Part 5: Long-term oil price trends, forecasts, and conclusions - Control & influences on world oil price

David Wood

David Wood & Associates

Lincoln, UK

Saeid Mokhatab

University of Wyoming

Laramie, Wyo.

EDITOR’S NOTE: This five part series of articles explores how different sectors of the oil supply chain are generically controlled by different international groups and how these controlling factions influence prices and fuel geopolitical tensions. This fifth part considers historical oil price trends and what these and forward oil prices on futures exchanges tells us about the long run price of oil. Conclusions drawn from all five parts of this series of articles pull together the key controls and influences impacting world oil price at this time of unprecedented uncertainty for the oil industry.

What oil prices should we use for long-term decisions? Some billion dollar scale decisions in the oil and gas industry, such as an acquisition of a large upstream oil producing company with oil reserves, require a long-term forecast of oil price over the next 10 to 20 years, or perhaps longer with some assets, to arrive at an agreeable sale and purchase price valuation. What long-run (or medium-term) oil price assumptions should be used?

Apart from using the “pseudo-sophisticated” numerical approaches described above, which struggle to even predict prices over the short-term, there are two approaches. Either use historical oil price averages over a number of years or, use the oil price forward curves quoted by the oil futures exchanges (e.g. NYMEX, IPE) for the medium-term and extrapolate for the later years.

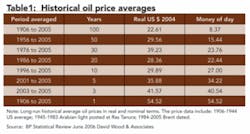

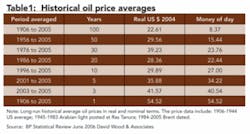

The first is backward looking (saying the past is the key to the future) and the latter is forward looking, integrating the combined expectations of all those currently trading in the physical and paper crude oil market. Both approaches are widely used, some by the same company at the same time for different transactions. Table 1 shows the past averages of oil prices calculated from the BP Statistical Review (June, 2006). When using these to predict long-term future prices it clearly makes sense to apply real average, but averaged over what interval? That is a subjective decision, but there is little to suggest that the long-run price over the past 50 years has been much less than $30 in real (2004) terms.

Using the oil forward curve approach to medium-term oil price forecasts is also not without problems in times of rapidly falling or rising oil prices. From first quarter (1Q) 2004 until mid-2006 oil prices have risen progressively. For the period 1Q 2004 to 1Q 2006 the front month Brent price rose by some $30 and the shape of the forward curve changed significantly summarized as follows:

Transaction values based upon forward curve oil price forecast in early 2004 would have had quite different outcomes for buyers and sellers over the ensuing period. However, one key advantage of using the forward curve as a forecasting guide is that paper derivatives such as futures and options can be used to hedge those price assumptions which help to reduce the medium-term risks of getting the forecasts wrong. Many buyers and sellers of upstream oil and gas assets use such hedging to reduce oil price transaction risks.

Some forecasts apply a combined approach: the forward curve for the first 2 or 3 years (combined with a hedge involving futures, swaps, or options to partially lock-in prices for that period) then an historical average oil price (including the most recent 5 or 10 years) to provide a long run oil price to apply as a flat (constant) real price going forward from year 4 to year 20 or beyond.

Such approaches do not require detailed knowledge of the complex structure, key players and drivers along the oil supply chain and oil prices. However, in making decisions on many long-term international investments in the oil industry it certainly would be prudent to understand and take into account the roles, strategies, priorities and potential influences of those key players on the global oil market.

That understanding might make it possible to detect critical changes in the oil markets early that could have significant impacts on short-term and long-term oil prices, bearing in mind, it is difficult to hedge effectively beyond a few years into the future.

Conclusions

- Oil is the most important energy fuel and source of a wide range of petroleum products and petrochemical products. It is the most political and global of commodities and oil prices influence economic performance and continue to be a factor in global conflicts.

- In such circumstances understanding the structure of the oil supply chain and how it has evolved historically is important in understanding the factors and parties that have had and will have influence over the oil markets and prices.

- Historical analysis suggests that IOCs and OECD nations have achieved enormous economic benefits, extracted more value and taxes from, and had more long-term influence on crude oil price by maintaining control over the refining, distribution, and retail fuel market sectors within the main oil consuming markets than primary producing nations have achieved from being confined to the upstream sector of the supply chain.

- Comparison over the past 30 years of OECD consumer price indices (CPI) for energy with crude oil price indices suggest that crude oil prices have increased at a much slower rate for most of that period than energy and petroleum product prices within the OECD. Cheap energy (including crude oil) provided the engine for OECD economic growth for much of that period.

- The widening of the oil supply gap for OECD nations, i.e. a greater dependence on imported crude oil, is a key factor contributing to recent increases in crude oil prices.

- OPEC and FSU (mainly Russia) are key players in filling that oil supply gap for OECD nations with much needed oil imports. Their respective market shares have fluctuated significantly over the past 30 years with huge impacts on crude oil prices, making a significant contribution to oil price volatility during that period. Going forward the availability of supply and market share from these key producing nations will have increasing influence on global oil markets and oil prices.

- Major oil exporting nations can be expected to expand and diversify their influence downstream along the supply chains as they secure more market share of OECD supply. They will be competing with the IOCs to establish controlling downstream positions in developing consuming economies (i.e. China and India).

- Many methodologies for modeling and forecasting future oil price behavior in the short-term and long-term are too simplistic (e.g. linked to too few variables such as OECD oil inventories) and have struggled since 2005 to predict oil price movements.

- It is as important to understand the geopolitical and structural influences along the oil supply chain as well as supply, demand, and inventory volumes when making oil price forecasts that will influence the value and performance of long-term investment decisions in the oil industry.

About the authors

David Wood [[email protected] and www.dwasolutions.com] is an international energy consultant who specializes in the integration of technical, economic, risk, and strategic information to aid portfolio evaluation and management decisions. He holds a PhD from Imperial College, London. He is based in Lincoln, UK but operates worldwide.

Saeid Mokhatab [[email protected]] is an advisor of natural gas engineering research projects in the Chemical and Petroleum Engineering Department of the University of Wyoming. He has published more than 50 academic and industrial papers, reports, and books. In addition to his technical interests, he has written extensively in wide circulation media in a broad range of issues associated with LNG, LNG economics, and geopolitical issues.