Turkmenistan lists ambitious plans for gas, oil development

This second of four articles on Turkmenistan features an official Turkmen perspective.

Before this decade is out, Turkmenistan, a leader among the former Soviet republics in terms of hydrocarbon resources, intends to make a giant leap in raising production and export of oil and gas.

Kurbannazar Nazarov, Minister of Oil and Gas Industry and Mineral Resources, stressed this point in late May 2002 at a roundtable in Ashgabat that focused on business cooperation in modern oil industry technologies, equipment, and services.

By virtue of its combined hydrocarbon resources, estimated at 22.8 trillion cu m (805 tcf) of gas and 12 billion tons (88 billion bbl) of oil, Turkmenistan can be viewed as a serious player in the Caspian region and the world.

For comparison, according to US Energy Information Administration data for February 2002, Azerbaijan's resources were estimated as follows: gas, 46 tcf; oil, 36-45 billion bbl; Kazakh- stan's resources: gas, 153-158 tcf; oil, 102-110 billion bbl.

In 2001, Turkmenistan raised oil production to 8 million tons/year (160,000 b/d) and its gas extraction to 51.3 billion cu m/year (4.9 bcfd). Compared with the preceding year, oil and gas production increased by 12% and 9%, respectively. Export of oil totaled 2.3 million tons/year (46,000 b/d), and gas exports reached 37.2 billion cu m/year (3.6 bcfd).

An increasing share of production comes from fields that operate under production sharing agreements with non-Turkmen companies. These are discussed in the second part of this three-part article.

During 2001-10, Turkmenistan plans to recover 300 million tons (2.2 billion bbl) of oil, nearly five times the 65 million tons produced in the previous 10 years. Gas extraction in 2001-10 is to total 907 billion cu m (32 tcf), compared with 408 billion cu m extracted in 1991-2000.

In 2010, Turkmenistan's goals are to produce 48 million tons/year (960,000 b/d) of oil and 120 billion cu m/year (11.5 bcfd) of gas and to export 33 million tons/year (660,000 b/d) and 100 billion cu m/year (9.6 bcfd) of this production.

The production increases are to be achieved primarily by discovering and developing new fields on offshore production sharing agreements to be signed. These arrangements are to yield as much as 50% of the country's oil production by 2010. Other gains should be expected from enhancing recovery at existing fields by working over wells and applying new technologies such as horizontal and directional drilling and gas lift.

Exports

For these ambitious plans to materialize, Turkmenistan needs to boost the capacities of its export infrastructure.

At present the country has no export oil pipelines. The prospects for pipeline construction are the subject of the concluding third part of this article.

The Turkmenistan-Europe pipe (formerly known as Central Asia-Center I, II, and IV), built in Soviet times and originating at supergiant Dauletabad-Donmez dry gas field, can move a maximum of 60 billion cu m/year (2.1 bcfd) of gas. The Bekdash-Europe pipeline from western Turkmenistan is just coming back to life after a long idle period that began in the early 1990s. The Korpedzhe-Kurtkui gas pipeline to Iran can handle a maximum 8 billion cu m/year (775 MMcfd) of gas.

Since Turkmenistan became independent, it has initiated a number of export pipeline concepts that target markets in Europe, China, Pakistan, and India. However, except for the 120-km gas pipeline to Kurtkui, for various reasons no other project has taken off.

Nevertheless, new opportunities for launching some of the planned pipeline projects have emerged in recent months. Turkmenistan's leader Saparmurat Niyazov seeks to capitalize on the efforts of the world community to kick-start development in Afghanistan and to give a push to construction of a gas pipeline and possibly an oil pipeline from southern Turkmenistan via Afghanistan to Pakistan. In July 2002, the head of energy agencies of the three countries agreed to choose Asian Development Bank (ADB) for financing the feasibility study for a gas pipeline. ADB granted $1.5 million for this purpose. This should happen soon.

Western Turkmenistan appears attractive to France's TotalFinaElf SA, which is keen on building an oil pipeline from Kazakhstan to Iran. In June 2001, TotalFinaElf presented a preliminary feasibility study prepared for the pipeline project, running in transit via Turkmeni- stan, to the government of Kazakhstan. With a transit pipeline up and running, Ashgabat would have a solid opportunity to use it for pumping its own oil.

