‘Enhanced front-end loading’ aims for assurance in project planning

Richard Westney

Justin Dahl

Westney Consulting Group Inc.

Houston

For several decades, the oil and gas industry has considered front-end loading (FEL) an essential best practice for assuring owners, when making the final investment decision (FID) on a capital project, that their expectations for cost, time to start-up, and levels of production or throughput will be met. Yet, despite large investments in the organizational ability to implement FEL, overall project predictability has not improved. Major upstream, midstream, and downstream oil and gas projects are still likely to experience cost and schedule overruns, and asset value is often lost when production or throughput fails to meet nameplate capacity.

The guiding principle of FEL is that investing time, resources, and funding early in project planning—at the “front end”—will pay off by making cost, time, and operational outcomes more predictable. No one is suggesting that starting engineering, procurement, and construction with a well-defined project is a bad idea; to the contrary, because it is clearly such a good idea, many project professionals are wondering what’s missing. Why do projects that are well-defined at FID still fail to meet their objectives? What must be done to make FEL best practices work better than they have to date?

The Influence Curve

The concept of FEL is derived from a 1986 report by the Construction Industry Institute (CII), which introduced the Influence Curve to illustrate how an owner’s ability to influence project outcomes is greatest in the early stages (Fig. 1). The intention was to encourage owners to place a higher priority on front-end activities and be willing to spend time and resources to complete them.

Although originally focused on cost, the Influence Curve was quickly accepted as applicable to all project success factors. While it is difficult today to imagine this concept being hard to accept, the pressure to move quickly to capitalize on opportunities caused many owners to continue to minimize the time and cost to get to FID. Of course, this also made it challenging for investment decision-makers to determine which projects were well defined and which were not.

Implementation of the Influence Curve required more specificity, so the next step was to clearly define the “front end” as the evaluation, definition, and planning prior to FID, and “project execution” as the work required post-FID to create an operating asset (Fig. 2).

While the oil and gas industry was experienced in project execution, there was not a generally accepted view of what constituted FEL. Best practices had to be defined so executives could set expectations and so project teams knew what they had to do to meet them. This led to FEL being expressed as a framework of project stages separated by decision gates. Project teams could now plan their work for each FEL stage based on the goal of completing the decision-support documentation (known as “deliverables”) that executives consider when making the decision to fund the following stage. Many owners have internal FEL stage-gate processes like this illustration in Fig. 3.

FEL succeeds when, by ensuring the quality of decision support deliverables, it enables high-quality investment decisions at each gate. The most important gate is FID, where full funding is committed and objectives that define success are set. If the information at FID is not complete and correct, decision quality may be compromised and the project destined to fail.

Unfulfilled promise

The Law of Unintended Consequences describes the common situation in which a well-intentioned action produces undesirable outcomes. For example, intending to motivate project managers to control costs, an executive may make it clear that they will face serious consequences if they must ask for additional funding to complete their project. The unintended consequences are likely to be padded estimates and a reluctance to provide early warnings of adverse cost trends, which are essential if overruns are to be avoided.

As might be expected, there are some unintended consequences from FEL.

Some of these are widely recognized, including a loss of individual accountability (when process conformance is valued more highly than project outcomes) and excessive time and expenditures during FEL. However, these are insufficient to explain the degree to which FEL has been ineffective.

There is another, largely unrecognized, consequence of FEL. It can be called the FEL Fallacy.

The FEL Fallacy is the mistaken belief that, if engineering and planning are sufficiently complete, financial stakeholders can have a high degree of confidence that the capital cost, time to start-up, and levels of production or throughput premised at sanction will be achieved.

Experience has shown this confidence to be misplaced. A successful outcome requires that the definition be not only complete but also correct.

Although a stage-gate FEL process may be producing definition deliverables that are (or appear to be) complete, this does not mean that they are correct. The conflation of completeness with correctness means that executives may not realize they are relying on estimates and schedules that are unrealistic, risk assessments that are understated, or forecast production or throughput levels that are optimistic.

