U.S. Pipelines Continue Gains into 1996

U.S. interstate natural gas, crude oil, and petroleum product pipelines turned in healthy performances for 1995, continuing impressive efficiency improvements that were evident in 1994.

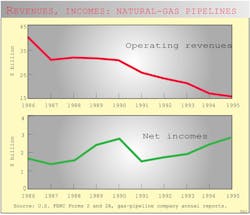

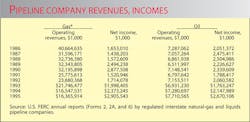

Annual reports filed with the U.S. Federal Energy Regulatory Commission (FERC) show that both natural-gas and petroleum liquids pipeline companies increased their net incomes last year despite flat or declining operating revenues (Fig. 1).

Natural-gas pipelines continued to solidify their functions as transportation providers by increasing the amounts of gas they moved for a fee and decreasing gas sold out of their systems.

Liquids pipelines moved more barrels in 1995 than a year earlier and added additional miles of line for future shipments.

Revenues and incomes earned from operations along with volumes moved are among data annually submitted to FERC and tracked by Oil & Gas Journal year to year in this exclusive report.

Other FERC documents, applications for new gas-pipeline construction filed for a 12-month period ending June 30, showed something of a rebound in U.S. pipeline construction. Plans for new construction had been in a 2-year decline.

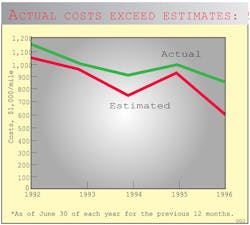

And what natural-gas pipelines actually spend to modify or expand their systems has been running ahead of what they estimated in initial applications to FERC. This trend is evident from companies' final-cost filings with FERC.

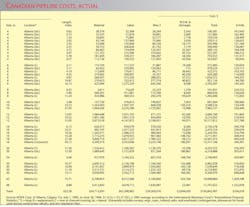

This year's report expands coverage of plans for new construction and completed-cost figures by including Canadian activity for the same 12-month period: July 1, 1995, to June 30, 1996.

Network snapshot

Data found in the pipeline-company tables at the end of this report include revenue, income, volumes, mileage operated, and investments in physical plants. These provide a snapshot of the U.S. regulated interstate pipeline system.

With the 1988 Pipeline Economics Report (OGJ, Nov. 28, 1988, p. 33), the Journal began tracking volumes of gas transported for others by major interstate pipeline systems.

These data have provided a method of tracking the changing U.S. gas-transmission industry.

Pipeline mileage

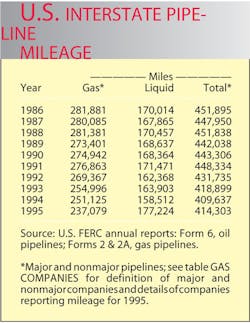

The number of companies required to file reports with the FERC varies each year. As a result, comparing annual U.S. petroleum and natural-gas pipeline mileage must be done carefully.

And such comparisons were further complicated for several years after 1984 when FERC instituted a two-tier classification system for companies (OGJ, Nov. 25, 1985, p. 55).

Definitions of the categories can be found at the end of the table "Gas pipelines" (p. 58) and in FERC Accounting and Reporting Requirements for Natural Gas Companies, para. 20.011.

Only major gas pipelines (about one-third of all reporting) are required to file mileage operated in a given year. So-called "non-major" companies may indicate mileage operated, but the information is not asked for specifically.

For 1984 and several years following, many non-majors did not describe their systems. But in recent years most have been providing such descriptions, including mileage operated.

For 1995, the FERC made an additional change to reporting requirements, this time for petroleum liquids pipeline companies.

In a Final Rule issued Oct. 3, 1995, FERC exempted from requirements to prepare and file Form 6 those pipelines whose operating revenues have been at or less than $350,000 for each of the 3 preceding calendar years.

These companies must file only a page 700, "Annual Cost of Service Based Analysis Schedule," of the Form 6. This page contains no mileage figures but does note total annual cost of service, actual operating revenues, and throughput in both deliveries and barrel-miles.

FERC-regulated natural-gas pipe line companies and petroleum liquids pipeline companies operated nearly the same number of miles in 1995 as in 1994: final data show an increase of nearly 5,000 miles (1%; Table 1).

All pipeline mileage operated to move natural gas in interstate service declined more than 14,000 miles (5.6%); mileage used in deliveries of petroleum liquids in common-carrier service rose by more than 18,000 miles (11%).

