Demand for oil assets running strong while demand for gas assets remains selective

Brian Lidsky, PLS Inc., Houston

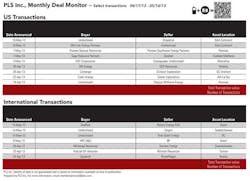

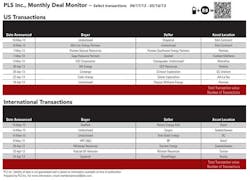

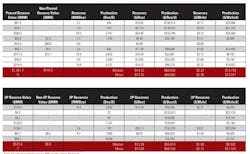

PLS reports that from April 17 to May 16, 2013, the pace of US oil and gas deal activity is returning to normal with 45 deals for $2.1 billion while Canada activity remains sluggish with 10 deals for $240 million. International activity is also slow with 12 deals for $1.6 billion.

In the US, several oil-weighted deals significantly breached the valuation benchmark of $100,000 per flowing bbl that PLS reported last month while the markets remain selective on gas-oriented assets – though gas values in general are above the lows set back in Q4 2012.

The largest US deal this month is Pioneer Natural Resources’ (PXD) $585 million offer to acquire all units of Pioneer Southwest Energy Partners LP (PSE) not already owned (48%) in a stock-for-unit transaction. This deal is of interest on several fronts. First, it is counter to the trend of parent dropdowns to MLPs and allows parent PXD to achieve administrative efficiencies and control optimal development. Secondly, PLS’ metrics of $155,000 per daily boe of production (87% oil) and $25 per boe proved (86% oil) are above the recent market averages and illustrate the strong market demand for oil production with predictable and low-risk growth – in this case the Spraberry field in the Midland basin of west Texas. Finally, acceptance of the offer is contingent upon the approval of the Conflicts Committee of PSE.

Another US corporate deal this month is Contango’s $390 million all-stock bid for Crimson Exploration. PLS values this deal at $53,000 per daily boe (47% liquids) and $2,500 per net undeveloped acre. In addition to being highly accretive to cash flow and reserves per share, the deal offers over 1 Tcfe of resource potential. Contango will use its high-cash-flow generating Gulf of Mexico properties to fund a liquids-rich onshore portfolio providing decades of future growth with exposure to the prolific Woodbine play in east Texas, the Eagle Ford, and the Niobrara.

In Pennsylvania’s Marcellus play, both Southwestern Energy and EQT bought primarily acreage deals from Chesapeake Energy and its partners. On April 30, Southwestern picked up 162,000 net undeveloped acres concentrated in Susquehanna and Wyoming counties for $93 million - or $512 per acre. The next week, on May 3, EQT bought 25,000 Marcellus acres plus 54 Bcf of gas reserves for $113 million. Valuing the gas at $1.00 per Mcf proved, the EQT deal implies an acreage value of $2,400/acre.

For US low-risk gas, PE-backed Saga Resources paid GeoMet Inc. $63 million for coalbed methane assets in the Black Warrior basin in Alabama. The assets include 43 Bcf (100% PD) and 10.7 MMcfpd which PLS values at $1.40 per Mcf proved and $5,700 per Mcfpd.

In Canada thus far in 2013, the upstream deal markets have tallied just $2.1 billion as compared to a recent annual 4-year average of $35 billion. This month’s largest deal is Whitecap Resources’ buy of an existing Viking light oil waterflood in the Dodsland area of Saskatchewan for $108 million from KNOC sub Harvest Energy. The asset is just 10 miles away from Whitecap’s existing Lucky Hills operations and adds current production of 900 boepd (95% oil) with growth expected to reach 1,200 boepd by 2014.

Internationally, activity this month totaled $1.6 billion with the largest deal being Petronas’ $850 million buy of a 40% non-operated position (BM-C-39 and BM-C-40 blocks) in the Campos basin, offshore Brazil from operator OGX. The blocks have contingent reserves of 76 MMboe ($11.14 per contingent boe) with first production scheduled for Q4 2013 via FPSO. Three other deals surpassed the $100 million mark this month – two in Brazil and one in Russia.

The markets remain well supplied as observed by PLS’ comprehensive Deals in Play research. Notable additions this month include Apache’s intent to sell $4 billion in assets prior to year-end 2013 as an orderly portfolio upgrade after buying over $18 billion since 2010. Other new assets up for sale include BP and Hilcorp selling Wyoming assets, Pengrowth selling conventional assets in Alberta and WPX looking to divest interests in Argentina.