OGJ Newsletter

House members plan bill to expand NGV use

Legislation to greatly expand the use of natural gas as an alternative to conventional transportation fuel will be introduced in the US House, three members said on Apr. 1.

The measure’s provisions will include an 18-year extension of three critical tax incentives that focus on natural gas as a transportation fuel, the purchase of natural gas vehicles (NGVs), and the installation of commercial and residential natural gas refueling pumps, according to Reps. Dan Boren (D-Okla.), John B. Larson (D-Conn.), and John Sullivan (R-Okla.).

Currently, the alternative fuel credit expires at the end of 2009, and the vehicle and refueling pump credits expire at the end of 2010, they noted.

Known as the New Alternative Transportation to Give Americans Solutions (NAT GAS) Act, the bill also would create a new tax credit for automakers producing natural gas and bi-fueled vehicles, the three federal lawmakers said. Currently, all major automakers manufacture NGVs for overseas markets, and this provision is critical to encourage them to begin offering NGVs in the US, they said.

The bill also would require that at least 50% of new vehicles placed into service by the federal government be capable of operating on compressed natural gas or LNG by the end of 2014, they added. The legislation also would provide grants for light and heavy-duty gas vehicle and engine development.

“We are at a crossroads, and the decisions we make today in Congress will determine the stability of our future energy industry, our domestic supply, and the daily cost of energy for millions of consumers and businesses across the nation. With natural gas vehicles, we have a real opportunity to establish a cleaner, cheaper fuel alternative that will provide an independent energy future for America,” said Boren, who has introduced similar bills in the past.

Energy investor T. Boone Pickens applauded the measure. “America’s national and economic security depends on moving off foreign oil as quickly as possible. Natural gas is the cleanest, most abundant, most economic fuel to replace imported diesel fuel. The US has enough natural gas to last more than 118 years; we should turn to it as an immediate replacement for foreign oil in fleets and heavy-duty vehicles,” he said.

Western climate plan would cost jobs, study says

A new study finds that a carbon cap-and-trade plan in the western US could slow investment, cost the region hundreds of thousands of jobs, and cut personal income for millions of workers.

The analysis, conducted by economists at the Beacon Hill Institute (BHI) of Suffolk University in Boston, also found that the proposed Western Climate Initiative (WCI) would require Western states to dramatically increase their number of government employees.

The BHI study reconfirms many of the findings of a study released last month by the Western Business Roundtable (WBR). That study concluded that the WCI plan could seriously damage the West’s economy if implemented in its present form.

The carbon cap-and-trade scheme is being pushed by a handful of western governors, the Western Governors’ Association, and some environmental groups, according to WBR.

In its September 2008 report, WCI released its research on cap-and-trade policy, which is intended by 2020 to reduce the amount of greenhouse gas (GHG) emissions to 15% below 2005 emission levels.

But BHI finds that due to an inadequate cost and benefit review, the WCI’s results show tens of billions of dollars of savings annually.

Using the WCI projections of increases in fuel costs, the BHI study authors concluded that the policies will decrease employment, investment, personal income, and disposable income.

None of the seven WCI states—California, Arizona, New Mexico, Oregon, Washington, Utah, and Montana—would escape economic harm should cap-and-trade be imposed, the new study found. Four Canadian provinces—British Columbia, Manitoba, Ontario, and Quebec—also signed the Western Regional Climate Action Initiative Agreement.

The BHI study found that under a scenario of a broad policy with no offsets, in which 100% of GHG emission permits would be auctioned off to emitters, the seven western states would lose as many as 251,674 private sector jobs, while the permit revenue would allow the states to hire as many as 142,241 state employees.

The plan also would put investment by firms at serious risk by slowing investment in the region by as much as $1.448 billion, and the plan would diminish total personal income by $6.35 billion to $18.31 billion/year.

Under a scenario where states auction the minimum of 25% of the permits issued, the West would suffer even greater losses, according to the study.

“If state governors and provincial premiers seek to truly meet the goals underscored in the WCI proposals, they should require a complete and thorough cost-benefit analysis,” BHI said. “This consortium of state and provincial governments should understand that, whatever the benefits of the proposals, they will place the state and regional economies at a competitive disadvantage to other regions through higher prices for energy and transportation, and [will] exert measurable, negative effects on their economies.”

