Brazil from risk, reward

This sponsored supplement was produced by Focus Reports. Publisher: Ines Nandin For exclusive interviews and more info, plus log onto energyboardroom.com or write to [email protected] |

Rio de Janeiro, Brazil, and summer is displaying the city in her full glory. The city's golden beaches slide into the sea; the warm waters offer cooling respite from the heat to locals and tourists spending time and money. Underneath the waters of the South Atlantic however, it is not golden beaches offering the entire country an economic opportunity but black gold: hydrocarbon resources that offer tremendous prospects for growth in Latin America's largest country.

Such confidence saw the state controlled hegemon of Brazil's oil and gas market, Petroleo Brasileiro Petrobras SA, or Petrobras, detail an ambitious plan of investment expending USD 236.7 billion until the end of 2017 to exploit offshore resources.

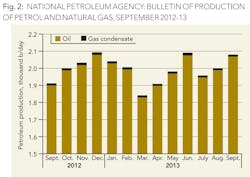

Despite such a significant figure, claims that Brazil has been overpromising and under delivering remain. 2013 was a year of frenetic energy for the Brazilian oil and gas industry: May 14th saw Brazil's first auction for oil and gas rights for five years, which raised 2.82 billion reais (USD 1.4-billion). This was followed by the presalt auction of October 21st, where Petrobras, Shell, Total, China National Petroleum Corporation (CNPC) and China National Offshore Oil Corporation (CNOOC) paid 15 billion reais (USD 6.88 billion) for the rights to the Libra field. New discoveries, too, underlined the huge opportunity that exists in Brazil: at the end of September, the SEAL-11 field was touted by Petrobras and IBV Brazil (50-50 joint venture between India's Bharat Petroleum Corp (BPCL) and Videocon Industries Ltd) as likely to contain over a billion barrels of oil, and in mid-November the ANP (National Petroleum Agency) stated that the Franco field off Brazil's southeastern coast could contain even more oil than the Libra reserve.

These promises are tempered by the fact that OGX (now Óleo e Gás Participações SA) announced that its Tubarão Azul operations were a commercial calamity in July. Almost three months later, OGX filed for bankruptcy. In November 2013, HRT, another indigenous Brazilian enterprise, had drilled 14 wells: failing to obtain oil from any.

Petrobas' PRODESIN divestment program, selling assets such as the entirety of Petrobras' wholly owned subsidiary Petrobras Energia Peru (PEP) to China National Petroleum Corporation (CNPC) for USD 2.6 billion to fund domestic development, has also run into trouble. In March 2013, Petrobras lowered the predicted value of asset sales by almost 40 percent to USD 9 billion from USD14.8 billion. Stories like this fuel the perception of risk in the Brazilian market.

Many commenters display morbid glee at indications of tumult affecting Brazil, particularly troubles affecting Petrobras. This schadenfreude, however, ignores socio-economic imperatives surrounding the oil and gas industry. Brazilian policy-makers acknowledge the importance of this opportunity and that it represents a golden path to economic development. Despite undoubted risks to entering the Brazilian market, the rewards available could be transformative for any business savvy enough to pilot a route to success.

Brazilian businessmen remain confident about opportunities in Brazil. "There is no question about the availability of the technology to drill and produce the pre-salt," says Renato Bertani, CEO of Barra Energia. Milton Costa, executive secretary of the Brazilian Petroleum Gas and Biofuels Institute (IBP) agrees, stating: 'I truly believe that Brazil is one of the best countries in the world to invest today given the size of the country and its population, the pace of its economic development, and the size of the opportunities both offshore and onshore.'

2014 will be the second year of Magda Chambriard's leadership of the ANP and Maria das Graças Foster's leadership of Petrobras. The latter has focused on reducing costs and increasing the capabilities of Brazil's operating giant, mobilizing for a big push to production. Almir Barbassa, CFO of Petrobras states: 'There are few companies in the world today that invest more in the future than Petrobras.' Chambriard has echoed this, calling for investment to be focused on developing productive capabilities. This investment and effort will profoundly shape the future of Petrobras and Brazil. In future, companies operating here need to balance between avoiding risk and pursuing rewards as Brazil's oil and gas industry matures and consolidates.

