Why it’s smart to consider investing in the Middle East

As worldwide energy demand and commodity prices continue to experience near-record levels, it stands to reason that the Middle East - a region with more than half the world’s known crude oil reserves and one-third of its natural gas reserves - would offer the biggest profit prospects for investors.

There are a variety of converging factors that make opportunities for investment in the Middle East more enticing than ever before. Even those energy companies that have never ventured onto foreign soil should take a long, hard look at the Middle East. Quite simply, now is the time to be there.

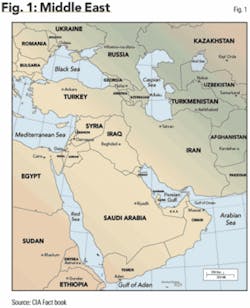

“Middle East” is a nebulous term that is traditionally applied by western Europeans and North Americans to the countries of Southwest Asia and Northeast Africa lying west of Afghanistan, Pakistan, and India, according to the Columbia Electronic Encyclopedia, published by Columbia University Press. The region came to be called the Middle East because it was viewed as midway between Europe and East Asia (traditionally called the Far East).

For purposes of this article, we will narrow the definition of “Middle East” to approximately a dozen oil-producing countries with distinct economic and social characteristics that lie between the southeastern Mediterranean Sea and the Arabian Gulf (Persian Gulf to most Westerners).

Population explosion

These Middle Eastern nations have at least one other characteristic in common - young, rapidly growing populations in need of employment. Only four percent of the population, in fact, is over the age of 65, compared with 12.5 percent in the United States.

According to the World Bank, the Middle East/North Africa region had the world’s second-fastest growing population from 1980 to 2002, posting 2.6 percent growth versus 2.0 percent for South Asia, 1.4 percent for East Asia/Pacific, and 1.1 percent for the US. (At 2.7 percent, only the impoverished Sub-Sahara Africa region grew more rapidly.) Moreover, the World Bank projects that this pattern will continue through 2015, with 1.7 percent growth for the Middle East/North Africa region versus 1.4 percent for South Asia, and 0.8 percent for both East Asia/Pacific and the US.

Foreign investment wanted

With Middle East governments aware that they can no longer provide full employment for their citizens, the enormous need for private-sector jobs for their young, rapidly growing populations is fundamental to the effort to attract foreign investment. But the primary need is not for foreign money - the present high oil prices have enabled Middle East governments to strengthen their foreign reserves and free up funds for future investments - but rather for the technology that is required to create long-term economic opportunities for these nations’ citizens.

While most of the pressure to attract outside investors is coming from inside their borders, the oil-exporting nations of the Middle East face tremendous political pressure from oil-consuming nations to increase exports. With production already at or near capacity, huge investments in additional energy infrastructure will be needed to accomplish this goal.

Incentives abound

What are Middle East governments doing to attract foreign investment? The efforts encompass measures including substantial changes in their tax, legal, and regulatory environments, all designed to make investment more appealing.

Tax rates are falling:

- Saudi Arabia recently passed a new income tax law to replace its 54-year-old predecessor. Among the highlights are corporate income taxes, which are now fixed at 20 percent (formerly 20 to 30 percent), and a tax rate applicable to natural gas activities of 30 percent. In addition, companies investing in the sector will also be subject to a tax that will range from 30 to 85 percent, based upon the projected rate of return.

- In Egypt a new tax law is expected in the near future to replace the one that has been in place since 1981. Under the proposed new law, the tax rate is expected to fall from 42 percent to 20 percent. Numerous special incentives are in place for oil and gas companies.

- In Kuwait, a proposed new law would reduce the maximum tax rate to 25 percent, although internal resistance makes the imminent passage of this proposal unlikely.

- In Oman, tax rates for all companies registered there have been set at 12 percent.

- Qatar’s Ministry of Finance is reviewing its current taxation system. It is expected that a new tax law will be enacted soon that will include additional tax incentives for foreign investors, as well as a reduced tax rate.

Liberalizing rules

In addition to reducing corporate tax rates, many Middle East countries are liberalizing ownership regulations, residency rules, and trade laws to allow foreign companies to more easily set up shop.

Single economic bloc emerging

Another development in the region is the continued push by the states of the Gulf Co-operation Council (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates) to create a single economic bloc with uniform economic policies.

This initiative has already given rise to a common customs union in the region and plans are afoot to adopt a single currency. Harmonization of rules across the region will make it easier for investors to adopt a regional focus for their future activities.

Downstream opportunities

Since oil was first discovered in the Middle East in 1938 and production kicked into high gear after World War II, the majority of participation by foreign companies has been in the upstream sector, with Western companies managing the region’s most precious economic assets: huge oil and gas reserves.

In the 1970s, leery of becoming too dependent on the West, Middle East governments nationalized practically all oil production and placed tight constraints on the nature and limits of foreign participation in the upstream sector.

