RISK decision support poised for quantum leap

From a standing start less than 20 years ago, energy trading and risk management (ETRM) exploded to well over 100 million contracts traded on the New York Mercantile Exchange (NYMEX) alone last year. By comparison, however, technology growth to support competitive ETRM trading and hedging performance has lagged.

Michael W. Hinton

Allegro Development

Dallas

Beyond the hype, software generally has failed to deliver what companies really need: sophisticated, forward-focused decision analytics informed by live market-data streaming, integrated with real-time views across the energy value chain. That means capturing, combining, and analyzing historical and current data from wellhead to end use, embracing every significant price and supply/demand factor, from production to pipeline allocations to physical deliveries and futures - accurate, holistic views that professionals can grasp at a glance and creatively explore.

Also on the wish list: end-to-end process visibility, rapid deployment, quick training, easy integration with enterprise systems, more effective customization, and plug-and-play flexibility to grow and change as markets, business strategies, and needs evolve.

However, software developers and their customers often still view energy trading, transport, and risk management as a series of discrete pieces, sometimes integrated, sometimes not. In most cases only lip service has been paid to the broader vision: flexible solutions that accurately reflect energy industry dynamics and allow users throughout the value chain of any energy commodity to optimize fully their decisions and actions. ETRM solutions based on conventional technologies have a long way to go - and customers know it.

Empirical data supports this view. UtiliPoint International, an industry research firm, recently found that companies have been replacing their ETRM software at a much higher rate than is true for other types of applications - a 75 percent higher replacement rate than customer information systems, for example. What’s more, 55 percent of companies that do plan ETRM replacement cited as a driving factor their current solution’s inability to satisfy new business requirements.

These findings spotlight two challenges: the inherent volatility of energy markets and conventional ETRM software’s inability to keep pace. While the former isn’t news, the latter opens up a crucial question: What will it take to deliver solutions that give industry players - from exploration and production companies to traders, transporters, refiners, marketers, utilities, and large consumers - a compelling edge over their respective competitors and counterparties in energy trading and risk management?

New ETRM capabilities

A convergence of information technologies will deliver new ETRM capabilities. These capabilities - either already on the market or in the wings - include graphics-based, multi-dimensional decision analytics, full integration of physicals and financials, and powerful multi-commodity decision support.

New, more effective displays will feature “executive dashboards” (Fig. 1), backed by extensive drill-down capabilities and more complete process automation than is available today. These solutions will be easier to use and will deploy and integrate more rapidly at lower cost than previous generations of ETRM solutions.

As a result, traders will gain better insights and glide through processes that currently slow them down, allowing time to increase the number of deals while improving the quality of decisions. Rapid deployment will put these new solutions into traders’ hands sooner. Ease of use will mean getting up to speed more quickly.

Financial impacts

There are wide-ranging financial impacts, partly because traders and their companies today bear huge hidden costs imposed by the constraints of traditional ETRM solutions. When these constraints are eased, trading, hedging, and the management of physicals will become more efficient and competitive. What’s in it for trading organizations? Here are some examples:

- Trading efficiency - Traders using a tightly integrated application environment operating with streaming data could reduce the time required to execute all aspects of a deal. Assume that better information and greater speed and efficiency enable one additional deal every four hours around the clock and that each deal is worth an average of $200 in profit or cost savings. The net revenue increase over a three-year period would exceed $1.3 million.

- Credit management - Trading teams could reduce bad debt by monitoring and instantly evaluating all open receivables, current receivables, and forward exposures by credit party - and taking instant corrective action such as raising collateral levels or requiring payment prior to delivery. Assume that a gas marketer has annual revenues of $50 million, bad debts typically in the one percent range, and, with next-generation ETRM, could all but eliminate this cost. Net savings over a three-year period: $1.5 million.

