Midstream operators focus on infrastructure expansions

Dan Lippe

Petral Consulting Co.

Houston

Pipeline-system capacity constraints in the Permian basin limited crude oil, natural gas, and NGL production in 2018, and fractionation capacity in Mont Belvieu, Tex., also constrained midstream companies.

The midstream industry’s path to success in building pipeline and fractionator capacity is straightforward: obtain long-term commitments from prospective shippers; acquire equity capital and project financing; obtain permits; and hire an engineering and construction firm. As with all major projects, the devil is in the details. Fortunately for midstream companies, New Mexico, Oklahoma, and Texas remain friendly territory for construction of new pipelines, with permitting not one of the devilish details.

As long as crude oil producers are successful in expanding oil production somewhere in North America, midstream companies will be called on to build new gas processing plants, expand raw-mix pipeline capacity, increase raw-mix fractionation capacity, and then market purity components to petrochemical plants, refineries, and international consumers. The midstream industry is well positioned to take advantage of the benefits of continued expansion.

NGL raw-mix pipeline projects

In the first major wave of infrastructure expansions (2008-16), Petral Consulting Co. estimates the NGL midstream industry increased NGL raw-mix pipeline capacity from West Texas to the Texas Gulf Coast by 1.3 million b/d. At yearend 2016, the industry had 2 million b/d of throughput capacity.

Enterprise Products Partners LP’s (EPP) Shin Oak mainline—the first new NGL raw-mix pipeline of the second wave—became operational in late-February 2019 (OGJ Online, Feb. 28, 2019). Shin Oak’s initial capacity was 250,000 b/d, and will increase to 550,000 b/d by yearend 2019. Targa Resources Corp.’s new Grand Prix NGL pipeline will become operational in second-half 2019 with a capacity of 300,000 b/d, while Lone Star NGL LLC, a subsidiary of Energy Transfer LP, will complete its 150,000-b/d Lone Star Express pipeline in second-half 2020 (OGJ Online, Nov. 8, 2018; Mar. 28, 2018).

Epic Midstream Holdings LP will complete construction of a new pipeline from West Texas to Corpus Christi, Tex., in second or third-quarter 2019 (OGJ Online, June 27, 2018). Initially, Epic will operate this pipeline in crude oil service until it is needed to bring NGL raw-mix feed to its fractionation site in Corpus Christi. Timing of the switch from crude oil to NGL raw mix depends on when an ExxonMobil Corp.-Saudi Basic Industries Corp. (SABIC) joint venture completes construction of a new petrochemical complex in the Corpus Christi area (OGJ Online, May 7, 2018). Once this project nears completion, Epic will switch the pipeline to NGL raw-mix service. Petral Consulting expects this pipeline, with a capacity of 450,000 b/d, will be in NGL raw-mix service by yearend 2022.

Total NGL raw-mix capacity will reach 3.0 million b/d by yearend 2020 and 3.45 million b/d by yearend 2022. Petral Consulting’s forecasts show NGL raw-mix production from New Mexico-West Texas will increase at a rate of 500,000 b/d/year. The new pipelines will be full by yearend 2024.

NGL raw-mix production

Crude oil production in all major US regions increased in second-half 2018 and so far in first-half 2019. US Energy Information Administration (EIA) statistics show crude oil production in New Mexico and Texas was 4.4 million b/d in fourth-quarter 2017. Production increased by 1.2 million b/d during 2018 and was 5.6 million b/d in fourth-quarter 2018. Before 2017-18, year-to-year growth in crude oil production in New Mexico and Texas had never been more than 800,000 b/d/year. By yearend 2019, NGL midstream and crude oil midstream companies will complete four new crude oil pipelines, and crude oil takeaway capacity for Permian basin producers will increase 2.0 million b/d. By yearend 2020, two more projects will be completed, and capacity will increase an additional 1.5 million b/d. Petral Consulting forecasts growth rates for crude oil production in New Mexico-Texas will accelerate in second-half 2019 and first-half 2020.

The accelerating growth in crude oil production in second-half 2018 would have increased NGL production at record-high rates, but gas pipeline capacity constraints limited growth in associated gas production. Pipeline capacity constraints, however, did not become critical until first-quarter 2019. EIA statistics showed year-to-year growth in natural gas production in New Mexico-Texas was 4 bcfd in fourth-quarter 2018. Year-to-year growth in fourth-quarter 2017 was 1.55 bcfd. Since gas-directed drilling in the major basins in New Mexico and Texas (Permian, Eagle Ford, Barnett) was about 2% in second-half 2018 and 1.6-1.8% in first-quarter 2019, we can reasonably conclude associated natural gas accounted for all year-to-year growth in natural gas production.

