Foreign investors play increasing role in US shale development

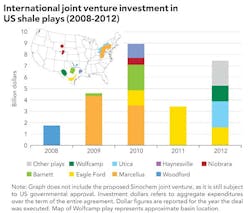

Investors from outside the United States are playing an increasingly vital role in the US tight oil and shale natural gas industry, according to the US Energy Information Administration. Joint ventures by foreign companies accounted for 20% of the $133.7 billion invested in US tight oil and shale gas plays between 2008 and 2012, says the EIA.

In early 2013, Sinochem, a Chinese company, entered into a $1.7 billion JV with Pioneer Natural Resources to acquire a stake in the Wolfcamp Shale play in West Texas. This investment highlights a renewed trend toward foreign joint ventures. Since 2008, foreign companies have entered into 21 joint ventures with US acreage holders and operators, investing more than $26 billion in tight oil and shale gas plays.

In all, there have been 73 deals between 2008 and 2012 involving foreign investors and US companies operating in shale plays. JVs by foreign companies accounted for 20% of these investments. The rest of the investments were either part of outright acquisitions—such as the Australian BHP Billiton oil company's acquisition of Petrohawk Energy—or were joint ventures among American companies (such as Hess and Noble Energy with Consol Energy) and financial institutions.

Most of the foreign investment in these joint ventures involved buying a percentage of the host company's shale play acreages through an upfront cash payment with a commitment to cover a portion of the drilling cost. Foreign investors in joint ventures pay upfront cash and commit to cover the cost of drilling extra wells within an agreed-upon time frame, usually between 2 to 10 years.

And, while most of the recent JV deals with foreign companies shifted from the dry natural gas plays to more liquids-rich areas such as the Eagle Ford, Utica, and Wolfcamp—a trend similar to domestic operations—expect the overall investment trend to continue as both US and foreign companies benefit.

US operators get financial support, while foreign companies gain experience in horizontal drilling and hydraulic fracturing that may be transferable to other regions. In addition, exploration and development opportunities are decreasing in much of the rest of the world. While foreign companies may pay sizable initial costs through JVs, these deals can be considered a cost of entry to the development of hydrocarbons through the latest technology.

"From a foreign investor/NOC perspective, sustained interest in securing additional capacity in liquids and oily plays combined with access to technology remain significant drivers for M&A. Combined with a relatively receptive political environment in the US and a tax and labor friendly environment, we expect foreign investors to continue to impact the US energy landscape," noted Drew Koecher, KPMG Energy Sector Leader for Transaction Services and Restructuring.