- Back-office operations - Trading organizations that now outsource their back-office processes could instead perform these tasks efficiently in-house, with full regulatory compliance, using a real-time ETRM solution integrated with trading operations. Assume an organization averages a monthly volume of one million MMBTU and pays a $0.05 management fee per MMBTU sold by the trading partner, resulting in a $50,000 per-month cost. Additionally, there’s a monthly charge of $10,000 for managing nominations and transport. The advanced ETRM solution eliminates these costs. Net saving over a three-year period: $720,000.

Leveraging real-time data

Also integral to the new, advanced solutions will be capabilities such as decision analytics and integration between physicals and financials. Analytics’ effectiveness is amplified by live market data feeds, which in turn is enabled by integration.

The need for live data feeds is growing because weighing permutations for optimal patterns of exercise is becoming exponentially more complex. Further, volatilities make patterns of exercise highly dynamic. One trader puts it this way: “In two hours the optimal dispositions on my screen will have all the decision value of an expired option.”

However, increasing their use of live data feeds will challenge traders in other ways. To leverage this barrage of information and quickly react, traders and other decision makers will need analytical results displayed in the form of dynamic 3D graphics. Competitive advantage will come from gaining an intuitive grasp of minute-by-minute trading activity against positions and potential dispositions within the context of a whole portfolio plus constraints such as value at risk (VaR), company policies, and credit limits.

With the rise of real-time decision making, integration, and related trends, information silos, enabled by the use of spreadsheets, put traders and their companies increasingly at a disadvantage. “From classic Black-Scholes to the latest models, industry has made great strides in understanding forward price movements and correlations,” says Dr. Ehud I. Ronn, professor of finance and director of the Center for Energy Finance Education and Research, University of Texas at Austin, and a consultant on energy trading and risk management.

“At the same time, I believe spreadsheets for analytics and deal management may be reaching the end of their useful life as primary platforms for ETRM decision making,” he added.

This trend is likely to intensify as traders’ use of real-time information proliferates, driving a greater need for integration and increasing the disparity between traders using information silos versus integrated solutions.

In addition to working with real-time market data, companies also require data integrity, security, and audit controls. These requirements will accelerate obsolescence - not because spreadsheets can’t analyze, but because they can’t integrate, communicate, collaborate, and ensure integrity and compliance.

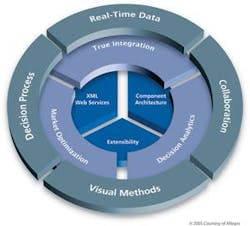

Therefore, actualizing the new solutions will demand a strategic set of capabilities and underlying information technologies - all converging, each with a sufficient level of maturity to enable the whole. Technologies include XML Web services, component architectures, and coherent platforms.

But what are they, and why are they crucial to the delivery of next-generation trading and management capabilities?

XML Web services comprise a technology that allows modern enterprise systems and components to communicate and collaborate via the Internet. Because most integration today is accomplished via the Web, XML Web services become the lynchpin. Web services also are the key to flexible, efficient provision of live data feeds from external sources such as market information services.

“ETRM solution providers offering market-ready solutions built from the ground up on XML Web services have a commanding lead on the market,” said Jon C. Arnold, worldwide utilities industry manager for Microsoft. “Energy industry solutions based on Web services are already helping companies to achieve unprecedented efficiencies that allow them to outperform their competitors at a lower cost.”

Arnold added, “Web services also make these solutions easier to upgrade - which is necessary in order to keep pace with changing needs. By developing ETRM solutions on an XML Web services-enabled platform such as Microsoft .NET, vendors are able to offer solutions that are much easier and more economical to deploy, maintain, scale, and modify for volatile markets.”

Rapid adaption: component architectures

The traditional “integrated suite” approach to delivering ETRM functionality is being successfully challenged by an emerging strategy known as component architecture. Its compelling advantages have earned this approach rapid market acceptance. An increasing number of new ETRM deployments are based on component architecture, yet this dramatic shift has gone almost unnoticed. It’s a quiet revolution.

A component architecture, especially when built on XML Web services, gives companies several compelling advantages:

- Integration - Inherent to the architecture, thus easy to implement.

