MANAGING PORTFOLIOS: Acquisitions help achieve growth potential

A key part of modern portfolio management is associated with mergers, acquisition and divestment of assets, and asset portfolios. Acquisitions have the potential to achieve growth more rapidly than can be achieved organically through exploration and exploit synergies with an existing portfolio. Divestments have the potential to monetize non-core assets, reduce overhead, and improve focus on material assets. Mergers have the potential to achieve step changes in size, economies of scale, and benefits from regional synergies.

As portfolios are rarely, if ever, perfectly composed or able to remain located on or near to a strategically defined efficient frontier, without management actions to move assets in and out, there is a constant need within most organizations to engage in MA&D activity.

For these reasons MA&D activity is a fundamental part of portfolio management. It is therefore helpful to consider what an acquired asset or portfolio of assets should be expected to achieve and how portfolio and MA&D teams can operate effectively within an organization.

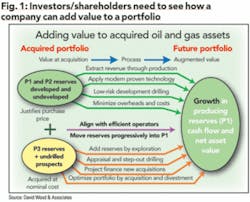

Fig. 1 illustrates how most acquisitions of upstream petroleum assets are structured and alternative ways in which they must perform to add value for the acquirer. Assets are commonly acquired on a price agreed by buyer and seller that is linked to proven (P1) and all or part of probable (P2) reserves valued on long-term oil and gas price assumptions.

For the acquirer to add value to this acquisition it has to achieve something over and above the assumptions used to justify the purchase price. Through synergies with existing assets and resources it may be able to increase production or reduce costs associated with P1 and P2 reserves.

If there are possible reserves (P3) or undrilled exploration prospects included in the acquired asset, these will usually not have contributed significantly, if at all, to the purchase price paid. Proving up additional reserves from the P3 or exploration components is where most potential added value lies.

In addition some of the E&P projects associated with the asset can be rationalized by project finance, farm-out, or divestment - all of which enable the value of the original acquisition to be leveraged.

Many companies evaluate MA&D opportunities on a stand-alone basis in a specific new ventures group functioning in semi-isolation from the operating business units and a portfolio group. Such evaluations in effect fail to identify and explore the interactions, synergies, and conflicts with the existing portfolio.

The large number of potential actions illustrated in Fig. 1 necessary to enable added value to materialize from an acquisition means that portfolio perspective on the evaluation is required. This can address, in addition to value and risk, the timing of investment requirements, staffing levels, and ability of a modified existing portfolio (i.e., one including the asset being considered for acquisition) to achieve established portfolio performance targets.

The portfolio value of the acquisition is likely to be different from the stand-alone asset value and is also likely to pose relevant questions associated with how the acquired asset will be integrated into the existing portfolio and developed once acquired.

It is clear from the above that there needs to be a close relationship between a new ventures group responsible for MA&D activity and a portfolio group, if portfolio rationalization is to be effective and achieve strategic targets.

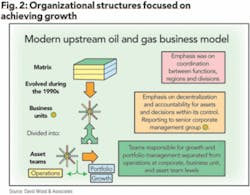

Fig. 2 addresses how business models for corporate organization have evolved in recent years and the consequence of this from the portfolio and MA&D management perspective.

The emphasis on divisional, functional, and line management structure of most organizations in the 1980s (e.g., Exxon Mobil) moved initially into a matrix structure (e.g., Shell) and on to a decentralized business unit and asset team structure devolving power and accountability down the organization (e.g., those pioneered by BP and others). Most petroleum companies are organized along one of these three models, or hybrids of them, and now operate portfolio and growth teams separate from business units.

Integrating portfolio and MA&D management at corporate, business unit, and asset team levels can be a challenge for highly decentralized organizations. Separate business units for operational assets and for growth (portfolio management, new ventures, and MA&D activity) make operational and strategic sense and are more likely to achieve high performance and promote accountability.

Emphasis of the operational business units and asset teams is to maximize value from worldwide operations. Emphasis for portfolio and new ventures teams is to focus on new opportunities and the bigger picture.

However, there needs to be close communication and cross-fertilization of staff and ideas among the new ventures, portfolio, and asset teams. Interactions between these teams become most important and stressful during MA&D transactions. If these groups do not maintain intimate working relationships and good communication with one another, this is likely to manifest itself in poor decision-making and MA&D outcomes. OGFJ

The author

David A. Wood [[email protected]] is an international exploration and production consultant specializing in the integration of technical and economic evaluation with management and acquisitions strategy.

About this Series

This series of articles addresses fundamental issues of petroleum asset-portfolio management. The material is drawn from training courses in strategic portfolio management that the author has developed for the petroleum industry since 1998. The author writes in greater detail about these subjects in four executive reports available for purchase through the Online Research Center of Oil & Gas Journal Online. For a list of titles and descriptions, go to www.ogjonline.com, click “Online Research Center” on the left navigation bar, then click the link under “OGJ Executive Reports.”