Shallow water gulf oil, gas supply: A glass half full or half empty?

The US Gulf of Mexico (GOM) has been and continues as a major source of domestic oil and natural gas supplies. Recently, some have begun to speculate that this critical domestic production area is or soon will be in decline.

The main argument for this dire outlook is that a sharp decline in shallow water (shelf) will more than offset any gain from the deep water (slope) (Fig. 1). This would have significant implications for higher domestic gas (and oil) prices, potential supply shortage, and decreased energy security.

The first article in this three-part series reviewed the development and production history of the gulf, focusing on areas in more than 200 m of water (OGJ, May 6, 2002, p. 52).

This article, the second in the series, will focus on areas in less than 200 m of water.

A third article will examine how continued technology developments and alternative royalty structures and public policies may shape the future of oil and gas development, in both the shallow and deep waters of the gulf.

Shallow water status

Recent history

The shallow water Gulf of Mexico is one of the "grand ole dames" of US hydrocarbon supplies. The first offshore well on the GOM shelf was drilled in 1947 in 20 ft of water off Louisiana. Today the gulf shelf:

- Has produced 10 billion bbl of oil and nearly 130 tcf of gas1;

- Provides 15% of US hydrocarbon production, equal to 820,000 b/d of oil, condensate, and natural gas liquids (NGL) and 10 bcfd of dry gas;2 and

- Has supported the discovery of 936 fields, 770 of which are still on production.3

But this is history. The question now is, is one last fling left in the "grand ole dame?"

Clearly, the gulf shelf is mature, with the largest fields and most economic prospects already discovered. However, year after year the gulf shelf displays significant resiliency, continuing to make substantial contributions to US oil and gas supplies. Therefore, to address the question above, a look at recent trends is warranted.

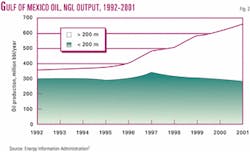

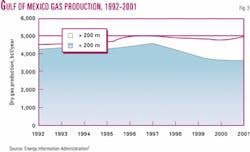

Figs. 2 and 3 provide a look at the gulf's recent oil and gas production, for both the shelf and slope. For the past 4 years, shallow water (shelf) oil and gas production has declined. Oil production has been falling moderately at 5%/year. Gas production, which had been declining 8%/year, stabilized in 2001.

Assessing the remaining supply potential or "remaining life" in the shelf is akin to addressing the question, "Is the glass half full or half empty?" We tend to lean toward the "half full" perspective and have assembled the facts and assumptions that support this point of view.

We ask the reader to pursue other thoughtful and well prepared sources4 5 for the "half empty" view.

Depletion, productivity

One of the more compelling arguments for a pending precipitous decline in shelf production is "accelerated depletion."

Shelf operators report that production wells decline 33%/year, with first-year wells declining by 47%.6 This has led to a view that on the shelf one must "run faster and faster just to stay in place." This view was cogently set forth in one well-respected industry spokesman's outlook for gas from the shelf:

"What is now 11 bcfd will likely decline to only 3 bcfd by 2005. Whether this can realistically be replaced by even higher drilling activity in this mature area is questionable for two reasons. First, the offshore rigs are now at near 100% utilization. Second, the fields each year are diminishing."7

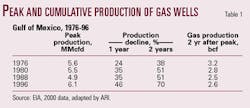

However, improved completion and production practices are enabling newly discovered wells to remain highly productive, offsetting the effects of depletion. The peak productivity of gas wells in the gulf has increased in the past 8 years (Table 1). The peak productivity for wells drilled in 1996 (the last year such data are available and the last year before significant contributions from deepwater discoveries) was 6.1 MMcfd versus 4.9 MMcfd in 1988.

While the sizes of new field discoveries have declined, technology progress has thus far offset much of the detrimental effects of resource depletion, and cumulative gas production per well in the first two economically critical years has remained relatively flat for the last 16 years.

Significantly, accelerated production (depletion) of discovered fields on the shelf is beneficial rather than detrimental:

- First, accelerated depletion enables the industry to operate efficiently, providing the same level of production from a smaller warehouse of reserves.

- Second, accelerated depletion enables the industry to economically develop smaller fields, expanding the producible gulf resource base.

- Third, since the requirement is to replace production, industry has to drill the same number of wells and add the same amount of reserves under either "accelerated" or "normal" depletion cases, if expected production is the same.

In fact, rapid depletion is often a corporate objective.