- Customization - Easy to tailor a solution precisely to the company’s needs.

- Cost avoidance - Companies buy only the functionality they need.

- Flexibility, adaptability - Easy to add, modify, upgrade, or remove functionality.

- Scalability - Enables smooth, economical upsizing and downsizing.

- Rapid deployment - Users gain competitive new capabilities sooner.

- Easy maintenance - Reduces IT burdens and lowers total cost of ownership.

Component architecture arose from a simple idea. Instead of bundling ETRM functionality into a handful of integrated application suites, it unbundles this functionality into smaller modules. Thus, for example, producers of crude seeking an advanced hedging solution plus logistics management can get precisely the functionality they need without purchasing a suite that also includes gas or power marketing.

Later, if this producer acquires a gas play, a gas module can simply be added to the integrated solution. But this approach’s flexibility goes further. Each component module stands alone as an independently functional application. Yet these independent components readily integrate in any combination to deliver a seamless “total solution” at any scale.

One key to this unprecedented flexibility is the underlying XML Web services platform. Each component “sees” all the others as simply another Web client. This elegant approach gives energy companies unprecedented ability to adapt to change by keeping information solutions up to date with evolving markets and business strategies.

Because the range of modules can be very broad, a component approach facilitates the new vision of competitive trading, physical management, and risk mitigation - bringing together all aspects of energy decision making in a single optimization environment, and extending the environment to applications outside traditional ETRM, such as production field accounting and management.

Consistent infrastructure: coherent platforms

Clearly, ETRM solutions built on a consistent, coherent software architecture can satisfy short- and long-term trading, risk, and strategic requirements better than comparable solutions resulting from an attempted merger of different software products requiring integration or interfacing.

Yet mergers and acquisitions among ETRM software vendors over the last several years have spawned numerous patchwork solutions. “Today they’re almost endemic,” says UtiliPoint energy industry analyst Dr. Gary Vasey.

This shouldn’t come as a surprise, he points out: “Different software vendors naturally have different design and development philosophies. But one should never underestimate the need for seamless integration between solutions and just how difficult this has proven to achieve.”

Thus, merged software can affect functionality, performance, integration, and the ability to achieve a smooth deployment - prompting caution among companies weighing their ETRM alternatives. Vasey advises, “Prospective users must ask tough, knowledgeable questions.”

Summary/conclusion

Information technologies such as XML Web services, component architectures, coherent platforms, and real-time decision analytics are beginning to converge into a new generation of energy industry solutions, reaching critical mass in 2005.

Heralding the emergence of a broad conceptual framework that embraces ETRM, field production, and other functionality, industry observers anticipate that the new solutions will offer compelling advantages, driving many companies to abandon information silos in favor of dedicated, integrated, enterprise scale ETRM solutions.

These solutions will provide traders and their managers with live market data, real-time decision analytics, and extensive collaboration and integration across traditional boundaries - all of which provide unprecedented ability to determine forward price movements and optimal patterns of exercise, along with such advantages as rapid deployment, flexibility, and ease of use.

As a result, companies adopting a broader paradigm and these new solutions will gain a measurable competitive advantage in strategy, operations, and finance. OGFJ

Beyond the hype, software generally has failed to deliver what companies really need: sophisticated, forward-focused decision analytics informed by live market-data streaming, integrated with real-time views across the energy value chain. That means capturing, combining, and analyzing historical and current data from wellhead to end use, embracing every significant price and supply/demand factor, from production to pipeline allocations to physical deliveries and futures - accurate, holistic views that professionals can grasp at a glance and creatively explore.

Also on the wish list: end-to-end process visibility, rapid deployment, quick training, easy integration with enterprise systems, more effective customization, and plug-and-play flexibility to grow and change as markets, business strategies, and needs evolve.

