TSX E&P spending up $3.5B

Canadian oil and gas company CAPEX up from last year, but expect a quiet Q4

Mark Young, CanOils, London

A drilling rig in the Evi field near the Peace River Arch area of northern Alberta.

Photo courtesy Lone Pine Resources

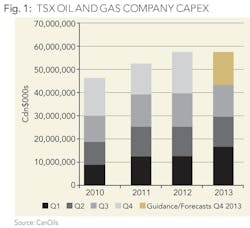

In 2013 so far (as of Nov 26th, 2013), the 100+ E&P companies currently listed on the TSX have recorded their highest combined 9 month capital expenditure in recent times. CanOils' argues however that this trend is very unlikely to continue, as there was a huge spend around the turn of the year that has inflated the figures. A look at consensus forecasts and guidance data for these companies in fact shows that 2013 will see TSX E&P capital expenditures end up just short of the total in 2012.

CanOils' quarterly oil and gas data, which now holds all Q3 reports for TSX-listed companies, shows that the first 9 months of 2013 have seen the Canadian oil and gas companies listed on the TSX spend just under Cdn$3.5 billion more than the equivalent period in 2012. Looking at Fig 1, it seems like quite an easy trend to follow, the 2010, 2011 and 2012 totals roughly show a 10% increase in total spend, year on year, but the data is being skewed by a bumper period of spending in the 6 months around the end of 2012.

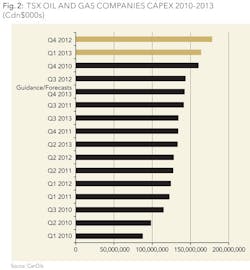

Between October 2012 and March 2013, these 100+ companies spent approx. $34 billion. This combined two-quarter total is well over 70% of the total year spend for these companies in 2010, and 65% of 2011. Fig 2 shows the last 16 quarters ranked on total CAPEX, and just how much more was spent in this six month period than usual.

It is clear that 2012 is only bigger than 2011 because of Q4, and the 9 month spend in 2013 is only bigger than 2012 because of Q1.

According to CanOils' company guidance and consensus forecast data, we will see another unremarkable spend (Cdn$14.2 billion) by these companies in Q4, meaning that 2013 capital expenditures will in fact end up similar to 2012, despite this Cdn$3.5 billion difference between the 9 month totals. The second and third quarters of 2013, and the predicted spend in the fourth all fall in the middle of Fig 2, showing companies are mainly happy with previous plans, and have been for some time, so no major expansion should be expected across the board.

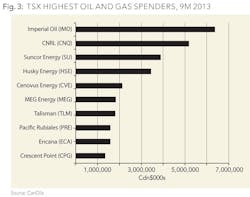

This could be down to many things, but the six month bumper spend around the turn of the year coincided with some of the lower benchmark commodity prices. For example, oil prices in Canada had fallen by around Cdn$15.00 during 2012, with Alberta Light and Medium falling from Cdn$93.99 in Q4 2011 to Cdn$79.88 in Q4 2012. Perhaps this less than spectacular 2013 is a symptom of companies having to tighten the purse strings after a large spend in a period where rising costs and these low prices meant you got less bang for your buck. Figure 3 shows the TSX highest oil and gas spenders for the 9 month period in 2013.

Notes:

All current and historic data referred to in this report is taken from the CanOils database.

The 100+ TSX listed E&P companies referred to throughout are the current TSX-listed E&P companies, as of Nov 26th, 2013. Any companies who have delisted or been acquired since are not included in this report.

About the author

Mark Young is a senior analyst at CanOils. The company provides data solutions for Canadian oil and gas company analysis. The database offers 10+ years of historical financial and operating data, all M&A deals in Canada and by Canadian companies, as well as financings, company guidance, executive compensation and consensus forecasts.