Managing Portfolios: Addressing organization challenges

David A. Wood

Consultant

Lincoln, England

Modern portfolio management projects are judged based on their contribution to long-term strategy and how they interact with other projects in the portfolio, as displayed by the feasible envelope, efficient frontier, and probabilities of strategic targets being achieved.

This is a dynamic process. Portfolio modeling and management should firmly link investment decision-making at the asset, portfolio, and the merger, acquisition, and divestment levels to a quantified corporate strategy.

Figure 1 illustrates the central and integrating role a portfolio model can play in management and decision-making within a petroleum company.

Having recognized the need for a numerical model to analyze value and risk for its portfolio of assets and the benefits this can provide in assisting performance optimization, the challenge for a company is to address the following key operational questions:

- How is the model used most productively?

- Where within the organizational structure should it reside?

- Who should manage it?

- Which groups within the organization should interact with or contribute personnel to a portfolio management group?

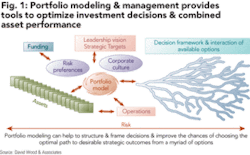

It is worth exploring these questions from a planning and an organizational perspective. The planning process functions and cascades through many organizations on three levels and time-scales: medium- and long-term planning (three to five years) addressing corporate strategy; business planning for the year ahead; matching resources and a budget for the current year to the business plan. Coordinated with this is the performance appraisal process for recently completed periods and benchmarking of key performance indicators for peer group companies.

Figure 2 shows the interactions of this planning process and how a portfolio management group controlling a portfolio model can contribute to it at all levels.

Corporate management interacts with the portfolio group, particularly for strategic and performance evaluation. Operational management, business units, and asset groups interact with the portfolio group in the areas of business planning, ongoing budgeting, and performance evaluation on an ongoing basis.

By being involved in the full planning cycle, the portfolio group/model can play a high-profile role within an organization. This planning role addresses how to most productively use a portfolio model to impact across all levels of an organization (see question 1 above).

If this broad and central role for a portfolio model is to be achieved, it is crucial to establish the organizational structure and position of the portfolio group in such a way that it can operate effectively without causing conflict or overlapping with the functions of other groups within an organization.

Many organizations struggle with these issues. A badly structured, located, and managed portfolio group will not deliver what is required and may lead to suspicion and mistrust between the operating divisions and corporate management.

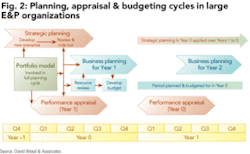

Figure 3 attempts to illustrate generically the answers to questions 2 and 4 above. A portfolio group ultimately has to sit near the top of an organization in order to influence and be influenced by strategy and key operational decisions. It is a mistake to isolate it from the operating divisions with information only flowing up from them into the portfolio group with little feedback or direct involvement in portfolio analysis from the business units and asset teams.

It is for this reason that arrows go in both directions in and out of the portfolio group from all the groups with which it interacts. The main role of many of the key functional positions within the portfolio group is one of coordination.

It is essential that the portfolio manager is a good communicator in order to promote information flow and a level of transparency within the organization that allay the fears and suspicions at the asset level that its primary role is to rationalize staff and divest all non-core assets.

The portfolio team itself needs to integrate multi-discipline skills and experience. Ideally, there should be a regular rotation of staff from the operating divisions and other corporate groups (i.e., strategic planning, corporate finance, and new ventures) to ensure that the portfolio group evolves as part of a developing organization and maximizes input, ideas, and viewpoints from all functions and divisions.

Figure 3 identifies at least nine coordination roles that need to be addressed by the portfolio group. Health, safety, environment, and IT could be added to this list, but these are considered to be core functions that should permeate the culture and all groups of the organization.

The numbers in boxes in Figure 3 show which other groups within the organization should contribute what information to the portfolio group and the feedback they should expect in return. A point worth emphasizing is that it is essential that asset teams are involved in the risk assessments of assets as part of the portfolio modeling process.

A portfolio group that expects an asset group to complete a data sheet with factual information about an asset project and to pass this up to the portfolio group for analysis without detailed interaction is unlikely to end up with a realistic assessment or understanding of the asset.

A significant issue to address is the power and influence a portfolio model and group can exert within an organization. This inevitably leads to power struggles and conflicts with other divisions, particularly in cases where an evolving portfolio group takes some of the decision-making influence and performance assessment away from division managers and increases their accountability.

It is important to recognize and confront such issues. The most difficult problems to solve in effectively operating a portfolio model within an organization are the human issues and resistance - not the technical and analytical issues.

These human issues can be addressed by good communication, transparency, and frequently emphasizing the benefits that a portfolio model can bring to each specific part of the organization. Acceptance and inter-group cooperation should be promoted by aligning remuneration and performance benefits of all groups to the strategic targets that the portfolio group is mandated to achieve by optimizing performance throughout the organization’s asset base. OGFJ

The author

David A. Wood [[email protected]] is an international exploration and production consultant specializing in the integration of technical and economic evaluation with management and acquisitions strategy.

About this Series

This series of articles addresses fundamental issues of petroleum asset-portfolio management. The material is drawn from training courses in strategic portfolio management that the author has developed for the petroleum industry since 1998. The author writes in greater detail about these subjects in four executive reports available for purchase through the Online Research Center of Oil & Gas Journal Online.

For a list of titles and descriptions, go to www.ogjonline.com, click “Online Research Center” on the left navigation bar, then click the link under “OGJ Executive Reports.”