Banks, funds lend renewed vigor to energy trading

Paula Dittrick

Senior Staff Writer

Oil & Gas Journal

Energy commodity markets in the US have readjusted in the aftermath of the Enron Corp. debacle to the point where the markets are attracting renewed investor attention because they are working well and appear poised for significant future growth. Higher, more volatile crude oil and natural gas prices have drawn the attention of investment banks and hedge funds. Well-capitalized banks involved in trading include Goldman Sachs and Morgan Stanley.

Other financial houses are also entering or re-entering the energy trading arena. Merrill Lynch & Co. recently bought the energy trading businesses of Entergy-Koch LP (OGFJ, 4Q 2004, p. 57).

“The market is functioning just fine without Enron,” said Arthur Gelber, president of Gelber & Associates Corp., Houston, an energy consulting and advisory firm specializing in energy trading practices and protocols, particularly gas trading. “People in the general commodity markets say ‘energy is in play.’ That means companies with large amounts of dollars are trying to invest that money, and they desperately want to find ways to invest in energy-more so than say five years ago,” Gelber said.

Trading forecasts

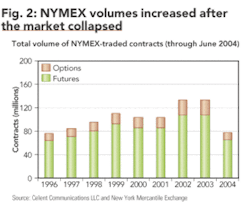

Celent Communications LLC, Boston, calculated that US natural gas and electric trading shrank from $1.8 trillion in 2001 to $1.3 trillion in 2002, but the firm forecasts that trading in these markets will approach $1.7 trillion by 2006. Celent released those statistics last year in its “US Energy Trading” report.

Adam Josephson, former Celent analyst and author of the report, noted that, “Investors of all stripes have increasingly become involved in the commodities markets.” He said energy commodities re-emerged as an asset class during a global economic recovery.

The new energy investors and traders bring increased liquidity and more sophisticated financial instruments and risk management strategies to energy markets, Josephson added.

Gelber agreed, saying that 2004 marked a very robust recovery in US energy trading, which had remained at a lackluster level in December 2003 following a dismal level in 2002.

“Now, we see that trend is reversing. Open interest is up, liquidity is up, bid and offers are narrowed in, and the Enron void has been filled by the hedge funds as well as the investment banks,” Gelber said.

He stops short of saying that there is sufficient liquidity for price transparency in the various energy markets.

“Liquidity is reverting back toward the efficiencies we had back in 1999 and 2000, but we have yet to get to the levels that I would like to see us at,” Gelber said.

Bernard J. Picchi, senior managing director for Foresight Research Solutions LLC, New York, envisions that the world energy futures market could someday rival the size of the $5 billion/day US Treasury market.

“As big as the world energy futures market is now, it’s only going to get larger as China and India develop transparent commodity markets, and as new contracts-like ones for LNG and carbon dioxide emissions credits-take off,” Picchi said.

He believes the exchanges and Over The Counter (OTC) trades will play a large role in the emerging economies of Russia, Kazakhstan, Azerbaijan, China, India, and many other countries. Although OTC trading dwarfs the size of exchange-listed commodity markets, the exchanges are a major influence on the OTC market.

“Further, virtually all energy users will have to hedge their oil and gas purchases for competitive reasons alone,” Picchi said.

Oil

The International Petroleum Exchange in London and its North Sea Brent oil contracts set the price on about 65 percent of the world’s oil trade, while the New York Mercantile Exchange crude oil contracts set the price on about 10 percent of world oil production, according to Picchi.

NYMEX trades about 260,000 oil contracts per day. Each contract represents the right to buy or the obligation to sell 1,000 bbl of US benchmark light, sweet crude oil.

In November 2004, Picchi calculated the nominal value of oil trading on the NYMEX was running $13 billion/day, or $3 trillion/year, and IPE trading value was about $6 billion/day of nominal value.

