The Restless Explorer

This sponsored supplement was produced by Focus Reports. Report Publisher: Ines Nandin. Editor: Eric Watkins. Project & Editorial Director: James Waddell. Project Coordinators: Chiraz Bensemmane, Zuzana Kudelova. Editorial Researcher: Cameron Rochette. For exclusive interviews and more info, plus log onto www.energy.focusreports.net or write to [email protected] |

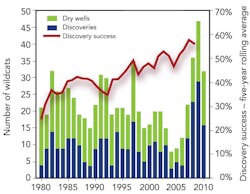

Having spent a decade tracing the steps of the UK along the same downward-spiralling production path, Norway has now found a second wind. A spate of world-class discoveries over the last couple of years has breathed new life into Norway's oil and gas industry. Indeed, as Norway unlocks its third petroleum province in the Barents Sea in the 22nd licensing round, its E&P story is clearly still being written. Currently garnering the envy of debt-laden and stagnating European economies, Norway is riding high on a second oil boom and faces a very different set of challenges. With unprecedented levels of E&P interest in the Norwegian Continental Shelf (NCS) the key questions are how long and how far can Norway now stretch its capacity without collapsing from the strain.

Sympathy for the Overpaid

In July, as the European press was reporting that Norway's oil and gas industry had shut down and British gas prices had shot up, I was sitting in an office with Hilde-Marit Rysst, president of the Norwegian Union of Energy Workers. We were discussing whether Norwegian offshore workers, whose average salary of $180,000 is twice that of the global average, who work a "two weeks on, four weeks off" regime and who currently retire at 62 were justified in launching a 16-day strike action. Undertaken to protect what some would see as rather indulgent labor rights, the strike of 708 workers ultimately reduced Norway's July oil production by 17 percent, and threatened Norway's reputation as a stable gas supplier.

For Rysst, however, the issue was not whether highly skilled Norwegian offshore workers deserved working conditions well above those of their counterparts in other countries. It was not even about employers reneging on past agreements. Rysst's main problem with the situation was the hypocrisy of an industry that was able to offer generous pensions to its chief executives now reining in the rights of the workers who paved the way for its success.

Helge Lund, CEO, Statoil

She pointed out that at one time the top 10 executives at Statoil earned the same as the CEO of ExxonMobil and that the industry was founded on more egalitarian principles. For her, the nature of Norwegian-based oil companies like Statoil is changing. "Firms in Norway are earning colossal amounts and the difference between them and their European counterparts is even greater than the difference between Norwegian worker pay and the average pay in Europe," said Rysst. For her, the only valid wage benchmarking is within Norway, and the only inequities are those that exist between the top and bottom of Norway's industry.

In September, the Norwegian Petroleum Association managed to head off another strike of 159 workers on North Sea fields by acquiescing to a 4.5 percent pay rise. Whilst the rest of Europe talks of pay freezes and austerity measures, these conversations can be heard only as faint echoes in Norway.

Derailing a Runaway Industry

Speaking at the 2012 Pareto Securities Oil & Gas Offshore Conference, with a tone of reserved bafflement, Statoil CEO Helge Lund parroted discussions taking place in the Storting (Norwegian parliament): "We believe that our economy is too strong, there is too much activity. This would seem like a joke to others." He continued: "The critics think Norway's blossoming oil and gas sector puts negative pressure on the Norwegian economy and hurts other branches."

Lund was referring to prominent politicians and economists who have been flirting with the idea of slowing down the pace of Norway's oil and gas development, fearing that it might disadvantage the rest of the economy. One of the three members of Norway's coalition government, the Socialist Left Party, has publicly announced that high offshore activity is harmful to the rest of the mainland industry. They see this wealth-generating industry creating a skills drain from other sectors and fueling a dangerous real estate bubble. In Norway's oil capital, Stavanger, buoyant oil-worker salaries have driven a rise in house prices, making it hard for lower paid workers to find places to live. As a case in point, local hospitals are short on nurses, whose salaries struggle to meet the cost of living in one of the top 10 most expensive cities in the world.

However, Lund warned that any restraint on the industry would throw up a huge challenge to investment and irrevocably harm value creation stemming from the industry.

In 2012, while other European economies dallied around anaemic growth figures, Norway was at various points Europe's fastest growing economy. Norway is projected to have a robust 2.8 percent growth in 2013 and, according to the Norwegian Petroleum Directorate, 21 percent of that growth can be attributed to the oil and gas industry, while 47 percent of Norway's exports are made up of petroleum sales and oil services. With such strong value creation one might ask: why punish the oil and gas industry?

