SPECIAL REPORT: Economics of Reservoir Management - Quantifying reservoir uncertainty

When it comes to making economic decisions around reservoir management, whether it be bid valuations, new field development and operational plans, production estimates, or divestments, there is one thing that today’s E&P operators can be certain about - that there will be a large element of uncertainty in their decisions.

That’s not to say, however, that the understanding of reservoirs has not increased dramatically over the last decade.

The increased sophistication of reservoir modeling techniques, the dramatic increase in computing speed with multi-million cell reservoir simulation models and the growth in reservoir simulation techniques - both in terms of features and accessibility - have all served to increase one’s knowledge of reservoirs. And expensive alternatives, such as drilling more wells or conducting more thorough reservoir sampling, has also helped reduce uncertainty.

However, from velocity models to fluid contact depths to permeability, faults and fractures, knowledge gaps and uncertainty in the reservoir still remain.

Better managing uncertainty

So if uncertainty is inevitable, how can one better manage and quantify uncertainty within the reservoir model?

By better quantifying uncertainty, areas of the reservoir that require more detailed analysis can be determined, and more accurate assessments and predictions of reservoir performance can be generated for the purpose of guiding development and operational decisions. The result will be reduced levels of financial risk.

And with new discoveries becoming smaller, evaluating uncertainty is today an essential means of maximizing the value of assets and optimizing production from one’s reservoirs. The better able you are to quantify the risk, the more you can improve the financial performance of the operator.

Different approaches to uncertainty

Traditional approaches to reservoir uncertainty have tended to be relatively narrow in that they are based on a single base case model that is then taken through to flow simulation.

The downside to such an approach is that there is not a broad enough range of scenarios to be tested, there is little spatial information and all decisions are based on a static criterion, such as volume.

Other approaches to uncertainty have tended to focus almost exclusively on reservoir simulation based on the understanding that only the dynamic analysis of the reservoir can fully quantify what the impact of the uncertainties will be on reservoir performance.

Supporters of this approach have been spurred on by the higher resolution, finer-scale simulation of oil and gas reservoirs enabling a supposedly more accurate prediction of field performances and better targeted capital expenditure.

Managing uncertainty across the reservoir workflow

While both single base case models and simulation within a dynamic environment can help contribute to managing reservoir uncertainty, all too often they are failing to take into consideration one essential element of uncertainty - a realistic geological model.

Reservoir uncertainty requires a completely integrated approach where uncertainty is evaluated across the entire reservoir model - covering both static and dynamic modeling workflow and which is based on a shared earth model consistent with all known geological information.

Uncertainty management should not just include tools that work on the dynamic model but also tools that work back towards the original geological models - the original source of the data input.

The importance of 3D modeling and the Neftex MENA Cube

One key means of basing uncertainty around realistic geological models is through 3D modeling, which despite its rapid uptake over the last few years, has surprisingly rarely been linked to uncertainty.

Properly utilizing multiple scenarios and realizations for risk analysis is a technique that requires a powerful and wide-reaching modeling package across the entire reservoir workflow. From well planning to fault seal analysis, 3D modeling can bring uncertainty management to the entire reservoir workflow

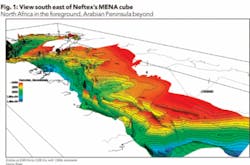

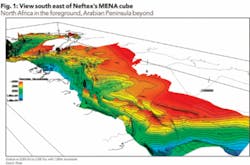

A good example of how modeling can reduce uncertainty is a commercial 3D stratigraphic model covering the entire MENA (Middle East/North Africa) region, developed by Neftex Petroleum Consultants Ltd. (Neftex), a UK-based geoscience consultancy. The model is called the Neftex MENA CubeTM.

As one can see in Figures 1 and 2, the Neftex MENA CubeTM provides a fully accurate geometric representation of the structural and stratigraphic compartments within the exploration reservoir, thereby helping operators to increase their structural understanding of fields, rank prospects accordingly and significantly reduce their subsurface risk and uncertainty.

null

The 3D geology generated by the Neftex MENA CubeTM was achieved by importing and presenting the data within Roxar’s reservoir modeling software IRAP RMSTM. This consisted of the mapping of up to six regional horizons over an area ca 8,000 km by 3,000 km, the importing of over 1,500 wells, over 150 regional cross-sections, over 600 digitized field depth contours and over 200 GIS facies maps.

With geology being naturally three dimensional, the result is a scalable 3D product, which provides a realistic, highly visual view of the data and helps to unify exploration and development activity

In addition, through Roxar’s well correlation tool, RMSwellstrat, Neftex customers will be able to group wells by classification, create well fence diagrams, view well trajectories and log data in 3D alongside other important reservoir data such as seismic, fault information and existing maps. The result is greater well intelligence, reduced subsurface risk, optimized production and greater quantification of uncertainty.

Capturing uncertainties in a dynamic environment

Uncertainty management should not stop at just geological modeling.

Uncertainty management should extend to include a range of other uncertainties and scenarios, such as structure, porosity/permeability, water saturation, fluid contacts, and flow assurance.

This is where flow simulation has such an important role to play, provided that it is based on realistic geology.

