Implementation issues concern operators

Rotary-steerable technology-Conclusion

Tommy Warren

Amoco Production & Exploration Technology Group

Tulsa

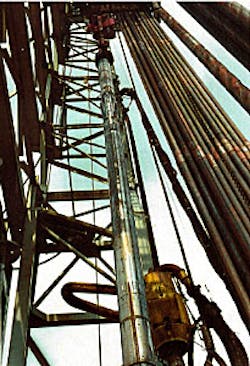

For simultaneous drilling and reaming operations, Cambridge Drilling Automation's automated guidance system has achieved impressive results including a single 7,100 ft run for Amoco Corp. The tool configuration includes a 121/4-in. hole size followed by a 14-in. reamer (Fig. 3).Because rotary-steerable technology performs quite differently from steerable motors, the operator must address implementation issues in order to use the most appropriate system.

Identifying an appropriate application for a rotary-steerable system, such as those mentioned in Part 1, is only the first step in receiving maximum value from the new technology.

Many operating practices have been developed over the past 40 years to facilitate mud motor drilling. The necessity of short trips, back reaming, and nonoptimal bit selection are sometimes accepted as requirements for drilling a directional well, when in fact, they may be requirements for drilling with steerable motors.

Beneficial effects

Changing these practices will not happen over night, nor should they. However, the operator must be willing to explore the limits of continuous pipe rotation and lower buildrates if maximum value is to be obtained from rotary-steerable tools.Improvements in hole cleaning are one advantage of continuous pipe rotation and can be achieved while reducing the time spent on hole cleaning activities, including the need for sweeps and special drilling-fluid treatments (Fig. 1 [68,377 bytes]). Unfortunately, though these benefits are apparent, they are often difficult to quantify.

Similarly, the potential for rotary-steerable systems to impact the well design, even during the planning stage, should be explored. In general, it is better to have a low and continuous build rate, from a torque-and-drag standpoint, rather than a higher build rate and longer tangent section. In many cases, a higher build rate is used with steerable motors because it minimizes sliding, but at the cost of increased hole tortuosity (Fig. 2 [75,248 bytes]). The actual directional well plan is often a compromise between what the reservoir engineer wants, such as optimizing drainage or hitting multiple targets, and what the drilling engineer can provide for the available budget.

In some cases, even the casing program is adjusted to conduct directional work at shallower depths, to avoid directional work through depleted zones, or to accommodate fluctuations in the equivalent circulating density (ecd) associated with cyclic sliding and rotating activities.

These issues are concerned more with the drilling characteristics of steerable motors than with the fundamental requirements of drilling along a directional path. Thus, each issue should be reexamined in light of rotary-steerable system capability.

Significant benefits from rotary-steerable systems can be achieved during the well-planning and drilling-execution phases for many directional wells, but require much more than simply replacing the steerable motor hardware with rotary-steerable hardware.

Maximizing the benefits of rotary-steerable systems requires changes in the way wells are designed so that operating practices can take advantage of the opportunities afforded by rotary-steerable tools. These changes may not be made immediately, but a conscious effort should be made to examine well design and operating practices to quickly incorporate the benefits afforded by rotary-steerable technologies.

Accept risk for experience

Another issue facing operators concerns balancing the needs to utilize new technology vs. delaying its use to reduce higher risks associated with early implementation.The greatest upside for rotary-steerable technologies may be from future applications, especially in the way it affects well planning and field development. However, confidence must be developed before the technology can be relied on for either of these.

Often this is complicated because technology is usually purchased on a single-well basis. This dilemma may be addressed by sharing the research and development risks with the service company. However, the interaction between the service provider and operator must be at a level so that the operator can see the bigger picture.

There are a number of major operators, particularly in Norway, that have already accepted and acted in this manner. As the operator becomes more comfortable with the technology, it will be pushed upward into the more critical applications as well as pushed downward into the more mundane directional jobs such as motor replacement.

Basing an exploitation plan on current directional capabilities may be short sighted in light of the rapid improvement in directional capabilities being provided by rotary-steerable technology.

One example of anticipating the impact of a future technology was British Petroleum Co. Plc's decision to develop Wytch Farm from shore-based locations. Clearly at the time this decision was made, the capability to drill a bottom-hole location, with a horizontal displacement of 33,181 ft (5,300 ft TVD), was not available.1 2

Rotary-steerable technology has made this possible and will enable other accomplishments in the next few years, previously considered unachievable.

