Testing the Atlantic Mirror theory

Justin T. Stolte, Latham & Watkins LLP, Houston

With editorial contributions by Michael P. Darden, Latham & Watkins LLP

The task of an explorer is difficult and demanding. Shareholders and management, along with the broader market, expect—and, in some cases, mandate—the relentless generation of prospects located in regions of the world that are stable, both politically and fiscally, at entry costs that are relatively insignificant (i.e., limited signature bonuses, limited work commitments, and/or limited promotes).

Given the current state of depressed natural gas—and, recently, natural gas liquids—prices and the significant cost and time requirements associated with LNG projects, the task is further burdened with the expectation that such prospects will be oil-bearing. This task has proved somewhat daunting to explorers in recent years, given the lack of "white-space" currently available to international oil and gas companies that satisfy such expectations.

Nonetheless, as the US unconventional land-rush shifts to a development stage, explorers have refocused, or, for some companies, enhanced, their efforts towards identifying prospects in parts of the world that, for a host of reasons, have been under-explored by the industry. Frontier basins in isolated portions of the world have been the recipients—and, in most cases, beneficiaries—of such efforts. One such area, the Equatorial Margin of offshore Guyana, Suriname, and French Guiana in South America (the "Guianas Equatorial Margin"), has seen a great deal of attention, as several companies have recently become very active in the area. It is the belief of many in the industry that the petroleum geology of the area closely resembles that of West Africa.

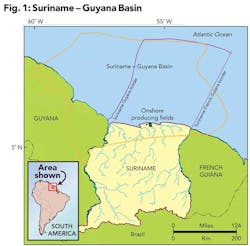

The basins of the Guianas Equatorial Margin, which are comprised of offshore and onshore portions, encompass the coastal areas of Guyana, Suriname, French Guiana, and small portions of Venezuela and Brazil. This article briefly reviews the offshore petroleum geology, recent offshore activity, and legal and fiscal regimes of Guyana, Suriname, and French Guiana.

Petroleum geology

The Guianas Equatorial Margin includes two sedimentary basins—the Guyana-Suriname Basin and the Foz do Amazonas Basin (collectively, the "Guianas Basins")—which are separated by the Demerara Plateau, a structurally high, thick succession of Jurassic and Lower Cretaceous carbonate-rich sediments.

The Guyana-Suriname Basin lies to the west of the Demerara Plateau, along the coastal regions of Guyana and the central and western parts of Suriname. A thick succession of Jurassic to recent-age sedimentary rocks of alluvial to deep-marine origins, along with a limited number of carbonates, are found in the basin. At least two world-class source rocks of Middle and Upper Cretaceous age, sometimes referred to as the "Canje Formation," are found in such sedimentary packages. To the east of the Demerara Plateau lies the western extension of the Foz do Amazonas Basin, which is located along the coastal regions of French Guiana and the western part (west of the Amazon Delta) of Brazil.

The Foz do Amazonas Basin contains a similar succession of sediments to that found in the Guyana-Suriname Basin. A large portion of the Guianas Basins is located offshore, where the sediments thicken as the water depth increases. In its World Petroleum Assessment 2000, the US Geological Survey estimated that the Upper Cretaceous sediment package of the Guyana-Suriname Basin alone could potentially hold 15.2 billion barrels of oil.

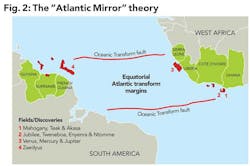

The petroleum system of the Guianas Basins is believed to be a mirror-image—labeled the "Atlantic Mirror" theory—of the petroleum system present in West Africa, where several large petroleum accumulations (e.g., the Jubilee discovery in the Tano Basin, offshore Ghana) have been discovered in recent years. The Canje Formation was deposited (approximately 90 million years ago) during the time that South America and Africa drifted apart at the Equatorial Atlantic Transform Margin and is believed to be the same source rock found in petroleum systems associated with significant petroleum discoveries in West Africa. Accordingly, the industry has identified several similarities with respect to source, timing, burial, compaction, and trapping mechanisms between the offshore Guianas Basins and the offshore basins of West Africa.

