Westwood Global Energy Group estimates 17 exploration wells could be drilled on the UK Continental Shelf (UKCS) within 18 months, testing unrisked resources estimated by oil companies to total more than 2 billion boe.

Of that total, more than 1 billion boe are in West of Shetlands plays, with more than 600 million boe in the Central North Sea, researchers said while releasing Westwood’s UK Offshore Exploration Performance 2008-17 report.

More discoveries are needed to ensure UKCS’s long-term production. Total SA announced a natural gas discovery on Glendronach prospect West of Shetland on Sept. 24, 2018. The Westwood report said Glendronach demonstrates high-impact discoveries are possible after 50 years of UKCS exploration.

David Moseley, Westwood reports manager for northwest Europe, said, “Our analysis shows that over the last decade, the UK replaced only 22% of oil and gas production through exploration, finding 1.5 billion boe of commercial resources.”

Industry tends to overestimate resources of prospective discoveries, which on average yielded 50% of pre-drill estimates since 2014, the report said.

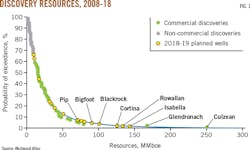

Fig. 1 shows the 17 wells of which eight are categorized as high-impact prospects targeting gross resources of about 2 billion boe. The prospects are plotted on a cumulative probability of exceedance curve for all discoveries, commercial and non-commercial, during 2008-17, showing the likelihood of actual resource size exceeding forecast resource size.

Although resources could be found that are more in line with operator pre-drill estimates, historic performance in the North Sea indicates this is unlikely. The average discovery size for the mature North Sea has been around 12 MMboe for the last decade, Moseley said.

Fig. 1 shows that prospects yielding more than 100 MMboe are unlikely because they are at the low end of the probability of exceedance distribution.

Just two discoveries larger than 100 MMboe were found from 202 exploration wells in the past decade. The first is Culzean gas and condensate field, expected to come on stream in 2019.

Total SA, the operator, expects the high-pressure, high-temperature (HPHT) field will reach peak production by 2020-21. Resources are estimated at 250 MMboe for Culzean, drilled in 2008.

Culzean field is on the East Central Graben of UK North Sea Block 22-25a (License P111) about 145 miles east of Aberdeen in 88 m of water. Total took operatorship of Culzean through its Maersk Oil acquisition, effective Mar. 8, 2018 (OGJ, Aug. 6, 2018, p. 36).

Total E&P UK discovered gas on the Glendronach prospect offshore UK West of Shetland with a well drilled to 4,312 m. It encountered a gas column of 42 m of net pay in a high-quality Lower Cretaceous reservoir. Resources are estimated at about 1 tcf.

The discovery, in 300 m of water on Block 206/04a in a formation below the Edradour reservoir, can be developed quickly with the existing systems around Edradour field, including the Laggan-Tormore infrastructure’s Shetland gas processing plant, Total said.

Glendronach is the largest UKCS discovery since Culzean. Total operates Glendronach with 60% interest. Partners are Ineos E&P UK Ltd., 20%, and SSE E&P UK Ltd., 20%.

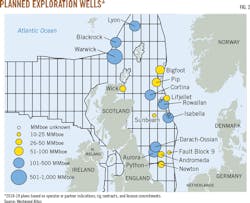

Fig. 2 shows pre-drill resource volumes of planned wells.

Other projects

Spirit Energy LLC’s farm-in to Hurricane Basement Reservoir Specialists’ acreage in September 2018 has accelerated testing of the 205-23 Warwick prospect, where prospective resources are estimated at nearly 1 billion boe.

Hurricane reports oil down to 2,258 m (7,408 ft) total vertical depth in the Lincoln discovery well. Based on this, Westwood analysts expect the 205/23 Warwick well will have a risk profile more akin to an appraisal well than an exploration well. Lincoln’s commerciality relies on proof-of-concept of a phased development of Lancaster field, starting with ongoing installation of an early production system (EPS).

Hurricane Energy made its final investment decision on the Lancaster EPS in September 2017. The EPS calls for two wells tied back to the Bluewater Energy Services BV-owned Aoka Mizu floating production, storage, and offloading (FPSO) vessel, which is being upgraded at Drydocks World’s Dubai shipyard.

