Evolving market dynamics of global LNG

Dale Nijoka, Houston, Ernst & Young LLP

Foster Mellen, Wilmington, NC, Ernst & Young LLP

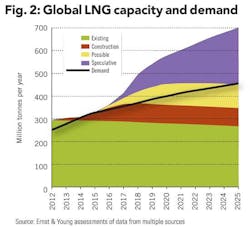

The modern global LNG industry is approaching its 50th birthday in 2014. A massive amount of new LNG capacity has been proposed — as much as 350 million (metric) tonnes per year (mtpa) — which, if all were built, would more than double current capacity (of less than 300 mtpa) by 2025. Even with reasonably strong demand growth, this implies growing supply-side competition, upward pressures on development costs and downward pressures on natural gas prices. Nevertheless, the very positive longer-term outlook for natural gas is driving investment decisions, both in terms of buyers' willingness to sign long-term contracts and sellers' willingness to commit capital to develop the needed projects.

LNG demand growth is front-loaded, but in the wake of a capacity surge over the last few years, capacity growth is now back-loaded. We are seeing a post-Fukushima squeeze, as well as a slowdown in near-term capacity additions, pointing to relatively tight markets over the next few years. LNG development costs have been rising at a torrid pace, and with LNG demand shifting to new, more price-sensitive customers just as the supply side battles with rising costs and increasing competition, sellers must adapt.

Artist rendition of the six LNG liquefaction units planned at Cheniere Energy's Sabine Pass LNG facility.Illustration courtesy of Cheniere Energy

The supply/demand magnitudes and dynamics aside, the biggest potential impacts are on LNG pricing: namely, will oil-price linkages continue to dominate global LNG contract pricing; will there be room for spot-gas price linkages; and will divergent regional gas prices show signs of convergence?

Going forward over the medium to longer term, we expect that there will most likely be a gradual but only partial migration away from oil-linked pricing to more spot or hub-based pricing. LNG sellers are reluctantly facing realities and are offering concessions in order to remain competitive. However, LNG pricing should not collapse, simply because the cost to supply is high and incentives to develop new capacity must be maintained. LNG is a very expensive game, and prices — however they are formed — must reflect this reality.

Demand growth consensus

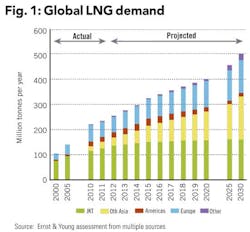

Total global natural gas demand is expected to grow by 1-2% per year through 2035, more than twice the expected growth rate for oil. But LNG demand growth is expected to be even stronger, particularly through 2020. While there is a wide range of forecasts available, a broad consensus of industry analysts/observers sees average annual growth of around 5-6% per year. After 2020, demand growth is expected to continue, albeit at a slightly slower pace (i.e., around 2-3% per year) as markets mature, demand shifts to more price-sensitive buyers, and some price subsidies are removed in non-OECD markets. However, global LNG demand by 2030 could be almost double that of the estimated 2012 level of about 250 million metric tonnes (see Fig 1).

Japan, South Korea, and Taiwan (collectively, JKT) have been and are expected to remain the backbone of the global LNG market. Accounting for more than half of total global LNG demand in 2012, the JKT countries are characterized as heavily industrialized with limited domestic energy options — i.e., they are seen as the "premium" LNG markets. However, the newer and growing LNG demand centers — China, India, Middle East, Europe, and South America — tend to have more available competitive energy options, including coal and oil, as well as other sources of natural gas, either from domestic production or pipeline imports. As a result, these new markets will generally be less willing to pay supply security premiums and will be more price sensitive.

The principal risks for LNG demand growth come from uncertainties around the global and regional economies and from increasing gas-on-gas competition. Global economic growth has been decelerating over the last few years, with the recovery from the global financial crisis of 2008/2009 relatively slow and uneven. More importantly, relatively new, "unconventional" supplies of natural gas, including shale gas, tight gas, and coalbed methane, could transform the world's energy markets. While global gas reserves have been growing steadily for decades, over the last decade the so-called unconventional gas revolution has roughly tripled the resource base that can be economically recovered. Generally lower-cost unconventional gas is likely to capture some of the demand that would have otherwise gone to LNG. Adding to the pressures from unconventional gas development are the planned or proposed new/expanded gas pipelines from Russia, the Caspian and/or Central Asia into Europe or Asia that could also eat into potential LNG demand markets.

LNG liquefaction capacity

Over the industry's last five decades, we have seen a progressive broadening of the LNG supply base, with three waves of suppliers. Algeria, Malaysia and Indonesia dominated the first wave, while Qatar and Australia dominated the second. The third wave could come from as many as 25 other countries, many of which currently have little or no capacity, but by 2020, these countries could provide as much as 30% of the world's LNG capacity.