Norway has gone to great lengths to prevent abuse of its oil wealth and resist the Dutch disease - the apparent relationship between the increase in exploitation of natural resources and a decline in the manufacturing sector. At $654 billion Norway's "Government Pension Fund" is the largest sovereign wealth fund in the world, swallowing up 100 percent of Norway's state oil revenues, with a limitation of four percent being made available for reinvestment by the state within Norway. The sagacity of this system has earned international respect, yet it seems that however strong the remedy, the runaway success of Norway's oil industry, nonetheless, poses a challenge to the rest of Norwegian society.

High on Utsira

But what kicked off Norway's second oil boom?

Over the course of 2012 Norway's part-privatized NOC, Statoil, Swedish E&P independent Lundin and their partners carried out appraisal drilling on the Johan Sverdrup field (formerly Aldous/Avaldsnes). Successful drilling programs since its discovery in 2010 confirmed that this giant field, which is expected to contain upwards of 3.3 billion boe, is not only one of the largest finds on the Norwegian Continental Shelf (NCS) since the mid-1980s but also one of the top five discoveries of all time in Norway.

The two blocks (PL501 and PL265) located in Norway's North Sea on the Utsira High, which now form the Johan Sverdrup discovery, appeared in the country's first licensing rounds back in 1965. Four successive license groups have been within meters of finding these oil reserves, but without success. Asked whether this discovery was part of a skillfully designed strategy emanating from Lundin's now legendary exploration manager, Hans Christen Rønnevik, or simply remarkable good luck, Torstein Sannes, managing director of Lundin Norway, replied: "It certainly feels like there was an element of luck in making this discovery. However everyone forgets that we spent $600 million in this area before it became a big success story."

Torstein Sanness, managing director, Lundin

Since Lundin first entered Norway in 2003, the company has enjoyed repeated exploration success, following a strategy oriented around Jurassic highs. In fact, the company has chalked up a discovery every three years since 2004: Alvheim Volund 2004, Luno (now Edvard Greig) 2007 and Avaldsnes (now Johan Sverdrup) 2010. However, Sannes makes no mistake that Johan Sverdrup is clearly a game-changer.

Sannes boasted not only that companies are now queuing up to partner with Lundin, but also that their loan facilities have been oversubscribed to the tune of $5 billion. He continued: "When Johan Sverdrup comes on-stream in 2018 or later we will see our production increase substantially. Statoil has been quoted as seeking 500,000 barrels per day from Johan Sverdrup after 2.5 years of production and Lundin can look at having around 25 percent of Johan Sverdrup's production." Moreover, Johan Sverdrup's water depth is around 115 meters, it is nearby existing oil and gas export infrastructure, and there are no high temperature/high pressure (HTHP) concerns, making these highly valuable barrels.

Erik Haugane, CEO, Det Norske

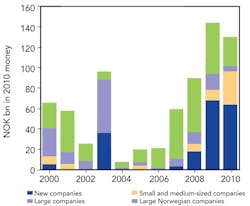

This remarkable story has spurred on the industry and other major discoveries have followed from Skrugard in 2011 to Garantiana in December 2012. Erik Haugane, CEO of Norwegian independent DetNorske, one of Lundin's key license partners on Johan Sverdrup, attributes this success, not to the good fortune of having a resource-rich shelf, but to the liberalization of the industry from 2000. He said that the major change occurred when the Norwegian Parliament gave up the rigid dogma of maintaining three oil companies on the NCS: Saga, Statoil and Hydro. Since then the Norwegian government in 2005 introduced a 78 percent tax rebate, which "took away the disadvantage of being a newcomer compared to the established companies who could transfer the tax to their operating costs immediately or push it forward for later income." For Haugane, it is the new arrivals to the shelf like Lundin which have reignited the industry and they are the ones that hold the key to reversing Norway's decade-long oil decline.

Buying into Norwegian Success

On the back of strong exploration incentives, the number of companies active on the NCS has increased to nearly 60 today from around 18 a decade ago. However, according to Svein Ilebekk, Cairn's director of Northern Europe, the number of companies is unsustainable in the current financial climate. "Accessing capital is a major issue today and will be even more critical going forward both in the UK and Norway. I think in a few years' time you will see an increased consolidation in Norway and a different set of companies," Ilebekk said.

Svein Ilebekk, director of Northern Europe, Cairn

Two of the companies Ilebekk helped found have been acquried by firms seeking entry into Norway: Revus by Wintershall and Agora Oil & Gas by Cairn. December 2012 then saw British E&P independent Tullow Oil acquire Norwegian pure-play exploration company Spring Energy for $372 million.

