Despite early exploratory disappointment and a longstanding trade embargo by the US, the Cuban government seeks more foreign help in the assessment of its deepwater oil and gas potential.

The country's national oil company and a Canadian operator, meanwhile, are drilling wells of increasing lateral displacement from land to further develop near-offshore reserves of mostly heavy oil along the northern coast.

At a conference called Safe Seas-Clean Seas in Havana Oct. 19-21, officials from state-owned Cuba Petroleo (Cupet) said negotiations are in progress with Sonangol of Angola and Petroleos de Venezuela SA for deepwater blocks in the 114,000-sq-km Cuban Exclusive Economic Zone (CEEZ) in the Gulf of Mexico.

Since the fatal Macondo blowout and spill off Louisiana in April 2010, the prospect of deepwater drilling off Cuba has raised concern in the US and elsewhere in the greater Caribbean area about spill prevention and response. Although the Cuban government has implemented a safety regime modeled on UK regulation, the system is untested and sparsely equipped. And despite restoration of US-Cuban diplomatic relations late last year and a measured easing of travel restrictions, the 53-year-old embargo remains in place.

It represents not only a problem for the rapid movements of people and equipment required by any response to an offshore accident but also a risk for oil and gas producers contemplating deepwater projects off Cuba (OGJ, Nov. 2, 2015, p. 36).

Four deepwater wells

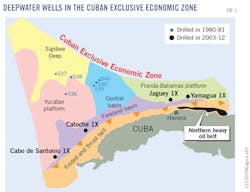

Since Cuba opened the CEEZ to foreign investment in 1999, operators working under production-sharing contracts (PSCs) have drilled four deepwater wells in the area, which lies off the northwestern part of the island nation. All the drilling occurred during 2003-12 (Fig. 1). The only other offshore drilling since 2003 was in shallow water off the island of Cayo Coco in central-northern Cuba.

None of the offshore wells found commercial hydrocarbons. Three of the wells drilled in recent years had oil shows but lacked effective seals.

The Repsol Yamagua 1X well, drilled in 2003-04 by the Ocean Rig Eirik Raude semisubmersible rig in 1,656 m of water, went to 3,374 m TD. It had shows of 19.5° gravity oil in a Lower Eocene breccia section above 2,700 m. The well also yielded poor oil shows from Cretaceous dolomites.

In 2011-12, the Saipem Scarabeo 9 semi-specially assembled to meet content restrictions of US sanctions-drilled three deepwater wells:

• Repsol Jaguey 1X, bottomed at 4,528 m in 1,778 m of water. It had shows of oxidized oil in Early Cretaceous carbonates below 4,324 m.

• Petronas Catoche 1X, went to 4,640 m in 2,234 m of water with gas shows in Upper Cretaceous and live and oxidized oil in Lower Cretaceous carbonates.

• PDVSA Cabo de Santonio 1X bottomed at 4,225 m in Lower Cretaceous carbonates with no reported results. Water depth is 2,128 m.

Zarubezhneft of Russia operated the post-2003 shallow-water well, L-01. Drilling by the Songa Mercur semi encountered technical problems and difficult geology and didn't reach target depth. The rig left Cuban waters in June 2013.

Earlier deepwater assessment of the CEEZ came via the former Deep Sea Drilling Project, which drilled six scientific holes with the Glomar Challenger drillship during 1980-81. One of those tests, at Site 535, had shows of live and oxidized oil in Lower Cretaceous pelagic limestone. The hole went to 4,164 m in 3,455.5 m of water.

From seismic surveys shot over the CEEZ during 1984-2011 Cupet has 31,193 line-km of 2D and 13,005 sq km of 3D data.

Oil traces in the Site 535, Yamagua, and Jaguey wells correlate chemically with crude produced in the northern heavy oil belt, which accounts for 97% of Cuban production. The oil in those fields is 6.3°-37° gravity with 0.27-9% sulfur, generated from Upper Jurassic pelagic carbonates.

Oil in the Catoche well correlates with oil from old onshore fields inland from the northern-belt producers.

