Probabilistic portfolio analysis

Balancing operational and financial risk

Paul D. Allan, Portfolio Decisions, Houston

The problem

Risk and uncertainty are rarely evaluated as an integral part of the planning process. An array of risks—from hydrocarbon potential and operating characteristics, to political or market factors—can have a significant impact on business performance. Rapidly changing capital markets, increased financing options, the scale of investments, and overall deal sophistication add to the complexity.

Within this context, questions of concern to the VP of Exploration might be:

- Can I achieve the desired reserves and production growth?

- What's the most effective allocation of capital to meet these goals?

The CFO's questions might include:

- Would existing financing support sustainable growth or will additional financing be needed?

- Should additional shares be issued? Will the value gained by developing certain assets offset share dilution effects?

Traditional planning techniques do not help executives evaluate the multiple interrelated risks they must manage. Clearly today's volatile and complex environment demands a new approach.

The Solution: Probabilistic portfolio analysis

Probabilistic portfolio analysis generates ranges of possible outcomes and probabilities for organizational performance forecasts based on interrelated risk factors (see Fig 1).

This expanded view helps companies address interconnected financial and operational risks by providing executives with insights into relationships between goals, capital allocation, options, and funding alternatives.

Each company has different types of risk drivers which may include such factors as:

- Drilling: timing, costs, lost time, environmental issues

- Geologic: probability of success, play validation

- Reservoir: system, production decline profiles

- Production: completion service availability, pressures, timing

- Marketing: infrastructure, take-away capacity options, dependencies

- Legal: above-ground risks, permit delays, environmental issues

- Financial: ratings criteria, leverage, macro-economic factors

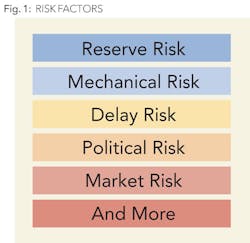

Based on multiple interrelated risk factors, probabilistic portfolio analysis generates a range of possible outcomes and probabilities for organizational performance forecasts. It yields one of the most useful perspectives for executives: aggregate forecasts that illustrate the probability of success for each metric across each time period, and the variations from the expected value, both upside and downside. The methodology can provide executives with insights into the relationship between their goals, capital allocation options, and funding alternatives and help them address interconnected financial and operational risk. See Fig 2.

The explicit consideration of the correlations and the cascade effect among risk factors make probabilistic portfolio analysis a very powerful tool for planning. For example, success for one project will influence the probability of success for a subsequent project. Some projects' probabilities of success can be influenced by subsurface factors which are combined with the above ground infrastructure risk to determine the range of outcomes for the project. The economic outcomes of all projects will be influenced by such factors as political risk, the availability of capital and critical equipment, and product pricing.

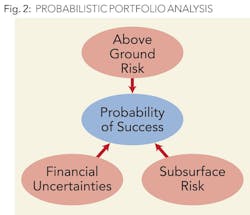

The output of such an analysis can show portfolio performance with ranges of uncertainty. Figure 3 depicts expected value, an 80% confidence band of outcomes, the targets for each metric, and the probability of achieving these targets.

Benefits and roadblocks

A probabilistic approach, combined with the ability to rapidly sample from alternative scenarios, gives executives an ability to pursue plans with a high confidence of delivering on specific objectives.

By contrast, traditional expected value planning and forecasting processes may develop forecasts that appear to meet objectives but in actuality could have a low probability of success (i.e. <50%).

If probabilistic portfolio analysis is so effective, why aren't all companies using it? While this process is quite mature at some oil & gas companies, the executives at others are unaware of it. Other executives may feel that their business is predictable enough that they do not need it. Some express concerns about the perceived complexity of the approach or believe that the necessary data isn't available or isn't "good enough."

These concerns have merit, but they can be addressed. The advanced analytics tools available today, used with guidance from those experienced in the techniques, can help companies get up to speed quickly and efficiently. Models can be built in short order and run by business staff instead of programmers or data scientists. The required data, in many cases, already exists within the organization or can be compiled from readily available sources. Over time, the analysis itself will often show where and how to improve the data.

A Case Study: Strategic plan development using probabilistic portfolio analysis

The following case study describes how these techniques are applied to the development of a typical E&P company's strategic plan. It highlights the insights made possible by concurrent assessment of operational and financial uncertainties and the value that the approach brought to the leadership team.

Key issues

The company profiled in this example was a mid-size independent E&P company with assets primarily in the domestic United States, both onshore and offshore. The company had a sizeable inventory of PUD locations as well as development extensions, low risk infill potential, and acquisition opportunities. It had been growing rapidly and had projected significant growth throughout the five year planning horizon via the development of existing discovered reserves and prospective acreage. A number of acquisition opportunities had come to light, and the executive committee had begun to seriously consider whether step-function growth through acquisition would be feasible and in the interest of shareholders.