Service sector perspective

There is a significant potential up side for operators to use rotary-steerable drilling systems. However, this does not automatically translate into profit for the service provider, whose investment is necessary for technological advancement.Most certainly, customer demand is an essential ingredient in profiting from an investment, yet the responses of customers and competitors are also important. All the major directional-drilling service organizations are developing a rotary-steerable alternative out of competitive necessity.

In many ways, the introduction of rotary-steerable technology is similar to the development of measurement-while drilling (MWD) technologies 15-20 years ago, especially in relation to the high development costs and rapid change during the development stage.

Even at this early stage of rotary-steerable technology development, it is likely that the industry has already spent more than $100 million on product development. As with the development of MWD technologies, not only do technology leaders have to invest capital to develop the product, but they must also spend money to develop a market for new product types.

A significant part of this market development cost is associated with minimizing failures so that these products do not receive a bad name.

Another similarity between the development of MWD and rotary-steerable technologies is that the level of complexity, from a maintenance and service standpoint, is higher than the services that were supplanted.

The best equipped and staffed motor-maintenance shop is ill equipped to handle the maintenance for most of the automated rotary-steerable systems. Thus, the rate of market expansion is governed not only by the performance of the technology, but by the rate that adequate service facilities and staffing can be put in place.

All this is tempered by the fact that a new technology, like rotary-steerable systems, will change rapidly in its early life. The expected life cycle of new tools should be assumed to bequite short when they are first introduced. Changes in designs will come fairly rapidly to facilitate improvements in reliability, simplify servicing, and respond to problems identified through use of the tools.

Newer market entrants, who have observed the market and technology development pitfalls, will provide additional pressure on the earlier entrants to upgrade tools. These rapid changes dictate that the tools should be depreciated on a steep schedule, thus driving up the price.

Value pricing

A high price for the service may seem unjustified by the customer when he or she looks at the hardware and expects it to cost only marginally more than what it replaced. On the other hand, from the provider's standpoint, it should be worth a reasonable portion of savings that it brings to the customer.For a technology like the automated rotary-steerable systems, the service organization must establish pricing based on "value to the customer" if it wishes to profit after recovering its development costs and high depreciation. Over time, the price will probably decline as competition increases. However, the greatest threat to maintaining the value pricing is the potential for competition from smaller suppliers.

Avoid negative publicity

Complex new technologies are more prone to higher failure rates during the introduction stage than are the mature technologies that they replace. Rotary-steerable technology is no exception to this rule.In many cases, operators make equipment decisions at the individual well-management level, where there is little incentive to take risks for the longer term. Even when the upside potential is quite high, a few failures can temporarily poison the well for a larger segment of the customer base.

Thus, the service organization is faced with a difficult balancing problem of how to grow the market for a new technology fast enough to gain and maintain a competitive advantage from their investment, while controlling adverse publicity from failures.

Providing up-front diligence in design and testing is the first step in making this approach work. The second most important component is to devise a way to involve the operator as a partner in the development of the technology.

This is being done with the rotary-steerable systems as some operators are sharing development costs, in some cases as partial prepayment for services.

Relative margins

Limiting the application of rotary-steerable technology to only truly "enabling" applications, like extended-reach drilling, would significantly restrict the size of the market.In addition, as the benefits of the technology are demonstrated for these applications, a demand is created for the technology, which is used to improve the efficiency of operations that would normally be done with a mud-motor system.

The profit margin for supplying motor technology is greater because the service company has sunk a considerable investment in hardware, service facilities, maintenance personnel, and skills for the more mature motor technology. This then creates a dilemma for the service provider. How can the new technology market grow while managing the affects on their existing markets?

Some of the rotary-steerable suppliers are trying to limit their target applications to high-cost enabling applications, for example extended-reach applications used at Wytch Farm, while others are aiming directly at the motor-replacement market. Nevertheless, the end result will be that as the new technology gains credibility, it will take over most directional drilling applications.

Threats

Over the last few years, both the service and operating sides of the industry have undergone considerable consolidation. This has had the effect of spinning off a pool of expertise that is not controlled by the major service companies, while creating a greater demand from independent operators for cost-effective services one step below the cutting edge.This is quite evident from the number of companies providing independent support for the development and manufacturing of MWD tools and mud motors. Thus, there is a considerable pool of talent that has the expertise to develop rotary-steerable systems.