A child of Norwegian venture capital company HitecVision, Spring Energy had built an extremely strong track-record in exploration since its foundation, making six commercial discoveries out of 12 drilling operations since 2008.

Discussing the origin of the company in 2007, Roar Tessem, founder and CEO of Spring Energy said, "I saw a great deal of opportunity in prospects that had been missed within the mature areas of the North Sea and also growing opportunities in the Norwegian and Barents Seas. This potential has certainly not diminished since then, in fact I rather think it is more focused now and this potential has been repeatedly confirmed by recent discoveries."

Tullow naturally brings financial muscle and experience to the operation and Tessem, now managing director of Tullow Norge AS affirmed, "We have a solid drill schedule over the 12 firm wells for the next 18-24 months. He continued, "We would also like to continue strengthening our ability as an operator because we will drill our first operated well in the second half of 2013 on the Mantra prospect just northeast of the Troll field."

Roar Tessem, CEO, Spring Energy

Both Spring Energy and Tullow Oil had been looking to expand into the North Atlantic and the merger was a good strategic fit. Well-known for its African E&P projects, Tullow's foray into Norway marked a new direction for the firm and the acquisition secured its fast access to 28 licenses on the NCS with potentially more on the way if applications in the 22nd licensing round prove successful.

An Equity Bridge to Norway

Addressing the shaky foundations of Europe's financial markets, Tom Reynolds, CEO of the dual-listed Norwegian-British E&P company Bridge Energy, expressed the opinion that the European downturn would not induce shareholders to sell, but could restrict access to new capital. According to Reynolds, the advent of the Greek sovereign debt crisis in 2010 certainly hampered Bridge Energy's first IPO attempt. Later a key tactic for Bridge Energy was to gain a second listing on London's Alternative Investment Market in addition to Oslo listing, in order to mitigate the scarcity of equity funding.

Tom Reynolds, CEO, Bridge Energy

Reynolds saw the UK as presenting a separate investor community, and one which was keen to get involved in Norway's exploration story. He explained that despite the European recession, "The Norwegian exploration success story carries a lot of weight in this investor community. There have been a number of pan-North Sea players or UK-focused players making their way into Norway over the last couple of years."

Alfred Kjemperud, managing director, Bridge Energy

Reynolds sees Norway's exploration environment as attractive due to its open access to seismic data and the availability of transportation and offloading infrastructure for fast-track tie-in programs. "This is a very well understood province with great data access and if you find what you are looking for it should be quicker, easier and more commercial to develop than in most other places in the world," said Reynolds.

Scott vs Amundsen in Oil & Gas

Just like Robert Falcon Scott and Roald Amundsen, the famous British and Norwegian explorers who competed to discover the South Pole a century ago, the UK and Norway are today locked in a similar competition. They share the same North Sea basin, and there is a race to attract investment to their continental shelves. Technically the British were the first to arrive on the scene, with a few years' headstart. But now it seems that Norway is pulling ahead, with 2011 marking the first year when more exploration wells were drilled in Norway than in the UK.

In the original race for the South Pole, Scott made use of ponies, dogs and even engine-driven sledges, whereas Amundsen stuck to using dogs the whole time. Similarly, over the last few years, the British have changed their fiscal strategy numerous times whereas the Norwegians have remained relatively steadfast in their approach.

For Gary Smart, CEO of Aberdeen-based completions specialist Tendeka, "Norway is far less volatile; the rig count has not suffered any major dips over the last 3-5 years. This makes it strong for investment and sustained business. With the new finds, the activity level is only going to increase further. You therefore do not need to worry too much about business decline. This stable environment has allowed some of our businesses to grow their presence since 2003."

He believes that the UK market will lag behind Norway's for some time to come and even if the UK tax incentives increase, "the market will need a long time before the investment is where it needs to be to reach the level it was before the recession - after all, the UK is still in recession." It is also important to him that in the UK there is no longer a strong presence of the international oil companies (IOCs), but instead many independents that, in his opinion, do not push new technologies as actively.

Gary Smart, CEO,Tendeka

According to the consultancy Wood Mackenzie, Norway's winning strategy has rested on four main pillars: the creation of the Awards in Predefined Areas in 2003, the 78 percent tax rebate on exploration, open seismic data access and fiscal stability. The race between the UK and Norway has historically been close, but in 2013 the NCS is expected to attract $37 billion to its waters and has already edged its way past the UK to hold the #1 global position in offshore investment compared to UK's #4.