Gas-pipeline constraints in New Mexico and West Texas became severe in first-quarter 2019, and wellhead gas prices fell below $1.00/MMbtu in March 2019 and were negative for two weeks in April. Crude oil producers will flare more associated gas, and some gas producers will shut in production of nonassociated natural gas from legacy wells. Until new gas pipelines are in service in second-half 2019, gas-pipeline capacity constraints will limit Permian basin gas-plant NGL production.

Regional trends

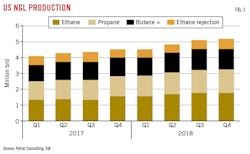

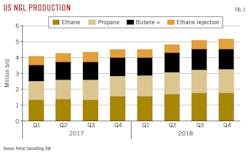

NGL production from all US gas plants was 4.54 million b/d in third and fourth-quarter 2018 (Fig. 1). Year-over-year growth in second-half 2018 was 820,000 b/d in third-quarter 2018 before rates slowed to 550,000 b/d in the fourth quarter. More importantly, quarterly trends showed zero growth in US NGL production in fourth-quarter 2018 vs. the third quarter. Zero growth in NGL production was the direct result of pipeline capacity constraints for crude oil, associated natural gas, and NGL raw mix in the Permian basin.

Table 1 summarizes quarterly trends in US gas plant NGL plant production through fourth-quarter 2018.

Gas plants in New Mexico-Texas, Kansas-Oklahoma, and the Rocky Mountains accounted for 70% of US NGL raw-mix production in second-half 2018. NGL production in these key regions was 3.27 million b/d in second-half 2018 vs. 2.70 million b/d in second-half 2017. Production was 3.27 million b/d in third-quarter 2018 and 3.26 million b/d in the fourth quarter.

As pipeline-capacity constraints for associated gas and NGL raw mix in the Permian basin became more severe in second-half 2018, gas processors in New Mexico and Texas continued to operate plants in ethane rejection. Propane+ production in New Mexico-Texas was 1.33 million b/d in third-quarter 2018 (100,000 b/d more than in second quarter) but fell to 1.30 million b/d in the fourth quarter. Most likely, propane+ production will show zero growth in first-half 2019 but will increase by 90,000 b/d in third-quarter 2019.

Ethane recovery, rejection

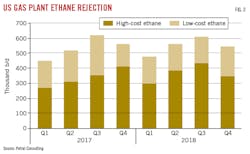

In second-half 2018, ethane production from all US gas plants was 1.77 million b/d, with ethane rejection averaging 600,000-625,000 b/d during the same period (Fig. 2). Gas plants in the US Gulf Coast, Kansas-Oklahoma, and Rocky Mountains produced 1.42 million b/d in third and fourth-quarters 2018. Year-over-year increases were 378,000 b/d in third-quarter 2018 and 190,000 b/d in the fourth quarter. Production from gas plants in the three regions that supply ethylene feedstock markets in Texas and Louisiana accounted for 80% of total US ethane production.

Based on trends in NGL composition (each component’s percent of NGL raw mix), gas plants in New Mexico-Texas were in maximum ethane rejection in second and third-quarters 2015. In this 6-month period, Petral Consulting estimates ethane rejection in New Mexico-Texas was 220,000-240,000 b/d. Although gas plants continued to operate in ethane rejection mode in 2016-18, ethane rejection in second-half 2018 had dropped to 145,000-185,000 b/d. Indexing second-half ethane recovery based on 2015 rejection ratios, ethane production in second-half 2018 would have averaged 886,000 b/d, and ethane rejection would have been 86,500 b/d more. Considering raw-mix pipelines were on allocation in third-quarter 2018, we have to ask why gas processors in New Mexico and Texas did not operate at maximum ethane rejection in second-half 2018. Ethane-recovery margins were positive for all plants in New Mexico and Texas, and gas processors increased ethane recovery up to raw-mix pipeline capacity limits.

