Sustainable water management

A key component to shale oil and gas operations

Aaron Johnson, Dow Water & Process Solutions, Midland, Michigan

While Shale oil and gas development can be game-changing for the United States energy market and beyond, concerns around the environmental impact of the process threaten to thwart industry growth. The majority of these concerns are tied to water issues, which creates a significant opportunity for the public and other stakeholders to gain a better understanding of the process.

Clean water and on-demand energy cannot exist without the other. The water-energy nexus refers to the dynamic, connected nature of water and energy. They are inseparable; water is required to extract energy sources, and energy is required to produce useable water. The water-energy nexus can become a vicious cycle, as lack of technology, poor management or inefficiencies in use in one area can affect the sustainability of the other.

Hydraulic fracturing can be an efficient and environmentally-contained process to extract shale oil and gas, provided best practices are followed and the most appropriate technologies are used in each phase of operation. This, coupled with effective legislation and regulatory requirements that encourage and expedite the adoption of water treatment technologies, will help facilitate sustainable industry practices.

The role of water in hydraulic fracturing operations

Water use in unconventional shale oil and gas extraction can be complicated (see Fig 1). The hydraulic fracturing process can use more than 5 million gallons of water per well, and water to support unconventional shale oil and gas production can come from a variety of conventional sources, including fresh or brackish waters from surface or groundwater withdrawal, treated wastewaters, and recycled water produced along with oil and gas. Regardless of the origin of the source water, it is important that the correct water quality is used during hydraulic fracturing operations to minimize the impact of unwanted salts and other compounds that may interfere with the performance of the fracturing fluid.

Water sourcing and water management decisions associated with shale oil and gas development fall into two primary categories: water utilization within hydraulic fracturing operations and the disposal of wastewater from drilling and production. After the completion and stimulation of shale oil and gas wells, fracturing flowback water, the portion of injected hydraulic fracturing fluids that return to surface before production, returns to the surface quickly over a few weeks and shows a rapid decline in quantity and quality (typically 10-30% returns in the first 1-2 weeks). Flowback water often contains very high total dissolved solids (TDS) and is characterized by the presence of sand, clays, polymers and chemistry associated with the drilling and completion of the new well. Shale produced water (i.e. water produced during oil and gas production), on the other hand, requires management in the longer term. Produced water flow rates are typically much lower and more consistent than flowback, is variable field-to-field and well-to-well, but has generally predictable flow rates and quality.

Existing technologies and emerging developments in the field

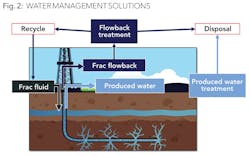

Among the concerns from an industry perspective is the availability of sustainable water management solutions to manage the rapid development of shales and other tight oil and gas resources (see Fig 2). Numerous water technologies are available today to enable complete or tailored removal of particulate, organic and ionic contaminants from various waters associated with development of these unconventional resources.

Conventional source waters

A variety of simple and advanced water treatments have proven capability to take the lowest water quality available in the region and treat it to a suitable level for use in hydraulic fracturing operations. Salinity (measured as TDS) and water composition must be compatible with the hydraulic fracturing fluid chemistry and formation to maximize shale gas recovery. Self-cleaning filters remove fine solids to protect pressure pumping equipment, maintain permeability of the shale, and serve as pretreatment for more advanced technologies. Ultrafiltration membranes further reduce turbity and provide virtually particle free water for more advanced treatment, such as reverse osmosis desalination. Nanofiltration and ion exchange technologies help tailor the composition of a number of source waters to meet specific needs of the hydraulic fracturing process.

Flowback and produced water

After the process of hydraulic fracturing is complete and the gas reservoirs are opened, down-hole pressures push a percentage of the hydraulic fracturing fluid back to the surface. This flowback water contains hydrocarbons, minerals, residual hydraulic fracturing chemistry and other substances originating from the shale itself. Flowback water must be collected and securely contained before it is either recycled or disposed. Measures are also taken to prevent circumstances in which flowback or produced water is discharged to the environment or to municipal wastewater treatment plants prior to significant treatment. The variable and short-term nature of flowback water makes treatment technically and logistically challenging.

