Riverstone-backed Fieldwood Energy buys Apache's GoM Shelf business

Brian Lidsky, PLS Inc., Houston

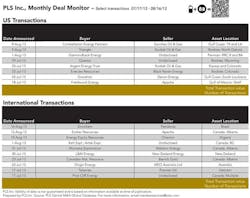

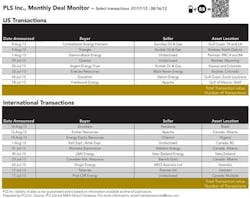

PLS reports that, from July 17 to August 16, the pace of US deals continues to pick up, tallying 38 deals for $5.1 billion (vs. 30 deals for $4.6 billion the prior month). Since 2007, the average monthly rate has been 39 deals for $5.5 billion. Canada also saw an increase to 19 deals for $1.9 billion vs. 17 deals for $1 billion the prior month (and 19 deals/month for $2.6 billion since 2007). Internationally, activity slowed to 14 deals for $1.5 billion vs. 32 deals for $16.4 billion the prior month (and 23 deals/month for $6.2 billion since 2007).

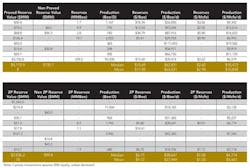

By far, the highlight of this month is the surprise $3.75 billion deal by Riverstone-backed Fieldwood Energy LLC for Apache's Gulf of Mexico shelf portfolio. The transaction immediately vaults Fieldwood into operating the largest GOM shelf asset base consisting of 95,000 boepd of net production (90% operated, 54% oil), proved reserves of 239 MMboe (75% developed, 55% oil), 406 producing blocks and 146 exploration blocks. Apache retains 50% rights to deep exploration in the producing blocks as well as 50% of all rights in the exploration blocks. The parties will jointly (operated by Fieldwood) pursue high-potential exploration including subsalt prospects.

PLS values the deal at attractive metrics of $15.69/boe and $39,474/boepd. Boosting this viewpoint, the reserves are highly developed and the portfolio will provide years of additional exploitation opportunities. For comparison, in the post-Macondo era (since April 20, 2010), PLS has tallied 33 GOM shelf deals over $10 million totaling $9.4 billion at average metrics of $19.28/boe (52% oil) and $50,385/boepd.

PLS interviewed Fieldwood CEO Matt McCarroll to shed some color on the transaction. Prior to Fieldwood, McCarroll led a team that built GOM-focused Dynamic Resources (with funding from Riverstone) which was sold to SandRidge Energy for $1.3 billion in February 2012 (metrics of $17.95/boe and $44,838/boepd). Riverstone stepped up again with the McCarroll team to back Fieldwood last December. Although Fieldwood was looking at various buys, once the Apache package came to market, McCarroll "dropped everything" to capture this "once in a career" opportunity.

Fieldwood expects to retain substantially all of Apache's shelf team consisting of 650 people, including 400 in the field. "Fieldwood has 12 employees today, so we look at this as inserting our small team inside the Apache Gulf shelf team, not the other way around." While the immediate focus is production optimization, then exploration and development, McCarroll expects to look at additional acquisitions. "I think it's a good time to be a buyer," McCarroll said.

On the Apache side, chairman and CEO G. Steven Farris said the company "has had a great run on the Gulf of Mexico shelf over the last 30 years, and the Shelf region and staff have played a vital role in making the Apache the company it is today." The sale substantially reaches the $4 billion divestment target Apache recently set for 2013 and, to date, there has been no official comment that this target will be increased.

Elsewhere in the US markets, buyers remain strong for oily assets (Bakken, Permian, Eagle Ford) and selective on the gas side (Gulf Coast, Midcontinent, Rockies). Valuations of both, however, are rising with PLS's latest benchmarks (based on trailing 6 months and tight screening of the datasets focused on developed assets) currently running about $120,000/bopd and $21.00/bbl proved for oil and $5,800/Mcfd proved and $1.70/Mcf proved for gas.

In Canada, deal flow improvement is evidenced by this month's sales by Apache and Barrick Gold. Internationally, deal flow slowed a bit but the themes of Asian buying (Sinochem in Brazil) and bolt-on country acquisitions (Talisman in Vietnam) remain in place.

Markets remain well-supplied with high-quality deal inventory across virtually all investment criteria. Multiple Bakken opportunities are available in the US while in Canada, Donnybrook Energy and Sunshine Oilsands are seeking strategic alternatives. Internationally, Marathon is selling Libyan assets and Talisman is marketing Norwegian North Sea assets.