Latching on to the Subsea Growth Story

In its 2011 paper, "An Industry for the Future", the Norwegian Ministry of Petroleum and Energy cited two time-critical initiatives aimed at boosting production from the NCS: improved oil recovery (IOR) from mature fields, and fast-track tie-in programs from new fields to existing infrastructure. Both of these initiatives are dependent on using Norway's mature infrastructure, some of which has been in production for more than 40 years.

The aim of the fast-track tie-in programs is to significantly reduce the time to bring a field on-stream to a matter of months from an average of 10 years. Statoil has been leading the way with this initiative, creating its own independent fast-track division encompassing a portfolio of 12 projects ranging in value from $500 million to $2 billion. The fast-track strategy has also caught the attention of numerous independents looking for low-risk, high commerciality from smaller fields.

Ragnar Hjelmen, operations director, J P Kenny Norge

According to Ragnar Hjelmen, operations director in Norway for UK engineering company J P Kenny: "There will be a lot more wells where they tie-back to existing infrastructure and given this trend in the market, the subsea investments are projected to double from 2012 to 2016. However, we have not yet seen this happening in 2012. As yet, not that much engineering work has been up for tender and it has mostly been very small-scale feed studies. However, the projected investments are huge, taking into account fabrication and installation and we expect the market to grow significantly next year [2013]".

As a consequence of this subsea opportunity, the 70-strong organization in Norway, which has a dual presence in Stavanger and Oslo, is now in a phase of rapid expansion. In meeting the capacity demanded by the market, Hjelmen believes J P Kenny will have an advantage in being able to draw on the international human resources of Wood Group, especially in a country famously tight on skilled labor.

An Interview with Øystein Michelsen, executive vice-president of development and production in Norway at Statoil

Focus Reports: Looking at how this partially-privatized state oil company conducts its E&P strategy in Norway, would you describe Statoil as an IOC or an NOC?

Michelsen: Statoil functions a lot like an IOC in Norway. The regulatory authorities in Norway are separated from the company and we therefore fall under exactly the same harsh scrutiny as any other player on the NCS. Of course, Statoil plays a certain "architect" role on the NCS as we are heavily involved in the most prolific areas of production. In this respect, Statoil is responsible for a lot of the infrastructure and consequently has a significant say in how this is developed. Nonetheless, this is a consequence of our size and historical role rather than of our function.

Øystein Michelsen, executive vice president development & production Norway, STATOIL

In around four years, 13 companies will have platforms on the NCS and there will be around 40-50 operators and 60-70 license investors. So far, we have been used to cooperating with the international majors and they are still our main partners in production. However, to an increasing degree, we are now building relations with newer and smaller players on the NCS.

Focus Reports: How does domestic production fit within Statoil's global objective to producte 2.5 million bpd by 2020?

Michelsen: Domestic production was always important to meet this goal and given the scale of new discoveries, it is even more so. The NCS will be a growth story for Statoil towards 2020. There is a slight reduction in production in the short term, but it will increase towards 2020 and our goal is to produce more than 1.4 million boed by 2020 from the NCS. We will grow our production in the order of 500,000-600,000 thousand boed until 2020; this is a tremendous growth story and our production on the NCS will match our international production over the coming years.

The perception of the NCS as a gloomy, sunset production area is simply wrong. The Northern finds in particular, such as Skrugard and Havis and the North Sea giant Johan Sverdrup have opened people's eyes to the ongoing potential of the NCS.

Focus Reports: I have heard you are targeting 60 percent recovery on the NCS. How important is IOR to your production growth over the next few years?

Michelsen: IOR is a very important part of our growth story. Typically it involves drilling more wells in existing fields and low pressure production. We are engaged in many of these projects around the NCS which are very exciting. For example there is one project at Gullfaks involving a subsea compression unit, which is smaller than the one we have installed at Åsgard. These subsea compression stations are very demanding, innovative and exciting projects; they represent an important step in the development of the subsea factory. Over the last couple of years, we have matured as much production from IOR projects as from new developments.

Seeking Oil & Gas Asylum in A Risky World

Over the past decade Norway has served as a comfortable training ground for European downstream companies such as RWE, Bayerngas and GDF to flex their upstream muscles. This trend continued in 2012 and it witnessed two major deals between Statoil and European downstream companies wishing to expand their upstream presence: Centrica and Wintershall. Wintershall alone forked out $1.35 billion for Statoil's stake in the Brage field, 120km Northwest of Bergen in the North Sea.