This partly explains why the largest opportunities for foreign companies today are found in the midstream and downstream sectors. Across the region, numerous opportunities are emerging for foreign companies and their suppliers to build, own, and manage liquefied natural gas (LNG) plants, pipelines, gas processing plants, refineries, chemical plants, power facilities, and other infrastructure facilities. For example:

- The natural gas business is booming. With huge reserves of non-associated gas, but lacking the infrastructure to transport and consume it, countries such as Qatar, Egypt, and Oman continue to make enormous investments in LNG facilities and natural gas pipelines. Saudi Arabia has also launched a number of projects under its Saudi Gas Initiative, where partnering arrangements with foreign companies in the upstream sector have been allowed for the first time since the creation of Saudi Aramco.

- Large volume gas-to-liquid conversion is rapidly moving from a dream to reality. Qatar is currently developing or planning a number of gas processing projects to convert methane-rich associated gas into middle distillates such as kerosene, naphtha, gas oil, and other products. Other countries are waiting in the wings to evaluate the lessons learned from the Qatar projects before catching their own GTL train.

- Refineries and chemical plants. Attracted by the proximity and relatively low costs of feedstock, many Western companies are investing in the region’s refineries and chemical plants. With growing demand for petrochemical products in South Asia and the Far East, there is a compelling case for investment in such projects in the Middle East region.

- Water and power needs present opportunities. A growing population and an increasing industrial base present many opportunities for the development of independent power and desalination projects across the region. To meet the power requirements of Saudi Arabia alone, the region will need to develop new power projects estimated at US$15 billion by 2010.

- Major construction projects. Construction companies have the opportunity to participate in many of the major development projects on the drawing board across the region.

Small Players Welcome

To some, discussion about foreign companies doing business in the Middle East undoubtedly conjures up images of global energy giants making multi-billion-dollar investments. While multinational majors have historically played a big role in the industry and continue to do so, there are more opportunities today than ever before for small and mid-sized companies to participate in the booming Middle East energy business.

In fact, many Middle East governments have shifted their emphasis away from the global giants and begun courting smaller, leaner organizations. Western companies with a competitive advantage over their larger peers - whether it’s a low-cost structure or an edge in developing and deploying technology - are prime candidates to make the short-list to participate in attractive investments in the Middle East.

Taking the plunge

While global business is always complex, entering the Middle East region presents a unique set of challenges for any company. Consequently, it is imperative to map out one’s strategy as clearly as possible and answer some very basic questions:

- Where do you want to go? Some countries, such as Bahrain and the United Arab Emirates, have traditionally been open to foreign investors, while others - including Egypt, Kuwait, Oman, Qatar, and Saudi Arabia - continue to open their doors. But there are newcomers with huge potential, including Libya and Iraq, ready to make their entrance onto the world business stage for those who understand how to do business in them.

- What do you know about your potential target? It’s common for Westerners to paint the Middle East with a broad brush, as a single homogeneous region, but it’s only after their differences have been understood that Western companies can fully appreciate the characteristics these nations share, particularly from business, economic and religious points of view. While the nations in the region share many cultural characteristics, and continue to promote a drive to harmonize rules and regulations, it’s important to realize that each country is a unique entity with its own set of opportunities and challenges. Some countries in the region are wealthy; others are poor. Some have modern legal and business environments; others do not. Some have a long history of working with Western companies, while others have only recently begun encouraging foreign investment.

- What kind of assistance do you need? While the value of good professional assistance cannot be underestimated in any area of the world, it is particularly valuable in the Middle East, with its combination of political, economic and religious issues. Among the issues you must deal with: How can you identify potential local partners and suppliers for your venture? How do you choose the legal structure that will offer the best advantages in the realm of taxation? Which are the appropriate government authorities and agencies to deal with your particular needs?

Indeed the Middle East will continue to present attractive investment opportunities for the foreseeable future - but Western companies must plan their regional market entry wisely in order to reap the rewards of their investments for years to come. OGFJ

The authors

Richard L. Overton is a partner in the Gulf Coast international tax services group in Ernst & Young’s Houston office. He specializes in international mergers and acquisitions and post-acquisition restructurings. He has been with Ernst & Young for more than 10 years, the past nine of which have been focused solely in the area of international taxation. Overton also has structured numerous international joint ventures using hybrid entities and has extensive experience in oil field services, upstream and downstream, exploration and production, and technology for the oil and gas industry.

Lee Cleland is the Gulf Coast area director of Ernst & Young’s international tax services group, based in Houston. He specializes in internal reorganizations and merger integrations, having led project teams on two separate Fortune 10 integrations and many more Fortune 1000 reorganizations. Cleland is recognized by International Tax Review as a leading specialist in international restructurings.

Finbarr Sexton is the tax partner in the Doha, Qatar, office of Ernst & Young. He is responsible for business and tax advisory services to a large number of international oil and gas companies operating in the Middle East region. Sexton is a member of the Middle East firm’s tax steering group and the firm’s energy, chemical, and utilities steering group, specializing in tax advisory services in the energy sector. He is the international tax correspondent for both the US-based Tax Analysts/Tax Notes International and the European-based International Bureau of Fiscal Documentation.