Complexities challenge oil, gas production in 2002

As the complexity of producing oil and gas grows, the oil and gas industry continues to seek a better understanding of producing mechanisms as well as to develop new tools for bringing fluids to surface at a lower cost.

Fields being developed and produced often are in harsh climates and deeper water, and some reservoirs have very high pressures and temperatures, low permeabilities, unconsolidated sand, viscous fluids, and wells drilled with complex trajectories and multilateral drains.

Other hurdles in the production process include:

- Understanding better the subsurface rock and fluid heterogeneities that influence ultimate fluid recovery.

- Preventing damage during completion and workover operations.

- Installing artificial lift to produce fluids to surface.

- Providing supplemental energy to mobilize fluids in the reservoir.

- Handling produced water, especially during a field´s latter stages of life.

- Preventing and remediating hydrate, paraffin, scale, and asphaltenes deposition in wells, flowlines, or production facilities.

- Inhibiting corrosive constituents in the flow stream that may damage equipment and tubulars.

- Operating in a safe and environmentally friendly manner.

The industry has made great strides in handling these complications, but significantly more hydrocarbons could be recovered with lower-cost solutions.

Some solutions already exist, but new technologies and practices for lowering oil and gas producing costs often take time to find widespread acceptance. Operators need time to understand when to apply the changes in even the best fields and wells because fields:

- Produce fluids with different characteristics.

- Have wells with different well depths and spacing.

- Have different producing economics.

- Are at different stages of depletion.

Production costs

Production costs in general have decreased in recent years for both offshore and onshore operations. As an example, one estimate is that average operating costs in the North Sea are now under $5/bbl compared with $7/bbl previously. But operating costs do have great variability.

For instance, heavy oil producing costs can range from $3/bbl to more than $11/bbl, depending on whether one produces oil with cold production or needs to mobilize it with steam injection.

New technologies have helped drive down costs. These technologies may initially cost more to install, but when one considers life-cycle costs, overall cost may be less. As reservoir interpretation has improved, the risk of installing equipment that might see service only in the future has also decreased.

Further helping to lower operating costs is cost management software that provides for real-time decision-making with workflow control and preventive and reactive budget tracking. This more manufacturing-based software also can check for cross-process accountability.

Aera Energy LLC´s process for applying lean manufacturing principles to its mostly shallow production operations in California-which have combined capital and operating expenses of about $1 billion/year covering output of 250,000 b/d of oil and 90 MMcfd of natural gas-include:

- Identifying common repetitive surveillance activities, such as well reviews and pattern reviews.

- Combining and eliminating tasks.

- Reconfiguring data management, engineering tools, and standard processes.

- Replenishing continuously knowledge and standard analysis templates and reviews.

- Minimizing duplication of effort and data entry time.

- Documenting standards and measuring and improving job performance.

Internet-based systems can lower costs by eliminating the infrastructure cost for installation and operation of host computers and dedicated telecommunications networks needed for supervisory control and data acquisition systems.

In these web-based systems, a remote terminal unit at the wellsite handles all host functions with an internet browser. This eliminates the need for an operator to own or maintain dedicated graphical user interface software.

The systems also have the flexibility of multiple-user web access for those with password privileges to view and retrieve data in real time or to receive automatic periodic reports. Information can be viewed from office and home personal computers or from handheld, palm-sized organizers.

For helping to mobilize oil in a reservoir, one of the more novel technologies under test is the use of seismic pulses. According to its developer, this in situ seismic stimulation creates elastic waves of high energy (up to 10 Mw) and low frequency that dislodge immobile oil droplets and coalesce oil films.

Fluid handling

To eliminate other costs, the industry has begun to install new technologies for handling the complexity of producing a multiphase fluid, consisting of various amounts of oil, gas, and water.

Gaining more acceptance in the industry are multiphase pumps and multiphase meters that eliminate the need for well site test separators and multiple flowlines to move gas and oil from remote headers to a central production and storage facility.

A survey, presented at a 2001 conference, said that from 1989 through 2001 the number of multiphase pump installations had increased from 1 to about 240. This number excludes progressive cavity pump applications. Of the 240 installations, 212 had twin-screw pumps, while most of the remaining had helico-axial pumps.

Pressure boosting in subsea projects and subsea separation may see more future installations, although to date only a few exist.

Downhole oil-water separators (DOWS) reduce water handling at the surface by separating it from oil downhole and simultaneously injecting the water into another formation.

The technology has promise for reducing produced water disposal costs, protecting potable-water aquifers, and increasing oil production.

