bar chart. One is skewed too far towards high-risk exploration and runs the risk of failing to assure future production growth or sustain current production in the medium term.

Another is tilted too far towards low-risk production in-field development and runs the risk of failing to replace its reserves base in the medium term. The third is more balanced and has projects that address both components of the reserves/production ratio. Of course, this simplistic view ignores the quality of the assets themselves. It is no good having a balanced portfolio of poor-quality, high-cost assets.

The lower part of Figure 1 illustrates qualitatively the generic attributes of the different types of projects typically held in upstream portfolios. The levels of risk, uncertainty (opportunity), potential reserves, and time to first production all typically increase progressively from in-field development projects to frontier wildcat projects.

Conversely, the chance of success, the fraction of reserves discovered that can be expected to be classified in the most valuable proven categories, and the ability of the project to secure debt financing (i.e., bankability) all increase progressively from frontier wildcat projects to in-field development projects.

Balancing a portfolio helps flatten out the steep gradients associated with these attributes (i.e., spread risk) and increases the chances of meeting the common strategic objectives of production growth coupled with reserves replacement.

A critical attribute not apparent from Figure 1 is that to minimize risk projects of the same type ideally should be independent of one other (i.e., unconnected or uncorrelated).

Five trend exploration wells with the same expected chance of success in the same play trend are generally considered to be more risky than five trend exploration wells, each located in a different play trend. This leads on to considerations of diversification that are linked to project dependencies and correlations.

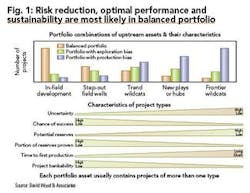

A useful way to demonstrate the risk-reducing potential of diversification, spreading the risk across larger numbers of upstream petroleum projects, is to consider a simple deterministic example of two independent exploration projects with different unrisked values and different chances of success and evaluate their risk on a stand-alone and combined basis. Figure 2 illustrates this example for two projects X and Y.

Project X has a 30 percent chance of success leading to $300 million net present value and a 70 percent chance of a dry hole leading to a cost of $15 million leading to an expected monetary value (emv = 300*0.3 + -15*0.7) of $79.5 million.

Project Y has a 70 percent chance of success leading to $118 million net present value and a 30 percent chance of a dry hole leading to a cost of $10 million leading to a similar expected monetary value (emv = 118*0.7 + -10*0.3) of $79.6 million.

If the probabilities and values are correct (a big assumption in the real world), by electing to drill one or the other of the prospects a participant’s chance of failure can never be lower than 30 percent. Figure 2 illustrates that by drilling both the chance of failure (i.e., both wells being dry is reduced to 21 percent) with just a slight reduction in emv.

The lesson here is that diversifying by going from one to two independent projects reduces risk significantly.

By extrapolating this effect across a whole portfolio of independent projects, we can see that diversification can reduce risk substantially. The effect increases as the influences from a sufficient number of projects are combined. Therefore, except for simple deterministic examples (e.g., Figure 2), it is difficult to estimate risk and risked value of asset combinations without the use of a computer model.

If there are strong dependencies among the projects, the risk reduction effect of diversification, as shown mathematically by the impact of correlation coefficients, is much less than for independent projects.

In a probabilistic analysis, standard deviations and semi-standard deviations are used to measure the level of risk for both individual assets and portfolios. Probabilistic portfolio models can uses such statistics to analyze the risk-reduction diversification effects and risked values of different combinations of assets.

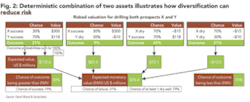

The large production and net income growth targets of the majors generally require a specific mix in the exploration focus of their asset projects that includes more higher risk frontier and trend wildcat projects to have a material impact on their existing portfolio (Figure 3). This mix must address the issues of balance and diversification in conjunction with risk, value, and materiality. OGFJ

The author

The author

David A. Wood [[email protected]] is an international exploration and production consultant specializing in the integration of technical and economic evaluation with management and acquisitions strategy. He also provides an extensive range of training on upstream economics, international fiscal terms, and strategic portfolio and risk analysis, both as an independent trainer and on behalf of several training organizations (see www.dwasolutions.com). After receiving a PhD in geochemistry from Imperial College in London, Wood conducted deep-sea drilling research and in the early 1980s worked with Phillips Petroleum Company and Amoco Corporation on E&P projects in Africa and Europe. During 1993-1998, he acquired and managed a portfolio of onshore UK and North Sea companies and assets before becoming a consultant. Wood is the author of four Oil & Gas Journal Executive Reports on risk analysis and related subjects (see box).

This series of articles addresses fundamental issues of petroleum asset-portfolio management. The material is drawn from training courses in strategic portfolio management that the author has developed for the petroleum industry since 1998. The author writes in greater detail about these subjects in four executive reports available for purchase through the Online Research Center of Oil & Gas Journal Online. For a list of titles and descriptions, go to www.ogjonline.com, click “Online Research Center” on the left navigation bar, and then click the link under “OGJ Executive Reports.”