Revenues continue to decline, net income increases in 1Q13

Don Stowers, Editor - OGFJ

Laura Bell, Statistics Editor - Oil & Gas Journal

Revenues for the group of publicly-traded US-based companies tracked by Oil & Gas Journal and Oil & Gas Financial Journal fell in the first quarter of 2013. They declined approximately $17.6 billion (6%) from the fourth quarter of 2012 and were down $67.6 billion (22%) compared to the first quarter of 2012 (year over year). Except for the final quarter of 2012, revenues for the group have declined each reporting period since the first quarter of 2012.

Net income for 1Q13 among the collective OGJ150 companies increased by nearly $8.6 billion (up 51%) compared to the previous quarter. However, in comparison with the same quarter in 2012, income declined by $1.9 billion (down 7%).

The number of reporting companies grew to 129 from 121 the previous quarter. Ten companies on the OGJ150 failed to report their earnings to the US Securities Exchange Commission by press time for this issue.

Year-to-date capital spending stood at slightly more than $47.5 billion in the first quarter of 2013. This is less than 0.1% different from YTD capital spending in the first quarter of 2012.

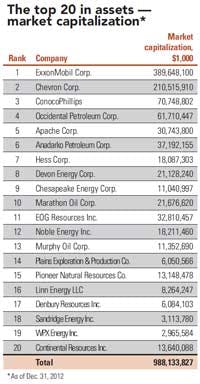

Total asset value for the group grew to more than $1.355 trillion from the previous quarter's total asset value of approximately $1.337 trillion, representing about a 1% increase.

Stockholder value for the entire group grew by nearly $9.7 billion (up 1%) from the previous quarter and by more than $11.1 billion (also about a 1% bump) from the same quarter in 2012.

Largest in net income

The 20 largest companies ranked according to net income had nearly $26 billion in collective net income for the first quarter of 2013. This compares with $22.6 billion the previous quarter and $27.3 billion the same quarter in 2012. The latest figures represent a 15% increase over the previous quarter and a 4% decline year over year.

The top three companies in net income – Exxon Mobil Corp., Chevron Corp., and ConocoPhillips – exhibited different characteristics. Of the three, ExxonMobil and ConocoPhillips showed increases over the previous quarter ($171,000 million for Exxon and $712,000 million for Conoco), while Chevron's income declined by almost $1.1 billion from the fourth quarter of 2012. Exxon, Chevron, and Conoco rank first, second, and third, respectively in net income for the quarter. The three petroleum giants collectively had $18.1 billion in net income, or 71% of the reported net income for the entire OGJ150 group of companies.

Rounding out the top 10 companies in net income for the quarter are: Occidental Petroleum ($1.4 billion), Devon Energy Corp. ($1.4 billion), Hess Corp. ($1.3 billion), Apache Corp., ($717 million), EOG Resources ($495 million), Anadarko Petroleum ($484 million), and Marathon Oil ($383 million).

The top 20 companies in net income together accounted for 103% of the net income for the entire group. Said another way, the remaining 109 companies in the group collectively reported a net loss for the quarter. Individually, 55 companies in the group recorded a loss. In the previous quarter, 62 of the reporting companies reported a net loss.

The largest companies, ranked by total assets, reporting losses were: No. 17 LINN Energy ($222 million), No 19 WPX Energy ($113 million), No. 20 QEP Resources ($3.7 million), No. 22 Newfield Exploration Co. ($8 million), No. 23 SandRidge Energy ($531 million), and No. 26 Range Resources ($76 million).

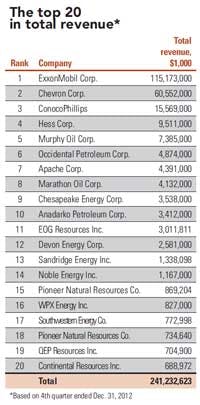

Largest in total revenue

The top 20 companies in total revenue had $224.4 billion in total revenue compared to $241.2 billion for the prior quarter (a decline of 6%) and $292.7 billion for the 1Q12 (a 23% drop).

Total revenue for the entire OGJ150 group was $235.4 billion, so the top 20 companies accounted for 96% of the revenues for the collective group of companies.

The top three companies in total revenue (ExxonMobil, Chevron, and ConocoPhillips) together took in just over $180 billion in revenue, which represents 77% of the revenue of the entire group of 129 companies. The three also accounted for 81% of the revenue of the top 20 companies in total revenue for the quarter.

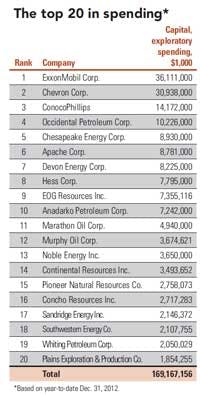

Top spenders

Spending by the top 20 companies in the first quarter of 2013 roughly equaled spending in the first quarter of 2012 – just shy of $40 billion. The top spenders were, in order: Chevron ($8.2 billion), ExxonMobil ($8 billion), ConocoPhillips ($3.4 billion), Apache Corp. ($2.5 billion), Occidental Petroleum ($2.1 billion), Devon Energy ($1.9 billion), Anadarko ($1.7 billion), EOG Resources ($1.6 billion), Chesapeake Energy ($1.6 billion), and Hess Corp. ($1.5 billion).

Fastest-growing companies

For the second consecutive quarter, Oklahoma City-based Gulfport Energy Corp. takes top honors as the fastest-growing company ranked according to stockholders' equity with a 35.6% growth rate over the previous quarter. This is down a bit from the torrid growth rate of 65.5% in the 4Q12. Gulfport is currently ranked No. 54 by total assets on the OGJ150 quarterly report. Gulfport has operations and acreage positions in southern Louisiana along the Gulf Coast, the Utica Shale of eastern Ohio, the Niobrara Shale in western Colorado, and in the Alberta Oil Sands in Canada. In addition, the company has interests in entities that operate in the Permian Basin of West Texas and in Southeast Asia, including the Phu Horn gas field in Thailand.

Coming in second is Pioneer Natural Resources Co., headquartered in Irving, Texas. Pioneer showed a 23.8% increase in stockholders' equity over the prior quarter and is ranked No. 15 on the OGJ150 report.

Synergy Resources Corp. was third with a 19.8% growth rate, and Evolution Petroleum Corp. was fourth with a 13.3% growth in stockholders' equity. The companies are ranked No. 87 and 97, respectively.

Click here to download the OGJ150 Quarterly "Quarter ending Mar. 31, 2013"

Click here to download the "The OGJ150 Company Index"