Hurricane recovery ‘slower than expected’

Mikaila Adams, Associate Editor, OGFJ

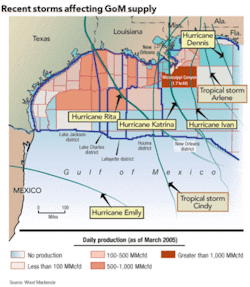

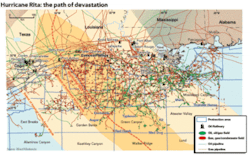

In the span of one month, two strong tropical cyclones struck the heart of the oil and gas producing region in the northern Gulf of Mexico and inflicted heavy damage to infrastructure, both onshore and offshore. Hurricane Katrina, the stronger of the two storms, came ashore along the Mississippi River delta southeast of New Orleans on Aug. 29. On Sept. 24, Hurricane Rita followed suit, striking the border of southeast Texas and southwestern Louisiana and inflicting damage to facilities that had been spared in the first storm.

Wood Mackenzie, the Edinburgh-based energy consultancy, held a briefing in Houston on Oct. 3 to report its findings as to the severity of the storm damage to the petroleum infrastructure in the Gulf and to provide an analysis of its implications for producers and markets.

What the company found is that nearly every link in the energy chain had been damaged by the storm - upstream, processing, pipelines, and support infrastructure required to maintain these links. Eugene Kim, senior analyst for Wood Mackenzie’s North American gas research group, said that although the full extent and implications of the sister storms’ impact on the energy complex and US gas markets is not yet known, it is clear these hurricanes will be major energy and macroeconomic events.

The Gulf of Mexico currently supplies 22 percent of US natural gas and is second only to the onshore Gulf Coast as a gas-producing region, said Kim, who added, “As the slower-than-expected recovery status from the combined storms starts to become more obvious, the market will finally get a good glimpse of the months ahead.” In addition to raising already record high gas prices to climb ever higher, bumps and bruises caused by the sister hurricanes are beginning to emerge.

Here are a few key points from the Wood Mackenzie hurricane analysis:

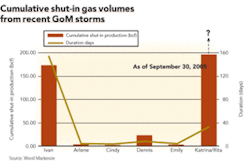

Supply. Hurricane Katrina struck with greater force than Hurricane Ivan (a 2004 storm), and Katrina’s path took it more directly through the densely populated central oil and gas producing region, including key protraction areas such as the Mississippi Canyon producing area and the Venice/Grand Isle infrastructure complex. More than 3.4 bcfd of production was exposed to hurricane-force winds, and Shell has already reported extensive damage at Mars and damage at Ursa, Cognac, and West Delta 143. Other producers have reported damaged rigs in the shallow water, while deepwater assessments remain preliminary and uncertain. Thus far, 18 rigs have been reported damaged by Katrina, 15 by Rita.

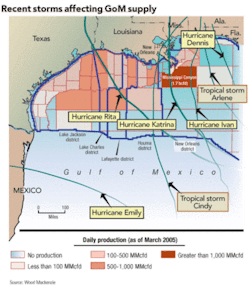

Processing Plants. Unlike Ivan, the catastrophic damage wrought by Katrina in the Louisiana Gulf Coast has severely impacted processing plant operations. Several plants - particularly in the Venice, La. area - are currently not operational. Even if the plants themselves are not damaged, localized flooding, lack of electricity, and personnel issues will probably mean outages of several weeks. Hurricane Rita’s winds mainly affected offshore GoM producing facilities in the deepwater (Green Canyon and Garden Banks) and the shallow waters (Ship Shoal, Eugene Island, South Marsh, Vermillion, East Cameron, and West Cameron). Rita affected many smaller processing plants. These plants have unique purposes and alternatives will be very limited. Some major plant “clusters” were also affected by Rita (Cameron/Johnson’s Bayou area). For this reason, gas quality from upstream production will become an issue for much of the winter.

