OGFJ100P company update

Independent research firm IHS Herold Inc. has provided OGFJ with updated production data for our periodic ranking of US-based private E&P companies. The rankings are based on operated production only within the United States.

Here, we take a look at some of the transactions in the private company space since the January 2013 issue and the last installment of the OGFJ100P.

Top 10

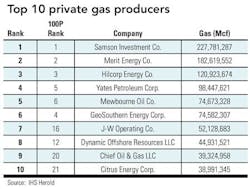

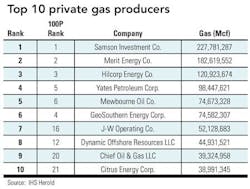

While the rankings for the overall Top 10 based on BOE production didn't change much, there were notable changes to the list of Top 10 private gas producers. In the January issue, the short list was rounded out by Walter Oil & Gas Corp. and Bass Companies, coming in at No. 9 and No. 10, respectively. However, in this issue, both Walter and Bass dropped off the list of Top 10 private gas producers are were replaced by Chief Oil & Gas LLC (No. 9) and Citrus Energy Corp. (No. 10). Castle Rock, CO-based Citrus Energy enters the list of Top 10 private gas producers in this issue after also increasing its overall ranking to No. 21 from January's No. 29 in the overall 2012 year-to-date production ranking. Even more dramatic is Dallas, TX-based Chief Oil & Gas LLC's jump from No. 54 overall in January's year-to-date ranking by BOE to No. 20 in this issue.

Capital

Equity commitments are still flowing in the private oil and gas company space.

One company new to the arena is Titan River Energy LLC. The private company's management team received a private equity commitment of $100 million from Ridgemont Equity Partners and Post Oak Energy Capital. The Fort Worth, TX-based oil and gas company, with an additional office in The Woodlands, will initially focus on the drilling and development of oil-prone shale plays in Texas.

The company's management team includes Chip Simmons, CEO; Lee Matthews, president and COO; Don Pearce, EVP of drilling operations; Kent Bowker, EVP of Geology; and Brennan Potts, VP of land and business development. The management team has extensive experience in the geologic assessment, drilling and completion of over 400 horizontal wells in several major shale plays, with a recent focus on the Eagle Ford Shale.

Ridgemont Equity Partners is a Charlotte-based private equity firm that specializes in middle market buyout and growth equity investments.

In the case of Capstone Natural Resources Partners, a private equity commitment was quickly turned into assets.

On March 11, the Tulsa, OK-based oil and gas producing company announced that it had acquired $50 million in oil properties in Andrews and Gaines Counties in West Texas. The acquisition of producing assets and associated acreage is being primarily financed with growth equity from Lime Rock Partners as part of its $100 million commitment to Capstone.

At the time of the announcement, Phil Terry, CEO of Capstone, noted, "Today is an important day in Capstone's young history. We believe that the newly acquired properties complement our existing asset base perfectly, adding production, cash flow, and low-risk drilling opportunities. The acquisition also provides Capstone with greater scale to assist us in our continuing plan to create value in every part of our strategy: high-density drilling, operational optimization, new acreage leasing, and property acquisitions."

Capstone is an exploration and production company focused on the Central Basin Platform of West Texas and Southeast New Mexico. Formed in early 2012, Capstone is led by Phil Terry, CEO (former CEO of Arena Resources), and David Ricks, president and COO (former VP of operations at Arena Resources Inc).

Management

On the subject of leadership, at least one private company, Eclipse Resources Operating LLC, has added to its senior management team in recent months. The State College, PA-based company has added Oleg Tolmachev to its management team in the role of vice president, drilling and completions. Tolmachev joins Eclipse from Chesapeake Energy Corp., where most recently served as the senior asset manager, Utica Shale. Tolmachev received a bachelor's degree from The University of Oklahoma. Eclipse Resources is focused on the acquisition, exploration, and development of unconventional oil and natural gas properties in the Appalachian Basin, including the Marcellus Shale, Utica Shale and Upper Devonian Shales. The company was founded in 2011 in partnership with EnCap Investments.