Ethane rejection by gas plants in high-cost regions (Rocky Mountains, North Dakota, Ohio, Pennsylvania, West Virginia) was 425,000-450,000 b/d in third-quarter 2018 and 325,000-350,000 b/d in the fourth quarter (Table 2). Ethane-recovery costs in winter 2018 were 40-45¢/gal for gas plants in the Rocky Mountains and 60-68¢/gal for gas plants in Marcellus-Utica. Recovery costs for gas plants in North Dakota were 55-60¢/gal. All costs are based on full pipeline tariffs and fractionation fees in Mont Belvieu.

Based on very weak prices for wellhead natural gas prices in West Texas, recovery costs for gas plants in the Permian basin were 25-30¢/gal during October 2018-January 2019 but fell to 14-16¢/gal in March 2019. When wellhead gas prices fell to -140¢/MMbtu, ethane’s shrinkage cost was -9¢/gal, and total recovery cost was 2.5-3.0¢/gal in mid-April 2019.

NGL market overview

Three markets account for more than 90% of US NGL demand:

• Petrochemical feedstock.

• Gasoline blending.

• Retail space heating and internal combustion.

International markets are now the most important outlet for US propane production, accounting for 50-55% of total demand on an annual average basis and 64-68% during the offseason.

All five NGL components are used as feedstock in petrochemical production, and normal butane, isobutene, and natural gasoline are used in gasoline blending. Retail space heating and internal combustion-engine markets, however, consume only propane. Of the various end-use markets for normal butane, only the refining industry notably increased domestic demand for gas-plant normal butane 2013-17.

NGL exports were 1.56 million b/d in 2018, 635,000 b/d (68%) more than in 2015. Ethane exports increased to 255,000 b/d in 2018 but were just 15% of total demand. Propane exports were 971,000 b/d in 2018, more than doubling exports in 2014. As propane exports doubled in volume during 2015-18, interregional product balances changed significantly. Butane exports in 2018 almost quadrupled 2014 volumes to average 158,100 b/d. Natural gasoline exports in 2018 were 180,000 b/d, bucking the trend of a rising share of total demand. Natural gasoline exports accounted for 36% of total demand in 2018 vs. 42% in 2014.

The market overview segment in this article focuses on ethylene feedstock demand and LPG exports.

Petrochemical feedstock demand

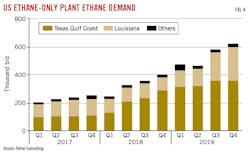

US ethylene capacity in June 2018 was 72.4 billion lb/year, with 10 US ethylene plants with a combined capacity of 16.5 billion lb/year in the ethane-only category. Each new ethane-only plant consumes 75,000-90,000 b/d of purity ethane. Four new ethane-only plants in Louisiana were scheduled for startup in first-half 2019 but, as of late April, none had reached steady-state ethylene production. When all four new plants in Louisiana reach full-capacity operating rates, they will boost total capacity for the ethane-only category to 20.25 billion lb/year. Ethane demand in ethane-only plants will average 560,000-570,000 b/d.

Petral Consulting determines monthly ethylene production and feedstock demand by conducting an independent monthly survey of plant operating rates and feedslates to track consumption of purity ethane, ethane-propane mix, ethane and propane contained in refinery off gas, purity propane (HD5), normal butane, natural gasoline, refinery-sourced naphtha, and gas oil.

Feedstock demand for NGL feeds (ethane, propane, normal butane, and natural gasoline) increased to 1.81 million b/d in third-quarter 2018 and 1.90 million b/d in the fourth quarter (Fig. 3). Ethylene producers took 5 billion lb/year of capacity out of service for maintenance turnaround in first-quarter 2019. None of the four new plants in Louisiana scheduled for startup in first-half 2019 began operating by the end of the first quarter, and NGL demand growth slowed to almost nil, and demand for NGL feeds averaged only 1.92-1.96 million b/d in first-quarter 2019. NGL feeds accounted for 93.4% of total fresh feed in third and fourth-quarters 2018 and again in first-quarter 2019.

Ethane demand was 1.44 million b/d in third-quarter 2018 and increased to 1.49 million b/d in the fourth quarter (Table 3). Although no new plants started up in first-quarter 2019, ethylene production increased 5 million lb/day, while ethane demand increased by 70,000-75,000 b/d to 1.55-1.58 million b/d. Ethane accounted for 75.4% of demand for fresh feed in third-quarter 2018, 75.3% in the fourth quarter, and 76.7% in first-quarter 2019.

Fig. 4 shows estimated US ethane-only plant demand through yearend 2019.