The similarities of such basins led Tullow Oil, which drilled the Jubilee discovery, to test the Atlantic Mirror theory through the drilling in 2011 of the Zaedyus-1 well in offshore French Guiana. The Zaedyus-1 well substantiated the theory, in part, by finding approximately 236 feet of net pay in two turbidite fans of Cenomanian-Turionian age, which are believed to contain 500 to 850 million barrels of recoverable oil equivalent.

Suriname, Guyana, and French Guiana may soon share electrical interconnectionFour major international energy companies jointly with the Agence Française de Développement (AFD) and the Inter-American Development Bank (IDB) have joined forces to explore an electrical interconnection among the South American countries of Suriname, Guyana, French Guiana, and the northern Brazilian states of Amapá (capital Macapá) and Roraima (capital Boa Vista). Coincidentally, these countries have recently entered into petroleum contracts with a number of oil and gas companies for exploration, development, and production rights in the Guianas Basin, onshore and offshore, which have the potential for transforming their economies. As part of a Memorandum of Understanding (MOU) signed March 15 for the Northern Arc Project, pre-feasibility studies will be planned to identify and evaluate electricity demand and power supply options. In addition, the studies will assess the political, institutional, regulatory, technical, economic, environmental, and social implications of a potential electrical interconnection of the Northern Arc countries. The partners, NV Energiebedrijven Suriname (EBS), Guyana Energy Agency (GEA), Électricité de France (EDF), Centrais Elétricas Brasileiras SA (Eletrobras), the AFD, and the IDB will obtain recommendations from the studies on the best alternatives to satisfy the electricity needs of the region along with a plan detailing critical action areas for the short, medium, and long-term development of the project. The Northern Arc Project has the potential to improve the quality of life of people living in the Northern Arc area. Electricity supply systems are isolated from each other and have difficulty providing clean and reliable energy at competitive prices. Infrastructure development in the context of this project would contribute to the sustainable integration of the Northern Arc countries and provide the basis for increasing economic growth and the social well-being of the region. The project would increase the countries' energy security and the reliability of the electricity supply. The Northern Arc Project is framed within the IDB's Latin America and the Caribbean Sustainable Energy for All initiative (LAC SE4ALL). The objective of the initiative, which is coordinated with the United Nations (UN) SE4ALL global initiative, is to end energy poverty in the Latin American and the Caribbean region by providing universal access to modern energy, expanding renewable energy generation, and implementing energy efficiency measures. During the Rio+20 meetings in June 2012, the energy/electricity utilities companies of the Northern Arc countries that were present acknowledged the Northern Arc Project as an important contribution to the LAC SE4ALL initiative. |

Recent activity

While few wells have been drilled in the Guianas Basins, there has been a recent wave of drilling in the region: (i) in Guyana, the Jaguar-1 well and the Eagle-1 well were drilled on the Georgetown Block and the Corentyne Block, respectively, in 2012; (ii) in Suriname, wells were drilled on Block 31 in 2011 and Block 37 in 2010 and 2011; and, (iii) in French Guiana, the Zaedyus-1 well and Zaedyus-2 well were drilled on the Guyana Maritime block in 2011 and 2012, respectively, with a third well spud on the block in January 2013.

In addition, several companies have recently completed, or will soon complete, significant seismic acquisition programs in the basins, which will likely lead to the identification of additional prospects in the region. Companies with investments in the region include: Anadarko, Apache, Chevron, CGX Energy, ExxonMobil, INPEX, Kosmos Energy, Murphy, Repsol, Shell, Statoil, TOTAL, and Tullow.