Looming tighter markets over the next 3-5 years or so suggests firming contract prices, at least until more new projects move to final investment decision (FID) and production. By 2025, the global LNG market should have room for all of the projects that are currently seen as "possible." However, unless there is substantially higher growth in LNG demand, building a significant number of the "speculative" projects implies increasing supply-side competition (see Fig 2).

The new North American exporters

Most notable among the potential new wave of LNG exporters are those in the US and Western Canada. Current US law requires an export license from the US Department of Energy (DOE) in order to export LNG. In general, export of LNG to a nation that has a free trade agreement (FTA) with the US is considered in the public interest and is typically approved without modification or delay. The DOE has more latitude in modifying the terms and/or stipulating conditions in considering applications for export to non-FTA countries. At present, the US has FTAs with 19 countries, of which only South Korea and potentially Singapore represent significant and economically viable LNG markets.

As of March 2013, 24 companies have submitted applications for US LNG export; 21 of these have been approved for FTA countries, but only one application, from Cheniere's Sabine Pass Liquefaction LLC, has received approval for export to non-FTA countries. The proposed projects are predominately located on the Gulf Coast, but they also include proposed facilities on the East and West Coasts. Importantly, most of the applications, including Cheniere's, would base exports from modified, existing LNG import facilities. These "brownfield" export projects would likely enjoy significant cost advantages from the existing infrastructure (particularly utilities, storage and port facilities), in comparison with other "greenfield" projects, without such infrastructure already in place.

More than 200 mtpa of US LNG export capacity has been proposed, which could generate up to 30 bcf/d of exports. However, the market is unlikely to need anywhere near that amount, with global LNG demand in 2012 at just over 250 mtpa, growing potentially to 400 mtpa by 2020 and to 500 mtpa by 2030. Clearly, firm offtake agreements will be critical for US projects to go forward.

In Western Canada, eight LNG export projects have been proposed, collectively with almost 75 mtpa of capacity or almost 10 bcf/d of exports. As in the case of the US, not all projects are expected to go ahead. The proposed projects are underpinned by a large resource base in Western Canada, supportive government policy, and a generally welcoming environment for foreign investment. Unlike the case in the US, the Canadian projects are primarily led by major IOCs and most of the proposed projects have Asian partners, in particular Japanese, Chinese, Korean, and Malaysian companies. However, the projects will be disadvantaged vis-à-vis their US competitors in that each of the Canadian projects will likely be an integrated greenfield project. Not only will the project developers construct the liquefaction/export facilities from scratch, they will also own and develop the gas resources. The projects will also require additional capital investment, likely from third parties, in the form of pipeline infrastructure from the gas source, presumably in northeastern British Columbia (BC).

Sticker shock — the capex challenge

The early wave of LNG projects was largely developed for capital costs of less than $200 million/mtpa of capacity, and with a few notable exceptions, the second wave of capacity was generally developed for costs in the $500-$1,500 million/mtpa range. However, the third wave of capacity is now challenged by what can only be described as a "step-change" in capital costs. Deutsche Bank estimates that the currently operating LNG projects were developed at an average cost of about $1,200 million/mtpa, whereas the average cost for the recently sanctioned and proposed projects is more than $2,600 million/mtpa, more than double the historical average.

LNG project proposals are growing faster than industry's capabilities to develop them. Generally at the high end of the cost curve, with development bottlenecks and spiraling construction costs, Australian projects are typically suffering the most problems. Sanctioned projects are generally less significantly impacted (except if contracts are reopened or renegotiated), but projects still seeking contracted offtake are at substantial risk.

In contrast, brownfield projects that include expansions to existing operations and those that will build on existing LNG import infrastructure, such as in the US, will have distinct cost advantages. Similarly, merchant LNG projects that don't include the upstream costs of gas supply development — again, as is the case for most of the US LNG export projects — will enjoy distinct cost advantages over the integrated projects.

Indexing and convergence

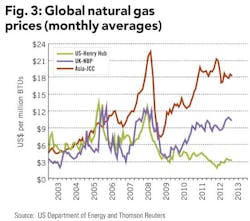

The last few years has seen a record divergence in regional gas prices, driven by both supply and demand factors — e.g., the US shale gas boom, the European financial crisis, and the Fukushima nuclear crisis (see Fig 3).

However, the advent of diverse new supply sources is challenging the LNG status quo, with Asian buyers presumably looking to modify or possibly replace their long-standing and relatively expensive pricing model of gas prices tied explicitly to oil prices.

