Unconventional hydrocarbons, big data, and analytics

Today, best practices can be quantified as they emerge. Acreage value changes can be tracked as they occur, and positions can be put together in hours instead of weeks.

Microseismic events associated with a frac job Image courtesy of Transform.

Allen Gilmer

DrillingInfo

Austin, Texas

"May we live in interesting times." This folk saying, an unverified ancient Chinese combination of curse and blessing, very succinctly describes the state and flux of the global upstream oil and gas industry in the age of unconventional hydrocarbons, big data, and analytics.

What will drive the highest return with the lowest risk? Tripling the size of current technical staff along with the per-seat software licensing, office, and benefits overhead attendant to that exercise all while hoping the new employees will integrate well with the current staff, or spending a small fraction of that number to triple the productivity of the current winning team?

The world's largest industry in flux means new and large opportunities. The old rules of thumb are being challenged. It's not good enough to lease land anymore. In today's oil patch, the best operators can produce up to three times as much as the worst operators and some 30% more than average operators for the same quality of acreage, thus calling into question exactly how effective the service company whisper advice is as a technology transfer mechanism. In this world, "best practices" is a fluid term with hundreds of experiments yielding potential step changes in productivity in certain grades of known reservoirs and new rocks.

This is a world where best practices can be quantified as they emerge, where drilling 20% to 40% fewer wells to recover the same amount of hydrocarbons can be proven to be effective; by avoiding the "more is better" rule of thumbs promulgated by service companies to optimize frack programs that can actually be quantified to produce the highest return achievable with what is currently known; or where big value can be had by identifying the holdings of those operators that condemned very valuable acreage due to poor practices.

It is also a world where acreage value changes can be tracked as they occur, and positions can be put together in hours instead of weeks, all in conjunction with a reality where we are losing a huge portion of our increasingly valuable technical professionals to retirement and where the last juice has been squeezed out of 30-year-old software code bases that merely digitally enhanced workflows that were born in the paper era.

Drillinginfo Inc. (DI), an upstream data-driven Software as a Service (SaaS) platform with more than 3,000 client companies that produce over 90% of US oil and gas, has recently acquired three companies while developing and deploying several new pieces of functionality to squarely address these new opportunities and the more basic fundamental problems of data I/O and the recreation of rote geological, geophysical, and engineering interpretations by hundreds or thousands of geoscientists that may work a particular area, forcing each new entrant to reinvent the wheel perpetuated by the traditional empty software/raw data provider licensing paradigm.

DI Rigs

By knowing the actual days to drill in a play, companies can benchmark against competitors instead of just internally.

As part of their efforts in the "monitored oilfield," 2013 saw DI release DI Rigs, a service that presents data collected from over 2000 GPS units that DI has placed on active and stacked US rigs, including specific rig data, such as drilling contractor, draw works, and horsepower information, and accounting for some 80% of all active rigs in the US and GOM, and seamlessly tied to drilling permits. This allows the rigs to be identified to target formations, depth, operator, and directional or horizontal drilling component. DI plans to expand its daily information to all US and offshore rigs by year end 2013.

The uses of these measurements are myriad. For operators, knowing which rigs are drilling near planned new drills can allow them to opportunistically slot wells in between long mobilizations. It also allows drilling engineers to quantify real drilling times by rig type in a play or area when building AFEs. Oilfield service companies can be assured that the rig is still on location and get the freshest notification of new rig ups. Drilling companies can generate new business for their rigs by exposing them to DI's over 3,000 company subscribers, and, in the case of public drillers, be assured that their days drilling isn't overestimated by public equity analysts. For business development and E&P analysts, it provides a quick and quantitative look at active drilling concentrations and the dynamic changes of such.

By year end, DI will release a mobile application that will provide driving instructions to the rigs and begin expanding its coverage internationally in an effort to provide the most comprehensive and reliable drilling activity coverage available on the planet.

Michael Wayne has joined Drilling Info as director of oilfield services to head up this effort. Michael brings deep domain expertise and over 20 years of experience to the table for Drillinginfo clients.

Transform software and services

In a recent Transform project, an operator was able to determine that they could reduce the number of wells drilled by 20% without impact to EUR, while also reducing the length of lateral and amount of proppant introduced…a cost reduction of over 250 million in the 100 well program and an increase of IRR of over 25%.

The upstream oil and gas sector knows Denver-based Transform as a leading edge developer of sophisticated geophysical interpretation tools that have successfully allowed companies to integrate various geological and geophysical data and interpretive products into a data model that allows a revolutionary capability to quantify both geological and drilling/completion/stimulation impacts on production, thus allowing far better field design and economics.

Transform recently released a hydraulic fracturing-induced microseismic imaging and modeling module that allows companies unparalleled insight into and measurement of induced fracturing and fracture mapping, as well as seamlessly integrating the results into its multivariant statistical analysis functionality, to further quantify how best to drill and complete wells in unconventional plays. Its recently released wave modeling functionality is being optimized to work real-time, thus creating the possibility of real time management of frack stages, i.e., stopping a frack when it is breaking away from zone.