For example, according to John Jeppesen, regional vice president for Apache Corp.: "We have fixed operating costs offshore, and we want to get the oil and gas out as quickly as possible. We do everything we can to accelerate production."5 However, should drilling stop or be curtailed on the shelf for some reason, the pending production decline would be considerably steeper under accelerated versus normal depletion.

Replacing reserves

The most critical leading indicator for future oil and gas production from the shelf is success in replacing reserves.

Accelerating production (faster depletion of reserves) can buy several years of stability, as has occurred on the shelf in early and mid-1990s. Eventually, to preclude a decline, one must replace what one produces. Here, performance in the shelf in 1993-2000 has been surprisingly favorable (Table 2):

- For crude oil and NGL, industry added 2.45 billion bbl of new reserves, replacing 99% of the 2.47 billion bbl it produced.

- For gas, industry added 27.9 tcf (dry) of new reserves, replacing 83% of the 33.6 tcf it produced.

- Most of the new reserve additions came from growth in previously discovered fields. During 1991-98 for crude oil and NGL, 90% of the reserve additions were from growth of older fields; for gas, 76% of the reserve additions were from reserve growth, with a strong 24% from new field discoveries.

Replacement outlook

The outlook for replacing reserves on the shelf improved significantly in the most recent (2000) assessment by the Minerals Management Service.1

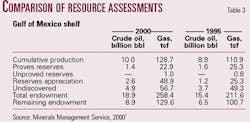

Just 5 years previously, the MMS judged that only 6 billion bbl of oil and 100 tcf of gas remained undiscovered, undeveloped, or unproduced. Today, the MMS assessment is that 9 billion bbl of oil and 130 tcf of gas resources remain on the shelf (Table 3). Much of this increase is due to more optimistic expectations for reserves appreciation (growth) for both oil and gas.

Shallow water leasing

In the mid-1990s, with the advent of deepwater royalty relief and progress in technology, much of industry's leasing attention shifted to the deep water. However, with independent producers becoming active, in the last 3 years (including initial data for 2002) more shallow water than deep water leases were acquired (Table 4).8

For example, in the most recent Central Gulf of Mexico lease sale (Sale 182), 57% of the blocks receiving bids were in less than 200 m of water, supporting industry's renewed shelf interest.

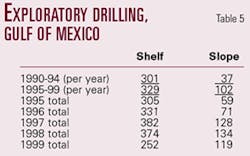

Moreover, the vast majority of exploratory wells drilled in the gulf are still on the shelf (Table 5). In the past 10 years, 3,500 exploratory wells were drilled in the gulf, with 2,900, or 83%, on the shelf. Moreover, the pace of exploratory drilling on the shelf has remained strong, averaging over 300 wells/year, including the depressed drilling in 1999, a time of low oil and gas prices.

Summary

As set forth above, the recent history and trends for the GOM shelf are mixed.

Clearly, the big fields have been discovered, but technology has enabled smaller fields to become economic, and most importantly, highly productive. Oil and gas reserve replacement, after declining sharply, has improved significantly in the past several years.

After being overwhelmed by the romance of the deep water, leasing and drilling on the shelf have been revitalized, particularly with increased entry by independent producers. Finally, the assessment of remaining resources for shelf oil and gas is much more positive than just 5 years ago.

Now, the questions become: What is the outlook for the shelf for the next 10-20 years? And, where are the opportunities that will arrest what would otherwise be a precipitous decline in shallow water oil and gas production?

The rest of the article addresses certain of these opportunities. The third article will discuss how a combination of technology, fiscal, and public policy actions would support their pursuit.

Remaining opportunities

Future oil and gas supply from the gulf shelf will need to be from different sources than the big field discoveries that provided the bulk of past reserves and production.

Sustaining supply will entail more intense development of discovered fields, the discovery and economic development of smaller and smaller fields, and the exploitation of new plays in deep formations, in subsalt areas, and in currently restricted offshore areas. Each of these topics is discussed below.

Large, older fields

Much of the new reserve additions on the shelf have been from intense development of the large and geologically complex older fields discovered in the 1960s-70s.

These large fields, compartmentalized by faulting and complicated deposition, contain numerous fault blocks and reservoirs, many of them still undeveloped. These fields offer opportunities for using sidetrack wells to add new pools, for recompleting behind-pipe sands, and for applying a host of engineering applications for increasing reserves (such as working over existing wells and adding compression).

The large, older fields in the South Pass protraction area (Table 6) provide an example of adding new reserves through more intense field development.

In 1990, the seven large, older South Pass fields had original proved reserves of 898 million bbl of oil and 2,545 bcf of gas. Nine years later, the application of a variety of intensive field development practices in these seven fields had added 131 million bbl of oil and 1,074 bcf of gas, an increase in overall field reserves of 23% (on a BOE basis).