The loss of natural-gas pipelines was almost entirely in reported gathering mileage which dropped more than 14,000 for 1995. Gathering lines for liquids companies, on the other hand, increased by nearly 4,000 miles (13%); crude trunk mileage increased by more than 5,600 miles (nearly 11%).

Whether FERC designates a liquids pipeline company an interstate common-carrier pipeline determines whether the company must file a FERC annual report (Form 6).

Mileage figures for 1995 continue the erratic pattern of liquids-pipeline utilization for the past 10 years (Table 1).

Deliveries

In 1995, natural-gas pipelines continued their shift from being primarily merchants of gas in the early 1980s to being mainly transporters of gas today.

Last year, more than 10 years after the historic FERC decision that forever changed the U.S. natural-gas transmission industry, gas pipelines moved nearly 32 tcf of other companies' gas and sold only 1.56 tcf from their own systems. The gas transported for a fee represented an increase of nearly 5% over volumes moved in 1994; the gas sold, a 7% drop over volumes sold a year earlier.

For 1994, companies had moved more than 30 tcf of other companies' gas and sold only 1.67 tcf from their own systems. The gas transported was an increase of more than 22% over volumes moved in 1993; the gas sold, a nearly 50% drop over volumes sold a year earlier.

Liquids-pipeline companies saw more throughput in 1995. The lines increased deliveries more than 700,000 bbl (5.8%) with product deliveries leading the increase with more than 500,000 bbl (10%) more than in 1994.

Crude-oil shipments (more than 54% of total liquids movements) increased by more than 160,000.

Trunkline-traffic (1 bbl moving 1 mile = 1 bbl-mile) for U.S. crude-oil and product pipelines, however, increased only slightly compared with 1994. This measure of system utilization rose by only 1% with declines in product traffic offsetting a nearly equal increase in crude oil traffic.

Top 10 companies

Oil & Gas Journal ranks the top 10 pipeline companies in three categories-mileage utilized, trunkline traffic (bbl-mile), and operating income-for oil-pipeline companies and three categories-mileage, gas transported for others, and operating net income-for natural-gas pipeline companies.

These rankings are broken out from the accompanying pipeline-company tables.

For all natural-gas pipeline companies, net income as a portion of gas-plant investment increased for the fourth year in a row and the seventh time in 8 years.

The term "gas plant" refers to the physical facilities used to move natural gas-compressors, metering stations, and pipelines.

Net income as a portion of gas-plant investment in 1995 was nearly 4.9% and has been rising steadily since 1991. For 1994, it was 4.2%; 1993, 3.6%; 3.1% for 1992; and 0.5% for 1991.

This indicator of companies' return on investment stood at 8.7% in 1984, the year the FERC began (with Order 436) its restructuring of the interstate gas-pipeline industry that culminated in 1992 with Order 636.

Beginning with 1985, net income as a portion of gas-plant investment fell precipitously through 1987 then began its gradual comeback.

For 1995, all gas-pipeline companies reported an industry gas-plant investment totaling more than $59.8 billion compared with slightly more than $57 billion for 1994, $55.6 billion for 1993, and $55.5 billion for 1992.

For interstate common-carrier liquids pipeline companies in 1995, net income as a percentage of investment in carrier property rose to nearly 9.6%. In 1994, the percentage stood at 8.2% compared to 5.5% for 1993, 7.6% in 1992, 6.6% in 1991, and 9% in both 1990 and 1989.

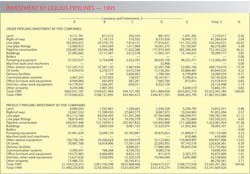

Actual investment in carrier property rose to nearly $27.5 billion in 1995 after falling in 1994 by slightly more than 2.7%. In 1993, it had risen by nearly 16.7%.

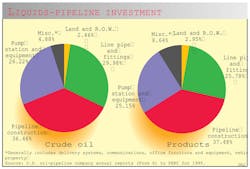

Oil & Gas Journal has, for several years, been tracking carrier-property investment by five crude-oil pipeline companies and five products-pipeline companies.

Table 2 indicates that investment by the five crude-oil pipelines stood at $2.02 billion at the end of 1995 compared with $1.97 billion at the end of 1994, $1.91 billion for 1993, $1.87 billion for 1992, and $1.89 billion for 1991.

Investment by the five product pipeline companies in 1995 was $3.5 billion compared with $3.3 billion in 1994, $3.2 billion in 1993, $3.1 billion for 1992, and $3.07 for 1991.