Risks and uncertainties

The risks and uncertainties to be considered were operational, geologic, reservoir, infrastructure, above-ground risks, and product pricing issues. All of these risks had a direct bearing on a number of financial measures, including EBITDA, debt to capital ratio, and projected share price.

Data and modeling

The model development process reached across organizational levels.

The planning team consulted with senior management to understand the executives' measures of success and their concerns. This provided the focus for the data collection and the model construction.

Asset teams developed risk-weighted range forecasts that incorporated the critical risks and reflected the impact of these risks on the amount and timing of capital and expense dollars, revenues, and production for each individual opportunity.

Country managers determined the important dependencies and correlations to be modeled.

The planning team imported forecasts into a model that aggregated metrics for alternative scenarios at the company level. This included generation of a forward looking income statement, balance sheet, and cash flow statement.

Analysis and insights

The planning team conducted analysis to investigate the aggregate range of outcomes for the performance measures and to understand the probability of success over time for each measure.

As executives gained insight into their business dynamics, they posed new questions and worked with the planning team through several cycles of scenario analysis. See Fig 4.

Value created for the leadership team

The CEO was able to have the entire team pulling in the same direction with clearly articulated performance expectations, and within a defined and quantified risk appetite. The CEO was also able to communicate performance targets to his shareholders with increased confidence.

The VP of Exploration was able to look at each major investment decision in the context of its impact on company objectives. By working with the planning team, probing to understand the dynamics of the business and then making modifications to the plan, the VP of Exploration gained confidence that specific performance metrics could be achieved. The process significantly increased the company's probability of success for delivering mid-term results, even while using the new aggressive growth plan.

The CFO was able to understand the depth of opportunities and the performance impact that additional funding would make available. The CFO was also able to quantify the probability that additional funding would be needed, and in what time frame. Alternative sources of funding were also investigated, providing insights into the trade-offs between dilution effects and value gains made possible through share issuance.

Practical considerations to using probabilistic portfolio analysis

Start with what you know

Executives need to clearly state what the concerns are and how they will measure success. Focus on the major risks and uncertainties, avoiding the temptation to capture every minor variation.

Using the risks that are already known and the correlations that are evident, a company can take a huge step toward building a risk-adjusted plan. Focus on the assets and initiatives that move the needle at the organizational level. Companies don't need to start by building probabilistic descriptions of every single one of their assets.

Focus on a few key issues

The most effective approach is to start with a clearly defined business question such as, "What's the probability I can meet my mid-term performance objectives given the current capital constraints?" or "Given our growth plans, what's the most appropriate debt to equity ratio?" Keep the approach focused on risks and initiatives that are most critical to the company's success. There is no need to build an approach that considers every nuance of every risk and every complexity of your business.

Keep the data and the modeling as simple as possible

Asset teams should describe the uncertainty that will impact the chosen success measures using risk-weighted range forecasts. A best case and worst case projection with an estimate of the probability of occurrence for each outcome is often sufficient.

Planning teams are then able to build these considerations into a risk simulation model that can derive an aggregate forecast. It is best to keep the number of moving pieces down. The portfolio elements should reflect actual decisions or high level business questions. Build the key correlations and dependencies, just enough to reflect the realities of your business.

What this means for executives

Operational and financial planning are often done separately with limited assessment of the interconnections. Risk and uncertainty are rarely evaluated as an integral part of the planning process. These two fundamental disconnects lead to unpredictable performance, missed opportunities, and exposure to unacceptable levels of risk.

Probabilistic portfolio analysis provides a practical and transparent structure for incorporating and balancing financial and operational interactions and risks (see Fig 5). The enhanced ability to evaluate multiple interrelated risks can significantly improve planning and decision-making at a group level. Trade-offs in company performance metrics may be tested and quantified across multiple scenarios or alternative strategies.

Significant shareholder value can be generated by exploiting the interaction among opportunities and financing options. Companies can then fully leverage their opportunity inventory and have a high confidence of delivering consistent and balanced performance.

About the Author

As vice president of research and development, Allan guides the firm's software development efforts, refines the product vision, and assists in the development of new markets for our software and consulting services. He joined Portfolio Decisions in 2000 as an executive consultant and partner after a 10-year career at Burlington Resources. Allan holds a BS degree in mechanical engineering from Texas A&M University.

Probabilistic Portfolio Analysis

A quick overview

Range forecasts are developed and weighted at an initiative or project level, combining resources required and potential outcomes over time. These range forecasts are then combined in a simulation model to forecast aggregate performance across a variety of company-specific metrics.

Organizational level risk can be evaluated by the probability of success for each metric in each time period, and by understanding the upside and downside variations from the expected value.