Similar opportunities exist in many other areas of the shelf.

The economics of intensive field development can also be quite attractive, aided by the ability to use existing platforms and infrastructure, by drilling into the same wellbore several times, and by the much lower costs of sidetrack development wells of about $2 million versus $6 million for a conventional well (for a reservoir 10,000 ft deep).

Smaller fields

A critical factor is the size and productivity of remaining oil and gas fields.

One concern is that as the shelf has matured, only progressively smaller fields remain, impacting economics and production.

Although it is relatively certain that no more giant fields-such as Eugene Island 330 (770 million BOE), West Delta 30 (720 million BOE), and Grand Isle 43 (640 million BOE)-are left to be found, this is not a "death wish" for the shelf. Fig. 4 shows the distribution of fields by size class discovered in shallow water at three points: 1980, 1990, and 1998. As time has progressed and technology advanced, smaller fields have increasingly become economic to discover and develop.

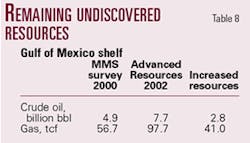

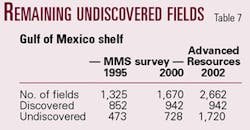

To provide an estimate of the volume of oil and gas in future small field discoveries, we have modified the MMS ultimate field size distribution by "filling in" class 9 through 13 field sizes using our internal estimates (Fig. 5). Based on this, we estimate that an additional 2.8 billion bbl of oil and 41 tcf of gas remain to be discovered in field sizes between 1 million and 20 million BOE, beyond the estimates provided by MMS (Tables 7 and 8).

Advanced exploration technology, dramatically reducing the number of dry exploratory wells, will be critical for economically developing these smaller fields. Also important will be the ability of these small fields to take advantage of existing infrastructure, in particular, existing, underutilized offshore production platforms linked with remote subsea and single well production facilities.

Should offshore technologies continue to develop, it is reasonable to expect that ever-smaller fields will contribute to "filling in" the left hand side of this distribution of discovered fields.

A look at the history of MMS resource assessments for the GOM shelf provides a perspective on the change in outlook for the numbers and resources in smaller fields. For example, in its 1995 assessment, MMS estimated that 1,325 fields would exist on the GOM shelf, with 852 already discovered. The 473 remaining to be discovered fields were estimated to hold 3.7 billion bbl of oil and 49.3 tcf of gas.

With the passing of time and more discoveries and data, the MMS (in its 2000 assessment) estimated that 1,670 fields would exist in the GOM shelf, with 942 discovered. The 728 remaining to be discovered fields were estimated to hold 4.9 billion bbl of oil and 56.7 tcf of gas. The bulk of the increase was in the number of midsize to small fields with 5 to 50 million bbl oil, corresponding to classes 11 to 15 (Fig. 5).

Advanced Resources' adjustment to the latest MMS field size distribution and resource assessment for shallow fields continues this historically established trend (Fig. 5). The 1,720 undiscovered smaller fields (including the "accidental" discovery of Class 11 and smaller fields) are judged to hold an estimated 7.7 billion bbl undiscovered crude oil and 97.7 tcf of undiscovered gas.

Enhanced oil recovery

Nearly 190,000 b/d of oil is produced in the US today from the injection of CO2 into oil reservoirs, mostly in the Permian Basin of West Texas and Eastern New Mexico.

The bulk of the 1.4 bcfd of CO2 injected comes from natural sources. However, in the future, CO2 produced from power plant and chemical plant stack gases could be used for EOR as well as to reduce emissions of greenhouse gases. The Gulf of Mexico lies near significant concentrations of industrial facilities and power plants, each a potential CO2 source.

A number of field tests in the 1980s explored the EOR potential of depleting fields in coastal and offshore Louisiana, with some technical success. These include:

- A light oil (26° gravity) immiscible CO2 flood was conducted in Timbalier Bay field beginning in 1984, utilizing a cyclic CO2 injection ("huff and puff") process. Production from two test wells in a 4,900-ft reservoir increased production from around 15 b/d to 200 b/d after CO2 injection. About 3 Mcf of CO2 were injected per incremental barrel of oil recovered.9

- A gravity-stable CO2 pilot in Weeks Island field, New Iberia Parish, South Louisiana, increased recovery in a deep, high permeability, steeply dipping reservoir from about 65,000 bbl (16% recovery efficiency) to over 270,000 bbl (66% recovery efficiency). Again, about 3 Mcf of CO2 were injected per barrel of oil recovered.10

