Bakken wealth a boon to North Dakota

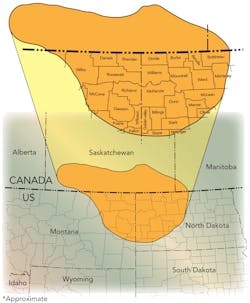

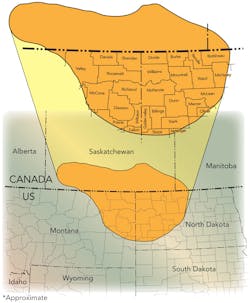

The Bakken shale play is located primarily in the Williston Basin in North Dakota, although parts of it extend into the neighboring state of Montana and into the Canadian provinces of Saskatchewan and Manitoba. It is believed to be one of the largest oil resources in North America.

In recent years, North Dakota has seen significant gains in real gross domestic product (GDP) per capita, coinciding with development of the Bakken. In 2001, North Dakota's GDP per capita was well below the US average, ranking 38th out of 50 states. Starting in 2004, the state's GDP per capita rose consistently each year, eventually surpassing the US average in 2008. By 2012, its real GDP per capita was $55,250, more than 29% above the national average. Even though the state appeared to be closing the gap on the US average before Bakken production began, the rising oil and gas production likely contributed to the economic growth the state has enjoyed.

In 2012, North Dakota reported the highest annual increase in real per capita GDP of any state in the country for the second consecutive year. In 2012, real per capita GDP in North Dakota increased by nearly 11% from the previous year, according to statistics released June 6, 2013 by the US Bureau of Economic Analysis (BEA). This is considerably higher than the national growth rate of less than 2% and is more than three times as large as the growth rate in Texas (3.27%), the state with the next highest annual growth.

Real per capita GDP has been rising steadily for the past decade in North Dakota, even as incomes around the rest of the country have fluctuated. Particularly high growth started in 2007, when increased production of oil and natural gas in the Bakken region was made possible by advancements in horizontal drilling and hydraulic fracturing practices. Between 2007 and 2012, annual crude oil production in the state increased five-fold, and annual natural gas gross withdrawals more than tripled. As a result, the real GDP of the state mining industry has grown by nearly 42% in the past year with a compound annual growth rate of about 39% between 2007 and 2012. This has led to increased demand for electricity by the industrial sector, and is spurring development of new oil and gas infrastructure.

Kodiak completes Williston acquisition

Denver-based Kodiak Oil & Gas Corp. has closed its acquisition of Bakken and Three Forks producing properties and undeveloped leasehold in the Williston Basin from Liberty Resources, another Denver-based oil and gas company.

Included in the acquisition are approximately 42,000 net leasehold acres and net production of approximately 5,600 barrels of oil equivalent per day (average net production for June 2013) located in McKenzie and Williams Counties, ND. The acquired leasehold includes 35 controlled drilling spacing units, based upon 1,280-acre units, and is 90% held by production. The southern Williams County lands, approximating 14,000 net acres, are adjacent to Kodiak's core Polar area. An additional 25,000 net acres are located in McKenzie County to the west of the company's Koala and Smokey areas. Kodiak has also assumed Liberty's contract for one drilling rig, which has 13 months remaining on its term.

The purchase price for the asset package was $660 million. Including the acquisition, Kodiak's leasehold position in the Williston Basin is now around 196,000 net acres.

Resolute selling Bakken acreage to Halcon

Resolute Energy Corp. is selling 22.9K net acres of non-operated Bakken shale acreage to a subsidiary of Halcon Resources for $75 million, according to industry analysts. Halcon, the operator of the acreage in Williams County, acquires the acreage for a fair price, said the analysts, pointing out "limited number of operators interested in acquiring non-op acreage." According to the analysts, the sale price was 87% of the year-end 2012 PV-10 value. By acquiring the acreage, Halcon, "who allocated capital elsewhere in 2014, diminishing the value of the property," said the analysts, the company is taking the property off Resolute's hands, a positive for Resolute in its deleveraging process.