According to a 2011 Ernst & Young report, "The Oil Downstream: Vertically Challenged", the soaring price of oil has shifted value creation sharply towards the upstream sector, suppressing the downstream margins in an extremely competitive European market. This change in the financial environment has encouraged leading downstream companies to look upstream.

Bernhard Krainer, general manager, OMV

Since our last meeting with Bernhard Krainer, general manager of OMV, in 2009, the company has more than doubled its license portfolio on the NCS to 17. Krainer notes that the "executive board of OMV introduced a new strategy in September 2011 with OMV focusing more on the upstream sector for future investments. As our activities in Norway are upstream focused, we are here certainly profiting from the new strategy."

For OMV, Norway provides a safe bet within its international operations: "In terms of our global portfolio, where some countries carry a certain amount of political risk, Norway provides a good counterbalance. OMV operates in several North African and Middle Eastern countries, where the situations can be less predictable compared to Norway."

A Few Facts about Statoil:

|

Although cautious of throwing heavy investment up to the Barents Sea where visibility on projects is still 15 years in the future, OMV feels that Norway offers sufficient stability to invest for the long term. Krainer noted: "OMV will be investing strongly in infrastructure in mid-Norway until 2017. The company sees this as an area where OMV can have considerable production in the medium term. The production start-ups from this region are scheduled for around 2017, which will shorten the waiting time for any bigger discoveries yet to be made in the Barents Sea."

Strikingly similar in terms of its motivations and strategies is Italian E&P company Edison. In May 2012 French electricity giant EDF completed the acquisition of the Italian junior and Raffaele Buonaguro, general manager of Edison Norge explained: "EDF is showing a strong interest in the upstream sector and in Edison as a company. With this support we are looking to transform our presence in Norway in the coming years."

Raffaele Buonaguro, general manager, Edison

Again Buonaguro echoed Krainer's view, on behalf of Edison, saying that, "Norway plays a key role within Edison's global portfolio, in part thanks to the stability of this market. Norway creates a relatively low-risk position for the company, as it moves into higher-risk regions." And again Edison sees itself playing a key role in mid-Norway's infrastructure as a partner in the Norwegian Sea Gas Infrastructure (NSGI) project. Buonaguro believed that this project would "serve as the access point for a future pipeline coming from the North." Though Edison's strategy is currently oriented more around the North Sea where he sees "tie-back to the market is much faster and easier to establish than in other areas, like the Barents Sea."

Gerhard Bauer, CEO, Lotos

In 2007, Polish refining giant Lotos began its adventure in Norway. Lotos Norge CEO Gerhard Bauer explains that his company has made a strategic commitment to the upstream sector. Bauer said that in the "period 2011-2015, it will commit $1.2 billion to its E&P operations to achieve a 100,000 barrels per day target by 2020 in which the vast majority will come from Norway." Where Lotos differs is in not having high-risk international projects in need of a risk-free counterbalance. Nor is Lotos currently investing in infrastructure. Instead, Bauer holds the ambition of rapidly transforming Lotos into a full spectrum E&P company on the NCS.

"We do not only focus on exploration but on becoming a full E&P player on the NCS. I think all this is very well received in Norway and in line with the Norwegian strategic focus on long-term development," said Bauer. Whatever their strategy, Norway continues to provide a safe haven and long-term growth opportunity for European downstream players in tough times.

The Risk of Norwegian Overenthusiasm

Kjell Pedersen, president and CEO of Petoro, the Norwegian state company responsible for managing the country's direct oil and gas license investments – a portfolio of $191 billion – expressed a note of caution to the country's intense E&P activity. The danger, as he understood it, is that such frenzied excitement, ironically, could stretch the supply chain too thin, limiting access to skilled labor and drilling rigs thereby driving up drilling costs to an unsustainable level and distracting the market from necessary investments in mature assets. He feared that instead of taking Norway to new heights, the weight of enthusiasm could collapse the floor of the industry.

Kjell Pedersen, president & chief executive officer, Petoro

Pedersen said: "It is clear that Norway is too costly compared to other countries and some analysts say the difference between Norway and the UK in drilling cost could be 45%." In fact, drilling costs on the NCS doubled over the first decade of the 21st century and Petoro, which was designed as a purely financially-focused organization, whose key performance indicators revolve around profitability, has found itself becoming increasingly involved in the technical side of the business to find innovative ways to reduce costs.

Petoro has been working closely with Norwegian NOC Statoil on new drilling concepts such as license groups buying and owning drilling rigs and extending drilling contracts to 6-8 years. Petoro also has been working with Statoil on new categories of rigs for light intervention operations (category A and D). Pedersen summed up: "We are doing a lot to try to reduce the overall cost, but some of the fundamental issues as to why Norway has come this high up on the cost curve are difficult to change. We are a rich nation of five million people, we have given ourselves the luxury of being expensive."