High LNG development costs will require ironclad long-term offtake agreements. But more recently, the market is witnessing the inherent conflict of increasingly-more-expensive projects resulting in selling to increasingly-more-price-sensitive buyers. From the supply side, oil is becoming somewhat scarcer, while gas is more plentiful. As a result, there is the inherent conflict of persistently high oil prices and a growing surplus of natural gas, with strict oil indexation becoming less tenable. Oil indexation of gas contracts will become more difficult with greater competition between sellers, more price-sensitive buyers, increasing energy deregulation, increasing gas-on-gas competition from new pipeline infrastructure, increasing spot market liquidity, and most importantly, increasing availability of spot-price-based LNG exports. In short, high-cost projects will find it harder to find shelter in bilateral contracts, and high-cost sellers will struggle to preserve pricing power.

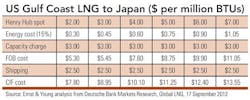

Critically, the possibility of spot gas-linked contracts for North American LNG could upset the traditional LNG pricing structure. Using the terms of the Cheniere Sabine Pass contracts, the attractiveness of "Henry Hub plus" pricing becomes apparent, both to buyers and sellers — buyers get access to supply not linked to high and presumably increasing oil prices, and sellers open margin opportunities. As shown in the table above, the "plus" component or "uplift" over the spot price needs to be about $6 per million BTUs. Thus, US LNG will be particularly attractive if spot prices stay under or around the long-term US spot gas price assumption of about $5-6 per million BTUs.

Notional FOB costs for proposed Western Canada LNG exports are assumed to be slightly higher than those for US Gulf Coast exports, largely due to the pipeline supply component (getting the gas from northeastern BC to the coast), but shipping costs to Asia are substantially less.

There are likely to be significant cost challenges for many of the proposed Australian LNG projects. In contrast, the proposed North American LNG export projects are particularly well-positioned, even though the US Gulf Coast projects will give up some of their FOB cost advantage with higher shipping costs. As substantial volumes of lower-cost LNG move into Asian markets, projects at the high end of the supply curve — namely, many of the Australian projects — will become increasingly vulnerable.

Going forward over the medium to longer term, we expect to see a gradual but partial migration away from oil-linked pricing to more spot or hub-based pricing. LNG sellers are reluctantly facing realities and are offering concessions in order to remain competitive. However, LNG prices are unlikely to collapse, simply because the cost to supply is high and incentives to develop new capacity must be maintained.

We are also expecting to see increasing destination flexibility in LNG contracts, increased "diversions" of cargos between markets, and increased re-exporting of cargos, all of which increase liquidity and will contribute to greater linkages between/among regions and markets. These increasing linkages between markets and the growing supply-side competition for premium Asian customers will provide some convergence of regional prices — namely Asian prices are pushed down, while North American prices are lifted somewhat, generally narrowing, but not eliminating, the regional differentials.

Other risks and challenges

Beyond the cost and pricing issues, companies have to consider and address a number of other risks and challenges. Most important for North American LNG exports is political risk. Particularly in the US, there may be domestic energy cost implications as a result of LNG exports. Gas-intensive industries that have recently gained competitive international advantage with low US gas prices are adamantly opposed to LNG exports. The recent study by NERA Economic Consulting for the US Department of Energy found that LNG exports would produce net economic benefits for the country despite somewhat higher domestic gas prices, and that these benefits would increase with export volumes. While the LNG community welcomed these findings, the report itself does not settle the politically charged issue. The US government always retains the right to not issue and/or to revoke export licenses. In addition, there simply are some concerns about the political "optics" of selling lots of gas to China.

In Canada, these risks center around rising environmental opposition, particularly with regard to potential pipeline and/or shipping spills, and around First Nations' land issues with the export facilities and the associated pipeline infrastructure.

Lastly, there is the industry record in terms of schedule delays and cost overruns. Only a few of the recent LNG projects have been delivered on time and budget, and it appears to be getter harder to do so. Projects are challenged by sheer train sizes, increasing technological complexity, labor issues and environmental issues, while upstream supply regions have also become more complex.

The complete Global LNG report can be found on www.ey.com/oilandgas.

About the authors

Dale Nijoka is Ernst & Young's Global Oil & Gas Leader and has more than 30 years of public accounting experience; Foster Mellen is a Senior Strategic Analyst in the Global Oil & Gas Center and is part of the Ernst & Young LLP knowledge organization.

Ernst & Young refers to the global organization of member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited does not provide services to clients. Ernst & Young LLP is a client-serving member firm operating in the US. The views expressed herein are those of the author and do not necessarily reflect the views of Ernst & Young LLP.