$25 billion in Q2 2013 is up 19% from slow Q1

Brian Lidsky, PLS Inc., Houston

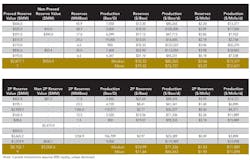

PLS reports that global upstream oil and gas M&A activity in Q2 2013 tallied $24.9 billion in 141 deals with values disclosed (214 total deals), up 19% from Q1's $20.9 billion in 117 deals (192 total deals). The combined H1 2013 total of $45.8 billion is the slowest six-month total since at least 2007 while the 258 deal count is second only to H1 2009 which followed the US financial crash in late 2008.

A highlight during Q2 was the closing of Freeport McMoRan Copper & Gold's $19 billion purchase of both Plains E&P and McMoRan Exploration. The deals are FCX's largest since its $26 billion buy of Phelps Dodge in 2007 and position FCX as a premier US-based natural resource company, being the world's largest copper producer now supplemented with high-quality oil and gas assets that provide strong cash flow and re-investment opportunities.

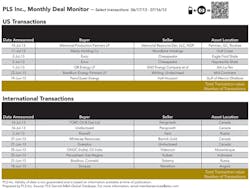

In the US, Q2 activity totaled $7.9 billion in 71 deals, down from $13.2 billion in 60 deals in Q1. For perspective, since 2007, the quarterly average is $16 billion and 70 deals. While the pace of deals is on par with recent history, there was a lack of mega deals in Q2. No deal breached the $1 billion mark for the first time since Q3 2009 and the largest deal for the quarter was Breitburn's $890 million buy of Oklahoma oil assets from Whiting In contrast to early 2009, the economic environment thus far in 2013 has been on the upswing, equity markets have been rising nicely, oil and gas price trends have remained stable to positive and there is plenty of deal inventory. The lack of more robust large deals may be indicative of a conservative stance on the part of buyers after several years of intense activity investing into new positions in resource plays. Many companies are simply turning their attention to drilling after having shored up their land positions. That being said, we expect deal activity to continue to be driven in large part by the capital needs of drilling out the resource plays which is in the early stages for many companies. The required capital will be sourced in part by continued assets sales of conventional production as well as additional joint ventures – many of which will continue to be with international companies.

In Canada, the deal markets are coming back after a slow Q1 in dollar terms. During Q2, Canada struck $2.0 billion in 28 deals (42 including those with no value disclosed) versus $609 million in 36 deals (48 total deals). Announced April 15, the largest deal was Centrica and Qatar Petroleum teaming up to buy the majority of Suncor's conventional natural gas business across western Canada for $1 billion.

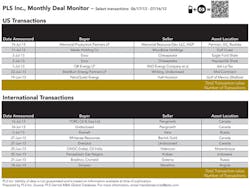

Internationally, Africa, South America and Russia were the global hotspots of activity while Europe and Australia slowed. Regarding Africa specifically, offshore Mozambique was active having heated up last year with the battle between Shell and PTTEP for the purchase of Cove Energy, whose primary asset is offshore Area 1. PTTEP ultimately won with a $1.7 billion buy. In March of this year, China's CNPC paid ENI $4.2 billion for a 20% interest in Area 4 and in June, India's ONGC and Oil India joined to pay $2.5 billion for Videocon's interest in Area 1. All this activity is driven by massive gas reserves destined for Asian LNG exports expected to begin in 2018. Elsewhere in Africa, Nigeria was also active with eight deals for $7 billion in the past year. The most recent large deal was Petrobras' sale of a 50% interest in its Africa assets (largely in Nigeria) to Banco BTG Pactual SA for $1.5 billion.

Looking forward, the markets continue to be well supplied with deal inventory. Our tally of global upstream deals for sale stands at $133 billion as of June 30, up from $116 billion on March 31. In the US, the tally is $37 billion, up from $35 billion while Canada is at $17 billion, up from $15 billion.