OGJ Newsletter

Ex-Im Bank approves $900 million in loans to Pemex

The US Export-Import Bank has approved $900 million worth of 10-year direct loans to Mexico’s state-owned Petroleos Mexicanos to support purchase of US goods.

The official US government export credit agency said the loans consisted of $600 million for purchases to be used in the new projects of PEP, formerly known as the New Pidiregas Projects, which are 18 onshore and offshore oil and gas exploration sites, and $300 million for the Canterelli oil fields. Both activities involve work in and around the Bay of Campeche off the northern Yucutan coast, it noted.

Ex-Im Bank said its financing will help assure that US products would be competitive, adding that exports of engineering services, oil field equipment, offshore platforms, drilling and upgrade services, and upgrade and rehabilitation services are expected to come from suppliers in Texas, Louisiana, Florida, Ohio, Pennsylvania, and other states.

Pemex is its largest borrower, the bank noted. Since 1998, it has approved $8.3 billion of financing for the company to buy US goods and services for its oil and gas exploration, development, and processing projects. This included a $150 million small business facility in August supporting Pemex’s purchases of equipment and services from US companies with 100 or fewer employees, the export credit agency said.

It noted that it authorized $1.5 billion of loans to support foreign purchases of US goods and services for oil and gas projects in fiscal 2008. During that year, the bank authorized a total of $14.4 billion in loans to support the purchase of $19.6 billion of US exports worldwide, it said.

EU parliament approves energy compromise

The European Union’s Parliament approved by a large majority the energy market liberalization compromise reached in October 2008 by the Energy Council.

Parliament earlier rejected the compromise in its first reading and insisted that integrated companies fully unbundle production and sale of natural gas and electricity, while the council battled for the choice among three options for separating supply and production activities from network operators.

Brokered by the current Czech presidency of the EU, full acceptance by the Council of Ministers and parliament was reached on the third legislative package on energy aimed at bolstering the internal gas and electricity markets. But the parliamentary vote has strengthened the role of both national and transmission system regulators and put citizens at the center of the market through a protective energy consumer checklist and special attention to vulnerable clients.

Both European Commission Pres. Jose Manuel Barroso and Energy Commissioner Andris Piebalgs welcomed the vote, which they said ensures more effective regulatory oversight “from truly independent and competent national energy regulators” and “facilitates crossborder collaboration and investment with a new European Network for Transmission System Operators.”

They said grid operators will cooperate and develop common commercial and technical codes and security standards, as well as plan and coordinate the investments needed for the EU, easing crossborder trade and creating a level playing field.

“By bringing national markets together, member states will be better able to assist one another to face energy supply threats,” they added. The main objective of the energy package is to put in place the regulatory framework to make the market fully effective and create a single EU gas and electricity market to achieve the lowest possible energy prices and better security.

The legislative package includes provisions to prevent control of transmission systems by companies from non-EU countries until they fulfill certain conditions. A national regulator could refuse certification of a transmission system operator controlled by “a person or persons from a third country” if the company does not comply with the unbundling requirements, and its market entry would jeopardize supply security for one or more EU members.

EU countries have 31/2 years to implement these provisions.

The council is expected to formally endorse the legislative text within the next few months. The legislation seems sure to be implemented as specified in 2011.