Cupet officials note that no CEEZ well yet has tested Upper Jurassic sequences, which contain the main source rocks and reservoirs of southern Cuban oil fields and are productive throughout the Gulf of Mexico.

The Cuban industry

The government reports Cuban oil and gas production at 80,000 boe/d and crude output at 52,000 b/d. The country relies on imports, mainly under subsidized terms from Venezuela, to meet most of its demand, estimated by US Energy Information Administration at 171,000 b/d.

Cupet operates four refineries. Havana's 36,400-b/d Nico Lopez refinery, which has a 12,500-b/d catalytic cracker, is the only facility with conversion capacity. The others are hydroskimmers: Camilo Cienfuegos, 65,000 b/d, at Cienfuegos; Hermanos Diaz, 30,000 b/d, at Santiago; and Sergio Soto, 2,800 b/d, at Sancti Spiritus.

Cuban refineries run little Cuban crude. Most of the heavy oil produced along the northern coast is diluted with naphtha and trucked to power plants for combustion.

The largest producing field is Varadero, near a resort town of the same name at the eastern end of the heavy oil belt about 125 km from Havana. Cupet estimates the Varadero resource at 11.3 billion bbl of oil in place. Recovery factors throughout the belt are low: 7-10%.

Wells on the northern coast are drilled directionally from land to penetrate subsea targets along multiple thrust sheets in the nearshore foreland basin. The Upper Jurassic-Lower Cretaceous reservoirs are fractured and karstified pelagic carbonates sealed by Paleogene shales.

In resort areas, surface locations and gathering stations are on the landward side of a coastal highway, obscured from view in recreational areas by berms and hedgerows.

Cupet officials say the longest well drilled in the area is in Varadero West field. The main hole in the VDW 1007 well went to 22,513 ft MD, with 5,552 ft TVD and displacement of 18,751 ft. A lateral hole in the well had 21,877 ft MD, 5,433 ft TVD, and 18,133 ft displacement.

Drilling in the northern heavy oil belt uses water-based mud and frequently encounters large intervals of reactive clays. Early drilling phases are especially complicated, and problems with hole stability and lost circulation are frequent.

International service companies working with Cupet include Great Wall Drilling Co., a subsidiary of China National Petroleum Corp.; Schlumberger; and Latitude Energy Services of Barbados.

Non-Cuban operators

The main non-Cuban operator in Cuba is Sherritt International Corp., a Toronto metals-mining company. Active in Cuba more than 20 years, Sherritt operates Puerto Escondido, Yumuri, and Varadero West oil fields under two PSCs.

In May 2014 the company negotiated a 10-year extension to the Puerto Escondido-Yumuri PSC. It has drilled eight wells, one more than required by the extension terms, and has ended the extension drilling program. Six of the wells produce oil, one is suspended, and one has been abandoned.

The company says production from the extension program fell below expectations and has lowered its expectation for gross working interest production in Cuba this year to an average of 18,500 b/d of oil from a previously forecast 19,000 b/d, with output in the third quarter having slipped to 17,693 b/d from 18,607 b/d in the second quarter. Average production in 2014 was 19,456 b/d.

Sherritt also has trimmed capital spending in Cuba for the late months of 2015.

In December 2014 Sherritt signed new exploration PSCs for 967-sq-km Block 8A in central Cuba and 261-sq-km Block 10 in northern Cuba. The contracts have 25-year terms and work commitments requiring reprocessing and acquisition of seismic data within 2 years.

In June 2014, Cupet signed separate agreements with CNPC and Rosneft of Russia. With CNPC it has a framework agreement covering production enhancement and drilling and other services supporting offshore exploration. The Rosneft agreement involves cooperation in enhanced recovery and other work in existing fields.

About the Author

Bob Tippee

Editor

Bob Tippee has been chief editor of Oil & Gas Journal since January 1999 and a member of the Journal staff since October 1977. Before joining the magazine, he worked as a reporter at the Tulsa World and served for four years as an officer in the US Air Force. A native of St. Louis, he holds a degree in journalism from the University of Tulsa.