Fig. 2 illustrates the investment split in the crude-oil and products pipeline companies.

Another measure of the profitability of oil and natural-gas pipeline companies in recent years is the portion net income represents of operating income (Table 3).

Through 1987, trends for liquids-pipeline companies and for natural-gas pipeline companies had been heading in opposite directions for 10 years.

For liquids-pipeline companies in 1995, income as a portion of operating revenues recovered to a level it had not reached since 1989: nearly 35% compared with 34.2% for 1989. In 1994, the portion was 29.5%, 25.4% in 1993, 28.8% for 1992, and 26.3% for 1991.

As a portion of revenues for all natural-gas companies, income was 17.75% for 1995, up from 14.3% in 1994, and up from 9.1% in 1993.

U.S., Canadian construction

Regulated U.S. interstate gas-pipelines must apply to FERC for approval for any modification or expansion of transmission facilities in interstate service. And in Canada, all pipelines must apply to either their provincial regulatory body or to Canada's National Energy Board for such modifications or expansions.

All applications, except under special circumstances for U.S. companies, must contain estimates of what such modifications will cost.

A tracking year-to-year of the mileage and compression horsepower applied for and of the estimated costs indicates future construction activity. Tracking is exactly what Oil & Gas Journal has been doing in this report since its inception nearly 30 years ago (OGJ, Nov. 21, 1994, p. 19).

And this year, Canadian figures for major activity are for the first time included.

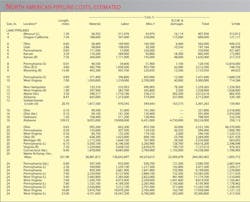

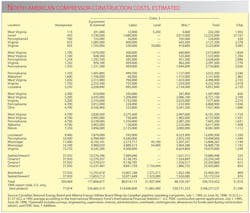

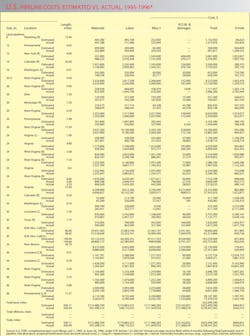

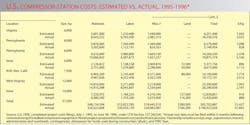

What companies estimated during the 1995-96 period it will cost to construct a pipeline or compressor station is broken out in Tables 4and 5.

Those tables cover a variety of locations, pipeline sizes, and compressor horsepower ratings. For 1995, no project was filed with the FERC for a compressor station in federal waters.

Healthy pace

For any period, not all projects that are proposed are approved; not all approved ones are eventually built.

Based on filings during the 12 months ending June 30, 1996, here's a snapshot of the immediate future of gas-pipeline construction on U.S. interstate system and Canadian construction for all types of service:

* Nearly 1,420 miles of land pipeline were proposed for both countries compared to only 724 miles for the U.S. for the 12 months before June 30, 1995 (Table 4).

* More than 350,000 hp of new or additional compression were applied for in both countries, compared to nearly 78,000 hp in the U.S. for the same the year before (Table 5).

Table 4 lists 62 land-pipeline construction projects and 2 marine projects. This compares with 66 land and 3 marine projects in the 1995 Pipeline Economics Report (Nov. 27, 1995, p. 39) and 77 land and no marine projects in the 1994 report. The latter reports covered only U.S. applications.

For the 12 months ending June 30, the 62 land projects amounted to a total cost of nearly $1.3 billion, up from more than $472 million for the same period in 1995. Total construction proposed July 1995-June 1996 was more than 1,541 miles for more than $1.4 billion.

Cost-per-mile figures may reveal more about cost trends than aggregate costs.

For proposed U.S. gas-pipeline projects in the 1995-96 period surveyed, the average land cost per mile was more than $898,000, compared to the 1994-95 period average of more than $650,000/mile.

For the period ending June 30, two marine projects were proposed for an average per-mile cost of $1.6 million. For the 12-months prior to the surveyed period, the 5 miles of planned offshore pipeline amounted to an average cost of nearly $550,000.

Cost trends

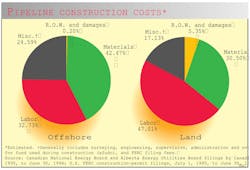

Analyses of the four major categories of pipeline construction costs-material, labor, miscellaneous, and right-of-way (R.O.W.)-can also indicate trends within each group.

Material costs include those for line pipe, pipe coating, and cathodic protection.