Today, ExxonMobil Corp.'s active hydrocarbon miscible flood at South Pass 89 field is producing 2,300 b/d of 38° gravity oil. This project, consisting of 12 producing wells and 8 injectors, is a primary contributor to the 13% growth in reserves since 1990 from this block that was discussed above and summarized in Table 6.11

Interest in CO2 flooding has also been revitalized in Southern Mississippi. Denbury Resources Corp. is pursuing CO2 EOR projects at its Little Creek and West Mallalieu fields and considering the application of CO2 in several others. These two fields are producing 3,600 b/d of incremental oil due to CO2 injection. Denbury estimates that an incremental 80 to 100 million bbl of oil is recoverable from CO2 floods in the region.12

While not considered economic to date, the application of CO2-based EOR processes to depleting fields in the gulf could be technically feasible, assuming the results from these onshore and coastal pilots can be extended offshore. Advancing technology and possible future incentives to reduce emissions of greenhouse gases could contribute to the economic viability of CO2-based EOR in the gulf. The extent of this potential will be explored in more detail in the final article in this series.

Deep formations

A portion of the new discoveries in the gulf shelf will be from deep formations, 15,000 ft or more below the sea floor.

Deep structures are apparent throughout the gulf. This geologic horizon is relatively unexplored; of the 35,000 wells drilled in the Gulf of Mexico offshore, only 1,842 are deeper than 15,000 ft subsea. The MMS estimates that between 5 and 20 tcf of undiscovered gas resources exist in three deep formations, with a mean estimate of 10.5 tcf, with substantially greater potential conceivable.13

To date, most of the deep wells drilled in the gulf were drilled in the 1980s, generally based on 2D seismic data. Only 503 reservoirs were found, with an estimated 10 tcf of recoverable gas. On average, the size of these discoveries was 20 bcf (or about 3 million BOE).

- The highest-quality discoveries were in the Norphlet Trend in the Northeast Gulf, where 24 reservoirs were discovered with an average discovery of 105 bcf/reservoir, contributing 2.5 tcf of recoverable gas.

- The other 479 reservoirs, providing 7.5 tcf of recoverable gas, had an average discovery size of 16 bcf.

These deep formations offer potential for discovering large reserves with high well flow rates, especially as 3D seismic is more extensively utilized.

Recent discoveries have shown that new completions in these deep formations can produce as much as 20 to 80 MMcfd. However, these wells will require high flow rates for the discoveries to be economically viable, since they will have much higher costs, on the order of $10-20 million/well.

These high cost wells must contend with high pressures and temperatures plus high levels of corrosive CO2 and H2S. While well costs will be high and specially designed jack-ups will be required, it is anticipated that deep wells will be able to utilize some of the existing shallow water infrastructure, offsetting some costs.

To encourage the development of deep gas reserves, the MMS recently initiated financial incentives for deep gas development in the gulf shelf. For discoveries at depths greater than 15,000 ft subsea, the lessee can receive royalty suspension on the first 20 bcf of production. At a gas price of $3/Mcf, this amounts to a saving of $10 million. The incentive applies to deep gas wells drilled within 5 years of acquiring a new lease.

Subsalt prospects

The gulf contains numerous prospects below vast, areally extensive tabular salt bodies that cover as much as 60% of the northern Gulf of Mexico shelf (Fig. 6).

Thick sediment accumulations that lie below these salts can contain significant volumes of hydrocarbons. A number of wells were drilled below the salt in the 1980s with little success. Over time, interest in subsalt prospects emerged as seismic acquisition and processing improved and big fields began to be discovered:

- Mahogany field, discovered by Phillips-Anadarko-Amoco in 1993 on Ship Shoal 349, was the gulf's first commercial subsalt development. Production began in 1996. The discovery well was drilled in 372 ft of water to a depth of 16,500 ft, with initial production of over 7,000 b/d of oil and nearly 10 MMcfd of gas.

- In 1994, a group led by Shell discovered Enchilada field on Garden Banks 128, followed by Chimichanga field on neighboring Garden Banks 127.

Due to technical difficulties in seismic imaging and drilling and the well-publicized series of dry holes, interest again waned. More recently, advances in 3D seismic technology to help identify subsalt prospects, and improved approaches for drilling through the salt, have led to major discoveries by Anadarko. And, once again there is interest in subsalt prospects:

- Tanzanite field was discovered in 1998 on Eugene Island 346 and is believed to contain 140 million BOE.

