A new era for marginal oil production

Don Warlick, Warlick International, Houston

Mature or marginal wells in North America are the silent producers among more newsworthy and technology-driven oil and gas wells of today. By definition, a marginal oil well produces no more than 10 b/d and a marginal natural gas well less than 50 Mcf/d. They have been deemed marginal also because they have gone through time, hanging on the edge of profitability.

Photo courtesy of Cano Petroleum

But times have changed. In December 2006, front month oil futures were near $60/bbl for oil and $7/Mcf for gas. There has been new life for marginal wells with support by higher price decks and affordable technology. This article will focus on marginal oil only, its place in North American production, and the potential attractiveness to the producer/investor.

History

The oil business started in North America almost 140 years ago and thereby has created a huge inventory of older wells. Time is not kind to conventional producing wells as they face inevitable decline - in mature wells we now see 25, 30, and up to 50 years of production, all hanging on or diminishing.

The evolution of development begins with initial completion and production, continuing into twilight years of marginal service, perhaps going into idle status, and eventually, plugging and abandonment.

It is during the marginal era that the owner/producer must continually evaluate his holdings and decide at some point whether to sell, plug, or rework with the hope of maintaining or even increasing production. It is in the marginal or late-years phase where there is new potential thanks to higher, sustained oil prices plus a dash of technology.

A sizeable well population

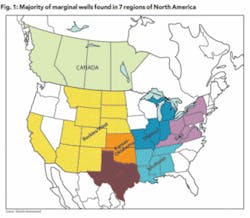

Marginal oil well concentration in the United States occurs in areas like eastern Oklahoma and Texas, Kansas, Ohio, and so on. Logically organized, those states and provinces with existing marginal oil wells are in 7 regions, as indicated on the accompanying map (see Figure 1).

| Region | Marginal Oil Wells (000) |

|---|---|

| Texas | 124 |

| Oklahoma-Kansas | 86 |

| East | 75 |

| Rockies-West | 65 |

| Southeast | 27 |

| Midwest | 24 |

| Total | 401 |

The larger regions contain huge numbers of marginally-producing wells. Remember also, on the services side, these wells have sizable parts and service requirements plus maintenance attention from suppliers. Total well breakout for US regions indicates the following:

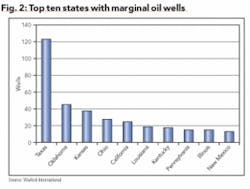

Considering well population by states in the US, it should be noted that the top states account for a big share of existing marginal oil wells. For the year 2005, the 10 leading states with the highest population of marginal wells account for almost 88% of all US marginal oil wells (see Figure 2).

| State | Marginal wells | Wells (000) | Production Mbbls |

|---|---|---|---|

| Texas | 124,116 | 124 | 139,959 |

| Oklahoma | 46,798 | 47 | 39,318 |

| Kansas | 38,692 | 39 | 25,828 |

| Ohio | 28,828 | 29 | 4,841 |

| California | 26,444 | 26 | 35,564 |

| Louisiana | 20,041 | 20 | 14,153 |

| Kentucky | 19,012 | 19 | 1,958 |

| Pennsylvania | 16,662 | 17 | 3,653 |

| Illinois | 16,407 | 16 | 8,461 |

| New Mexico | 14,069 | 14 | 14,066 |

Orphaned wells

Going beyond marginal oil wells, whether operating or idled, there is an additional segment that exists in most of the regions - orphaned wells. By definition these are wells that have been inactive 12 months or longer and obviously not operating. If there is a current operator they have failed to report well status to state or provincial agencies - but it’s probable the last known operator is insolvent or has abandoned the well, most likely years ago.

There may be in excess of 55,000 orphaned oil and gas wells across the US and Canada. Texas reported 12,905 such wells early in 2005 with oil wells accounting for almost 60% of the total. When a state oil and gas commission takes over these wells, it assumes the responsibility for disposition - evaluate them or plug and abandon for safety and environmental reasons.

The P&A endgame can be expensive, so a number of states have created orphaned well reduction programs that allow bonded operators to assume ownership at little to no cost. In addition, there can be various incentives and in some cases tax abatement for a measured period of time.

The intent of the state is to restart production where possible, collect revenues in the future, and avoid P&A and other shutdown costs. The new operator, with a fresh look at existing well and production records, appropriate technology, and sufficient resources could give new life to an abandoned, orphan well.

Marginal production important

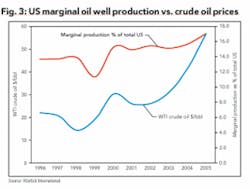

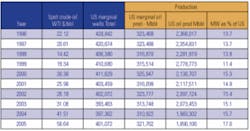

As shown in Figure 3, marginal oil wells have recently increased their share of production with just over 17% of total US oil production in 2005.