These smaller companies may have no existing market to cannibalize, can operate with much less overhead, and are under less pressure for fast expansion of the technology as they introduce it.

Of course the smaller companies may not be able to compete on the high-end systems where fully integrated advanced MWD and rotary-steerable systems are needed. The standard response to this threat is simply to expect the smaller companies to be bought out. However, this environment will still provide a downward pressure on the price of rotary-steerable services.

Commercial systems

There are a number of companies that supply rotary-steerable tools, and a like number that have tools in various stages of development. The current leader in terms of available tools and runs made is Baker Hughes Inteq's AutoTrak system. This system has made over 225 run while drilling more than 210,000 ft.The technology provides closed-loop directional control with a fully integrated MWD system.2 It was originally commercialized for 81/2-in. holes, but recently has become available with a limited supply of tools for 121/4-in. holes (OGJ, Mar. 2, 1998, p. 65).

Camco Drilling & Service Co. (purchased by Schlumberger Inc.) is second in terms of runs made. This company provides a rotary-steerable tool that can be run as a stand-alone tool with any MWD or interfaced with Schlumberger Anadrill's MWD tools. This technology was used on BP's Wytch Farm record extended-reach well.1

Currently, these tools are available for 81/2-in. holes, but a tool for 121/4-in. holes should be available soon.

Cambridge Drilling Automation has implemented a much smaller number of runs with a standalone tool marketed exclusively through Anadrill for 121/4-in. and larger hole sizes (Fig. 3). This tool, capable of simultaneous drilling and reaming operations, has achieved some impressive results, including a single 7,100 ft run for Amoco Corp.

All of the above companies demonstrate the significant advantages of rotary-steerable tools as well as the frustration experienced in introducing a new technology.

Other systems

In addition to these three industry leaders, additional companies are also working on rotary-steerable drilling systems. Sperry Sun is working with a shaft deflection-type tool where the shaft deflection is enclosed in a nonrotating housing. The tool includes components obtained from a cooperative agreement with Japan National Oil Co. as well as designs licensed from Cambridge. They expect to have a commercially available system by the first quarter of 1999. 3Anadrill is also working on a bit-pointing device that does not require any nonrotating contact with the borehole wall. This tool has already begun field testing and is also expected to be available in early 1999.3

Directional Drilling Dynamics Ltd., Three D Stabilizers, Rotary-steerable Tools LLC, D.M. T. Welldone Drilling Services GmbH, and others also have standalone tools under various stages of commercialization.

Several companies, including Integrated Rotary Systems Inc., Servicios Especiales San Antonio Directional S. A., Rotary Directional Technologies LLC, Tesco Corp., Industrial Agencies Ltd., and others are working to provide rotary-steerable services based on a tool licensed from Amoco.

Gaps to be filled

The most active market segment for reasonably sophisticated rotary-steerable tools include 81/2-in. systems, followed by 121/4-in. systems. In general, companies that began with 81/2-in. systems will move on to 121/4-in. systems and vice versa.There has been little work directed towards the development of:

- Hole sizes smaller than 81/2 in.

- Systems with build rates greater than 8°/100 ft.

However, for re-entry and multilateral applications, higher build rates may be desirable. In addition, smaller-diameter rotary steerable tools could enhance the potential for various "rigless" slimhole workover operations, and provide alternatives to sliding operations with coiled tubing technology.

Another potential market includes tools designed for larger hole sizes, aimed directly at motor replacements in conventional directional wells. There are areas where the directional requirements are not extreme, but the formation environment is not friendly to steerable motors, such as depleted zones and underbalanced drilling operations.

Some of the independent developers are working on less-sophisticated rotary-steerable systems for these markets.

References

- Cocking, D.A., Bezant, P.N., and Tooms, P.J., "Pushing the ERD Envelope at Wytch Farm," SPE/IADC paper 37618 presented at the SPE/IADC Drilling Conference, Amsterdam, Mar. 4-6, 1997.

- Colebrook, M.A., Peach, S.R., Allen, F.M., and Conran, G., "Application of Steerable Rotary Drilling Technology to Drill Extended Reach Wells," SPE/IADC paper 39327 presented at the SPE/IADC Drilling Conference, Dallas, Mar. 3-6, 1998.

- Von Flatern, R., "Steering Clear of Problem Well Paths," Offshore Engineer, October 1998.

Copyright 1998 Oil & Gas Journal. All Rights Reserved.