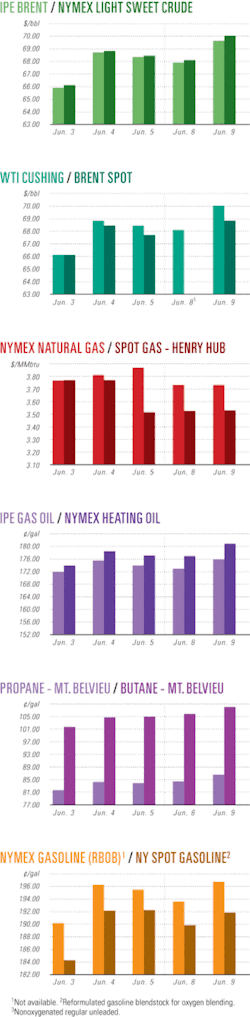

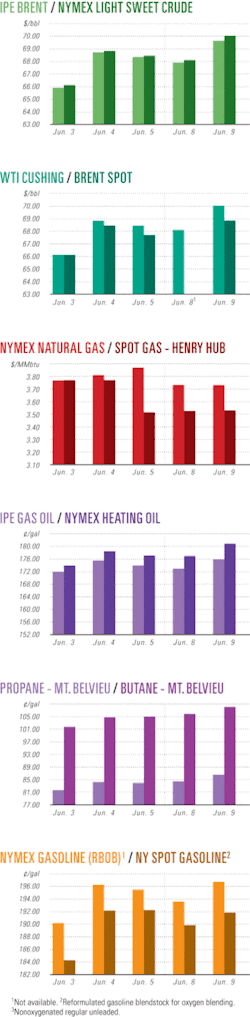

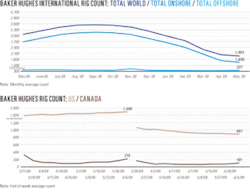

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesLarge Caguan basin find shapes up in Colombia

Emerald Energy PLC and Canacol Energy Ltd., Calgary, are delineating what appears to be a large heavy oil discovery in Colombia’s Caguan basin 200 miles south of Bogota.

Five wells have been drilled, a sixth is drilling, and a seventh is planned in the southern part of Capella, an accumulation of 9-11° gravity oil in the Eocene Mirador formation that appears from 2D seismic to cover 22,000 acres on the Ombu E&P contract area.

Delineation drilling is planned on the northern half of the structure later in 2009 after environmental permitting.

Emerald Energy said gross proved and probable reserves are 14.8 million bbl from estimated initial oil in place of 245 million to 1.1 billion bbl. The six existing wells are on the southern 7,400 acres of the structure. The first five wells found oil in both intervals.

Emerald Energy and Canacol hold 90% and 10% interest, respectively, in the 74,130-acre Ombu contract area, and Emerald Energy holds 100% working interest in the 27,181-acre Durillo contract area adjacent to and southwest of Ombu. Emerald Energy said Durillo may have potential in the same exploration play as Capella.

The vertical Capella-1 went to a total depth of 3,802 ft in mid-2008 and found 189 ft of potential hydrocarbon-bearing interval in two Mirador sandstones. The two tested at a combined 240 b/d oil progressive cavity pumps.

Emerald Energy plans a cyclic steam injection pilot in one well this year. The field production rate is constrained by oil trucking and sales capacity. The individual intervals tested at initial rates of 26-240 b/d of oil and stabilized at as much as 400 b/d on extended tests, with water cut steadily declining to 6%.

Afghanistan launches first-ever bidding round

Afghanistan’s Ministry of Mines said it “has initiated the process that will lead to the bidding round for the award of exploration and production-sharing contracts for hydrocarbon operations.”

The ministry reported that the two gas blocks and one oil block to be auctioned lie in the northern part of the country where most oil and gas fields were discovered in the 1970s.

It said the Jangalikalan and Juma-Bashikurd gas blocks together hold recoverable reserves of 52 billion cu m, while the Kashkari oil block has recoverable reserves of 64.4 million bbl.

Two years ago, after completing a multiyear study, the US Geological Survey estimated Afghanistan’s mean undiscovered resources at 15.7 tcf of gas, 1.6 billion bbl of oil, and 562 million bbl of natural gas liquids (OGJ Online, Mar. 27, 2006).

USGS said much of Afghanistan’s petroleum resource potential and all the known oil and gas reserves are in the north. It said most of the undiscovered oil is in the Afghan-Tajik basin, while most of the undiscovered gas is in the Amu Darya basin.

A road show for the Afghan licensing round will be launched in Kabul on Apr. 26 before it travels on to Dubai, London, Calgary, Houston, and Singapore (OGJ Online, Mar. 19, 2009).