However, software developers and their customers often still view energy trading, transport, and risk management as a series of discrete pieces, sometimes integrated, sometimes not. In most cases only lip service has been paid to the broader vision: flexible solutions that accurately reflect energy industry dynamics and allow users throughout the value chain of any energy commodity to optimize fully their decisions and actions. ETRM solutions based on conventional technologies have a long way to go - and customers know it.

Empirical data supports this view. UtiliPoint International, an industry research firm, recently found that companies have been replacing their ETRM software at a much higher rate than is true for other types of applications - a 75 percent higher replacement rate than customer information systems, for example. What’s more, 55 percent of companies that do plan ETRM replacement cited as a driving factor their current solution’s inability to satisfy new business requirements.

These findings spotlight two challenges: the inherent volatility of energy markets and conventional ETRM software’s inability to keep pace. While the former isn’t news, the latter opens up a crucial question: What will it take to deliver solutions that give industry players - from exploration and production companies to traders, transporters, refiners, marketers, utilities, and large consumers - a compelling edge over their respective competitors and counterparties in energy trading and risk management?

New ETRM capabilities

A convergence of information technologies will deliver new ETRM capabilities. These capabilities - either already on the market or in the wings - include graphics-based, multi-dimensional decision analytics, full integration of physicals and financials, and powerful multi-commodity decision support.

New, more effective displays will feature “executive dashboards” (Fig. 1), backed by extensive drill-down capabilities and more complete process automation than is available today. These solutions will be easier to use and will deploy and integrate more rapidly at lower cost than previous generations of ETRM solutions.

As a result, traders will gain better insights and glide through processes that currently slow them down, allowing time to increase the number of deals while improving the quality of decisions. Rapid deployment will put these new solutions into traders’ hands sooner. Ease of use will mean getting up to speed more quickly.

Financial impacts

There are wide-ranging financial impacts, partly because traders and their companies today bear huge hidden costs imposed by the constraints of traditional ETRM solutions. When these constraints are eased, trading, hedging, and the management of physicals will become more efficient and competitive. What’s in it for trading organizations? Here are some examples:

- Trading efficiency - Traders using a tightly integrated application environment operating with streaming data could reduce the time required to execute all aspects of a deal. Assume that better information and greater speed and efficiency enable one additional deal every four hours around the clock and that each deal is worth an average of $200 in profit or cost savings. The net revenue increase over a three-year period would exceed $1.3 million.

- Credit management - Trading teams could reduce bad debt by monitoring and instantly evaluating all open receivables, current receivables, and forward exposures by credit party - and taking instant corrective action such as raising collateral levels or requiring payment prior to delivery. Assume that a gas marketer has annual revenues of $50 million, bad debts typically in the one percent range, and, with next-generation ETRM, could all but eliminate this cost. Net savings over a three-year period: $1.5 million.

- Back-office operations - Trading organizations that now outsource their back-office processes could instead perform these tasks efficiently in-house, with full regulatory compliance, using a real-time ETRM solution integrated with trading operations. Assume an organization averages a monthly volume of one million MMBTU and pays a $0.05 management fee per MMBTU sold by the trading partner, resulting in a $50,000 per-month cost. Additionally, there’s a monthly charge of $10,000 for managing nominations and transport. The advanced ETRM solution eliminates these costs. Net saving over a three-year period: $720,000.

Leveraging real-time data

Also integral to the new, advanced solutions will be capabilities such as decision analytics and integration between physicals and financials. Analytics’ effectiveness is amplified by live market data feeds, which in turn is enabled by integration.

The need for live data feeds is growing because weighing permutations for optimal patterns of exercise is becoming exponentially more complex. Further, volatilities make patterns of exercise highly dynamic. One trader puts it this way: “In two hours the optimal dispositions on my screen will have all the decision value of an expired option.”

However, increasing their use of live data feeds will challenge traders in other ways. To leverage this barrage of information and quickly react, traders and other decision makers will need analytical results displayed in the form of dynamic 3D graphics. Competitive advantage will come from gaining an intuitive grasp of minute-by-minute trading activity against positions and potential dispositions within the context of a whole portfolio plus constraints such as value at risk (VaR), company policies, and credit limits.