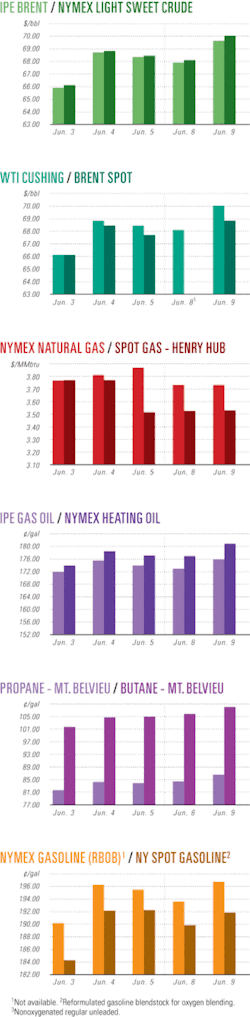

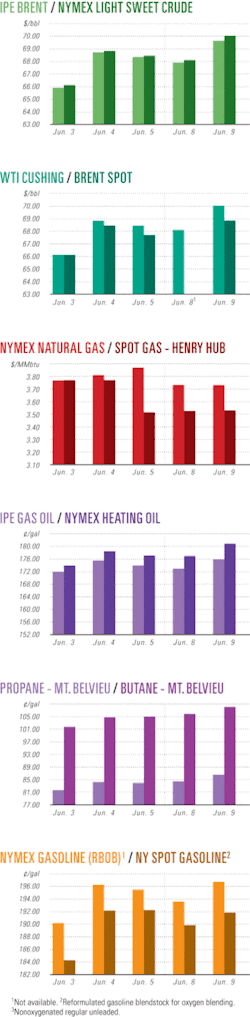

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesConocoPhillips finds gas with Poseidon-1

ConocoPhillips made an apparent natural gas discovery in the Browse basin off Western Australia during the drilling of its Poseidon-1 wildcat in permit WA-315-P about 480 km north of Broome.

The company intersected a 10 m hydrocarbon-bearing sand at a depth of 4,796 m just below the top of the Mid-Jurassic Plover formation, followed by two additional hydrocarbon-bearing intervals of 67 m and 114 m deeper in the stratigraphic section. Mud logs and logging-while-drilling equipment indicated hydrocarbons are present. The shows have yet to be fully evaluated but will be analyzed on completion of drilling and wireline logging operations.

The find, which is likely to be gas and condensate, lies just to the north of Woodside Energy Ltd.’s giant Torosa gas-condensate field and northwest of Inpex Corp.’s Ichthys gas-condensate field.

The well is being drilled by semisubmersible Sedco 703 and is the first of a six-well program by ConocoPhillips and its joint venture partner Karoon Gas Ltd. of Melbourne in three adjacent permits.

ConocoPhillips has 51% interest in WA-315-P with Karoon holding the remaining 49%.

Africa Oil gets blocks in Ethiopia, Kenya

Africa Oil Corp., Vancouver, BC, acquired Lundin Petroleum AB’s portfolio of exploration block interests in Ethiopia and Kenya for $23.7 million.

The blocks are in the underexplored East African rift basin petroleum system.

The acquisition included an 85% working interest in Blocks 2, 6, 7, and 8 and a 50% working interest in the Adigala block in Ethiopia and a 100% interest in Block 10A and a 30% interest in Block 9 in Kenya (see map, OGJ, Apr. 14, 2008, p. 40). Africa Oil will become operator except on Block 9.

The deal brings Africa Oil’s total holding to more than 200,000 sq km. Good quality seismic data show robust leads and prospects throughout the blocks, Africa Oil said.

The exploration program for the next 2 years includes seismic and drilling in both countries. Africa Oil also plans to drill in Puntland, Somalia.

ENH, Kalila Energy sign gas exploration deal

Mozambique’s state-owned Empresa Nacional de Hidrocarbonetos de Mocambique has sold Indonesia’s PT Kalila Energy Ltd. a 75% stake in the Buzi Block for $30 million.

The partners will undertake natural gas exploration in the central Sofala province for the next 8 years and will drill two exploration and two appraisal wells.

The contract also provides for funding for social responsibility and staff-training programs.

According to reports, Buzi holds estimated reserves of 10-17 bcf of gas.

Petrotrin to explore Trinidad’s Galeota block

Trinidad and Tobago’s state-owned Petrotrin LLC signed an exploration and production contract with Bayfield Energy (Galeota) Ltd. for exploration of Galeota block and revitalization of Trintes oil field.

Malcolm Jones, Petrotrin executive chairman, said Bayfield will pay all of Petrotrin’s capital investment and operating expenses in respect of the minimum work obligations for the first 4 years.