Propane demand was 265,200 b/d in second-half 2018, unchanged from the first half. Demand in second-half 2018 varied within a range of 240,000-245,000 b/d in August-September to 295,000-300,000 b/d in December. Propane’s share of fresh feed was 13.3% in third-quarter 2018 before increasing to 13.9% in the fourth quarter. Demand in first-quarter 2019 fell 15,000 b/d to 265,000-275,000 b/d. Share of fresh feed was 13-13.75% in the first quarter.

In 2017-18, normal butane was the only feedstock providing ethylene producers a major economic incentive to use less ethane. Ethylene producers, however, continue to view normal butane as a seasonal and supply-limited feedstock. Until normal butane availability in the merchant market improves to a level that supports year-round demand at 1.5-2.0 times current demand volumes, normal butane will remain a seasonal opportunity feedstock. Ethylene producers, hence, will maintain ethane demand at its historic high based on share of fresh feed.

Refinery demand for normal butane

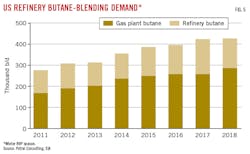

EIA statistics showed demand for butane (gas-plant normal butane plus recycled refinery-grade butane) as an RVP blendstock during the blending season was 415,000 b/d in winter 2018, down 8,200 b/d from winter 2017 (Table 4). During winter 2013-winter 2017, RVP blending demand had increased 117,500 b/d (38%), with annual growth rates of 10,000-45,000 b/d/year in 2014-17. Gas-plant normal butane typically accounts for 60-65% of total RVP blending demand.

Growth in RVP blending demand in winter 2018 was nearly unchanged from 2017 due to abnormally weak pricing differentials for unleaded regular gasoline vs. crude oil in all major regional markets throughout the world (Fig. 5). The consolidated US and regional views, however, do not adequately reflect the trend in demand for gas-plant normal butane, particularly for the USGC. On a total US basis, demand for gas-plant normal butane was 278,500 b/d, up 22,600 b/d from 2017.

USGC refiners consumed 152,600 b/d of gas-plant normal butane, with winter-2018 demand 16,100 b/d (11.8%) higher than the previous year. In contrast, USGC refiners recycled only 31,300 b/d of refinery butane (18,200 b/d, or 37%, lower from 2017).

Ethane exports

In contrast to LPG markets, ethylene producers currently are the only buyers involved in ethane exports. Also, in contrast to propane and butane exports, ethane exports, for now, have just four destination markets: Canada, India, Mexico, and Scotland. EIA reported third-quarter 2018 ethane exports to Canada by pipeline were 88,700 b/d before increasing to 99,600 b/d in the fourth quarter.

US International Trade Commission (ITC) data showed waterborne ethane exports were 119,800 b/d in third-quarter 2018 and 105,700 b/d in the fourth quarter. Exports to India accounted for 63% of total third-quarter waterborne exports and 71% in the fourth quarter. Exports to Scotland accounted for 34% in the third quarter and 26% in the fourth quarter, while exports to Mexico were 3% of total waterborne exports in both the third and fourth quarters. Within the next year or two, the US will begin exporting ethane to Brazil.

Consolidating pipeline exports as reported by EIA and waterborne exports based on US ITC data, ethane exports were 260,500 b/d in third-quarter 2018, up 55,600 b/d (27%) from 2017. Exports increased to 273,000 b/d in fourth-quarter 2018, or 64,000 b/d (31%) more than in 2017.

Propane exports

International LPG buyers increased propane purchases from US sources in second-half 2018 vs. both first-half 2018 and 2017. US ITC reported exports from all terminals were 0.99 million b/d in third-quarter 2018 and 1.03 million b/d in the fourth quarter. These volumes include exports from all USGC, East Coast, and West Coast terminals.

Exports from USGC terminals were 886,000 b/d, accounting for 89.3% of total exports in third-quarter 2018. Exports increased to 924,000 b/d in fourth-quarter 2018 to account for 89.7% of quarterly exports. USGC exports in third-quarter 2018 were 8,600 b/d more than in 2017, while exports in the fourth quarter were 112,900 b/d more than during the previous year.

The Asia Pacific continued to be the most important destination for propane exports from USGC terminals in second-half 2018. Exports to Asia-Pacific destinations increased to 504,600 b/d in second-half 2018, up 24,800 b/d from 2017. While the US-China trade war disrupted propane exports to China in second-half 2018, some US exports continued to move to Chinese buyers. Exports to China between January-April 2018 were 86,000 b/d but dropped 49,300 b/d in May-December. Japan took advantage of favorable pricing in Mont Belvieu, increasing liftings in second-half 2018 to 330,000 b/d, or 150,600 b/d (84%) more than in first-half 2018.