Exposed to the eyes of the world

Petrobras effectively has an open run at goal, the government in 2010 guaranteeing them preferential access to presalt resources: only Petrobras is the sole operator in this domain- a fact which is not uncontroversial in Brazil. João de Luca, president of the IBP says 'IBP has been opposed to the single operatorship for Petrobras in the pre-salt since the government first suggested it. In our opinion it is not good either for Petrobras or for the rest of the Brazilian industry.'

Petrobras' development plan for presalt gives exploration and production 62.3 percent of investment as the company seeks production of 5.2 million boe/day by 2020. Brazil's state controlled oil company is going all in, as its unwavering focus and levels of debt indicate.

Domestic fuel price restrictions continue straining the giant's revenues whose shares recently fell when the Brazilian government failed to produce a plan for bringing fuel prices to market parity, albeit concurrently permitting a limited increase to reduce pressure on Petrobras. On January 7th 2014, the state controlled company sold USD 5 billion in bonds to help finance offshore development over the coming five years. Accordingly, the company's debt increased approximately 206 percent between 2006 and 2012.

Worryingly, the rating agency Moody's downgraded the debt ratings of Petrobras to Baa1 from A3 reflecting the 'high leverage of state' (a measure considering debt and equity) and Petrobras stocks fell from USD 17.9 to USD 12.5 per share between November 18th 2013 and January 22nd 2014.

Brazil asks a great deal from its hydrocarbon industries, seeking jobs and to boost development using its oil resources. Some of these regulations are on occasion considered stifling, such as local content requirements (LCRs). Another common complaint is the limited availability of skilled, technical labor.

Total is a prominent international oil company (IOC) working in Brazil with bold ambitions for growth. Denis Palluat de Besset, managing director of Total E&P Brazil, argues government policy could be improved. "At the moment, LCR is a punitive system; it can kill a project and means that companies may not engage, afraid of the risks doing so would entail," he says. "An incentive system is wiser, encouraging investment in the areas of the sectors which are providing for the needs of companies such as Total. This would make the system more beneficial for contractors, the whole supply chain and the government."

Another significant cost is procuring suitable labor: Brazil's oil and gas sector hungers for experience and technical skills. Frequently businesses deal with this themselves, setting up training schemes where possible.

These difficulties are felt by indigenous and foreign companies. "Three years ago, the Norwegian Trade Minister visited Brazil," remembers Hans Ellingsen, general manager of Olympic Maritima, a company aiming to build up its fleet to a minimum of ten vessels by 2017 from four in October 2013. "It was the biggest trade delegation ever from Norway," he continues. "It was a big show that led a lot of Norwegian suppliers that had never set foot in Brazil to believe that they would get rich in a heartbeat here. That is not how it works. A friend of mine once said, 'Brazil is not for beginners.'"

Ellingsen, from Norway, has worked in Brazil for over 20 years and is familiar with local challenges. He predicts the future of the market: "Petrobras today is responsible for 93 percent of the vessel contracts. The latest data indicates this will drop to 70 percent in the coming five years, as IOCs grow their operations."

DARING TO SUCCEED!

Philippe Levy, country manager, SBM Offshore talks about establishing his company in Brazil:

SBM turned local content into something positive. Levy ensured that his local suppliers were fully equipped and trained to provide for SBM's needs.

Whilst working on the P-57 platform for Petrobras, Levy states: "I asked them [the local suppliers] to dedicate 20-25 percent of their turnover to us. The question I got was if it would be sustainable." Levy adds that frequently these suppliers had only worked for Petrobras. However, he persisted. "I told them that it would be sustainable, because SBM believed that local content would start to grow and will stay and remain stable.