“This work obligation consists of both seismic and exploration wells together with production enhancement facilities,” Jones said. He said Trintes oil field, which was discovered in the 1960s and had so far produced 22 million bbl of oil, will be revitalized and that recent seismic surveys had revealed the real possibility of another Trintes look-alike field in the southwest quadrant of the block.

“There is a high probability of finding additional hydrocarbons in commercial quantities,” Jones said. Burren Energy won the bid to explore Galeota block, but UK-based oil company was sold in 2007 to the Italy’s ENI SPA for $3.5 billion. Burren Energy’s operations include oil fields in Turkmenistan, Congo, Egypt, and Yemen. Burren’s shareholders then invested in Bayfield.

Jones said the exploration program will involve the acquisition of 120 sq km of full-fold 3D seismic and drilling of at least seven exploration wells to depths ranging 6,500-12,000 ft. “Through this aggressive exploration development program, both Petrotrin and Bayfield remain hopeful that production can be optimised and that there will be major successes in Galeota.

Bayfield Chief Operating Officer Simon Gill said, “By that time, we think the world economy should be improving and the oil price should improve. Now is a good time for us to get in and do the work. Hopefully, we’ll get good prices for doing the work and you get your reserves in the future.”

Galeota block lies 6 nautical miles east of Galeota Point in southeastern Trinidad. Bayfield will hold a 65% working interest in the new licence and be the operator of the asset and Petrotrin will hold a 35% nonoperating interest.

Bayfield plans to spend $110 million on the project.

Drilling & Production Quick TakesKentucky sets CO2 EOR, sequestration projects

Projects to sequester carbon dioxide and test its use in enhanced oil recovery are under way in western Kentucky.

As much as 8,000 tons of CO2 is to be injected for 6 months into the Mississippian Jackson sandstone at 1,870 ft in a well in Sugar Creek field in Hopkins County.

Three producing wells operated by Gallagher Drilling Inc., Evansville, Ind., will be monitored for changes in production as the result of the CO2 injection, which is to start in mid-May. The geological surveys of Kentucky and Illinois are cooperating in the project.

Meanwhile, the Kentucky Geological Survey spud a well Apr. 23 in southeastern Hancock County, Ky., 8 miles southeast of Hawesville, with a projected total depth of 8,300 ft. Later CO2 is to be injected to test the capacity of various formations to serve as permanent storage for the substance, which is expected to turn supercritical.

The drilling follows the shooting of reflection seismic surveys in December 2008. Both projects are in the Illinois basin.

PTT could buy gas from Natuna D Alpha block

Indonesia is negotiating with Thailand’s PTT PLC for the purchase of undisclosed volumes of natural gas from the Natuna D Alpha block, according to a senior government official.

“We are currently still negotiating the gas price and the possibility of transporting it to Rayong, [Thailand,]” said Indonesia’s Energy and Mineral Resources Minister Purnomo Yusigantoro.

Purnomo, speaking before the Indonesian Association of Petroleum Engineers, said PTT had earlier been in talks with Indonesia to buy gas from other blocks, but at that time the company decided to obtain its gas supply from Myanmar instead.

“The gas supply [from Myanmar] now seems to be declining, so the company is looking for gas from other sources,” said Purnomo, who did not detail how much gas PTT might buy, saying the volume was still under negotiation, along with pricing.

Meanwhile, state-owned PT Pertamina has still not decided on its new partner for the development of Natuna D Alpha’s reserves, but Purnomo said the state firm and the Indonesian government would offer the block’s natural gas to potential buyers anyway.

“We are always looking for the market, because we don’t want to be too late,” said Purnomo, who added that buyers must be found before the block enters production, which may begin in 2017.

Initially, Pertamina and ExxonMobil Corp. had rights over the Natuna D Alpha block, but the government decided in 2005 not to extend the US firm’s contract, saying it had failed to submit the results of a feasibility study.

In June 2008, the Indonesian government appointed Pertamina to develop the block, and the state firm shortlisted eight potential partners: ExxonMobil, Royal Dutch Shell PLC, Chevron Corp., Eni SPA, Total SA, StatoilHydro, China National Petroleum Corp., and Petronas.