Revival of pipeline proposals once put on the back burner heightens the interest of foreign companies for Turkmenistan's oil and gas sector. New export pipelines would improve economics of existing production projects as well as opportunities for new projects to take shape. Construction of new export capacity will generate income opportunities for engineering, construction, and other service companies.

Offshore treasures

Turkmenistan's sector of the Caspian Sea covers 78,000 sq km and is one of the most prospective parts of the country and of the Caspian region as a whole even though boundaries remain in dispute.

According to estimates of experts from UK Western Geco, the hydrocarbon potential of the Turkmen shelf of the Caspian Sea in 2,000-7,000 m of water totals 11 billion tons (80 billion bbl) of oil and 5.5 trillion cu m (194 tcf) of gas.

These estimates do not include the contract areas where foreign companies already work. Turkmen oilmen believe that high geological prospects, a mild climate that allows year-round work, and a favorable investment framework combine to create optimal conditions for oil and gas exploration and production operations.

More than 77,300 line km of 2D seismic surveys have been completed in the Turkmen sector of the Caspian Sea since prospecting and exploration began there. Exploration density averages 1 line km/1 sq km. Foreign companies joined the studies in the second half of the 1990s.

For example, Western Geco (formerly Western Atlas) shot 16,000 km of seismic data using modern technologies and equipment, and jointly with the State Corp. Turkmengeologiya for the first time carried out studies in less than 10 m of water, extending onshore and tying the data to deep boreholes.

To date, more than 113 offshore wells have been drilled with the drilling volume standing at 445,000 m for an exploration density of 5.64 m/1 sq km. Ten hydrocarbon deposits were discovered in the course of geological exploration, some of which joint ventures are developing. Prospective zones were identified and classified in terms of their potential, and a new geological model of the Turkmen offshore sector was developed.

The best-explored offshore portion is the Cheleken-Livanov high, with all discovered hydrocarbon deposits associated with it. This zone accounts for most of the deep drilling performed so far. Over 100 exploration wells of combined drilling length of 380,000 m have been drilled there.

The degree of exploration of the rest of the offshore strip is low. Only 11 exploration wells have been drilled in the South Caspian Province, and no deep exploratory drilling has been carried out in the Middle Caspian-Garabogaz Province. Seismic exploration densities are 1.5 km/1 sq km in the South Caspian zone and 0.12 km/1 sq km in the Middle Caspian.

Average depths of pay horizons at offshore deposits vary widely. For instance, pay horizons at Dzhigalybeg (Zdanov) offshore field close to shore occur at 2,300-2,500 m, while production horizons at Diyarbekir (Barinov) and Magtymguly (Livanov) fields farther offshore occur at 4,500 m.

Taking into account that over 80% of hydrocarbon resources are found in deposits that occur more than 3,000 m deep, as well as in poorly studied accumulations, there exists a high probability that new large oil and gas deposits will be discovered. These prospects are primarily associated with the development of the Pliocene oil-and-gas bearing complex in the South Caspian depression and Mesozoic-Paleozoic deposits on the slope of Middle Caspian.

Development of offshore reserves requires billions of dollars of investment, and Turkmenistan counts on attracting foreign companies. In the mid-1990s Ashgabat signed a PSA with Malaysia's Petronas for exploration and development of contract area Block 1.

In 1997-98 Turkmenistan held an international tender, declaring the consortium of Mobil Oil Corp. of the US and Kern of the UK the winner for the Serdar block with an estimated 200 million tons (1.46 billion bbl) of oil recoverable and with Teksuna of China for the Gaplan block with 88 million tons (642 million bbl) of oil and 132 billion cu m (4.7 tcf) of gas estimated recoverable. However, declining world oil prices cooled investors' interest for new costly projects, and negotiations between the sides did not lead to the signing of contracts.

In 2000, the government enacted a program of licensing on Turkmenistan's sector of the Caspian Sea spanning the period until 2010. That program encompasses 32 license blocks with a total area of 78,000 sq km. Geological and geophysical data packages on the size of reserves and economic models have been prepared for these blocks.

Presentations held in Houston, London, and Ashgabat generated offers from a number of companies to start negotiations. Turkmen officials say that by yearend 2002 production sharing agreements will be signed with at least one or two companies.

Onshore prospects

Development of onshore fields is also viewed as important in raising Turkmen production.