The US Pipeline Grid. It is known that Hurricane Katrina and Rita damaged pipelines. Although damage assessments remain preliminary, major pipeline systems for the most part stand ready to accept gas. Some systems, including Tennessee and Sonat, are reporting some damage or uncertainly. Regardless of the operational integrity of the pipelines themselves, however, the grid itself will be tested over the next few weeks, and much of the gas coming back online will likely have to be unprocessed. Most pipelines are expected to work with producers to restore as much production as possible, without processing, but only for an interim period. Some sources, due to the quality of their gas, may have to be limited or remain off. Downstream pipelines have been using their gas to blend-down gas received further east due to Katrina outages. With Rita comes more wet gas to be dealt with.

Shut-In Volume Expectations. The infrastructure issues, related to both processing and personnel are much worse and will complicate and delay the return of shut-in production, regardless of the upstream damage. Early reported peak shut-in production volumes as well as number of platforms evacuated for Hurricane Katrina exceeded that of Hurricane Ivan. After reaching a peak daily gas shut-in rate of 88 percent of total GoM production on August 30, the peak daily gas shut-in rate fell slightly to 72 percent on September 2 as operators returned to the unaffected western GoM production facilities. Because of the far-reaching depth and breadth of the regional damage, Wood Mackenzie expects a slow, rather than rapid, return of shut-in supply. US GoM production will remain crippled for months, and shut-ins are likely to exceed 1 bcfd for an extended period of time, rather than the seven to eight weeks following Ivan.

Other Disruptions. The extreme flooding has made many roads impassable. In addition, lack of electricity, helicopters, access to supply terminals and boars, and over-stressed personnel will hamper repair and recovery efforts along the Gulf Coast for weeks to come.

Market reaction has been swift:

• Gas prices have risen dramatically in absolute terms and relative to crude oil. Prices at the Henry Hub surged from a seasonal record level of $9.50/MMbtu during the week prior to Katrina’s strike, to an average over $12.00/MMbtu in shortly thereafter. The crude price rose from an average of $10.25/MMbtu to $11.00/MMbtu. Natural gas is now trading at a premium to WTI.

• The spread between fall and winter prices has collapsed given the projected change in supply and probable storage injection rates through the end of injection season. The October to January spread averaged $1.10/MMbtu in the week prior to Katrina, but fell to $0.75/MMbtu shortly thereafter. The narrower spreads should hold through injection season as injection rates are reduced well below otherwise attainable levels.

• Storage is now expected to reach only 3,125 bcf before withdrawal season - a 175 bcf deficit versus 2004 levels, and just under the four year average of 3,173 bcf. Because weather adjusted withdrawals have climbed dramatically over the past three years with the plateau in US supplies and an increasing reliance on gas for winter power generation, this inventory level will expose the market to price spikes through hat least mid-winter.

• The release of oil from IEA stocks will affect crude oil and product prices and could form a dampening influence on further oil price gains for the short term until the damage to offshore production is clearer. During the fourth quarter, oil prices should be supported by winter demand and low stocks. Crude oil prices during the fourth quarter in the mid- to high-$60/bbl region would hold gas prices around $12/MMbtu and up to $14/MMbtu through mid-winter.

Although there will be some negative effects on demand, both due to regional damage and high prices in general, we now expect natural gas to at least maintain parity with WTI crude oil prices through mid-winter, with gas periodically testing extremely high distillate prices levels. If oil holds in the upper $60/bbl range, the Henry Hub gas price should hold around $12 to $14 through mid-winter. Storage inventories will remain tight.

Wood Mackenzie emphasized that its assessment is preliminary and that time will tell just how damaging these two hurricanes were to the oil and gas industry. The super majors and large independent petroleum companies will provide more detailed information when they report their third-quarter information.

Time will also tell if the industry must face more challenges like those caused by Hurricanes Katrina and Rita. Hurricane season ends November 30. OGFJ