Although it does not appear that any of the above-referenced wells (other than the Zaedyus-1 well) will be deemed commercial successes, the wells, collectively, have provided the industry with encouraging results because they positively identified certain attributes of a significant petroleum system. In particular, the presence of a hydrocarbon source and reservoir-quality sands were identified in a number of the wells. Accordingly, companies operating in the area have sharpened their efforts with respect to the identification of sealing, trapping, and migration mechanisms within the basins in an effort to further substantiate the presence of such a petroleum system.

Notwithstanding the non-commercial outcomes of recent wells, the industry's interest in the offshore Guianas Basins remains robust, as was evidenced by recent new-country entries by Apache, Chevron, and Kosmos in Suriname and recent new country entries by Anadarko and Pacific Rubiales Energy (through its investment in CGX Energy, a small Canadian company) in Guyana. A bid round to be held later this year in Suriname, which is its fifth international bidding round, is expected to generate strong bids on offshore acreage (Blocks 54, 55, 56 and 57 on the Demerara Plateau) located within the country's maritime borders.

Legal and fiscal regimes

GUYANA

Guyana was originally a Dutch colony, and later a British colony, until it achieved independence in 1966. Upon achieving its independence, Guyana became a sovereign state, and is the only South American country whose official language is English. The form of government in Guyana is a republic, divided into 10 administrative regions, with an executive president and a parliamentary legislature.

At this time, it appears that Guyana lacks an ultimate energy authority responsible for overseeing the petroleum sector. However, in 2012, a proposal was approved for the creation of a Petroleum Advisory Board, indicating that a structure for such an authority will soon be established. In practice, the petroleum division of the Guyana Geology & Mines Commission ("GGMC") is the governmental authority for petroleum contracts in Guyana, as it is granted the responsibility of planning and securing petroleum investments in the country.

The principal legislative instruments for upstream oil and gas in Guyana are the Petroleum (Exploration & Production) Act No. 3 of 1986, Chapter 65:10 and its implementing regulations (collectively, the "Act"). Petroleum contracts are typically awarded through direct negotiations with the GGMC.

The regime for petroleum contracts is established under the Act, with the terms of petroleum contracts to be based on a production-sharing contract model. Under such contracts, the state is to receive no less than 50% of profit oil, and contractors are allowed to recover a maximum of 75% of gross production—through cost oil—during the first three years of production, following which, such amount decreases to 65%. The tax rate in Guyana for corporations is relatively high at 40% for "commercial companies."

Pursuant to the Act, the term of a petroleum contract is to be divided between an exploration stage (through the issuance of a petroleum prospecting license) and a development and production stage (through the issuance of a petroleum production license). The initial term of a prospecting license is four years, which is renewable twice for a period of three years each. Production licenses are issued for a period of 20 years and are renewable in periods of 10 years.

It should be noted that Guyana is currently involved in a border dispute with Venezuela regarding the maritime boundary between the two countries. Consequently, the Pomeroon Block in offshore Guyana, which is currently held by CGX Energy, has been placed effectively in force majeure.

SURINAME

Suriname is a former British colony, and later a Dutch colony (acquired, interestingly, in a trade in which the British received New Amsterdam, which is present-day New York) that achieved its independence from the Kingdom of the Netherlands in 1975. Suriname is the smallest sovereign state (in size and population) in South America and, although communications in the petroleum industry in English are normal, its official language is Dutch. Like Guyana, the form of government in Suriname is a republic. Suriname has one legislative house, and its head of state and government is the president.

The authority to enter into petroleum contracts for exploration, development, and production rights in Suriname is granted exclusively to "state enterprises." The state enterprise responsible for negotiating and entering into such contracts is Staatsolie Maatschappij Suriname N.V., which is the national oil company of Suriname. Staatsolie holds all mining rights—onshore and offshore—in Suriname and, as such, is responsible for awarding (and administering) contracts through direct negotiations or bidding arrangements with other "established" petroleum companies. The primary instruments governing petroleum operations in Suriname are Staatsolie's Concession Agreement (Decree E8-B, Official Gazette 1981 no. 59), the Mining Decree of 1986 (Official Gazette 1986 no. 28), and the Petroleum Law 1990 (Official Gazette 1991 no. 7, as amended in 2001).

