Middle East meets West: Islamic finance opportunities for Western energy companies

Given the global nature and scope of the oil and gas industry, professionals in the energy field are often somewhat familiar with doing business in Middle Eastern countries.

Many energy executives have worked in partnership with Middle Eastern governments and private companies, pursued transactions in predominately Muslim nations outside the Middle East (such as Indonesia), or perhaps even lived and worked in a city such as Riyadh, Dubai, or Kuala Lumpur for a time.

Yet despite these experiences in working with the Muslim world, few Western oil and gas companies, the financial institutions that serve them, or the attorneys who advise them understand or have practiced the growing phenomenon that is Islamic finance. Few are aware of how it can benefit Western energy companies seeking a way to secure alternative sources of financing for projects (whether such projects are located in the Middle East or, given the strong private equity drive out of the Middle East region, in the US or other developed jurisdictions). Some may have encountered Islamic finance in conjunction with large projects in the Middle East, supplementing conventional sources of funding but not taking center stage in the oil and gas industry.

Still, terms like Shari’a or Sukuk remain alien to most professionals in an industry more familiar with utilizing traditional sources of capital to fund operations and finance growth strategies. To many Western minds, Islamic finance continues to sound exotic, something used in faraway places to raise capital for companies and projects in the Islamic world, not something accessible or useful to American enterprises.

In fact, Western oil and gas resources and Islamic finance techniques are ideal partners, and the potential for growth in this sector of the marketplace is exceptionally promising. Hopefully, more players in both the oil and gas industry and the Islamic finance sector will recognize the synergy between the two fields.

At the outset, a quick overview of what constitutes Islamic finance and how it differs from traditional Western finance may prove helpful.

Under Islamic law (or, in Arabic, Shari’a), certain types of commercial activities are forbidden as sinful and there are prohibitions on the types of financial arrangements into which Muslims are allowed to enter. Chief among the proscriptions is the charging of interest (or Riba in Arabic).

The ban on Riba renders most conventional Western finance techniques - loans and bonds in particular - incompatible with Shari’a. A key precept of Shari’a is that investors should not make money purely off lending money. Profits should come from productive assets or successful business and investment activities, with the financiers effectively acting as investors and sharing in the risks. Islamic law also forbids Muslim investors from engaging in highly speculative risk taking, an amorphous concept known as Gharar.

Fundamentally, Shari’a also disallows any investment in underlying activities that are considered to be vices, such as businesses that promote alcohol, pornography, gambling, or pork products. Given the prohibition on Riba and Gharar, investments in an otherwise “clean” industry may be tainted if the underlying business is highly leveraged or in debt.

Despite these restrictions on certain types of banking activity, devout Muslims have maintained a position at the crossroads of commerce since the eighth century. Within the limitations imposed by Shari’a, a number of Islamic finance techniques have been developed for application in a variety of commercial settings.

What all such techniques have in common is that they promote ethically and financially sound investments within the ambit of risk-sharing arrangements. These include, but are not limited to, cost-plus financing (Murabaha), leasing (including lease-to-own) arrangements (Ijara), partnership structures (Musharaka), and forms of venture capital investing (Mudaraba).

Sukuk offerings represent a pioneering innovation that has gained particular prominence in the Islamic finance industry in recent years. A Sukuk is a type of asset-backed certificate often used in securitization transactions that utilize one or more of the Islamic finance techniques, including some of those mentioned above.

A typical Sukuk entitles the investor holding the certificate to periodic payments similar to a bond. But a Sukuk represents an undivided beneficial ownership interest in the underlying asset with the returns being dependent upon the performance of the underlying assets with no recourse to the obligor (although some security arrangements may be put in place).

Similar to conventional bonds, Sukuk offerings have evolved to include trading on secondary markets. By the end of 2006, an estimated $30 billion in Sukuk offerings had been issued in the Islamic world, with such financings taking place both within the Middle East and in other Muslim nations with active Islamic finance markets, particularly Malaysia.

Although Islamic finance has existed for more than a millennium, in the past two decades its sophistication and prominence has grown exponentially. Modern Islamic finance has flourished into a multi-billion dollar market: It is reported that more than $300 billion is held in Shari’a-compliant investments globally, with this sum growing rapidly as profits from high oil and gas prices accumulate in the Middle East and as Muslims in emerging countries move into the middle class and seek religiously acceptable and socially responsible places to invest their savings.

