Upstream News

Chesapeake, foreign partners set for big US shale spend in 2013

Analyzing Evaluate Energy's recently released 2013 capital expenditure and average well cost data for the major US shale plays, it becomes clear that foreign companies will have a huge influence on how the industry develops over the coming year. Joint ventures involving foreign investors, which have been entered into over the past few years, have budgeted to spend big this year, and will be amongst the biggest spenders in the country for the second year in a row. It will be a big year in particular for Chesapeake Energy (CHK), a company with foreign joint venture partners in five US plays. The company and its various partners are estimated to be the biggest spenders among companies with available drilling plan data in three of those five plays in 2013.

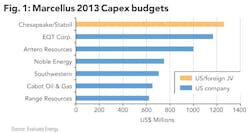

Marcellus

This play is still very much a US stronghold in terms of ownership, and this year's drilling CAPEX budget graph (Fig. 1) still shows this. However, Chesapeake's arrangement with Norwegian Major Statoil (STO) is estimated by Evaluate Energy to the biggest budgeted spender in the play for the second year in a row, and to be drilling the most wells.

These, and especially Chesapeake's, may seem high spends in the current climate for what is primarily a gas play, but the Marcellus has seen lots of drilling completed and data collected in the past 5 years, meaning the play has become a very low-risk environment close to a crucial demand center, with reasonably low average well costs. Range Resources Corp. (RRC), despite being the lowest of the "big-spenders" on the above chart, are drilling at an average cost of $5 million per completed well, $2.7 million cheaper than the average for the play, as estimated by Evaluate Energy.

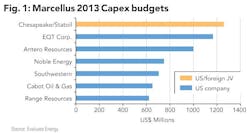

Eagle Ford

The Eagle Ford has seen far more foreign activity in the M&A market over the last few years than the Marcellus, and these investors are clearly not set to sit back for a gentle ride over the next year. Chesapeake again have the highest spend budget (Fig. 2), along with Chinese state-owned CNOOC this time, and fellow Asian companies Reliance Industries (RIL) and GAIL also have significant plans for the year ahead with their respective partners. Joint venture agreements with foreign companies make up almost half of the top 10 estimated/reported budgets for the play in 2013.

Big spends here are to be expected, as they were last year, due to the high oil content in large areas of the formation. Chesapeake's joint venture CAPEX budget with CNOOC is the big change from last year in the play, and the outstanding statistic, being almost three times larger than the estimated budget in 2012. Carrizo's (CRZO) new agreement with Indian NOC, GAIL, is also noteworthy as it has enabled an increase of around $200 million on the company's spend last year, squeezing the joint venture into the top 10 budgets for the year, from available data.

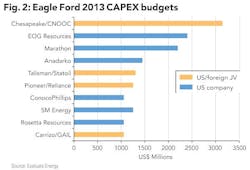

Utica

The Utica in Ohio is another play where Chesapeake and its foreign joint venture partner are planning a big year. The data here is even more striking (Fig. 3), with Chesapeake and French major Total (TOT) estimated to be spending over four times more than the second highest reported budget in 2013.

Chesapeake will maybe feel they have a point to prove in this play. In 2011, the company sparked a rush for land in Ohio after initial well results from Chesapeake predicted large oil content in the play, however well data from the Ohio Department of Natural Resources has since shown that, in the main, the play has been producing gas. This is probably the main reason behind the low CAPEX budgets set by other companies in the play, as new gas wells, especially at the relatively high average well cost for 2013 in the Utica of around $10 million, are not something many companies will be drilling in the current climate of low prices and already abundant supply. But Chesapeake and its partner Total will definitely be leading the way in trying to turn the fortunes of this play around, if it is at all possible.

Following the disappointing results in the Utica, this year could well turn out to be pivotal for Chesapeake's future. The joint venture's budget in the Utica of around $2.2 billion is a large estimated outlay for Chesapeake, even if the 60% drilling carry from Total is taken into account, for wells that will be primarily gas prone. The company, and of course its partners, will be hoping that large spends in the lower cost environments of the Marcellus and the Eagle Ford – the plays have an average completed well cost for 2013 of around $7.7 million and $7.5 million respectively – will reap enough reward to cover potential hardship should the data from Ohio continue in this disappointing trend.

This report was created using Evaluate Energy's collection of approximately 200 estimated and reported US and Canadian shale play capital expenditure budget figures, drilling plans and average well costs for 2013. The data covers 11 plays: Bakken, Barnett, Duvernay, Eagle Ford, Fayetteville, Haynesville, Marcellus, Montney, Niobrara, Tuscaloosa Marine and the Utica. All figures correct as of May 1st, 2013.

— Mark Young, Evaluate Energy

Noble Energy makes new offshore discoveries

Noble Energy Inc. has discovered natural gas at the Karish prospect offshore Israel and oil at Gunflint in the Gulf of Mexico (GoM).

The discovery well offshore Israel was drilled to a total depth of 15,783 feet and encountered 184 feet of net natural gas pay in lower Miocene sands. The Karish well, located in the Alon C license approximately 20 miles northeast of the Tamar field, is in 5,700 feet of water. Discovered gross resources, combined with the de-risked resources in an adjacent fault block on the license, are estimated to range between 1.6 and 2.0 trillion cubic feet (Tcf) with a gross mean of 1.8 Tcf.

The Karish discovery is the fifth discovered field with an estimated gross mean resource size over 1 Tcf. It is also the seventh consecutive field discovery for Noble Energy and its partners in the Levant Basin. With the addition of Karish and the recent increase in resource estimates at Tamar and Leviathan, total discovered gross mean resources in the Levant Basin are now estimated to be approximately 38 Tcf.

Noble Energy is the operator of the Alon C license with a 47.06% interest. Co-owners are Avner Oil and Delek Drilling each with a 26.47% interest.

The company also confirmed deepwater oil at Gunflint in GoM on June 25. The second appraisal well at the Gunflint field found 109 ft of net oil pay. The Mississippi Canyon 992 No. 1 well, 1 mile west of the original discovery well, was drilled to a total depth of 32,800 ft in a water depth of 6,100 ft. Results of drilling, wireline logs, and reservoir data have confirmed an estimated gross resource range of 65 to 90 MMboe in the primary structure. Noble Energy operates Gunflint with a 31.14% working interest. Other partners in the project are Ecopetrol America Inc. (31.5%), Marathon Oil (18.23%), and Samson Offshore LLC (19.13%).