"P-57 was a big success. The SBM supplier network grew, and we started to create alliances. SBM even stimulated foreign companies to enter Brazil and forge alliances with Brazilian manufacturers to be the preferred partner to SBM, because Brazil had the capacity, but not the engineering capabilities to manufacture."

"Of course they took a risk by doing this." Levy, however, feels the solid manufacturing base created was worth this risk. This supply chain which now provided for the FPSOs Paraty and Ihlabela- P-57 has paved the way for further works. Levy elucidates what developing this supply chain means for SBM: "With the Brasa yard…we can easily execute projects at 65 percent [LCR])."

Levy concludes, stating that SBM had to convince the supply chain, demonstrate success, and capitalize on to create a reliable reputation for SBM in Brazil.

SBM commenced a joint venture partnership with Naval Ventures Corp in the Brasa Shipyard, which started in 2011. The Brasa Yard is located in Niteroi and is a 65.000m2 module yard capable of assembling up to 12 FPSO modules at once. 'Owning the yard, the crane barge, and the quay side facilitates a very smooth execution of the project for SBM. These three tools combined ensure that we control our own destiny' states Levy.

The decision to invest in this yard has turned SBM into an important, local player in the Brazilian shipbuilding industry.

"There is so much to develop in a short period of time that is hard to believe that the global supply chain will be able to cope," says Paulo Cesar Martins, president of Abespetro, an organization that represents 51 service companies from various segments, all key players in the Brazilian oil & gas industry. "We are not only talking about massive quantities of several different critical components, but also with very high specs."

"If you take the example of Petrobras' portfolio of prospects, detailed in their latest five year business plan, even considering its experience and leading technology, it is impossible not to be concerned over their capacity to take on the load. This brings uncertainty to the market."

Decision makers face a dilemma between potential rewards and the risk in obtaining them. Total is one, illustrated by the company's late decision to join the Libra Consortium.

The recent October 2013 auction, selling the rights to Brazil's Libra field in the Santos Basin, is a prime demonstration of the rewards awaiting persistent companies. The field has an estimated recoverable oil volumes of 8-12 billion boe. Denis de Besset, managing director of Total E&P in Brazil remarks: "I am confident that those companies who are absent from Libra will be the ones who most regret the outcome of the Libra auction."

The Libra block was discovered approximately 105 miles offshore from Rio de Janeiro in the Santos Basin. The field could generate a trillion USD in public revenue and is totemic of the opportunities available from Brazil's pre salt resources- its size and volume mean that the reserve is vital to Petrobras' hopes of producing 4.2 million bpd by 2020, double its current production rate.

Libra became a possibility for Total because, de Besset attests, the final agreement saw parties split risks of production and rewards from the venture. Total was pleased excessive political interference now seems unlikely. Shell, CNPC and CNOOC joined Petrobras in commercial activities on this field, indicating their agreement that Brazil's promise outweighs possible hazards.

Tech-fix

"These criticisms of Petrobras, as well as issues including the downfall of OGX and HRT's momentary wobbles have created the prevailing feeling amongst investors that Brazil currently represents a risky business venture," says John Riggs, managing director at Intermoor do Brasil, a company providing mooring services including engineering and maintenance. Intermoor has taken on some particularly challenging projects, including installing drilling and production conductors on the Papa Terra platform. Mr Riggs commends on this saying 'It was a very tight technical spec with strict tolerances for the welded pipe, the conductor position and inclination, etc., which were really beyond what is normal in the industry."

However, whilst Riggs does speak of risk in Brazil, far from discouraging investment, Riggs argues that now is the time to act- confirming his confidence that investing in Brazil now will see solid returns, he states: "Now is the time to invest looking at the developments in the North East, because in three years the market most likely will turn again. Investors will need to remain alert to the fact that this is a window that will close: prices will rise as Brazil demonstrates it is a country fully capable of developing [its] pre-salt resources." Riggs' opinion is echoed across the industry.