The explosive economic growth in Muslim nations such as the United Arab Emirates, Bahrain and Malaysia, which each boast relatively open free market systems, has led to fierce competition to establish leading markets and exchanges for Islamic products. Traditional Western financial hubs such as London, New York, and Singapore are struggling to keep up in a quickly expanding market although they have all taken steps to better understand, hence attract, Islamic capital.

The Muslim world is finding that there is more supply than demand in regional Muslim markets, and Islamic financial instructions (including Islamic banking arms of Western banks) are therefore seeking new outlets for Shari’a-compliant investments. Accordingly, the Islamic finance marketplace, sufficiently matured and highly liquid, is now in a position to serve as a significant source of capital for Western energy companies.

The basic tenants of Islamic finance, steeped in centuries of religious scholarship and tradition, are compatible with the funding of oil and gas projects for Western energy companies. This is especially true given the inherent nature of oil and gas properties and the classification and treatment of oil and gas interests under the laws of key US states.

As discussed, Islamic finance principally favors commercial relationships in which the investor (e.g., a bank, an individual or a fund) shares in the risks associated with the underlying business endeavor. Yet, to appeal to the widest range of Islamic investors, the interest in the underlying asset or enterprise should be largely passive (as in the West, only a small percentage of investors have the expertise or desire to make controlling equity investments).

Fundamentally, oil and gas law in most American jurisdictions allows for the division of ownership on many levels: the surface estate can be owned separately from the mineral estate (i.e., a lease), properties can be held jointly by multiple owners, mortgages can be granted in oil and gas interests, and purely economic passive ownership rights such as royalties can be carved from a mineral estate. This allows for Islamic investors to hold a real economic interest in an oil and gas property without having the responsibility for conducting the oil and gas operations.

Several key US states that account for significant production of, and investment in, oil and gas treat oil and gas property rights as real property interests. In Texas and Louisiana, for example, interests in oil and gas, including royalty interests, are characterized as real property interests. An investment in real property, with its attendant ownership rights that are well-recognized under American law, provides an excellent vehicle for passive investing from an Islamic perspective.

Islamic law favors investment through shared ownership in tangible assets where possible. Shari’a also requires, in the context of Shari’a-compliant transactions, that the rights of the parties are clearly defined; real property rights are well defined under US law and such interests can be freely transferred, recorded and mortgaged.

Oil and gas interests can also serve as valuable collateral in an Islamic finance transaction, which reduces the risks associated with investing. Real property rights - especially in the form of production payments - also may enjoy certain protections under bankruptcy law.

An oil and gas company interested in raising capital can carve a passive economic interest out of its oil and gas properties in favor of an Islamic investor. This is particularly useful in the context of Sukuk offerings. A royalty interest or production payment can serve as the underlying asset backing the certificates, with the Islamic investors holding a beneficial undivided interest in the asset (which would be considered to be ownership in real property).

With a royalty interest or production payment backing a Sukuk offering, the Islamic investor (perhaps through an intermediary entity or entities) purchases this real property interest up front and earns a return on his investment over time through the stream of income generated by the royalty or production payment. Properly structured as a Sukuk, this form or investment can return the Islamic investor periodic payments that are similar to amortized interest and principal payments.

Instead of making a loan, the investor purchases an interest in productive real property and shares in the risks associated therewith. The investor bears a certain degree of reserve and operational risk, but there are a variety of ways to mitigate these risks and take security without jeopardizing Shari’a compliance.

International banks and a handful of law firms have taken steps towards bridging the gap between Islamic finance and American oil and gas law, but only the tip of the iceberg has been uncovered. While so far only limited progress has been made in connecting oil and gas companies in the West with Muslim money by way of Islamic finance, the opportunities are evident and a new trend may be emerging.

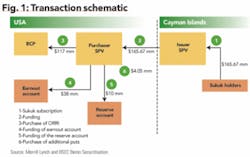

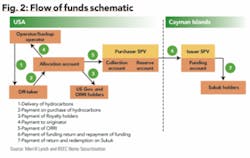

The East Cameron Gas Co. Sukuk offering is the first (and, to date, only) Islamic financing supported by oil and gas interests in the US or benefiting an American energy company. The transaction, which closed in July 2006, constitutes an example of a transaction in which Islamic finance and investment principles and the legal system governing investments in the oil and gas sectors in the US have successfully converged.