With the rise of real-time decision making, integration, and related trends, information silos, enabled by the use of spreadsheets, put traders and their companies increasingly at a disadvantage. “From classic Black-Scholes to the latest models, industry has made great strides in understanding forward price movements and correlations,” says Dr. Ehud I. Ronn, professor of finance and director of the Center for Energy Finance Education and Research, University of Texas at Austin, and a consultant on energy trading and risk management.

“At the same time, I believe spreadsheets for analytics and deal management may be reaching the end of their useful life as primary platforms for ETRM decision making,” he added.

This trend is likely to intensify as traders’ use of real-time information proliferates, driving a greater need for integration and increasing the disparity between traders using information silos versus integrated solutions.

In addition to working with real-time market data, companies also require data integrity, security, and audit controls. These requirements will accelerate obsolescence - not because spreadsheets can’t analyze, but because they can’t integrate, communicate, collaborate, and ensure integrity and compliance.

Therefore, actualizing the new solutions will demand a strategic set of capabilities and underlying information technologies - all converging, each with a sufficient level of maturity to enable the whole. Technologies include XML Web services, component architectures, and coherent platforms.

But what are they, and why are they crucial to the delivery of next-generation trading and management capabilities?

XML Web services comprise a technology that allows modern enterprise systems and components to communicate and collaborate via the Internet. Because most integration today is accomplished via the Web, XML Web services become the lynchpin. Web services also are the key to flexible, efficient provision of live data feeds from external sources such as market information services.

“ETRM solution providers offering market-ready solutions built from the ground up on XML Web services have a commanding lead on the market,” said Jon C. Arnold, worldwide utilities industry manager for Microsoft. “Energy industry solutions based on Web services are already helping companies to achieve unprecedented efficiencies that allow them to outperform their competitors at a lower cost.”

Arnold added, “Web services also make these solutions easier to upgrade - which is necessary in order to keep pace with changing needs. By developing ETRM solutions on an XML Web services-enabled platform such as Microsoft .NET, vendors are able to offer solutions that are much easier and more economical to deploy, maintain, scale, and modify for volatile markets.”

Rapid adaption: component architectures

The traditional “integrated suite” approach to delivering ETRM functionality is being successfully challenged by an emerging strategy known as component architecture. Its compelling advantages have earned this approach rapid market acceptance. An increasing number of new ETRM deployments are based on component architecture, yet this dramatic shift has gone almost unnoticed. It’s a quiet revolution.

A component architecture, especially when built on XML Web services, gives companies several compelling advantages:

- Integration - Inherent to the architecture, thus easy to implement.

- Customization - Easy to tailor a solution precisely to the company’s needs.

- Cost avoidance - Companies buy only the functionality they need.

- Flexibility, adaptability - Easy to add, modify, upgrade, or remove functionality.

- Scalability - Enables smooth, economical upsizing and downsizing.

- Rapid deployment - Users gain competitive new capabilities sooner.

- Easy maintenance - Reduces IT burdens and lowers total cost of ownership.

Component architecture arose from a simple idea. Instead of bundling ETRM functionality into a handful of integrated application suites, it unbundles this functionality into smaller modules. Thus, for example, producers of crude seeking an advanced hedging solution plus logistics management can get precisely the functionality they need without purchasing a suite that also includes gas or power marketing.

Later, if this producer acquires a gas play, a gas module can simply be added to the integrated solution. But this approach’s flexibility goes further. Each component module stands alone as an independently functional application. Yet these independent components readily integrate in any combination to deliver a seamless “total solution” at any scale.

One key to this unprecedented flexibility is the underlying XML Web services platform. Each component “sees” all the others as simply another Web client. This elegant approach gives energy companies unprecedented ability to adapt to change by keeping information solutions up to date with evolving markets and business strategies.