Gelber, formerly a global crude oil trader for Conoco Inc., said world oil prices always have helped set direction for the US economy, but he believes oil is more important to the US economy now than it was five years ago.

“Recently, oil is very much in play and it’s in play more for the investment bankers and the commodity funds than in previous years. The market is much more volatile than it used to be, and there is a lot higher level of interest than we have seen previously,” he said. “The economy seems to have a profound interest in oil prices, and you can see that the stock markets and the bond markets all are reacting to oil markets. That has not been the case in prior years.”

Gas, power

Josephson believes the growth in US gas and electric trading volumes will continue beyond 2006. He declined to issue a forecast for five years out, saying the market trends are too uncertain.

He calculated his 2006 forecast by using NYMEX volumes from previous years and by talking with numerous traders and industry representatives about the value of the US gas and power markets.

Oil was excluded from the Celent report because it is a global market rather than a regional market like gas and power.

After Enron and a host of other energy merchant firms collapsed in late 2001 and 2002, the US gas markets saw decreased volumes while volumes collapsed in the electric markets. Josephson examined the degree to which these markets have recovered.

“The industry is finally starting to recover from the scandal that it will forever be associated with and is poised to grow substantially in the years to come,” he said. “Credit-risk management is improving. Industry participants are playing far more attention to counterparty credit risk, using clearing mechanisms such as the NYMEX ClearPort platform. Price transparency has improved.”

Price discovery remains a problem for lack of a proper price reporting system in both gas and power markets, Josephson said. But he sees improvement on the horizon.

Currently, 17 percent of the gas and power market is traded via electronic exchanges, with short-term gas contracts being the most heavily traded. Celent estimates that electronic trading will account for 29 percent of the market by 2008.

“More and more trading will migrate to screens. As a result, it stands to reason that reporting will improve. It will just take some time as the existing products add platforms or as perhaps other companies launch electronic trading platforms,” he said.

But many US traders simply are unwilling to rely exclusively upon screen-based deals. Celent said a significant percentage of energy trading will remain floor- and phone-based because of the wide variety of contract structures and conditions.

“One of the reasons marketing companies exist is their ability to tailor transactions to exactly what their clients need via OTC contracts,” Josephson said. “Electronic platforms are not likely to displace that direct customer contact, of which there is a substantial amount. And, NYMEX has no intention of moving away from the open-outcry format.”

Open outcry is the dominant trading method. One of the leaders in electronic systems has been the Intercontinental Exchange (ICE), an Atlanta-based partnership of US and European finance and energy companies that also own the IPE in London.

“ICE produces indices derived directly from electronic trades,” Josephson noted, adding that the Federal Energy Regulatory Commission is urging industry participants to increase electronic trading to facilitate price discovery.

Market players

Banks having established investment banking divisions with US energy trading operations include ABN AMRO Bank NV, Bank of America Corp., Barclays Bank PLC, Citigroup, Merrill Lynch, Deutsche Bank Group Inc., and UBS.

“Banks have increased their efforts to profit from energy by trading for their own account,” Josephson said. “The banks’ current enthusiasm for energy contrasts with the mid-1990s when several scaled down their activities as investors moved into equities.”

A growing number of pension funds are turning to commodities to diversify away from equities and bonds, he said. Meanwhile, hedge funds “will continue to have a voracious appetite for energy trading.”

Peter C. Fusaro, chairman of Global Change Associates Inc., a New York energy and environmental risk management consultancy, noted that the entrance of energy hedge funds into energy commodities trading started primarily in the US. But Canada now has energy hedge funds, and energy hedge fund activity in oil trading is expected during 2005 in Europe and Asia. Hedge funds have considerable influence over markets, he said (OGFJ, 4Q 2004, p. 21).

Fusaro said that he had identified close to 300 energy funds by late last year, and he believes the “true number is much higher.”

Traditional energy companies are either exiting the trading arena or are becoming further marginalized by the activities of the hedge funds and investment banks, he added. OGFJ