London-based consultant Exclusive Analysis recently predicted: “In the coming year, core al-Qaeda is…likely to focus on the military jihad in Afghanistan as the primary means of draining the US economy (OGJ Online, Apr. 3, 2009).”

Flemish Pass off Newfoundland gets discovery

StatoilHydro Canada Ltd. will apply for a Significant Discovery License for an indicated deepwater discovery in the frontier Flemish Pass basin in the Atlantic Ocean off eastern Canada.

The company didn’t disclose the hydrocarbon type and said it will file for the SDL even though further analysis is needed to determine the well’s potential.

The discovery came at Mizzen O-16 in 1,100 m of water on EL 1049 some 500 km east-northeast of St. John’s and 180 km east of Whiterose oil and gas field in the Jeanne d’Arc basin.

The wellsite is 6 miles north of a well that PetroCanada drilled on the Mizzen prospect that found noncommercial oil. The Mizzen L-11 and Tuckamore B-27 wells were drilled in the Flemish Pass basin in the winter-spring of 2003 (OGJ, Aug. 15, 2005, p. 34).

StatoilHydro Canada praised the crew of the Henry Goodrich semisubmersible, which spud the well Dec. 21, 2008, and support contractors for carrying out the drilling in the heart of the North Atlantic winter storm season (OGJ, Oct. 27, 2008, p. 56).

Interests in the license are StatoilHydro 65% and Husky Energy Inc. 35%.

Drilling & Production Quick TakesPetrobras, Repsol YPF find oil in Santos basin

Brazil’s state-run Petroleo Brasileiro SA (Petrobras) and partner Repsol YFP SA made a declaration of commercial viability to the country’s Agencia Nacional do Petroleo (ANP) for a light oil and gas discovery made on Block BM-S-7 in the Santos basin.

Piracuca field lies in 200 m of water off Sao Paulo state, 200 km from Santos. The partners, Petrobras 63% and Repsol YPF 37%, estimate in-place reserves at 88.5 million cu m or “about 550 million boe.”

The declaration of commercial viability is the outcome of “intense exploratory activity” carried out on this block, the partners said, adding, “With the new field, it will be possible to increase the potential for light oil and gas production in shallow waters.”

The announcement coincided with reports that Petrobras notified ANP on Apr. 6 that it found traces of oil in a test well drilled on the C-M-401 Block offshore in the Campos basin. Petrobras holds a 100% stake in the block.

Petrobras reported that data from early March showed that the Peregrine 1 rig was drilling at the site in 977 m of water and targeting a depth of 3,333 m.

Meanwhile, ANP said ExxonMobil Brazilian subsidiary Esso Santos is drilling a second well on Brazil’s Santos basin Block BM-S-22 to a depth of 5,404 m in 24 m of water.

ExxonMobil Chairman and Chief Executive Officer Rex Tillerson said the second well is designed in part to give ExxonMobil a “better understanding” of BM-S-22, but he declined to discuss what the firm expects to discover.

While the block is close to major finds in Santos’ presalt layer, Tillerson played down projections of discoveries at BM-S-22, saying, “We have one well” and “it’s just too early” to predict what will be found on it.

ExxonMobil is operator of the block with a 40% stake. Hess Corp. also holds a 40% interest while Petrobras owns the remaining 20%.

CGES: Iraqi output target needs $28-43 billion

The Center for Global Energy Studies, London, in an Apr. 2 publication estimates that Iraq will need to invest $28-43 billion for raising its oil production capacity to 6 million b/d, a goal set during the regime of former President Saddam Hussein.

Besides the investment in fields, the estimate includes repair and refurbishment of pipelines, storage, and loading facilities to return capacity to 3.5-4 million b/d .

For the fields, CGES estimates that Iraq requires $9.6-13.6 billion for restoring production to the 3.8 million b/d produced before the 1980-88 Iran-Iraq war. Current production capacity is 2.7 million b/d.

To raise production to 6 million b/d would require an additional $18.6-26.9 billion, CGES says.

Burullus Gas extends rig contract

Burullus Gas Co. has extended its chartering of third-generation semisubmersible rig Scarabeo 6 from Saipem SPA under a $400 million contract.

The new contract will last until fourth-quarter 2014. The rig will remain in Egyptian waters.

Scarabeo 6’s operating capacity is to be upgraded to 1,100 m from 780 m of water in 6 months in late 2011 or early 2012.

Burullus Gas is a joint venture of British Gas International Ltd. 25%, Petronas Carigali Sdn. Bhd. 25%, and Egyptian Natural Gas Holding Co. 50%.