In geological terms, the country's oil and gas bearing territory is divided into three large regions: western, central, and eastern Turkmenistan.

Western Turkmenistan. Covering 138,000 sq km, this is the principal region both in terms of oil reserves and oil production.

Turkmen geologists cite the following figures characterizing the geological potential of the region: Commercial oil reserves are estimated at 154.8 million tons (1.1 billion bbl), prospective reserves (C2+C3) at 126.3 million tons (921 million bbl), and expected reserves (D1+D2) at 2 billion tons (14.6 billion bbl).

Of the total explored oil reserves in western Turkmenistan, foreign license holders account for 11%. All other reserves are included on the balance sheet of the State Concern Turkmenneft.

Some 1,670 exploration wells for a combined 5 million m of hole (over 50% of total drilling in Turkmenistan) have been drilled in western Turkmenistan. Exploration well depth averages 3,900 m. Exploration maturity in western Turkmenistan stands at 122 m/1 sq km and seismic density at 1.5-2.5 km/1 sq km.

Of the 30 hydrocarbon deposits discovered to date, most are multihorizon, geologically complex fields. The largest of these fields are Goturdepe, Barsagelmes, Korpedzhe, Burun, South Gamyshlydzha, and Eastern Cheleken.

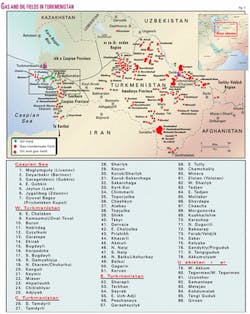

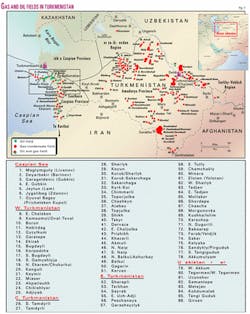

Gas production in western Turkmenistan has been rising the past few years. The gas resource base is made up of the Goturdepe, Barsagelmes, Korpedzhe, South Gamyshlydzha, Ekerem, and Ordekli fields (Fig. 1 and Table 1).

Central Turkmenistan. Occupying 170,000 sq km, this is the least geologically explored region in the country.

Around 600 exploration wells have been drilled for a combined 1.6 million m of hole (some 16% of Turkmenistan's total drilling volume). Exploration maturity in central Turkmenistan stands at 9.4 m/1 sq km. Exploration well depth averages 2,800 m, while most of the identified reservoirs occur at 600-4,000 m in depth. Deep horizons remain largely unexplored.

Around 50 gas-condensate and oil-gas deposits have been identified to date in central Turkmenistan, the largest of them being Bovrideshyk, Tedzhen, and Karadzhaulak. Such fields as South Kyrk, Gutlyayak, Mydar, and Ilakly have produced commercial oil flows, thereby confirming good prospects for oil production. The region's oil and gas bearing prospects are associated with chalk and Jurassic deposits.

Eastern Turkmenistan. Covering 180,000 sq km, this region harbors mostly gas reserves.

Around 950 exploration wells have been drilled for a combined 3.4 million m of hole (around 34% of Turkmenistan drilling). Exploration maturity stands at 17 m/1 sq km.

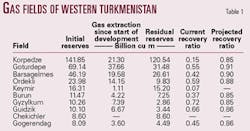

Over 60 gas and gas-condensate deposits have been discovered in the region, Dauletabad field being the largest. Other large deposits are Shatlyk, Malay, Naip, Odzhak, Samantepe, Achak, and Kirpichli (Fig. 1, Table 2).

Eastern Turkmenistan accounts for 80% of the country's annual gas production. Gas is produced by State Concern Turkmengaz.

In the past few years South Yeloten, Seyrab, and Koshabulak fields have produced commercial oil flows. The Toreshikh discovery showed that commercial oil reserves occur in the platform portion of Turkmenistan in early and middle Jurassic deposits.

Introduction of modern technologies and equipment virtually at all stages of development will be required to reach the goal of raising hydrocarbon production onshore. Among other things, Turkmenistan plans to introduce new technologies into geophysical and exploration, drilling, development, and production, well rehabilitation, and into other service operations. Long-term plans call for complete replacement of the drilling fleet.

Next: The contribution of oil production by foreign operators under production sharing agreements.