The contracting regime for recent petroleum contracts in Suriname is based on a production sharing contract model. In Suriname's upcoming bid round, production sharing contracts will include an initial first phase of exploration of four years. Under such contracts, the share of profit oil will be determined using a sliding-scale R-factor, with royalties and income tax rates of 6.25% and 36%, respectively. Staatsolie will have a "back-in" right under such contracts of up to 20% on each development and production area.

FRENCH GUIANA

French Guiana is an overseas department of France and is part of the European Union. It is represented at the French National Assembly and its head of state is the President of France. A "Prefect," who is appointed by the President of France, is responsible for local administration of the region. French Guiana relies heavily on financial aid from, and the political stability of, France and, as such, has recently rejected offers of broader autonomy from the country. The official language of French Guiana is French, but several other local languages exist.

Unfortunately, there is a lack of legislation in French Guiana regarding offshore petroleum exploration, as existing legislation (the 1810 Mining Code) generally only deals with onshore and coastal petroleum exploitation. Consequently, it appears that offshore petroleum activities in the country are primarily governed by the applicable provisions of the 1810 Mining Code and the contractual terms of the petroleum licenses granted to companies. The French government has recognized the issue (arising, in large part, as a result of the Zaedyus-1 discovery) and is currently evaluating whether to replace the existing 1810 Mining Code with legislation covering offshore petroleum exploration and production.

Given the lack of applicable legislation, the contractual terms that are typically offered in French Guiana are not readily available. Nonetheless, it has been reported that contracts are governed by a royalty/tax concession model, with a sliding-scale royalty rate, which is based on production volumes, and a corporate tax rate of 23%. It is worth noting that the first oil exploration license granted in French Guiana, the "Maritime Guiana Permit," was initially granted in 2001 for a period of five years, and has been renewed twice, with a current expiration date occurring in 2016. It appears that licenses for offshore exploration in French Guiana are awarded on a direct-negotiation basis.

Concluding remarks

The next several years will prove critically important in the validation of the Guianas Basins. The region generally represents a low-risk operating environment for offshore petroleum investment, as Guyana, Suriname, and French Guiana are generally politically and fiscally stable and offer contractual terms for petroleum investment that are relatively competitive in the region. Therefore, the success of the basins—as is often the case—will be dependent, in large part, on (i) the results of near-term drilling programs and (ii) the identification of an inventory of prospects from near-term seismic acquisition programs. If the success of the basins is validated, which would likely also be a validation of the Atlantic Mirror theory, the industry can expect a frenzy of activity similar to what has been seen offshore West Africa. OGFJ

About the author(s)

Justin T. Stolte is an attorney in the Houston office of Latham & Watkins LLP and a member of the firm's Global Oil & Gas Industry Team. His practice focuses on representing and counseling clients in a broad range of domestic and international oil and gas transactions and projects. Stolte recently worked in a commercial/business development role for a large independent and, prior to law school, worked as a petroleum engineer for a super-major in the Permian Basin.

Michael P. Darden is a partner in the Houston office of Latham & Watkins LLP and is the co-chair of the Global Oil & Gas Industry Team. His practice focuses on international and US oil and gas ventures (including LNG, deepwater, and unconventional resource development projects), international and US infrastructure projects, and energy-based financings.

NOTE: This article is not the work-product of Latham & Watkins LLP and, therefore, should not be deemed to represent the views and/or opinions of the firm. Further, this article should not serve as a substitute for legal advice or the reading of the applicable laws, legislation, rules and regulations of the countries referenced herein. While not cited in this article (due to editorial constraints), the author would like to acknowledge the use of several sources of information in its preparation; in particular, reports prepared by the following companies were of great assistance: Maplecroft; Tudor, Pickering, Holt & Co.; and Gustavson Associates. The images included herewith were prepared (in the order presented herein) by Staatsolie, Tullow, and CGX Energy. |