No new floater orders placed last quarter

The market for floating production systems has frozen as a result of the abrupt downturn in the global economy with no orders for production floaters placed in the last quarter, according to International Maritime Associates Inc., Washington, DC.

IMA says this is the first time since 1996 when it began tracking floating production units (FPUs) that no companies have placed orders during a reporting quarter. As a result, order backlog for production floaters has dropped 30% from the same time last year, it says.

Its latest report notes that companies have delayed several orders for production floaters including three floating production, storage, and offloading vessels and a MinDoc, which is a deep-draft floating production unit for supporting dry-tree completions in deep water.

IMA said one FPSO operator has filed for bankruptcy and a second has sold its interest in an FPSO under construction. At least one other FPSO operator looks in tenuous condition, IMA added.

On the other hand, its long-term outlook for FPUs remains strong because of the number of development projects at various stages of planning that will need floating production or storage systems.

In its latest report, IMA identifies more than 155 projects that will require floating production systems. About one third of these are at an advanced stage of bidding or final design, IMA said.

Because of these projects and an anticipated recovery in the oil price, it forecasts that companies will order 93-141 production floaters in the next 5 years.

Processing Quick TakesAxens lets contract for Kremenchug refinery

Ukrainian holding company Ukrtatnafta has awarded Axens SA of Paris a contract for upgrading the gasoline pool at the 360,000 b/d Kremenchug refinery. The Kremenchung facility has the largest throughput capacity in the Ukraine.

The upgrading project, the first of its kind in the Ukraine, will enable the production of Euro V gasoline grade in the 2011 timeframe. The project involves the addition of Prime-G+, naphtha hydrotreating, and DIH isomerization units.

The combined naphtha fractions from the two existing fluidized catalytic crackers will be fed to a 610,000 tonne/year Prime-G+ unit, where the product sulfur content will be lowered to 20 ppm. The C5-C6 straight-run and catalytic reforming fractions will be processed in a 380,000 tonne/year hydrotreater then isomerized in a deisohexanizer-type isomerization unit to produce an 88 RON (research octane number), light gasoline cut.

Ukrneftekhimproekt, Kiev, will perform the detailed engineering.

Aramco, Sumitomo to expand Petro Rabigh facility

Saudi Aramco reported it plans to sign an agreement with Sumitomo Chemical Co. to develop Phase 2 of its refinery and chemicals complex in the port city of Rabigh on the Red Sea.

Aramco Pres. and Chief Executive Khalid A. Al-Falih said his firm would “soon” sign a memorandum of understanding with Sumitomo to further develop the $10 billion Petro Rabigh complex.

Al-Falih’s statement confirmed an earlier press report saying Sumitomo Chemical planned to build another large petrochemical complex in Saudi Arabia adjacent to one scheduled to come on line at the end of this month.

That first phase of the project involved upgrading the 400,000 b/d Rabigh refinery to produce higher-quality products, including petrochemical units to produce 900,000 tonnes/year of polyethylene, 700,000 tpy of polypropylene, 600,000 tpy of monoethylene glycol, and 200,000 tpy of propylene oxide.

To implement the project’s first phase, Aramco and Sumitomo Chemical formed the joint venture Rabigh Refining & Petrochemical (Petro Rabigh).

The Saudi government recently approved investment plans for the second project, and the Nikkei Business Daily (NBD) on Mar. 12 reported that Petro Rabigh would soon conduct a feasibility study to identify investment amounts, output, and other details.

Construction could start as early as yearend, with the complex targeted to come online sometime in 2013-14.

Although yet to be determined, total investments are forecast at ¥300-500 billion. Both Sumitomo Chemical and Aramco will inject additional funds into the joint venture, and they plan to request financing from a banking consortium.

“The facility will be positioned as a second-phase project, but will be a huge…complex with cracking furnaces for naphtha and ethane gas,” NBD said.

Despite the ongoing slump in the world economy, Sumitomo Chemical sees demand for petrochemical products rising over the long term in emerging markets and plans to market value-added products from the second complex to China and India as well as to Europe, NBD said.

The complex will mass-produce 20-30 high-function products such as autoparts-grade plastics and materials for LCD televisions.

A total investment of ¥500 billion was planned when Petro Rabigh was formed in 2004, but ballooning prices for resources and other factors swelled outlays for the first complex to ¥1 trillion.

“This time around,” NBD said, “the downward trend in materials prices and construction costs due to the weak economy spurred the decision to make an additional investment.”