Siccar Point Energy, Aberdeen, will test the 204/5b Blackrock and 208/2 Lyon Paleocene prospects in 2019. The 204/5b Blackrock has potential to add resources to the Cambo development while the 208/2 Lyon has potential to create a northern area gas hub.

Discovered in 2002, Cambo field is on UKCS Licenses P1028 and P1189, 30 km southwest of Rosebank field and 50 km north of Schiehallion field. Siccar Point acquired a 100% operated interest in Cambo via its January 2017 takeover of OMV (UK) Ltd. Shell UK farmed in for a 30% interest in May 2018.

Siccar Point describes Cambo as a large basement high with sedimentary sequences draped atop the structure.

North Sea plans

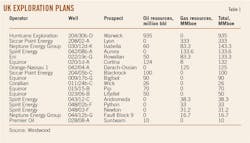

The table shows operators’ resource estimates for pending North Sea wells. In the Central North Sea, three wells will target individual resources greater than 100 MMboe.

Rowallan, on Block 22/19c, is an HPHT prospect with condensate targets in the Triassic Skagerrak and Mid-Jurassic Pentland formations. Block operator Eni UK has contracted the jack up Ensco 121 to drill the well, with partner Serica Energy fully carried on all associated costs.

Pre-drill resources are about 133 MMBoe. Rowallan’s drilling was scheduled to start in December 2018.

Neptune Energy Group recently acquired Apache Corp.’s interest in the Triassic Isabella well on Block 30/12d in the Central Graben. Isabella targets an HPHT reservoir. Pre-drill estimated resources are about 143 MMboe.

UKCS License P 2170 (Blocks 20/5b & 21/1d) contains the Verbier oil discovery. Equinor is license operator with 70% interest. Jersey Oil & Gas has 18% interest and CIECO V&C (UK) Ltd. has 12% interest. Verbier appraisal drilling is planned for early 2019. Equinor’s 21/1d Cortina exploration well, on the same license as Verbier, is expected to be drilled in 2019. Jersey Oil & Gas, Equinor’s license partner, estimates Corina has resources of 124 million bbl. Corina targets an Upper Jurassic stratigraphic trap.

Southern North Sea prospects have combined potential of more than 1 tcf: the Carboniferous Aurora prospect, operated by Spirit Energy, and the Carboniferous Darach prospect and the Permian reef Ossian prospect, operated by Orange-Nassau Energy BV. Successful development would extend the plays north of Breagh gas field.

Several wells, with pre-drill estimated resources in the range of 51-100 MMboe, are testing either new or revised play concepts. These include Equinor’s Triassic 9/22a Bigfoot and Upper Jurassic 15/15 Pip prospects.

Bigfoot is on License P2314 near Mariner field. Equinor and BP Exploration Co. each hold 50% interest.

Pip is on License P2318, with Equinor and BP as equal partners. Pip is an underdeveloped area on the East Shetland platform. Equinor also plans to drill the Lifjellet exploration well in the Jaeren High area next year.

Previous exploration

A total of 117 companies drilled 199 UKCS exploration wells targeting 26 plays during 2008-17, discovering 1.5 billion boe of commercial resources (of which 900 MMboe was sanctioned for development) at an average of 150 MMboe/year and a finding cost of $5.10/boe.

UKCS operators replaced 22% of production through discoveries over the decade. Commercial success rates averaged 27%. Eight companies found half of the reserves.

By 2012-13, exploration had declined to an average of 15 wells and 10 MMboe discovered per year from a high of 32 wells and about 471 MMboe discovered in 2008.

Activity stabilized at an average of 15 exploration wells/year after the 2014 oil price crash and commercial success rates recovered to a high of 45% in 2016, which Westwood attributes to selective drilling of improved prospect inventories.

Resource volumes discovered reached a high of 180 MMboe in 2017.

Maersk was the most active explorer, having drilled 20 exploration wells, and found the most net resources at 215 MMboe.

Other than Maersk, only BP PLC and Dana Petroleum found more than 100 MMboe net resources. Five of the most active explorers reported finding costs of less than $2/boe.

Exploration drilling dropped during 2018, with only three wells completed in the first 9 months. Two of the three were commercial discoveries, including Glendronach.

Moseley said, “What will be important going forward is rigorous prospect definition and the discipline to drill fewer but better wells.” He said companies need to sustain the success rates and lower finding costs reported since 2014.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.