Asbjorn Olsen, managing director of Transocean, was also a little more sanguine in his assessment of the capacity problem. He agreed that although the market is currently undersupplied with rigs, he disagreed that this was creating unsustainably high day rates. Olsen said, "the day rates for standard floating rigs are in the low five hundred thousands, which is not significantly above global averages. I believe the 'high day rates' in Norway is a theme that has been over-played by the oil industry quite a bit. The lifting cost for oil in Norway is not that much higher than in the rest of the world; it is really in the midfield." On the question of capacity, he continued that by 2016, the number of mobile rigs on the NCS would increase to around 50 from 33 today, in his view, restoring the supply balance.

Asbjorn S. Olsen, managing director, Transocean

Olsen saw the capacity problem slightly differently: "this expansion in the number of rigs in itself represents a major challenge for the industry, given that we will need to qualify new people to operate them." Through its acquisition of Aker Drilling last year and a 40-year history in Norway, Transocean has been able to establish a strong local labor force capable of taking on operations. Yet, Olsen says that it is difficult for the company to expand further due to skills shortages.

Regarding whether they could bring in competence from the UK, Olsen replied: "Norway is a very different market from a competence standpoint and you need a different set of technical skills and also documentation of those skills with proof of competency. This creates some barriers for workers from the UK, for example, to work in Norway." For Olsen the shortage of people is the single most important challenge facing the Norwegian industry.

An Industry Without People

From an HSE and cost perspective, the ideal for most oil and gas companies would be to have no employees at all on offshore rigs; this is exactly the direction that the Norwegian industry is headed. Whether you call them smart fields, intelligent fields or integrated operations, Norway is pioneering the movement to bring more of a platform's operations onshore.

Asgeir Knutsen, general manager, Emerson Process Management

Asgeir Knutsen, president of Emerson Process Management AS, one of the companies paving the way for the integrated operations concept, said: "Most or all of the major oil companies have envisioned this as part of their production concept. I see a turning point now where technology is mature enough to let companies achieve the integrated operations model." Enabled by recent advances in wireless technology and driven by cost and safety, Knutsen sees the benefits for IOCs as much as for independents, believing that the majors would be able to generate efficiency savings, while the young independents could reduce their human labor requirements in a tight skills market.

Paul Horne, managing director, KCA DEUTAG Norge

However, for Paul Horne, managing director of KCA Deutag Norge, the leading fixed platform drilling contractor in the North Sea, the advances in distance control over rigs does not mean that the oil and gas business is becoming less people-centric. A former roughneck of 15 years himself, Horne stressed, "technology may provide us with the best automatic system in the world; yet, at the end of the day, the real challenges are to have people with the right skills who also have leadership and the ability to manage and effectively work with people." He even touted the company's location in Bergen for offering the closest point to many offshore operations and believed that the integrated operations were a valuable training tool and a complement rather than a replacement for offshore staff.

What's the Rig Idea?

Statoil is experimenting with several drilling concepts designed to reduce operating expenses on the NCS. One of these is the fit-for-purpose rig concept, which Magnar Fagerbakke, current vice president for Market & Contracts at COSL Drilling Europe, helped to establish when he worked at Statoil more than a decade ago. "The first time Statoil started looking at this was in 1997. In places like the Halten area there is a mass of subsea installations, flowlines and line pipes - a subsea spaghetti," he said. Conventional rigs with dangerous anchors are no good and Statoil has around 500 subsea wells – this represents around 12 percent of the global total. Fagerbakke saw the movement towards light intervention rigs and Category J, Jack-up rigs as highly logical to reduce moving ill-equiped and expensive conventional rigs around sensitive areas.

Magnar Fagerbakke, vice president marketing & contracts, COSL

Statoil has claimed that the NCS is short of midwater rigs or category D. Almost all wells on the NCS are shallower than 500 meters and it is only in the very West of the Barents Sea that the depth descends to 1,500 meters. COSL's operations began in Norway in 2007 on the back of contracts from Hydro and targeted this midwater segment. Fagerbakke claimed: "Our units cost approximately half the price of the deepwater units which have entered the Norwegian market in recent years. COSL rigs are therefore already well suited for the NCS." He believed that this trend could have a positive effect on cost reduction.