Technologies exist to treat flowback water to be recycled into the next hydraulic fracturing job, remove contaminants before disposal, and improve water quality to meet discharge and re-use standards. Application specific examples include selective ion exchange for boron removal for "gel fracs", self-cleaning fine particle filters to remove suspended solids, polymeric adsorbents for organic compound removal. Numerous water management solutions are available to facilitate proper treatment of flowback and produced water for recycling, reuse or disposal. However, the use of these processes or any of these unit operations will be dependent on the water composition for the given area.

The rise of recycling

Water recycling is widely seen as a potential means of reducing the impact on local water resources, particularly in areas where hydraulic fracturing is new or water is relatively scarce. Recycling also reduces the need for long-range trucking of makeup water to the well pad and subsequent wastewaters to remote disposal facilities, thus providing both an economic and environmental win. Technology advancements allow for the reduction of water withdrawals and increased reuse of water recovered from producing oil and gas wells (see Fig 3).

For example, oil and gas companies working in the Eagle Ford Shale and Permian Basins have started to use membrane systems to recycle and reuse high salinity produced waters from shale oil development. Mobile systems employing advanced pretreatment, allowing ultrafiltration to pre-treat high-pressure nanofiltration membrane systems, offer much higher recovery of water compared to reverse osmosis desalination. Nanofiltration selectively removes ions, such as calcium, magnesium and sulfate, which interfere with both fluid and formation chemistries, while allowing sodium chloride salts to pass through the membranes. Configurations of nanofiltration and reverse osmosis systems have also been used to clean and concentrate the brines—essentially splitting the waste streams into reusable brines and fresh water. Recovered brine may be reused for drilling fluids and hydraulic fracturing, while the low-salinity permeate is beneficially reused as service water.

Recycling and reusing produced water can reduce costs in some instances, preserving fresh water resources, and improve the sustainability of the hydraulic fracturing operation.

Meeting emerging needs of the water-energy nexus

Hydraulic fracturing can be an efficient and environmentally-contained process to extract shale gas, provided the correct procedure is followed and the most appropriate technologies are used. Continuously improving and adopting advanced water treatment technologies and best operating practices is critical to facilitate the sustainability of hydraulic fracturing operations. Legislators and regulators need to spend more time considering how they can accelerate the adoption of available water treatment technologies, especially those for fracturing water recycling and reuse.

States are in the best position to develop regulatory requirements and procedures for projects that involve hydraulic fracturing, given that each formation has unique properties. Each state, however, must allocate the proper resources to develop, oversee and enforce the proper rules and regulations. Of the 27 US states that support 99.9% of all natural gas exploration activities nationwide, all 27 have permitting requirements in place that govern the siting, drilling, completion and operation of wells, including hydraulic fracturing.

Economic growth will depend on the development of all sources of energy—including oil, coal, natural gas, nuclear power, wind, solar and geothermal, among others. Without an effective, sustainable effort to drive the development of energy sources and management of demand, the global economy will struggle to grow and create the jobs of the future. Leaders in the public sector need to turn their attention to how they can help accelerate adoption of water technology, in order to facilitate a sustainable hydraulic fracturing process that stimulates economic growth.

Maintaining a social license to operate requires paying attention to regulatory trends and changes in public sentiment. With effective product stewardship, clean-burning natural gas and oil from shale reserves can be produced in a safe, responsible and effective manner.

About the author

Aaron M. Johnson is Global Application Development Leader for Dow Water & Process Solutions (DW&PS). Since 2009, Johnson has been responsible for establishing and leading Dow's Oilfield Water Technology program to meet water treatment challenges facing the hydrocarbon E&P industry. DW&PS' programs for produced water and injection water treatment include development of new water treatment components as well as new applications research in membranes, ion exchange resin and specialty adsorbent technologies. With the acquisition of Clean Filtration Technologies LLC by The Dow Chemical Company in 2012, Johnson now leads Dow's newest produced water business effort in the macro-filtration market.