But to date, only a limited number of DOWS have been installed.

Headers for handling produced fluids also have seen some changes. For instance, on a ChevronTexaco Corp. operated lease in the Midway-Sunset field, Kern Co., Calif., modular headers allowed for faster and more flexible installation, left a smaller footprint, and included in their design more safety, environmental, and ergonomic considerations.

An offshore production trend is the installation of a floating production facility in a role similar to that of a fixed platform acting as a regional hub for tying in new subsea discoveries to an existing pipeline or offloading infrastructure.

For instance, Shell Offshore Inc.´s recently completed Serrano and Oregano oil and gas fields, in about 3,400 ft of water in the Gulf of Mexico, are tied back to the Auger tension-leg platform with single electrically heated pipe-in-pipe flow lines to aid flow assurance.

But fixed platforms also serve as hubs, as in the case of the Gulf of Mexico´s Aconcagua, Camden Hills, and King´s Peak fields development.

These three dry gas fields, in 6,200-7,200 ft of water, will be tied back tied to the Canyon Station host platform in 299 ft of water and 55 miles from the most distant well location.

Some operators envision subsea tiebacks of 100 miles or more as the industry develops new flow-assurance methods that prevent or remediate hydrate, paraffin, scale, and asphaltenes deposition in wells, flowlines, or production facilities.

Intelligent wells

Intelligent, or smart well, completions show promise especially in producing areas with high intervention costs, such as in deepwater subsea completions.

These downhole tools and sensors allow operators real-time control and monitoring of flow from each separate producing or injection interval in a well.

Although estimates are that the industry has installed, to date, only about 70-80 low-end and high-end intelligent completions, these systems have the potential for increasing production by optimizing the production profile, improving ultimate recovery, providing operational flexibility, eliminating intervention costs, increasing reservoir knowledge, and optimizing flow assurance problems caused by sand, paraffin, hydrates, and asphaltenes.

These intelligent completions let operators react in real time to changes in downhole conditions.

For example, if sensors indicate excess gas or water entry from an oil-producing interval, an operator can shut in that interval while still producing from other zones without needing intervention equipment such as wireline units, coiled tubing units, or workover rigs.

The low-end versions of these systems rely on hydraulic operations, while the high-end versions are all electronic systems.

These systems can include one or more of such components as:

- Surface-controlled downhole chokes or sliding sleeves for regulating fluid flow from each completed interval.

- Downhole data acquisition sensors for measuring temperature, pressure, and flow of each interval.

- Data transmission, storage, retrieval, and analysis systems.

Reservoir evaluation

The industry still has a lot to learn about the reservoir itself. It continues to have problems with the integration of production data into high-resolution models for reconciling static and dynamic reservoir data. A reservoir model derived from static data such as geologic, well log, and seismic data may predict fluid flow that does not match pressure transient observations, tracer data, multiphase production history, and time-lapse seismic measurements.

But new evaluation techniques are providing operators with more accurate views of the subsurface.

The image on the previous page from a steamflood operated by ChevronTexaco in the Coalinga field in California, shows changes in fluid distribution in a steamflood over time determined from 4D seismic analysis.

Streamtube-based visualization is another technique that helps evaluate the effect of changes in well geometry on production, as seen in the images on the left.

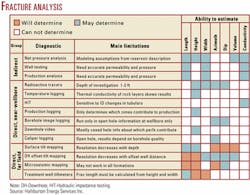

New methods also are affecting the interpretation of hydraulic fracture geometry.

Both tilt meters and microseismic data have altered how the industry views hydraulic fracture geometry. Interpretation of these measurements often indicates that fractures are significantly more complex than previous calculated through rock mechanics and hydraulic fracture simulators.

Both tilt meters and monitoring microseismic claim to provide the industry with a direct measurement of hydraulic fracture parameters.

The table on the following page lists various fracture evaluation methods and their ability to estimate fracture parameters.

Most reservoirs in the world, even those that are abandoned, still contain some unrecovered hydrocarbons that might be recovered if the economics allow.

For instance, a recent multiyear, multifield evalution of the potential for refracturing gas wells showed that, out of nine wells restimulated, six treatments were economically successful. But for all nine, the treatments increased incremental reserves by 2.9 bcf at an average $0.26/Mcf cost, indicating a highly successful program, even when accounting for the unsuccessful restimulations.

The key to a successful program was the candidate selection method and the study indicated that inclusion of a fuzzy logic component in a virtual intelligence method holds considerable promise.