However, regarding Statoil's idea for license groups to potentially own the rigs themselves on fields like Troll, Oseberg and Gullfaks, Fagerbakke remained slightly skeptical. He believed that transferring a high value asset from an organization taxed at 28 percent onto the balance sheets of a company taxed at 78 percent would make the idea financially difficult to implement.

A 50-Year Journey to an Uncertain Destination

"Over the last 50 years, Norway has opened approximately half of the total production area available and we are now in the process of establishing a new third petroleum province in the Barents Sea. By working on this strategy, we see the potential to arrest and even reverse Norway's production decline," said Norway's Minister of Petroleum and Energy Ola Borten Moe. The major finds on Skrugard and Havis in the Barents Sea in 2011 gave credence to the idea that the Arctic offers the silver bullet for Norway's oil decline and Norway's 22nd licensing round, which offered up 72 licenses in the Barents Sea, has gathered unprecedented interest from oil and gas companies seeking a share of the pie.

Impressive 12 streamer spread off the back deck of Polar Duchess, she is the sistership to our flagship vessel Polar Duke.

Moe saw a gradual upward progression in the industry from Ekofisk in the North Sea back in 1969, to the opening up of mid-Norway around 30 years ago and now after 50 years the establishment of the Arctic basin. Norway is by no means alone in its Northern ambitions, with China recently vying for observer status on the Arctic Council. Interest in this region is heating up.

Ola Borten Moe, minister, Ministry of Petroleum and Energy

However, the transition is a politically sensitive topic: Moe's own political party in the government coalition, the Center Party, opposes this direction. Moe's overtures to the oil industry to press on to the Arctic were publicly denounced by Prime Minister Stoltenberg who affirmed that this was not government policy. Moreover, all impact studies on Lofoten, much-coveted by the industry, but also one of the most important spawning grounds for Atlantic fish, have been put on hold until after the September 2013 election. There are big changes facing Norway on how far to push exploration and it will be interesting to see what comes out of the tight race predicted between the incumbent Labour-led government and the Conservative opposition in this year's election.

For Dolphin Geophysical, a company with a seven percent share of the global seismic market, Norway still represents 30 percent of their revenues and the Barents Sea is a huge opportunity. Dolphin Geophysical CEO Atle Jacobsen said: "We have a lot of activity in the Barents Sea in 2012 and this will remain buoyant in 2013, driven by the 22nd licensing round and the awards which will come. We are now looking at the 23rd licensing round because in this industry you need to remain one step ahead. The former grey zone with Russia and the Jan Mayen ridge are two huge potential areas, and we have already worked on behalf of the Norwegian Petroleum Directorate in this region. It will be interesting to see if these new areas are included in the 23rd round."

Atle Jacobsen , chief executive officer, Dolphin Geophysical

As Jacobsen saw it, whether, "the government chooses to open up acreage is a highly political discussion. However, with successful development of the Barents Sea region, the pressure would be taken off developing areas such as Loftoten [closer to the Norwegian Arctic shoreline] which will be a much tougher political decision." Jacobsen therefore believed that the degree of industry pressure to open up this key fishing region depended on oil companies identifying strong resource potential from Norway's 22nd licensing round.

Sakhalin Energy

Stranded up North

Market access is the freezing-cold elephant in the room in any discussion of the industry's movement to the Arctic. 2012 was a year when the ambitious Shtokman project in Russia crumbled as its target market, the US, discovered that it already had bountiful quantities of natural gas locked up in shale deposits.

Return of the Fixed Platform

The concrete drilling platform, a gravity-based structure, was a uniquely Norwegian brainchild. Sturdier, but much more expensive than steel platforms, only around 50 "condeep" platforms have ever been built, compared to 5,000 from steel. Looking at the last decade, only five concrete platforms have been built: two GBS platforms on Sakhalin 2 were build for Shell and one on Sakhalin 1 for ExxonMobil in Russia, one LNG receiving terminal was built in the Adriatic Sea near Venice, and one more is being designed for the Hebron field in Canada.

Christian Norgaard Madsen, chief executive officer, Multiconsult

Norwegian engineering consultancy firm, Multiconsult was involved in all of these projects. Its CEO, Christian Norgaard Madsen, now believes that these concrete structures are about to go through a revival as the industry heads into the Arctic. Madsen saw that the development of operations in the Barents Sea, where the water depth is rarely below 100 meters, suited the condeep structure. He explained that structures "can withstand drifting ice flows, they last longer, you can drill whilst protected inside one of the concrete shafts, you can also add thousands of tonnes of load on the topside," pointing out that Statoil was seeking to install more compressors. For Madsen, these structures had already proved their worth in Sakhalin and would be well suited to other regions, such as Norway's Barents Sea and Russia's Kara Sea.

