Brazil touts better terms in new bid round

Brazil's National Petroleum Agency (ANP) has made the terms for its second oil and gas exploration licensing round more flexible in order to attract smaller companies.

ANP had responded to a flurry of complaints from companies that accompanied its first exploration licensing round (an article by an ANP official that begins on p. 78 details this response). Contracts were signed last month for 12 of the blocks awarded in that first round (OGJ, Oct. 4, 1999, Newsletter).

The greatest criticism was reserved for a hefty royalty rate schedule. ANP Executive Director David Zylbersztajn said that the agency is considering revising royalty rates: "The law is rather harsh because it pre-defines royalties. Thus, we are studying a formula that makes this value variable in accordance with the viability of an oil field."

What's on offer

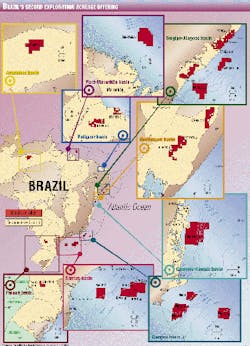

Brazil's second licensing round, slated to take place late by second quarter 2000, will offer 23 blocks-13 offshore (7 in deep water and 6 in shallow water) and 10 onshore-in 9 sedimentary basins (see map, p. 32).

Of the offshore blocks, 4 are in the Campos basin, off Rio de Janeiro state; 5 are in the Santos basin-where Petrobras recently discovered a giant oil field, with estimated reserves of 600-700 million bbl (OGJ, Sept. 27, 1999, p. 37); 2 are in the Sergipe-Alagoas basin; and 1 each is in the Camamu-Almada and Para-Maranhao basins.

Of the 7 deepwater blocks, 4 are in the Santos basin, 1 is in the Campos basin, and 2 are in the Sergipe-Alagoas basins. Of the 10 onshore blocks, 2 are located in the Potiguar basin (Rio Grande do Norte state), the largest hydrocarbon producer after the Campos basin; 3 each are in the Sergipe-Alagoas and Reconcavo (Bahia state) basins; and 1 each is in the Amazonas basin and Parana basins.

The blocks being put up for tender cover 59,000 sq km, or about 1% of Brazil's sedimentary basins. Most of the 5 million sq km of Brazil's sedimentary basins are unexplored for hydrocarbons.

ANP increased the number of onshore blocks offered to 10 for this round from 4 in the first licensing round. Zylbersztajn said that this decision was made to attract smaller companies that did not participate in the first round.

The pre-tender of the second licensing round will be published by year- end; the full tender, with details such as the auction date, will be released 45 days before the second licensing round is held.

Data packages with geophysical information to be purchased by interested parties will remain available until yearend. Interested companies will have 6 months to analyze the data compared with 4 months in the first licensing round.

Greater flexibility

ANP's terms for the second licensing round were made to be more flexible to attract small and midsized independents, Zylbersztajn noted. In the first licensing round, only multinational companies bid.

In the second licensing round, ANP will classify competing operators as: C, small companies; B, midsized independents; and A, multinationals.

According to Zylbersztajn, the new rules include the reduction of registration taxes and the elimination of a requirement to drill wells during the first exploratory period. Also, the minimum financial requirements were reduced to $3 million for C operators, from the $10 million in net assets required of all bidders for the first licensing round.

The data package for C operators will also have reduced prices: $20,000 for each of the three onshore basins, or $50,000 for all three. Data packages will be available for purchase until yearend, and the bid criteria for selecting winning bids will be published at least 45 days before the bid auction.

The B type operators will be allowed to bid for 15 of the blocks, while A operators will be free to bid for all blocks. Block operators will be required to hold interests equivalent to a minimum 30% of the consortium holding any block and will have to submit technical qualifications. No participant may have less than a 5% stake in any consortium, and participation in more than one bid for the same block will not be allowed-neither alone, nor in a combine, a prohibition that extends to affiliates.

Winning bidders will have 1 year within the first exploratory phase to analyze technical data and decide whether to proceed with investments or not. If the latter occurs, there will be no penalty, but the companies will not be entitled to the refund of any amounts paid as either bonus or rental fee during the period.

The final license round notice, which will contain the royalty rate and the criteria for determining winning bids, will be published at least 45 days before the bid auction. Companies can send their qualifying documentations now, but they will still be able to do that up to 15 days after publication of the final notice.