"Miscellaneous" costs generally cover surveying, engineering, supervision, contingencies, allowances for funds used during construction (afudc), administration and overheads, and FERC filing fees.

R.O.W. costs include obtaining right-of-way and allowing for damages.

For the 62 land and 2 offshore projects surveyed for the 1995-96 period covered in this report, costs-per-mile for the four categories were as follows:

- Material-$306,569/mile

- Labor-$430,787/mile

- Miscellaneous-$173,126/mile

- R.O.W. and damages-$44,513/mile.

Table 4 lists proposed pipelines in order of increasing size (OD) and increasing lengths within each size.

The average cost per mile for the projects shows few clear-cut trends related to either length or geographic area.

In general, however, the cost per mile within a given diameter indicates that the longer the pipeline, the lower the incremental cost for construction. And broadly, lines built nearer populated areas tend to have higher unit (per-mile) costs.

Additionally, road, highway, river, or channel crossings and marshy or rocky terrain each strongly affects pipeline construction costs.

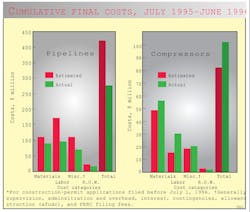

Fig. 3, derived from Table 4 for land pipelines, shows the major cost-component split for land-pipeline construction costs, both estimated and actual.

Material and labor for constructing land pipelines make up more than 77% of the cost. For offshore projects, material and labor make up more than 75%.

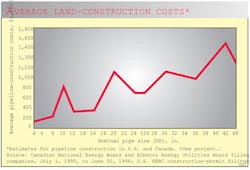

Fig. 4 plots the average pipeline construction cost for land and offshore gas-pipeline construction projects listed in Table 4.

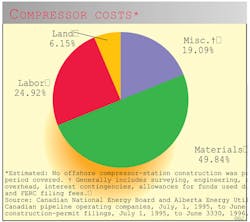

Fig. 5 shows the cost split for land compressor stations based on data in Table 5.

Table 6 lists 10 years of $/mile land-construction costs for natural-gas pipelines with diameters ranging from 8 to 36 in. The table's data consist of estimated costs filed under CP dockets with the FERC, the same data that are shown in Tables 4 and 5.

The average cost per mile for any given diameter, Table 6 shows, may fluctuate from one year to another as projects' costs are affected by geographic location, terrain, population density, or other factors.

Costs per mile from 1995 to 1996 are mixed with generally higher estimates for labor and, to a lesser extent, for materials.

Yearly fluctuations in these figures are illustrated in construction figures for a 12-in. pipeline.

These had dropped by more than 30% 1986 to 1987, jumped by more than 47% in 1988, fell again in 1989, leapt by more than 86% in 1990 only to fall sharply in 1991.

Actual spending

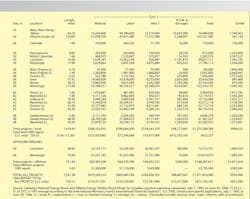

Actual costs for a project which is approved and built must be filed with FERC within 6 months after the pipeline's successful hydrostatic testing or the compressor's being placed in service.

Fig. 6 shows 5 years of estimated-vs.-actual costs on cost-per-mile bases for project totals.

Tables 7 and 8 show such actual costs for pipeline and compressor-station projects reported to the FERC during the 12 months ending June 30, 1996. Fig. 7 for the same period, depicts how total actual costs for each category compared to estimated costs.

Some of these projects may have been proposed and even approved much earlier than the 1-year survey period. Others may have been filed for, approved, and built during the survey period.

And in its initial filing, each pipeline project may have been reported in construction "spreads," or mileage segments, which is how projects are broken out in Table 4.

Completed-projects' cost data, however, are usually reported to the FERC for an entire filing, separating only pipeline from compressor-station (or metering site) costs and lumping several diameters together.

And this year, actual costs for gas-pipeline construction in the Canadian province of Alberta are included in Table 9.

Overall, actual U.S. gas-pipeline construction costs fell short of anticipated ones by more than $145 million.

This was due primarily to actual labor costs not meeting expected costs by more than $75 million. Similarly, costs in all other categories fell short of estimates as well.

Table 8 shows that actual costs for installing compression exceeded estimates by nearly $24 million.

Labor costs accounted for much of the difference, exceeding estimates by nearly $15 million. Actual material costs were more than $8 million over estimates.

Actual costs for miscellaneous items were greater than estimated by nearly $2 million.

Copyright 1996 Oil & Gas Journal. All Rights Reserved.