Independent research firm IHS has provided OGFJ with updated production data for our periodic ranking of US-based private E&P companies. The rankings are based on operated production only within the United States. Here, we take a look at some of the transactions in the private company space since the April 2013 issue and the last installment of the OGFJ100P.

Top 10

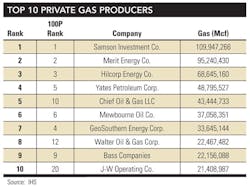

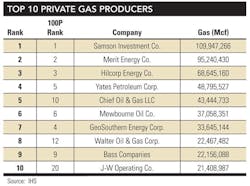

In this, the first data set with 2013 production, we see minor shuffling within the Top 10 list. Samson Investment Co. edged out Merit Energy Co. for the top spot on the list, while Sheridan Production Co. and Walter Oil & Gas Corp. were nudged out of the Top 10 in this issue. Previously, Sheridan and Walter ranked No. 7 and No. 10, respectively. They came in at No. 11 and 12, respectively in this installment. Bass Companies moved into the Top 10, coming in at No. 9, up from its previous place at No. 12 in July. The biggest mover for this installment is Chief Oil & Gas LLC. The Dallas, TX-based company with operations primarily in Pennsylvania's Marcellus Shale, moved up from its previously-held No. 21 seat to round out the Top 10.

Capital

Midland, TX-based Parsley Energy, founded by CEO Bryan Sheffield in 2008 and financed through development packages with individual working interest owners, has seen a recent period of high growth. With growth comes the need for additional capital. Following debt financing and tactical support from Western National Bank and Chambers Energy Capital in its first years, the company has recently seen support from Natural Gas Partners (NGP) and Wells Fargo.

In August, the Midland Basin operator closed on a $65 million preferred equity investment by NGP. Then, one month later, Parsley Energy entered into a $750 million credit facility with Wells Fargo.

In a span of five years, the company has drilled more than 270 wells, has 9 rigs running and is currently producing over 17,000 boepd on a gross operated basis and over 5,000 boepd on a net basis. The company holds over 73,000 net acres, employs roughly 60 people, and has jumped from the No. 65 spot to the No.32 spot on the OGFJ100P.

While the company will continue vertical development in the Wolfberry play, it plans to begin its horizontal drilling program in the fourth quarter of 2013.

Transactions

In August, Sequel Energy LLC, along with GE Energy Financial Services and Lucas Capital Management LLC, sold Williston Basin conventional oil and gas reserves in North Dakota to an undisclosed buyer for $210 million.

Sequel Energy, ranked No. 74 in this installment of the OGFJ100P, retained ownership in the Bakken and Three Forks shale, including approximately 4,100 boepd net production and 53,000 net acres of leasehold in North Dakota's Williston Basin.

The Denver, CO-based company will continue to focus on its operated drilling programs in Williams and McKenzie Counties. The company initiated its Williams County program in mid-2012 and expects to complete its first McKenzie County well by the end of September 2013.

Formed in 2006 with equity commitments from Lucas Capital Management, Sequel develops and operates unconventional oil properties in the Williston Basin on behalf of two partnerships with GE Energy Financial Services.

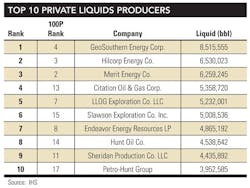

In a separate deal involving North Dakota, this time acreage in Williams and McKenzie counties as well as acreage in Roosevelt and Richland counties of Montana, Denver, CO-based Whiting Petroleum Corp. closed on its $260 million acquisition from privately-held Petro-Hunt (No.17) The acquisition includes roughly 17,282 net (39,310 gross) acres targeting the Middle Bakken and Three Forks zones of the Williston Basin. The properties include 13 operated 1,280-acre Bakken/Three Forks drilling spacing units with an average working interest of 58% and net revenue interest of 48%. 92% of the acreage is held by production.

Net oil and gas production from the properties was estimated to average 2,420 boepd in August 2013. Whiting estimates proved reserves to be acquired at 17.1 MMboe as of the August 1, 2013 effective date of the acquisition, of which 85% is oil and of which 24% is proved developed producing and 76% is proved undeveloped. Based on these metrics, PLS Inc. values the acreage at $5,500 per acre.

Another August transaction saw No. 10 Chief Oil & Gas, the biggest Top 10 mover in this installment, and IMG Midstream enter into a strategic gas supply agreement that allows locally produced Marcellus gas to stay in the local area for power generation.

The long-term natural gas supply agreement calls for Chief to supply natural gas to multiple IMG electric generation facilities to enable the production of clean natural gas fired power. The agreement covers a specific area of mutual interest in Northeastern Pennsylvania along the Access and PVR Partners' midstream systems.

Under the agreement, the parties will work together to identify additional gas-fired project opportunities to compliment Chief production positions in the region. The company has a regional office in Wexford, PA, currently holds 125,000 acres in Bradford, Susquehanna, Wyoming, Tioga, and Sullivan counties where it operates four rigs and has drilled over 100 wells. The arrangement adds IMG to Chief's local gas origination efforts and adds business process and scale efficiencies to IMG's business model.

IMG expects the arrangement to enable construction to commence on up to three power generation facilities by the end of 2013.

Click here to download the PDF of the "2013 Year-to-date production ranked by BOE"

Click here to download the PDF of the "2013 Year-to-date production - alphabetical listing"

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.