In fact, the FEL Fallacy can actually increase the likelihood of project failure by enabling four forces of failure: unchallenged assumptions, overconfidence, tunnel vision, and functional segregation.

Unchallenged assumptions

Project leaders and teams constantly make important engineering, planning, and commercial decisions—often quickly. But when quick decision-making relies too heavily on unchallenged assumptions, poor decisions—with disastrous consequences—can result.

The error of unchallenged assumptions occurs when the scenarios under which the work will be done are oversimplified. For example, a scheduler may assume that the time required for thousands of construction laborers to obtain visas and work permits to work on a new refinery in a developing country will be the same as it was on his or her last project, a process plant in a large European industrial park. Had this assumption been challenged, a closer look would have revealed this to be a major risk factor requiring early mitigation. Failure to recognize and mitigate this risk could create major delays and costs.

How does the FEL Fallacy encourage unchallenged assumptions? The FEL mindset that the top priority is the decision gate at the end of the stage can drive behaviors that minimize the importance of critical decisions during the stage. As a result, these decisions are often made without being challenged by the tough questions essential to critical thinking. Project plans will then lack the robustness necessary to withstand the inevitable trials every project faces during execution.

Overconfidence

Project leaders and teams are confident, as they should be, that their project will succeed. But when confidence becomes overconfidence, bad things can happen.

The error of overconfidence occurs when:

• The estimates of cost and time to start-up are stated as having a high probability of success when, in fact, if all risks are considered, the chances of success are actually quite low. In probabilistic analysis, this is understating the mean value.

• The potential variations to the estimate and completion date are stated as being small when, in fact, if all uncertainties are considered, the range of possible outcomes is actually quite large. In probabilistic analysis, this is understating the standard deviation.

Project leaders and teams tend to focus on the internal risks they understand and can mitigate, since the source of these risks is usually the owner organization itself. For example, if the team defines a project well and is disciplined about not making changes, the risk of costly execution changes will be reduced.

External risks are those whose sources lie outside the owner organization. For example, the risks of higher prices due to unanticipated market conditions and of design changes due to new regulations are often present. Unlike internal risks, project teams have a limited ability to mitigate external risks.

The result of the failure to consider all risks and uncertainties can be a false sense of confidence in a successful outcome.

How does the FEL Fallacy encourage overconfidence? When a team has followed an FEL stage-gate process (which largely addresses internal risks), it is easy to believe “we’ve done everything right.” This can drive behaviors of ignoring or diminishing the significance of external risks and result in an unrecognized, high level of cost and schedule risk exposure.

Tunnel vision

Project leaders and teams focus on defining scope and planning execution. But when this focus excludes external perspectives, tunnel vision can result.

The error of tunnel vision occurs when project teams become so inwardly focused that they fail to see the value of outside information. It usually results from confirmation bias, in which people tend to value only information that supports the decisions they have made and the work they have done. Important information that might change their work tends to be discounted or ignored. For example, a suggestion that an effort be made to seek lessons learned by competitors with similar projects might be dismissed as a waste of time. The result could be repeating costly mistakes of other projects.

How does the FEL Fallacy encourage tunnel vision? Tunnel vision is seldom intentional; rather, it results from mindsets and behaviors over a period of time. Since the FEL mindset encourages the belief that if definition is done well execution will take care of itself, it can drive behaviors that are inwardly focused and place little value on insights from independent, outside experts. This can result in plans, designs, and decisions based on inaccurate information.

Functional segregation

Project leaders and teams are held accountable for safety, cost, time, and quality so outcomes in these areas are naturally where they focus. But when this focus lowers attention to interfaces with commercial, legal, finance, operations, or other key functions, misalignment can result.

The error of functional segregation occurs when mutually dependent functions, such as engineering and operations, fail to have timely communication and coordination. Creating asset value requires more than good project management; sound commercial and financial agreements, effective public relations, and operating efficiency are also essential. For example, commercial agreements (e.g., commitments to feedstock suppliers and off-takers) and financing models (e.g., the use of export credit agencies) often impact the project schedule. Yet many schedulers ignore the critical interfaces between the commercial, financial, and engineering functions. Similarly, engineering decisions may be made in order to reduce capital cost, when timely input from operations would have made it clear that production or throughput could be compromised.