Because the range of modules can be very broad, a component approach facilitates the new vision of competitive trading, physical management, and risk mitigation - bringing together all aspects of energy decision making in a single optimization environment, and extending the environment to applications outside traditional ETRM, such as production field accounting and management.

Consistent infrastructure: coherent platforms

Clearly, ETRM solutions built on a consistent, coherent software architecture can satisfy short- and long-term trading, risk, and strategic requirements better than comparable solutions resulting from an attempted merger of different software products requiring integration or interfacing.

Yet mergers and acquisitions among ETRM software vendors over the last several years have spawned numerous patchwork solutions. “Today they’re almost endemic,” says UtiliPoint energy industry analyst Dr. Gary Vasey.

This shouldn’t come as a surprise, he points out: “Different software vendors naturally have different design and development philosophies. But one should never underestimate the need for seamless integration between solutions and just how difficult this has proven to achieve.”

Thus, merged software can affect functionality, performance, integration, and the ability to achieve a smooth deployment - prompting caution among companies weighing their ETRM alternatives. Vasey advises, “Prospective users must ask tough, knowledgeable questions.”

Summary/conclusion

Information technologies such as XML Web services, component architectures, coherent platforms, and real-time decision analytics are beginning to converge into a new generation of energy industry solutions, reaching critical mass in 2005.

Heralding the emergence of a broad conceptual framework that embraces ETRM, field production, and other functionality, industry observers anticipate that the new solutions will offer compelling advantages, driving many companies to abandon information silos in favor of dedicated, integrated, enterprise scale ETRM solutions.

These solutions will provide traders and their managers with live market data, real-time decision analytics, and extensive collaboration and integration across traditional boundaries - all of which provide unprecedented ability to determine forward price movements and optimal patterns of exercise, along with such advantages as rapid deployment, flexibility, and ease of use.

As a result, companies adopting a broader paradigm and these new solutions will gain a measurable competitive advantage in strategy, operations, and finance. OGFJ

The author

Michael W. Hinton is vice president - industry solutions for Allegro Development Company, a Dallas-based developer of software solutions and related services for the energy industry and the financial community. Since joining Allegro in 1997, he has held management roles in product and implementation management. Prior to joining Allegro, he held managerial positions with several independent gas companies. Hinton has a BS degree in chemical engineering from Michigan Technical University.

New software solutions

Today’s newest energy trading, transport, and risk management software solutions have begun to achieve what earlier technology only promised - integration, automation, collaboration, and compliance - from producing point to end use.

The following examples illustrate how these solutions have begun to transcend traditional ETRM boundaries. They enable users to improve efficiencies and achieve other competitive advantages by integrating business processes throughout the value chain.

- Upstream: field production - An oil producer faced a complex accounting challenge. This operator was successfully using steam to extract heavy crude from a mature field. However, his team was spending 30 hours at a time allocating production among hundreds of wells. Using component-based integration, the same allocations took three minutes - total.

- Midstream: physicals management - An integrated oil and gas company sought to improve business data quality and make downstream operations more efficient. The company now uses an integrated, component-based software solution to manage lease and bulk refinery-supply transactions, including contract management, pipeline scheduling, volume actualization, invoicing, and management reporting, plus disbursements to interest owners for all lease purchases. The integrated system makes it easy to maintain divisions of interest by lease, handle processing of conveyance transactions, and generate regulatory reports.

- Entire value chain: strategic flexibility - The ability to add components to an integrated solution made sense to an expansion-minded European energy company. This company required a proven gas trading and risk management system that could rapidly scale with increased activity levels while having the capability to manage electric power, oil, and possibly coal trade exposures, through progressive adaptation. It needed an integrated trading solution that allowed for consolidation of front-office deal and contract capture, middle-office control, and back-office settlement activities. The solution consisted of independently functional modules that seamlessly integrate in any combination. This component architecture gave the company the functionality it needed, while allowing it to deploy quickly and accommodate future strategic expansion. - Michael W. Hinton