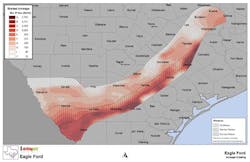

A graded acreage map for natural gas for the Eagle Ford by DI Analytics.

Image courtesy of Drillinginfo.

Transform will be releasing a cross-disciplinary platform at year end that combines geophysical, geological, and engineering tools in a low cost, enterprise-wide basis that integrates with the DI browser-based tools that will allow clients to pick an area, and open up an analytical work bench on their desktop fully populated with DI data.

Wellstorm

A major oil company today shares all of its MWD and LWD in real time throughout all of its offices in a single format and available to its various softwares…

Wellstorm devised both a secure cloud and a behind-the-firewall appliance to allow companies to collect and manage real-time WITSML feeds from loggers and rigs and to effectively store this data for future use. It then followed up by creating a web browser-based 3-D visualization environment to visualize these real-time data in conjunction with the user's own subsurface data, including seismic data.

DI has incorporated this technology to securely combine the user's own data, including seismic and real-time logging and drilling information into its next generation user environment and will provide these cloud service and the 3-D visualization components will be available to all members at no additional cost as part of the DI's next generation architecture releases that are scheduled to begin in October. The DI Wellstorm Appliance and tools by which CTOs and CIOs can incorporate these elements into their own proprietary systems will also be available by year end.

County Scans

Quick action after an important event is often the difference between being in the play or out of the play.

DI's acquisition of County Scans in 2012 highlighted its commitment to deepen the mineral ownership information, including open acreage, unleased portions of leased tracts, and pugh clause open acreage opportunities that are triggered by new events. DI has over 50 counties back to sovereignty and has added recent leasing (typically back 20 years) to over 100 more counties in its coverage areas and rapidly expanding its coverage across both components over the next three years. DI recently released functionality for members to access complete lease documents beneath the mapped mineral tracts and will soon release its integrated run-sheet application.

DI A&D info

A producing property is for sale next to a well that is being fracked in a zone that is HBPed by the for sale property that has been historically non-productive. The result of that frack can radically change the value you are willing to pay for that property.

Identifying what properties or companies are for sale or in play in the context of best practices, local activity, and acreage availability can drive value very effectively. DI began building out its property and deal listing service a few months ago to supplement its Global Exploration Opportunities (GEO) product line focusing on non-North American opportunities. Property listing and access to North American properties are free to any DI member.

DI EUR info

Evaluating whether choking back increases ROI, or determining if newer wells are really outperforming older wells becomes simple when looking at EURs.

DI calculates EURs for every producing well in the US and Canada every month using two different methods, hyperbolic and multiphase. DI also calculates metadata every month to define the variability of the EUR number as time progresses, essentially a "grade" on the predictability of the EUR. Currently available in DI Desktop, it will make its appearance in the DI web system in early 2014.

"In today's oil patch, the best operators can produce up to three times as much as the worst operators and some 30% more than average operators for the same quality of acreage."

What they all mean in DI

There are 50 experiments taking place in the oil patch every day. When one works, many properties change value instantaneously. Profound value is contained in knowing and acting on that value change sooner than later. Securely incorporating your own information allows even more insight and quantification of that value change. Further, using information about what various geological and petrophysical signatures were associated with hydrocarbon production is a novel new way of looking for hidden pays.

DI has spent the last two years completely re-architecting its next generation system to more effectively distribute its interpreted geological data, its continuously updated statistical grading of acreage and operations in popular unconventional plays, and the onboarding of over 100 terabytes of information coming from the two million plus paper inventory of historical scout cards and well logs from all across the world in order to allow its clients to do radically accelerate the productivity of their technical staffs.

Among the benefits of this emergent architecture are:

- DI's data and interpreted knowledge products will be available to clients other software platforms in a much more convenient manner,

- Users can seamlessly integrate their own and others data and interpretations into the DI browser WITHOUT exposing it to DI servers or any servers outside of their firewalls, creating a truly immersive and secure environment to visualize ALL work results from widely distributed teams, and

- It will allow much better cross disciplinary collaborative workflows, either through the DI web interface proper, or as managed components of client proprietary systems. OGFJ

About the author

Allen Gilmer is co-founder, chairman, and CEO of Drillinginfo. Prior to co-founding Drillinginfo in 1999, he was an independent oilman for seven years, co-founding three profitable E&P companies. He began his oil patch career with Marathon Oil Corp. as a geophysicist working in research, seismic acquisitions, and South American exploration. Gilmer is active in all aspects of Drillinginfo's new product development and is recognized for his industry leadership and vision. He holds several patents in the field of multi-component seismology. He received his BA in geology from Rice University and his MS in geology from the University of Texas at El Paso.