The team of lawyers and bankers who worked on this innovative transaction explored the common ground between American oil and gas law and Shari’a concepts, and it soon became apparent that the two jurisprudences complement each other well. Such compatibility ensured that this pioneering deal was achievable and it indicates that Sukuk-type financing may become a more common method of providing an alternative source of funding to US energy companies and entrepreneurs.

The East Cameron Gas Co. Sukuk offering involved a production payment carved out of federal oil and gas leases in the Gulf of Mexico. Under an oil and gas Sukuk structure, including the East Cameron Gas Sukuk offering, the oil and gas company that receives the benefit of the Sukuk offering can continue to own and operate the underlying leases. The operator of the properties commits to making certain operational commitments, as is common in royalty transactions.

The Sukuk holders receive a share of the production from the property through their ownership of the production payment, but are not guaranteed a set return. The investors bear the risk of the performance of the underlying oil and gas assets, although the deal was carefully structured to include a number of mitigants aimed at controlling risks.

Notwithstanding these mitigants (which include reserve accounts), the transaction remains largely non-recourse to the operating company. From a Shari’a-structuring point of view, the Sukuk certificates represent an undivided beneficial ownership in the real property (in this case, the production payment).

Two international Shari’a scholars, one based in Bahrain and the other based in the US, who were retained by the underwriters, reviewed the transaction documents and issued a Shari’a-compliance certificate, also know as fatwa, making it possible to market the Sukuk to Islamic investors. Such certificate (roughly equivalent to a legal opinion under Islamic law) effectively concluded that the production payment rights are sufficiently material, hence they can constitute the assets that will support the Sukuk that are offered to investors (the Sukuk were offered through intermediary entities to both international and US investors by way of a private placement; the Sukuk were later listed on secondary exchanges in Europe). It is for this reason that some bankers refer to Sukuk as an Islamic alternative to asset-backed securities.

The structure employed in the transaction was also designed with bankruptcy, tax and securities law concerns in mind in order to satisfy the requirement of investors in the United States and beyond, both Islamic and non-Islamic. The successful marketing of the Sukuk to both sets of investors is a testament to the success of the use of Sukuk in this context and its potential as an alternative financing mechanism in as far as the US oil and gas industry is concerned.

Other techniques commonly employed in Islamic financings could also prove quite useful to Western oil and gas companies.

The Sukuk structure described above may serve as a template for American oil and gas companies seeking to leverage their oil and gas properties through the securitization of a royalty interest. Other types of Shari’a-compliant structures could be used in conjunction with royalty interests.

Shari’a encourages partnership arrangements in which the investors contribute capital while the other partner contributes expertise and sweat equity. This could prove to be an ideal vehicle for raising funds for oil and gas projects in which Muslim money combines with the management and operations experience of Western oil and gas industry professionals. Additional opportunities include using Islamic leases and sale-leaseback structures for the financing of major equipment purchases.

Other types of Islamic structures have already been used for construction financing in concert with conventional sources of funding, but such examples have so far been limited to the Middle East. It may be an ideal time to expand the use of Sukuk and other Shari’a- compliant financing techniques to the Western world and American oil and gas projects in particular.

About the authors

Ayman Khaleq [[email protected]] is a partner in the Dubai office of Vinson & Elkins LLP whose practice focuses on structured finance (including Islamic finance), private equity, and capital markets. He helped lead a team of V&E lawyers who represented BEMO Securitisation SAL and Merrill Lynch, as arrangers and co-lead managers, in connection with the first-ever Sukuk offering by a US oil and gas company, East Cameron Gas Co. He is a frequent speaker and author regarding legal developments in the Middle East as well as the structuring, documentation, and marketing of Islamic securities and finance products.

Chris Richardson [[email protected]] is an associate in the Hong Kong office of Vinson & Elkins LLP, where he specializes in international business transactions with a particular emphasis on the energy industry. He was part of the V&E team that assisted in structuring the first-ever Sukuk offering by a US oil and gas company. He has published a number of articles on Islamic finance and international energy topics.

DISCLAIMER: This article is intended for educational and informational purposes only and does not constitute legal advice or services. If legal advice is required, the services of a competent professional should be sought. These materials represent the views of and summaries by the author. They do not necessarily reflect the opinions or views of Vinson & Elkins L.L.P. or of any of its other attorneys or clients. They are not guaranteed to be correct, complete, or current, and they are not intended to imply or establish standards of care applicable to any attorney in any particular circumstance.