MANAGING PORTFOLIOS: Impact of Corporate Culture and Perception

Editor’s note: This is the final installment in a series of articles by UK-based consultant David Wood on portfolio management. For more information about the comprehensive Executive Reports from which these articles derived, see the shaded box on the next page.

David A. Wood, Consultant, Lincoln, England

Modern portfolio management is inexorably linked to strategy objectives and strategic development. Many difficult issues that arise for portfolio managers are related to the implementation of new or modified strategies. Just as decisions are influenced by structured and unstructured information and analysis strategic development is influenced in similar ways, it is useful to consider established corporate strategy concepts in the context of portfolio management.

Each corporation has its own corporate personality that is influenced by its history, nationality, corporate culture, performance, portfolio diversity, regional preferences and prejudices, risk preferences, public image, etc. For this reason, one individual making the same decision on the same asset at the same time would probably interpret the issues slightly differently than another.

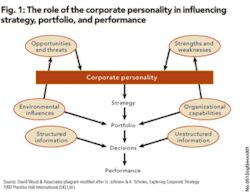

Fig. 1 illustrates how strategic analysis is filtered through this corporate personality, as well as individual decision-makers’ prejudices, before a strategy is chosen and implemented. This strategy then directly influences portfolio optimization decisions and ultimately performance.

The recognition of this bias and influence, unique to each organization, has important implications for portfolio management, merger, acquisition and divestment evaluations, and structuring bids for assets. It means that it is unlikely that any two petroleum organizations will value and risk the same asset given exactly the same information. Corporate biases alone will lead to differences in the stand-alone valuations of that asset.

When portfolio synergies, values and risks, different cost, and availability of capital are factored into valuations of specific assets it is certain that the risked valuations by any two corporations are likely to vary significantly. Analysis of bids submitted in lease sales or bidding rounds for the same tracts by a range of companies confirm this fact.

As well as conducting some “corporate psychoanalysis” to understand institutionalized biases of their own organization’s corporate personality, portfolio managers should keep in mind that other organizations, partly because of different corporate personalities, may view and value assets differently. Such understanding can be exploited when negotiating for assets or formulating bidding strategies, etc.

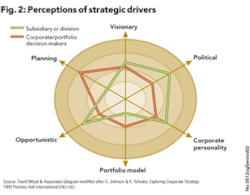

Another key aspect to corporate personality is that different parts of an organization may see the same situation from different perspectives. The rationale for decisions made at the corporate level may have been seen differently than from the divisional or subsidiary levels that are influenced by those decisions.

Perceptions of what criteria are being used to drive strategic decisions can vary greatly at different levels within an organization (Fig. 2). Even if such perceptions are incorrect, they can damage performance, alignment, and cooperation with the corporate strategy and portfolio management process. If the senior management does not take steps to inform and align the divisions in its corporate approach, such differences in perception can lead to conflict.

Conflict often manifests itself within the portfolio management and decision-making process. Communicating views can helps to avoid inaccurate perceptions that may arise by fostering an open and cooperative culture in which information is regularly fed up and down reporting lines.

When evaluating a portfolio of assets it makes sense to broaden the evaluation far beyond the key strategic performance indicators. This provides a better understanding of the fundamentals driving the organization’s strategy and its portfolio.

Fig. 3 illustrates the range of factors that might be included in an assessment of specific strategies and how they might impact an asset portfolio. Note that corporate personality, alignment, and risk preferences form part of that assessment process.

The author

David A. Wood [[email protected]] is an international exploration and production consultant specializing in the integration of technical and economic evaluation with management and acquisitions strategy.