How does the FEL Fallacy encourage functional segregation? Ironically, FEL stage-gate processes are intended to promote functional integration. But, since they often encourage excessive focus on engineering, procurement, and construction, FEL can subordinate interfaces with other functions, resulting in suboptimal asset value.

Proposal: Enhanced FEL

Overcoming the FEL Fallacy requires a rigorous approach to assure that decision-support deliverables are correct.

The solution proposed here, Enhanced FEL, improves an owner’s FEL stage-gate processes by bringing internal and external resources to bear on added assurance activities that enable correctness.

What is “correctness”? And how can it be assured? Assuring correctness is not just about eliminating errors; what must be assured is that the right questions have been asked and answered, that the right people have been engaged—in the right way—and that all relevant information has been considered. For example, a completed deliverable could be considered correct if project leaders have good answers to such questions as:

• Have all internal and external risks been identified and openly communicated, and have their potential impacts been assessed?

• What new process or digital technologies could be applied, and have they been fully considered?

• What current market trends might impact project outcomes, and how have they been considered?

• Have all the due diligence and reporting requirements of lenders and joint venture partners been fully accounted for?

• Have operational personnel been fully involved in developing the basis of design?

The structure of an Enhanced FEL stage-gate process that codifies the approach to assurance is illustrated by Fig. 4. This shows how the plan for assurance activities in each stage can be integrated into the stage work-plans used in an owner’s existing FEL stage-gate process.

To overcome the FEL Fallacy, the stage-assurance plan must directly address each of the four forces of failure. Enhanced FEL achieves this with four assurance enablers (Fig. 5).

Critical thinking guidance

Since a result of the FEL Fallacy can be failure to challenge assumptions, critical thinking guidance during each project stage can avoid the consequences of poor decisions.

The ability to apply critical thinking to project plans and decisions is usually the result of experience. A mentor for an early-career project manager might coach her or his client by asking critical thinking questions such as, “Have you considered X?” Retirement of many experienced project leaders has made such coaching increasingly rare. But in its absence, critical thinking questions can be incorporated into the stage-gate process to provide guidance for project leaders at each project stage.

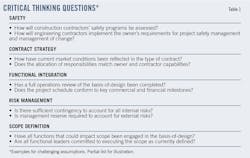

Critical thinking questions, such as the examples in Table 1, are best organized by grouping them into each driver of project success. Other typical drivers include stakeholder alignment, supply chain effectiveness, and technology. Critical thinking questions also provide an effective format for facilitating readiness reviews prior to each gate.

Wide-range risk analysis

Since the result of the FEL Fallacy can be a failure to fully account for external risks, wide-range risk analysis can avoid the consequences of overconfidence.

Wide-range risk analysis is focused on assuring that all project risks, internal and external, are identified and addressed in the funding and risk-mitigation plans. Since external risks are those that are most often unidentified, underestimated, or ignored, an external perspective is helpful in ensuring these are properly evaluated (Table 2).

Owner organizations vary in terms of how, and by whom, external risks are assessed and of how funding is provided. In many cases, the primary role of the independent expert becomes one of overcoming internal, optimistic biases and assuring that the best and worst-case scenarios that provide the ranges used in Monte Carlo cost and schedule risk analysis are realistic.

Independent expert insight

Since a result of the FEL Fallacy can be failure to consider external information, independent expert insight applied to the development of key deliverables can help avoid the consequences of tunnel vision.

Deliverables that may need independent review include commercial or financial agreements, engineering designs, construction plans, and cost estimates. For example, an outside review is usually recommended when new technology is being applied, a critical service is involved (e.g., validating the mooring design of a floating production facility), or extraordinary uncertainties are present (e.g., a grassroots LNG plant in an undeveloped location). Operator inexperience with a project’s size, location, or technology may also make independent insight critical.