Exports from Marcus Hook, Pa., were 76,100 b/d in third-quarter 2018 and 78,400 b/d in the fourth quarter. Sunoco Pipeline and MarkWest Energy Partners LP put their 200,000 b/d—which will increase to 275,000-b/d by yearend 2020—306-mile Mariner East 2 pipeline into service in fourth-quarter 2018 (OGJ, Feb. 4, 2019, p.48). Mariner East 2 will enable producers and gas processors in Marcellus-Utica to increase exports via the export terminal at Marcus Hook. Until Mariner East 2 entered service, East Coast exports were limited by throughput rates on Mariner East 1. Over the course of the next few years Mariner East 2 will enable producers and gas processors in Marcellus-Utica to double export volumes via the Marcus Hook terminal.

Normal butane exports

Butane exports from all US terminals were 210,500 b/d in third-quarter 2018, up 88,200 b/d from 2017. Consistent with historic seasonal patterns of the past 3 years, butane exports in fourth-quarter 2018 were 175,300 b/d, just 30,000 b/d more than in 2017. Butane exports from USGC terminals were 180,700 b/d in third-quarter 2018 and 160,600 b/d in the fourth quarter.

Whereas propane exports from USGC terminals were delivered to 36 destinations in second-half 2018, EIA statistics showed normal butane exports from these terminals were delivered to 27 destinations. Exports to five destinations in the Asia Pacific accounted for 47% of total exports. Shipments to destinations in the Caribbean, Central America (including Mexico), and South America accounted for 15% of total exports, while exports to Africa accounted for 12%, with Morocco as the primary African destination. Finally, international LPG buyers shipped 17% of USGC exports to destinations in Europe, with shipments to Turkey alone accounting for 49% of total European shipments. Other destinations in Europe are home to ethylene plants.

Near-term outlook

During second-half 2018 and first-half 2019, midstream companies will race to complete new crude oil and natural gas pipelines. Until new natural gas pipelines are in service, crude oil producers in West Texas and eastern New Mexico will continue flaring associated gas production, and gas producers will shut in some nonassociated natural gas from legacy wells. When new pipelines for natural gas and crude oil are completed, and associated gas production increases in tandem with crude oil production, NGL production from gas plants in the Permian basin will boost raw mix deliveries into the Gulf Coast in 2020 by 300,000-500,000 b/d vs. 2019.

While three new ethylene plants in Louisiana were slated for startup in first-quarter 2019, none were in operation in first-quarter 2019. Indorama Ventures Public Co. Ltd. reported its refurbished plant at Lake Charles, La., was in operation in late April. Another plant owned and operated by the Lotte Chemical USA Corp.-Westlake Chemical Corp. joint venture was nearing completion and scheduled to be in production before the end of June. The status of Shin-Etsu Chemical Co. Ltd. US subsidiary Shintech Inc.’s new ethylene plant in Geismar, La., remains uncertain. When these 3 plants reach full capacity, however, they will consume 95,000-105,000 b/d. The fourth new plant—Sasol Ltd.’s long-planned 1.5-million tonne/year integrated ethane cracker and downstream derivatives complex in Westlake, La.—is scheduled for startup in August or September (OGJ Online, Mar. 20, 2019). When Sasol’s plant reaches full-capacity, it will increase ethane demand by 90,000-100,000 b/d. Finally, sometime in second-half 2019, Formosa Petrochemical Corp. will commission its new plant at Point Comfort, Tex. (OGJ, Sept. 3, 2018, p.76). When all new plants scheduled for startup in 2019 are running at full capacity, demand for ethane will reach 1.80-1.85 million b/d.

The author

Daniel L. Lippe ([email protected]) is president of Petral Consulting Co., which he founded in 1988. He has expertise in economic analysis of a broad spectrum of petroleum products including crude oil and refined products, natural gas, natural gas liquids, other ethylene feedstocks, and primary petrochemicals.

Lippe began his professional career in 1974 with Diamond Shamrock Chemical Co., moved into professional consulting in 1979, and has served petroleum, midstream, and petrochemical industry clients since. He holds a BS (1974) in chemical engineering from Texas A&M University and an MBA (1981) from Houston Baptist University. He is an active member of the Gas Processors Suppliers Association.