The reason for marginal production’s increased share? The biggest driver is the elevated and apparently sustained price of crude oil - an average spot price of $56.64/bbl in 2005 compared to $14.42 in 1998 and $30.38 in 2000. In total, US marginal wells produced 322 MMboe last year.

There is more to the story though, as drilling for new US oil wells since 1998 has stalled in a range of 4,000 to 8,000 wells per year (with 8,193 reported for 2005) hardly adding to the US producing oil well population of about 506,000.

The result: Marginal oil production as a share of the total increased to 17.2% last year. But if one removes Alaskan and offshore oil production from the US total of 1,869 MMboe/year, then the marginal oil production share jumps to 35% of the adjusted total - and becomes even more important to the US oil supply in a strategic sense.

But don’t forget the impact of appropriate technology in marginal fields with improved lifting methods, efficient reworking of existing wells, and better handling of produced water. All this helps to better the overall economics of marginal project management.

Marginal and orphaned oil wells for the opportunist

The important factor to consider in taking over marginal or orphaned wells is whether one can make a profit on these older wells - just basic economics. Marginal wells currently operating are not orphaned wells. Almost all marginal wells are still producing but at low levels while orphaned wells are replete with unknowns.

Typical oil producers with large numbers of producing wells may offer marginal wells in lots of 5 or more. The advantage of buying existing wells is that they have reasonably complete well histories beginning with the original completion. Another advantage is infrastructure in place, ideally in decent shape and reasonable working order.

Orphaned wells are another story. They can be found by contacting individual agencies overseeing oil and gas operations in a state and will be found in all levels of condition ranging from good to terrible. Finding well history and past workover reports on orphaned wells can be quite difficult for obvious reasons.

Why consider orphaned wells? There is long history of many of these wells being operated by less competent owners who may have missed zones of opportunity, mismanaged earlier exploration attempts, or merely exhausted their funds. Remember also there are significant numbers of high-risk, low-return wells in this category.

But are there surface equipment and tubulars at the site that could be reclaimed and sold? That could be another option for the field-savvy opportunist.

A marginal business checklist for investing

While the following is by no means complete, it should provide critical-issue reminders, with some attention at the wellsite level, for those considering acquisition of marginal properties in today’s upstream environment:

- Begin with a strategy in mind: Are you looking for behind-the-pipe opportunities, checking missed zones, considering re-stimulation of old formations, applying new technology, or just interested in flips?

- Develop a list of critical parameters in your evaluation: Select area, fields, particular location, depths, geologic structures, formations of interest, wellbore conditions, status, and condition of surface and subsurface equipment, etc.

- Research, research, research: Find as much information on the site/well as possible from all sources like state agenciesand mineral owners (in many cases the land owner is not the mineral owner). Check with the local courthouse, connect with field hands operating the lease (or who previously operated the lease), find old logs - the extent of this effort will pay off.

- 4. Perform field inspections: Don’t render judgment on first appearance of the site; the real value is down the borehole. Check on wellheads for leaks and problems, gages, surface pumping and storage, and gathering systems. Gather fluid samples, water included.

- Evaluate nearby production: What’s the history of production from nearby wells operating in same formation? Any indication of missed or depleted zones on the wells under consideration? Can you secure log histories of nearby wells?

- Summarize the opportunity to this point: Depending on an unbiased assessment of the previous parameters, a preliminary decision for a go-forward could be determined, and it is only then that the real work of negotiating begins...but now from a position of knowledge.

Finally, while oil and gas investment opportunities abound in many areas of the US and Canada, marginal production has become more of a factor in the bigger picture. Today there is more affordable technology that can be employed in marginal developments, better information available (especially to those who research it with determination), and the prospect of high crude prices.

Is there opportunity here? Always...but investing in marginal deals calls for good due diligence and access to sound field operations knowledge.

The author

Don Warlick [[email protected]] is president of Warlick International, a market and business consultancy established in 1977 that specializes in global energy.

MW opportunities explored

Warlick International and PennWell Corp. have teamed up to offer a comprehensive new report on marginal well opportunities titled “North America’s Forgotten Oil Cache: A Marginal Wells Development Guide for E&P, Service Companies, and Investors.”

More information is available at www.ogj.com. Click on “Resource Center,” then “Business, Executive, and Research Reports.”

The report’s author, Don Warlick, has previously published a series of strategic energy reports that are marketed through PennWell, including an in-depth look at Libya’s upstream and midstream oil and gas markets, and more recently, a comprehensive look at unconventional gas in North America.