Iain Wilkinson, socio-director at Petrolink, an information and communications technology company points out that: "Brazilian executives will often analyze information differently to British executives; this has a great deal to do with Brazilian analysis of risk - there is a different feel here for how far a business can stretch - which does translate into business strategy." Wilkinson feels that Brazilians better seize opportunities than companies from more risk-averse backgrounds, by acting early and decisively.

BRAZILIAN BULLS-EYE

Luis Araujo, regional manager Aker Solutions discusses the value of Brazil to his company:

Aker Solutions has been in Brazil for about 30 years, but only in the 1990s entered the oil and gas market. We signed our first contract with Petrobras in 1994, and since then have delivered around 200 subsea christmas trees to Petrobras. We have become a key supplier for Petrobras, particularly in subsea equipment.

During the 2011 crisis we realized we needed to tackle this market head on, considering the importance of Petrobras and Brazil to our global business. In an effort to do so, we engaged with Petrobras at all levels from operational level to the senior representatives and together we developed a detailed plan for the future. We jointly convinced our board of the need to invest more in Brazil.

The technical challenges in Brazil are seeing the arrival of highly sophisticated, technically adept companies gathering to capitalize on Brazil's subsea wealth, despite the risks described. This technology helps the companies reduce risk. It is unlikely that Petrobras' aim of producing an additional two million barrels per day by 2020 would be accomplished without using new technologies on mature fields. Almir Mr Barbassa highlights that Petrobras' strategy is one with finesse: "Operational efficiency is tied to our producing fields, but we have offshore fields that have been producing for thirty years, so the equipment is no longer new and has to be improved in ways. We did most of this in the last two years, essentially in the second half of last year and the first half of this year. Now we are seeing production responding." Petrobras is targeting both new resources and ensuring productivity from existing assets remains high with technologies capable of delivering greater results than previously.

Kongsberg Oil & Gas Technologies (KOGT), is another company seeking to bring advanced solutions to the Brazilian market as an established subsea EPC contractor and developer of information technology solutions for drilling operations. The company's general manager, Håkon Ward, states: 'The clear development trend in [the IT systems] market at the moment is towards real time data…and monitoring of operations.'

'[A] facility KOGT offers which is of particular use to the offshore Brazilian market is through our K-Spice and Ledaflow software systems. Together they are an integrated solution, delivering process simulation and multi-phase flow simulations. KOGT is the sole provider of this holistic system. By having these tools, clients have access to a far more detailed understanding of the whole process of production, from drill-bit to wellhead. …these services can assist Petrobras or other players in maximizing the extraction of oil from mature fields… in a way which will secure maximum returns…The need for this facility in Brazil is acute.'

"Technology is very important," agrees Miguel Gradin, president of Gran Energia, a company focused on oil & gas services, intermodal logistics, and project management. "Petrobras' aim of producing an additional two million barrels per day by 2020 cannot be accomplished without using new technologies on mature fields, and the support of service companies."

For investors looking to Brazil, research and development is vital to reducing perceptions of risk. Asked about the importance of further investment in R&D, Marcos Isaac Assayag, formerly executive manager of Petrobras' R&D Center, Centro de Pesquisas Leopoldo Américo Miguez de Mello (CENPES) says, "Continuing to invest in R&D on top of what is done already is a must. Certainly we can create a lot more value by optimizing drilling operations, so that we could drill faster, cheaper and safer, or by improving recovery factors so that we could extract, with the same number of wells, more oil from the reservoir."

The R&D investment of Petrobras was around USD 160 million per year in 2001-2003. This increased six fold in 2004-2008, reaching a level of USD 900 million. From USD 3.1 billion invested across the period 2009-2011, 47% went to exploration and production. Petrobras is prioritizing research and development in order to gain further profit.