StatoilHydro to refurbish NCS installations

StatoilHydro will shut down 21 production installations on the Norwegian Continental Shelf (NCS) this year to expand capacity, technical improvements, and extend their economic life.

The installations and plants to be revamped include Oseberg, Statfjord, Gullfaks, Snorre, Troll, Kvitebjorn, Visund, Sleipner, Grane, Huldra, Veslefrikk, Brage, Heimdal, Volve, Glitne, Snohvit, Norne, Asgard, Kristin, Njord, Sture, and Karsto.

StatoillHydro will finish the turnarounds by Oct. 1 to meet gas delivery commitments and avoid poor weather.

The company has shut down LNG production from Snohvit following problems with its seawater heat exchangers. Two of the seven were replaced last autumn, and four more are due to go during a lengthy turnaround after the summer.

Many installations on the NCS will be upgraded, the company said. “Compared with 2008, when 26 shutdowns involved 270,000 work-hr in all, this year’s program involves fewer but larger operations. Some 313,000 hr are due to be worked.”

The first shutdown began Apr. 2 on Statfjord B and is a major program that will be the last on the platform to extend the field’s production life.

Oseberg also will be refurbished in June, which includes repairing the flare system at the field center and implementing part of the low-pressure project.

Capacity upgrades are planned for Snorre A, while work on Troll A includes preparations for a new gas pipeline to Kollsnes and expansion of the living quarters.

Statfjord field’s life has been extended beyond 2020. This project is estimated at 23 billion kroner, including the Tampen Link pipeline, which delivers Statfjord gas to the UK, and the submersible pumps for Statfjord B and C. But this is higher than the original estimate of 15 billion kroner.

StatoilHydro and its partners are to invest in eight new electrical submersible pumps on the Statfjord C platform, and they are considering adding four pumps on the Statfjord B platform.

Total investment for the submersible pumps on Statfjord B and C is in the range of 3.5 billion kroner, and is subject to approval by the partners.

Processing Quick TakesBP: End US import tax on Brazilian ethanol

BP PLC has sent a letter to the California Air Resources Board (CARB), calling for its support in ending US import duties on Brazil’s sugarcane-based ethanol.

According to the letter, seen by Brazil’s state news agency, BP “believes sugarcane-based ethanol will be the lowest-carbon biofuel available in the first years of the Low-Carbon Fuel Standard.”

By supporting the end of import taxes on Brazil’s ethanol, the letter says, California would send a strong sign to lawmakers in Washington, DC, that the state is seriously committed to meeting emission targets.

The agency said BP is the only oil company in the world that invests in Brazil’s ethanol, holding a 50% stake in Tropical Bioenergia, located in Goias state, which started operations in September 2008.

The stake resulted from $683 million investments made jointly with the Maeda Group and SantelisaVale, now controlled by Louis Dreyfus Commodities.

BP Chief Executive Officer Tony Wayward recently said the company will invest $6 million in Brazil’s sugarcane-based ethanol over the next 10 years.

CARB was to vote on Apr. 30 regarding new regulations to reduce emissions in the state.

Meanwhile, Brazil’s state-run Petroleo Brazileiro SA (Petrobras) plans to begin selling gasoline blended with bioethanol in the Tokyo metropolitan area as early as this summer.

Petrobras has already built a facility to blend fuels at its base in Chiba Prefecture, and the Brazilian firm also will make use of a refinery it acquired last year in Okinawa Prefecture.

Meanwhile, Nippon Oil plans to meet the competition by offering biofuel at 1,000 affiliated gas stations in the Tokyo metropolitan area in June. Along with other domestic wholesalers, Nippon Oil expects to sell fuel containing 360,000 kl of bioethanol in fiscal 2010.

FTC proposes motor fuel economy guide changes

The US Federal Trade Commission has proposed amendments to its fuel economy guide for the first time since it adopted the guide in 1975.