Independent expert insight requires involvement by subject matter experts (SMEs) from outside the project. These independent experts may be from one or a combination of these sources:

• Inside the owner organization (e.g., from a functional group, another project team, or a different operating facility).

• Outside the owner organization (e.g., from a specialized consulting firm).

• Joint venture partners (e.g., from a joint venture partner with valuable expertise).

Planning and alignment reviews

Since a result of the FEL Fallacy can be failure to integrate key functions, planning and alignment reviews during each FEL stage can avoid the consequences of functional segregation.

Asset value is created when three drivers are in place: favorable, sustainable agreements; a reliably profitable operating facility; and a construction project that cost-effectively converts the business opportunity into an operating asset.

Since different functional groups are focused on each of these value drivers, planning and alignment reviews can ensure consistency among the deliverables being produced. For example, the project schedule should provide start-up milestones that are consistent with commitments stated in sales and purchase agreements, and the project definition should provide plant capacity and reliability that is consistent with the business case.

Planning assurance enablers

Developing an assurance plan engages a team early in each stage to define key decision points, schedule expert reviews, and determine exactly how the completeness and correctness of each deliverable will be assured.

The stage assurance plan should consider each deliverable in terms of its overall importance to the project’s objectives, as well as the level of risk or uncertainty involved. It should schedule the timing of reviews such that each deliverable has enough definition yet still provides time to incorporate recommendations. It is important to avoid excessive reviewing or a “checkers checking checkers” scenario.

Building organizational capability

Just as dedicated organizational capabilities were required to implement FEL stage-gate processes, an organizational capability for assurance also requires resources and executive leadership.

The authors have experience with three assurance organization strategies, all of which have shown to be effective if implemented correctly (Fig. 6):

• The assurance function is within the major-projects organization.

Since assurance can be a project-support function, and since the major-projects organization contains most of the people with project experience, this is a natural fit. The downside is that those providing assurance are from the same organization as those whose work is being assured, so there may be (or appear to be) an insufficient level of independence.

• A project enters a contract with an independent assurance provider.

The scale of major projects often requires the use of outside expertise. Since assurance is, by definition, an outside perspective, an independent service provider can be a good choice to lead it. The downside is that the outside provider may, over time, be seen as part of the team and no longer completely independent.

• Audit department handles assurance with support from external experts.

Since assurance is focused on assessing correctness, it can be provided through the audit function. Many operators have experts working in audit who can provide useful assessments and recommendations. The downside is that an audit can make a team defensive.

Regardless of the approach chosen, the key to success is that project leaders and teams regard the assurance function as genuinely helpful and the implementation of assurance enablers as vitally important. The perception that the effort applied to assurance is a waste of time or will be used to produce a report that will be used against team members must be avoided at all costs.

Improvement, not abandonment

Project professionals in the oil and gas industry are under intense pressure to lower costs and improve predictability. Their response in past years was to increase the focus on FEL, hoping that better implementation would bring better results. By now, too much has been invested in FEL best practices and organizations to abandon them.

The solution is to enhance FEL stage-gate processes already in place (Table 3). By recognizing the hidden impact of the FEL Fallacy, and implementing the assurance enablers that can overcome it, FEL can finally deliver on its promise to substantially improve capital project results.

The authors

Richard Westney ([email protected]) is founder/director of Westney Consulting Group. Author or coauthor of five books on project management, he has served as visiting faculty at leading universities in the US, Norway, and Russia. A registered professional engineer, certified project management professional, and member of the National Academy of Construction, he holds degrees from the City College of New York, Rensselaer Polytechnic Institute, and Harvard Business School.

Justin Dahl ([email protected]) is managing principal of Westney Consulting Group, leading the firm’s strategic engagements including independent risk assessments, predictive project analytics, strategic planning, and organizational performance improvement. Currently serving as Vice-Chairman of the Board of Directors of the Engineering & Construction Contracting Association, he holds degrees from Texas A&M University and the Jones School of Business at Rice University.