Will Arctic Express rescue gas prices-or is it already too late?

Will the latest Arctic Express across much of the US and Canada rescue an otherwise forgettable heating season-and natural gas prices with it?

The short answer is no, because a week's worth of even the extreme weather seen in the past day or so would not be enough to sustain a gas price spike.

However, several analysts have noted that the US National Weather Service has forecast near-normal temperatures for the US for the balance of the season. "Normal" temperatures in winter mean robust gas demand. And robust gas demand sustained over much of the season might pull down a huge overhang in gas storage, enough to keep prices from being further depressed before the start of the summer cooling season.

If the cold weather doesn't materialize to the extent forecast, however, look for a further plunge in gas prices before the cooling season and economic recovery turn things around again.

Weather wobbles

While digging out from under all the snow today, many may soon forget that the week started with seasonal record highs for many areas of the country.

Last week marked the third consecutive week of warmer than normal temperatures and the eleventh such week of the overall heating season, notes UBS Warburg analysts Ron Barone and James Yannello.

US temperatures have averaged 18% above normal for the season so far and 26% higher than last year. All major sectors of the US have been warmer than normal, except for the West Coast, which was 12% colder than normal.

Even the US National Weather Service seasonal forecasting tools are conflicted, with one predicting lower than normal temperatures and another the opposite for February, March, and April. Apparently that has left consensus landing straight up the middle.

Market factors

It remains to be seen how much of a dent this week's deep freeze has put in US gas storage levels.

There remains a lot of gas to work off before inventories can drop to a level the industry might feel comfortable with.

According to American Gas Association data, industry withdrew 111 bcf of gas from storage last week, compared with 125 bcf the week before and 128 the same time a year ago and well within market expectations.

Here's the bad news: US gas storage levels remain more than 1 tcf above the same level a year ago and 600 bcf above the prior 3-year average for this time of year. Remember this time a year ago? US gas inventories year on year were posting a deficit of more than 500 bcf.

Gas inventories last week rose to 2.3 tcf vs. 1.2 tcf last year, well below the record of 3.1 tcf set on Nov. 23 but still 600 bcf above the prior 7-year average.

It's likely that the Arctic Express at the end of the week prevented an even worse buildup in the year-to-year storage surplus that the mild weather at the beginning of the week spawned.

"Nevertheless," said Barone and Yannello, "if one were to apply the average 7-year historical weekly withdrawal rate of 81 bcf going forward, Apr., 1, 2002, storage supplies would approximate [1.5 tcf] vs. the prior 7-year Apr. 1 average of 946 [bcf]."

The irony here is that there are some underlying bullish market signals even with the storage glut and overall seasonal demand lag, according to Kristin Dall, senior analyst with Wakefield, Mass.-based Energy Security Analysis Inc.

The amount of speculative short overhang for New York Mercantile Exchange gas futures contracts would normally signal a bullish warning to the market, she said: "If the market is threatened by some extremely bullish event, there is enough potential for prices to skyrocket and turn things around."

But until the weather intervenes, the short strategy seems a safe bet, she added.

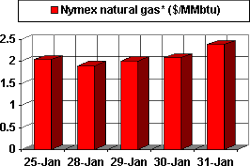

With gas prices hovering near the critical psychological threshold of $2/MMbtu-a level not sustained this low since early 1999-it's clear that lagging demand has lowered the floor under prices.

However, Dall also believes that "Funds have helped to drive this contract to $2/MMbtu and could take it even further.

"There have been two other time periods in recent years when noncommercials have held this high a percentage of overall open interest in Henry Hub contracts-both resulting in increased price pressure and volatility," she said.

Blowdown threat

Much more downward price pressure could be on the horizon without a wintry weather rescue of the gas market.

According to a research note by a team of analysts with CIBC World Markets Inc., gas price weakness in the first quarter could be extreme if storage capacity holders blow down gas in storage, regardless of the weather, to avoid financial penalties for carrying gas in storage beyond the withdrawal season.

"Should this occur," CIBC noted, "an abundance of gas would be available in the spot market, which could push prices to below $2/Mcf."

Without an inventory blowdown, says CIBC, US storage will be about 1 tcf above end-of-winter levels a year ago and 686 bcf above the 8-year average end-of-winter level of 933 bcf.

The bears have their way with all the market gloom and doom this week. Next week's column will focus on the bulls' case for a gas price rebound in the near term.

OGJ Hotline Market Pulse

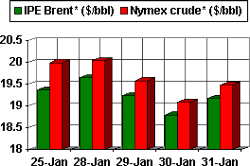

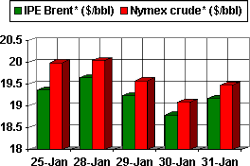

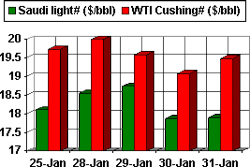

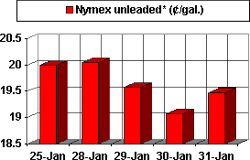

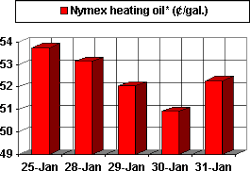

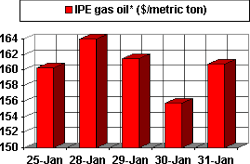

Latest Prices as of Feb. 1, 2002

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null