Managing portfolio risk

Using asset-based cost of capital to improve capital allocation helps take the risk out of portfolio management.

Jon Lock and Randy DeGeer, Marakon, Chicago

Before we get into the details, here's a brief summary of what we think is required to reduce the risk in portfolio management by improving capital allocation:

- Oil and gas executives should take an explicit, rather than implicit, view of asset-based risk when making resource allocation decisions.

- A regression-based analytical model can support transparency and increased insight on Weighted Average Cost of Capital (WACC) for oil and gas assets.

- Implementation at the executive level can improve the portfolio dialogue, decision-making process, and resource allocation for oil and gas companies.

Context

When examining their portfolio of businesses, executives in the oil and gas industry traditionally have taken a uniform approach toward one of the most important variables in determining value – risk (Think of this as the 10% after tax cost of capital most oil and gas firms use to value their projects). While some commentators decry the lack of sophistication in the valuation process, it is our observation that oil and gas managers are much more sophisticated, especially in the current environment. More precisely, these managers take an implicit approach to their risk assessment and valuation methodology – a practice which, while practical, has many pitfalls.

Experienced petroleum executives have a strong understanding of risk at the project level and will intuitively risk-weight the portfolio in order to compensate for the fact that most projects will only take into account geological and commercial risk in their plans. As a result, projects that generate similar results on objective metrics (e.g., Net Present Value) will take on different subjective values in the minds of executives when decisions regarding resource allocation are being made. This allows the decision process to include many of the other key risk factors in oil and gas, including: geopolitical risk, regulatory risk, stakeholder risk, and technology risk.

In our experience, making the risk dimension of resource allocation explicit and transparent provides a powerful upgrade to the resource allocation discussion, and improves the quality of dialogue among the senior executives charged with making high stakes investment decisions. Oil and gas management teams jeopardize making ill-informed, non-value based decisions by not making risk an explicit part of portfolio decision making.

An improved method

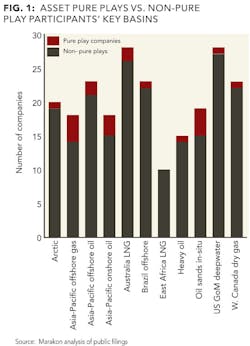

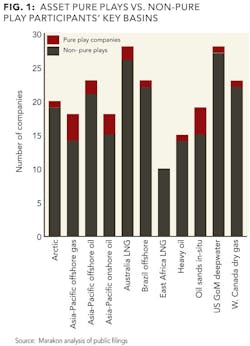

In order to make the trade-offs clear and the risk-weighting transparent, we use a regression- based analysis to compute the project level risk in a portfolio. The approach is especially powerful in oil and gas where it is very difficult to find asset pure plays that would provide relevant comparables. Often the pure plays that exist are sub-scale, providing for a less than optimal comparison despite resource type similarities. (See Figure 1.)

We apply a weighted least squares (WLS) methodology to assess relative risk based on production barrels and assets within a particular geography (though other methodologies have been proposed in the literature). We then extend the resulting betas to compute a cost of capital for each relevant asset type or play.

Because asset definitions will vary from company to company, managers applying this technique must be careful to accurately assess the asset classes used to baseline the regression. In addition, care must be taken in the selection of the market index (e.g., S&P500, TSX, FTSE1000) to ensure uniformity in the study.

Implementation

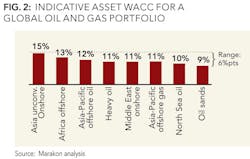

Assets within a portfolio can have as much as a 10% point difference in WACC between their least risky assets and their most risky assets – a figure which would significantly change resource allocation decisions if explicitly recognized. (See Figure 2.)

We apply a WLS regression methodology across a universe of oil and gas peers, regressing their respective five-year historical weekly share price betas against their share of capital in different asset types, weighted by their absolute capital in each asset type. The result is a unique beta for each asset type which is used to compute the WACC for each asset in the portfolio.

Practical considerations

Applying this explicit risk methodology to the resource allocation question is best done at the executive level where the totality of the business and portfolio of assets can be taken into view. It is an impractical burden on the business to operate with non-uniform costs of capital at the business unit level, and can have unintended consequences as business units compete for capital. Benefits from this methodology include:

- More efficient resource allocation decisions.

- Greater ability to make grounded investment and M&A choices.

- More accurate assessment of the portfolio's intrinsic value, and the value of individual asset components.

Collectively, these result in a more coherent and balanced oil and gas portfolio and, over time, increasing shareholder value creation.

Conclusion

It is our belief that cost of capital at the asset level should be explicitly taken into account when making portfolio level resource allocation decisions in oil and gas. A regression-based analytical model provides the most accurate view of differentiated cost of capital across asset types – though pure plays can work in limited situations. This increased level of transparency at the executive management level can help teams to maximize capital efficiency and resource allocation by providing a set of strong, objective guide rails to the risk lens in portfolio analysis.

About the authors

Jon Lock and Randy DeGeer specialize in corporate strategy and portfolio management for oil and gas companies at consulting firm Marakon. They are based in the Chicago office.