In order to support this direction, Multiconsult last year acquired Barlindhaug Consult, doubling the company's headcount in the North of Norway and is heavily involved in Arctic research, within the Sustainable Arctic Marine and Coastal Technology (SAMCoT).

In Norway, the lucrative European markets for natural gas are more than a thousand miles from any potential gas discovery in the Barents Sea. Norway's first gas field in the Barents Sea 187 km Northwest of Hammerfest, Snovit, started production in 2006 and sends its gas to a liquefaction facilitiy at Melkøya on Norway's Arctic coastline. However, in 2012 the decision was taken by Statoil not to develop a second LNG train at this facility, which in the eyes of Erik Karlstrøm, CEO of North Energy, is indicative of the industry moving in favor of a pipeline solution.

Erik Karlstrøm, CEO, North Energy

Karlstrøm said, "the activity level and industrial development in this part of Norway is completely dependent upon being able to commercially sell gas to the market. To us, the real competitiveness of the Barents Sea is based on financing pipelines running to Europe." In his view, huge quantities of unconventional gas from Asia-Pacific would already swamp key markets like China. So, Norway should exploit its competitive position close to the European market.

North Energy already sits on the Norwag gas discovery in the Barents Sea but needs market access. Fortunately, Karlstrøm believes that the quantity of stranded gas has already reached the crucial tipping point where a pipeline solution becomes the preferred option.

Geir Lund, managing director, Concedo

Norwegian pure-play exploration company, Concedo, is another firm with its eyes fixed on the commerciality of the Barents Sea. With two non-operated licenses to be drilled on blocks to the west of the Skrugard find in 2013 and 2014 Geir Lunde, managing director of Concedo, is under no illusion that the Barents Sea is a difficult sell. Lunde said: "In Norway, the threshold for a tie-in development is around 20-30 million barrels, a standalone would need above 100 million barrels and in the Barents Sea this goes up to 200 million barrels." He said if the average discovery takes around 10 years to develop in the rest of Norway, one could assume much longer for the Barents Sea. Concedo therefore chooses to balance its risk across Norway's three oil provinces, but the hope is always to strike big in the Barents Sea.

Responsible Risk-taking

The potent public scrutiny that has borne down upon the oil and gas industry since the 2010 Macondo disaster was given renewed strength in 2012 following Christophe de Margerie's note of caution about the risks of Arctic production being excessive. And as concerns mount about the ramifications of an oil spill in Arctic waters, international eyes are turning to Norway as the country with the safest continental shelf – in spite of its challenging environment.

Magne Ognedal, director general, Norwegian Petroleum Safety Authority

Much of Norway's climate of safety can be attributed to the work of Magne Ognedal, one of the longest serving elders in the Norwegian oil and gas industry and president of Norway's Petroleum Safety Authority (PSA). Duty-bound to create the safest E&P environment, Ognedal said that he was profoundly influenced by the 1980 disaster on the Alexander Kielland semi-submersible rig operating on the Ekofisk field, that capsized and killed 123 people, just one week after he began working for the PSA.

Ognedal claimed that the PSA's approach to safety had changed little over the last 30 years, even in the face of huge pressure post-Macondo and he attributed the success of Norway's safety regime to the decisions made in 1985 to reorganize the regulatory regime. He said: "As a result of that reform in 1985, we changed the approach from prescriptive to functionality-based regulations" in contrast to prescriptive regimes in other countries like Russia. International authorities from the US and Canada are collaborating with the PSA, and other countries are seeking to emulate it.

Stig H. Christiansen, CEO, Add Energy

Stig Christiansen, CEO of Add Energy, a Norwegian company specializing in well integrity and crisis management, notably involved in resolving international blow-outs from Montara 2009 and Macondo 2010 through to Elgin in 2012, affirmed that Norway "is the safest shelf in the world and many emerging countries look to the Norwegian model." He noted that recently New Zealand was having the same debates as Norway had held many years ago and that for Add Energy's fast growing business in Australia and New Zealand knowledge of Norway's regulatory environment was invaluable.

Christiansen praised Norway's authorities for resting ultimate responsibility on the shoulders of operating companies. He said it is paramount as companies extend operations to the Arctic and that, given the unacceptability of a spill in this region, the industry would have to "prove that we are willing to invest and able to understand and manage the risks.'

Part 2 of our special report on Norway, dedicated to the service sector, will soon follow in an upcoming issue of Oil & Gas Financial Journal. |