Prior to this week’s announcement, Sumitomo Chemical chose to have its petrochemicals business in Tokyo manage the Rabigh project, considered one of the world’s largest integrated complexes for petroleum refining and petrochemical manufacture.

Petro Rabigh will independently operate the complex, while Sumitomo Chemical will be responsible for the sale of produced petrochemical derivatives.

Placid Refining completes hydrotreater

Placid Refining Co. LLC completed its 20,000 b/d fluidized catalytic cracker gasoline hydrotreater at its refinery in Port Allen, La.

The new unit, along with other improvements, will enable the refinery to meet all applicable clean fuel standards for its products.

The $63 million project, the largest single capital project in Placid’s history, is part of the refinery’s $300 million upgrade and expansion to increase capacity to 80,000 b/d from 55,000 b/d while reducing total air emissions by 50%.

Mustang, a subsidiary of international energy services company John Wood Group PLC, provided the engineering, design, procurement, and construction management for the project.

Transportation Quick TakesQatargas charters LNG ships

Qatargas Operating Co. Ltd. chartered the Q-Flex and Q-Max LNG carriers delivered to Nakilat, the Qatari-listed shipping company from shipyards in South Korea. Both ships will transport LNG produced by Qatargas 3 to the US.

The Al Sadd carrier Q-Flex carrier is one of the world’s largest with a capacity of 210,000 cu m and is under a long-term contract. It was delivered from the Daewoo Shipbuilding & Marine Engineering Co. Ltd., Okpo shipyard on Geoje Island. The Mekaines Q-Max LNG Carrier has a capacity of 266,000 cu m, and it too is under a long-term charter. It was delivered to Nakilat at Samsung Heavy Industries Co. Ltd. shipyard on Geoje Island.

Nakilat said the Q-Flex carrier has 50% more capacity than conventional LNG carriers with about 40% lower energy requirements because it has maximized economies of scale and efficient engines. Q-Max has 80% more capacity. Both are unique and purpose-built for Nakilat to send efficiently Qatar’s natural gas to markets throughout the world, the company added. Qatargas 3 shareholders are Qatar Petroleum, ConocoPhillips, and Mitsui & Co. Ltd.

Qatargas inaugurates delayed, two-train project

Qatargas has inaugurated its much-delayed 15.6 tonne/year Qatargas 2 in a ceremony in Ras Laffan City, the industrial complex north of Doha that has grown up around the country’s LNG export industry.

The inauguration follows delivery last month of the project’s first cargo, carried by the 210,000-cu m Q-Flex vessel Tembek, to the new South Hook terminal at Milford Haven, UK.

Qatargas 2 originally was to have produced its first cargo in late 2007, but mechanical problems and labor difficulties slowed its progress, according to press reports.

The project, according to Qatargas, is the world’s “first fully integrated value chain LNG venture.” It consists of three offshore unmanned platforms, two of the world’s largest LNG trains, each capable of producing 7.8 million tonnes/year, 850,000 tpy of LPG, 140,000 b/d of condensate, five 145,000 cu m storage tanks, and a fleet of 14 Q-Flex and Q-Max ships. Vessels in the latter category can carry upwards of 266,000 cu m of LNG.

Qatargas 2 consists of Trains 4 and 5; each employs Air Product’s proprietary APX process technology. It was LNG produced from Train 4 that arrived at the South Hook for use in commissioning the terminal. Ownership in Train 4 is split between Qatar Petroleum 70% and ExxonMobil Corp. 30%. Train 5 is owned by Qatar Petroleum 65%, ExxonMobil 18.3%, and Total SA 16.7%.

Total was a late comer to the project, buying into the project in late 2006. Total also holds 8.35% in the South Hook. QP holds 67.5% and ExxonMobil 24.15%.

Located in West Pembrokeshire in Wales, the terminal is the largest LNG receiving terminal in Europe, according to Qatargas, with capacity of 15.6 million tpy and employing the largest diameter storage tanks in the world. South Hook’s sendout will be able to meet up to 20% of current UK natural gas demand, according to project sponsors.

NWS group marks LNG production milestone

The Woodside Petroleum Ltd.-operated North West Shelf joint venture’s LNG plant on the Burrup Peninsula near Karratha in Western Australia marks its 20th anniversary this month of LNG production coming on stream. The first shipment of LNG left for Japan in late July 1989.

North West Shelf Australia LNG Pres. Peter Cleary said the original 20-year contracts signed in 1985 with the Japanese had underpinned the development of the LNG production and export facilities.