- Hickory field (Grand Isle 116) was also discovered in 1998. The discovery well, drilled to TD 21,600 ft, encountered 300 ft of pay in multiple sands after drilling through over 8,000 ft of salt, the thickest salt section drilled in the gulf. Reserves are estimated at 40 million BOE.

- Tarantula field was discovered on South Timbalier 308 in 481 ft of water. While reserves have yet to be established, the discovery well in this field encountered 170 ft of net pay.

Shallow water potential

The past progress in technology, including improved exploration success from 3D seismic and much lower finding costs from improved drilling efficiencies,14 has enabled the shelf to remain as a resilient source of domestic oil and gas.

The greater use of these technologies and rigorous pursuit of the wealth of opportunities remaining on the shelf led us to conclude that "the glass is still half-full" and, with proper incentives and policies, may remain half-full for some time.

We are examining the impact of these opportunities in Advanced Resources's Gulf of Mexico Natural Gas & Crude Oil Capacity and Production Forecasting Model (ARGOM).15

The change in the nature of future oil and gas resources and development on the shelf call for accelerated progress in exploration and production technologies and more rigorous resource assessment methodologies. The areas of priority include giving greater attention to the nature and distribution of small fields, using more engineering-based (rather than merely statistical) assessments for reserve appreciation (growth), developing a better understanding of exploration success rates and the discovery process in subsalt and deep formations, and incorporating the economics of using subsea completions and tiebacks with existing infrastructure.

Even greater supply potential could be realized with future technological advances and supportive fiscal and leasing policies. In the near term, shallow water production will be influenced by the outlook for price incentives, such as royalty relief.

The longer term future of the shelf will depend on:

- The pace and extent of technological advances.

- Access to currently restricted, shallow water areas of the eastern gulf.

- Future environmental requirements affecting offshore development.

- Financial incentives for stimulating development.

- Sufficient capital, manpower and infrastructure.

The impact of these and other factors on future shallow and deepwater Gulf of Mexico oil and gas production will be explored in the third article.

References

- US Department of Interior, Minerals Management Service, "Outer Continental Shelf Petroleum Assessment, 2000," 2000.

- Energy Information Administration, "US Crude Oil, Natural Gas, and Natural Gas Liquids Reserves 2000 Annual Report," DOE/EIA-0216 (2000), December 2001.

- US Department of Interior, Minerals Management Service, "Outer Continental Shelf Estimated Oil and Gas Reserves, Gulf of Mexico, Dec. 31, 1999," OCS Report MMS 2002-007, February 2002.

- Nehring, Richard, "The Gulf of Mexico: Rising Star or Over the Hill?," presentation made at the Energy Information Administration Annual Energy Outlook Conference, Mar. 27, 2001.

- Williams, Peggy, "The Gulf of Mexico Shelf," Oil and Gas Investor, Vol. 20, No. 2, February 2000, pp. 28-39.

- Energy Information Administration, "Accelerated Depletion: Assessing Its Impacts on Domestic Oil and Natural Gas Prices and Production," DOE/FE-0424, September 2000.

- Simmons, Matthew. R., "Domestic Natural Gas Supply and Demand: The Contribution of Public Lands and the OCS," Testimony before the Subcommittee of Energy and Mineral Resources of the Committee on Resources of The House of Representatives, Washington, D.C., Mar. 15, 2001.

- US Department of Interior, Minerals Management Service, Offshore Statistics by Water Depth (www.temporarygomr.com/homepg/fastfacts/WaterDepth/WaterDepth.html), 3-25-02.

- Simpson, M.R., "The CO2 Huff n' Puff Process in a Bottom Water Drive Reservoir," SPE Paper 16720, 1987.

- Johnston, J.R., "Weeks Island Gravity Stable CO2 Pilot," SPE Paper 17351, 1988.

- Moritis, Guntis, "California Steam EOR Produces Less, Other EOR Continues," OGJ, Apr. 5, 2002.

- Schempf, F.J., "CO2 Injection Grows in Gulf States," Harts E&Pnet, September 2001.

- US Department of Interior, Minerals Management Service, "The Promise of Deep Gas in the Gulf of Mexico," OCS Report MMS 2001-037, 2001.

- Energy Information Administration, "Performance Profiles of Major Energy Producers, 2000," DOE/EIA-0206 (00), January 2002.

- Eppink, J.E., Kuuskraa, V.A, and Kuck, B.T., "Assessment of Natural Gas and Oil Supply Issues in the Deepwater Gulf of Mexico," paper OTC 12225 presented at the 2001 Offshore Technology Conference, Houston.

Next: How technology, royalty incentives, and public policy may shape the gulf's future.