Petrobras is aware that new technology offers a more secure path to profit. "Despite being very cost-aware given the investment the pre-salt developments require, Petrobras has always been very keen on using new technology,' states Stephan Dezaunay, country manager for PGS. "This focus on using better technology to increase production has paid off. In September 2013, pre-salt production of 329,000 barrels per day (bpd) has increased eight fold from the average pre-salt production in 2010 of 42,000 bpd."

Professionalism precedes profit

Joao Geraldo Ferreira, CEO of GE Oil & Gas for Latin America talks about the qualities giving his company a competitive edge:

GE has built a high caliber professional structure in Brazil where good business practices are based on high quality people. The best gas turbine and the highest specification christmas trees in the world were designed by people who were empowered to take forward these technical issues. At GE, we seek to create the environment for empowerment.

Any company must have a structure optimally designed to achieve key goals and ambitions. Staff with an accurate and in-depth understanding of the Brazilian market are important and the right, high quality people who will assist a company achieving its goals. Such an understanding will allow the business to react better to government regulation and design products and services optimally customized to the local environment.

Lastly, I would say that it is important to ensure one listens. Never assume a complete understanding of any issue. Acceptance of other views will ensure a more durable and better thought out plan for success.

Many companies are investing in technology to augment their business. Dezaunay describes the motivations for PGS to invest in more advanced capabilities: caused by the "lack of bids [until 2013], PGS…felt we needed to diversify and invest in a technology center to enable us to work on reservoir and monitoring services.

"Companies in Brazil are actually keen to use new techniques. PGS has ventured into new ways of executing seismic" continues Dezaunay. He summarizes: 'PGS is continuously challenging conventional industry wisdom and merits, both globally and in Brazil.'

Petrobras' and the wider Brazilian oil and gas industry's production increase is being facilitated by ever more offshore infrastructure and equipment coming to Brazil, each adding to production capabilities. ABS, a market leader in providing marine and offshore classification services, is one company eager to expand operations offshore. José Carlos Ferreira, vice president, South American Region for ABS states that: "We did not get to where we are by chance. We became the industry leader through lots of hard work and by leveraging our international network for support." Ferreira continues: "considering the innovative nature of our industry, we keep abreast of the latest technologies and developments. The offshore industry certainly moves with great speed, and if we intend to regulate, then we have to keep up with the pace. To this end, we have enacted two initiatives in Brazil: the establishment of an Offshore Technology Center as well as an Offshore Technical Committee."

This increase in capacity is underlined by the fact that in October 2013, cumulative extraction by Petrobras from presalt deposits reached 250 million boe.

A grand total such as this is perhaps the reason Almir Barbassa, states: "It takes a period of heavy work before we start producing oil and generate the cash flow." Describing steps forward from Petrobras he says: "we have to optimally capitalize on the opportunities we have in front of us, such as the pre-salt fields. Already today we are producing more than 300.000 bpd… Reaching such output in six years' time is faster than many other countries."

"Petrobras is installing more than thirty oil rigs between 2013 and 2018." Petrobras has also started the development of 20 FPSOs, each costing 1.5-1.8 billion USD. Barbassa highlights: "Every time an FPSO comes online, the production curve receives a boost. In 2017, we will produce 750.000 bpd more than today – all oil."

The IEA agrees Brazil's future as a large-scale oil producer is likely. In November 2013, the IEA predicted Brazil's production tripling by 2035, to 6 million bpd. The IEA considers a domestic focus on energy efficiency is key to Brazil meeting its export targets.

Brazil's government has allowed Petrobras to increase in fuel prices at the pump to ease pressure on the giant. There are indications price restrictions could ease again as early as March 2014.

Clearly, Brazil's prosperity is linked to the development of offshore pre-salt resources. Many key skills will have to come to Brazil from abroad, and companies must consider risk and potential profit before coming here. Brazil is a market requiring shrewd planning prior to entry. However the more that companies can offer Brazil, the more Brazil offers commercially.

One certainty exists- this country will be relentless in its pursuit of realizing the potential of its offshore energy opportunity.