Questa Engineering Corp., an international petroleum consulting firm based in Golden, Colo., is an example of how effective simulation can quantify uncertainties.

In the spring of 2002, Questa began working on a full-field simulation project for an independent oil company based in the US mid-continent region. The company needed a reliable full-field simulation model to optimize high-pressure air injection and horizontal infill drilling program for a tight reservoir in Williston basin.

Reservoir simulation was considered vital to the project’s success because decline curve techniques couldn’t accurately predict the oil rate response during transient periods in which new wells were drilling and selected producers were being converted to injectors.

Using 9 years of production history and air injection information from an analog field nearby, Questa and its client chose Roxar’s TempestTM simulator to achieve a history match, and used the model to optimize the timing and sequence of infill drilling and to convert producers to injectors.

The simulation model was used to optimize the timing and sequence of infill drilling, as well as the conversion of existing wells to air injection. Initially, as new wells were drilled on 320-acre spacing, oil production spiked.

The model was tuned and validated to reflect drilling and conversion activity through the fall of 2004, including 21 months of high-pressure air injection. Then, 12 months later, measured water and oil production rates were compared with the forecast.

“The predictions and actuals matched almost exactly,” says John Campanella, senior reservoir engineer at Questa. “We’re pretty proud of that, especially because it was during a huge transient phase when things were changing rapidly. I think it shows what an engineer can accomplish by properly using an effective tool like TempestTM.”

Since 2005, three drilling rigs have been active in the field, and new infill wells are being drilled on 160-acre spacing. Estimated primary recovery was only between 8 and 10% of original oil in place. Now the client’s company is predicting recovery of 24%.

Through effective simulation, accurate information can be provided to help optimize infill drilling, convert existing wells to air injection, reduce uncertainty, and bolster the economics of the field.

Moving beyond a ‘what if’ scenario

Today’s uncertainty management should allow for uncertainties to be quantified across the complete reservoir characterization and development workflow.

Uncertainties in depth conversion, structural modeling, geological property modeling and dynamic reservoir simulation should all be able to be simultaneously evaluated ensuring that the full impact of these often independent uncertainties is captured through realistic 3D static and dynamic reservoir models.

The results are models that integrate all available data including seismic, well log, and other geological data and attempt to quantify all structural and reservoir property uncertainties.

Furthermore, through an extensive range of sensors, gauges and flow meters, which measure temperature, pressure, sand and the flow rates of oil, water, and gas in the well stream, models can be updated in real-time.

Whereas current modeling technology only offers ‘what-if’ type analysis - allowing for multiple realizations of what would happen if a well was choked back, for example, companies, such as Roxar, are looking to close the loop and use right-time data to rapidly update the reservoir model.

Creating a shared earth model

Closing the loop is the ultimate goal of reservoir simulation. In this way, geometrically accurate models can be built up and then created into simulation models, consistent with all known geological information. This equates to uncertainty management across the complete static and dynamic workflow.

One essential tool for closing the loop, particularly in existing reservoir, is history matching - the act of adjusting a reservoir model until it closely reproduces its past behavior.

History matching’s accuracy is almost completely dependent on the quality of the model as well as the accompanying production data. However, if this is achieved, history matching can help simulate future reservoir behaviour with a high degree of uncertainty as well as provide a vital link between dynamic simulation and the underlying geological data.

It was this vision of integration across the reservoir characterization workflow and closing the loop between static and dynamic data which led to Roxar acquiring UK-based software company, Energy Scitech Ltd. and its history matching and uncertainty estimation production, EnABLETM, in August 2006.

EnABLETM takes information from the geological descriptions of the reservoir, and then uses history matching and uncertainty estimation to predict how a field will perform. In this way, it brings geological modeling and simulation closer together and provides valuable information on the economics of the reservoir.

It is not a reservoir simulation as such, rather it is a tool that calibrates simulation models against prior observations by adjusting input data in order to reproduce or match past performance.

In the absence of production history, EnABLETM reflects uncertainties in the data directly with uncertainties in the predicted production - a vital link.

The result is a better understanding and measuring of uncertainty in reservoir production performance predictions. In partnership with Roxar’s modeling and simulation tools, the ultimate vision is that E&P companies will be able to generate a statistical framework for a rapid understanding of production behavior and create robust estimates from a shared earth model.

The net outcome is a shared earth model with uncertainty and simulation models that are fully consistent with their underlying geological interpretation.

This is Roxar’s vision - a big loop so to speak that will have a huge impact on quantifying uncertainties, reducing financial risk and having a better control over reservoir economics.

Not a done deal

No one can claim yet that the big loop between the geological data and the simulation has been fully closed.

What is important, however, is that the vision and the technologies to achieve that vision are now present.

While, to a certain extent, uncertainty is still inevitable, there is much that can be done today to ensure that decisions are made with maximum amount of information. The resulting impact on reservoir management economics will be seen for many years to come.

About the author

David Hardy [[email protected]] has 14 years’ experience as a reservoir geologist, the last 10 working with every aspect of reservoir modeling. He is currently product manager for Roxar’s integrated reservoir modeling and simulation solution, IRAP RMS.