The guide, which FTC developed to prevent deceptive advertising and facilitate the use of fuel economy information, would be amended to reflect technology improvements over the past 34 years and changes in the US Environmental Protection Agency’s fuel economy labeling rules for new cars, the commission said on Apr. 24.

The changes fall into three separate areas, it said. FTC’s guide would adopt EPA’s revised fuel economy labeling requirements. It would be modified to expand the scope of existing guidelines to include new vehicle types that run on fuels other than gasoline, such as natural gas and electricity. And it would include guidance related to cruising range information in advertisements for vehicles that run on alternative fuels.

FTC said it would publish a notice about the proposed changes in the Federal Register soon. Comments will be accepted through June 26.

Transportation Quick TakesMitsubishi-led LNG project may be shelved

The Japanese-led consortium seeking to build the Senoro LNG plant in Central Sulawesi, Indonesia, may have to delay its plans due to lower reserves of natural gas in the Senoro and Matindok fields than earlier estimated.

“We are now waiting for the operators to decide whether they still want to develop the project with the lower proven reserve,” said Indonesia’s Energy and Mineral Resources Minister Purnomo Yusgiantoro, in reference to the consortium comprised of state-owned PT Pertamina (Persero), PT Medco E&P, and Mitsubishi Corp.

Purnomo, who said upstream oil and gas regulator BPMigas also would discuss the matter with the consortium, announced Indonesia’s state-owned oil and gas research and development center (Lemigas) had found reserves in the fields to be lower than the consortium’s estimate of 2.4 tcf.

The minister did not detail Lemigas’ findings, saying the institution “might” publish its results later on. But ministry adviser and former BPMigas chairman Kardaya Warnika said the lower proven gas reserves meant the LNG plant could not meet its initial production target.

“Lower proven gas reserves means less LNG production,” said Kardaya. “Thus the plant may not be able to meet its initial production target of 2 million tonnes/year of LNG.”

The Senoro LNG project came under public scrutiny when PT LNG Energi Utama (LEU) last August filed a lawsuit against Mitsubishi over claims the Japanese firm had unfairly won the project.

LEU, which claims exclusive rights to be involved in the Senoro LNG project, filed its lawsuit with Indonesia’s Business Competition Supervisory Agency, which still has the case under review.

Mitsubishi holds a 51% stake in the Senoro LNG project, while Pertamina holds 29% and Medco E&P holds 20%.

Indonesian firms need $6.5 billion for tanker fleet

Indonesian shipping firms, eyeing favorable new legislation, need $6.5 billion to purchase 127 ships to replace foreign-flagged tankers currently carrying oil and gas in that country’s waters.

“We need around 5-year $6.5 billion loans to build new ships to substitute for the foreign ships,” said Johnson W. Sutjipto, chairperson of the Indonesian National Ship-owners’ Association (INSA).

According to Johnson, who spoke before a conference on ship finance, foreign shipping firms earn $1.385 billion/year from the operation of 127 ships for oil and gas transport, as well as offshore activities.

Johnson spoke about changes in Indonesian law regarding the transport of oil and gas in domestic waters. Under the new legislation, which comes into effect in January 2010, foreign ships will not be able to operate in Indonesian waters and must be replaced by Indonesian-flagged ships.

“This offers opportunities for national banks to finance new ship procurement for oil and gas transportation,” said Johnson, who also noted key difficulties for local shipbuilders.

“The problem is the national shipping industry still faces difficulty in getting domestic financing since the banking industry demands a long-term transportation contract and a 30% equity financing from a shipyard company,” he said.

While foreign banks are ready to finance the ship procurement, Johnson said they are hesitant because Indonesia has not yet ratified international legislation that would enable them to recover their investment through the arrest of ships.

Meanwhile, the state Bank of Indonesia released data showing that shipping loans as of February still represented just 2% of the bank’s total loans, despite an 80% increase in shipping loans year-on-year.

BI Deputy Governor Muliaman D. Hadad said the small loan percentage was due to uncertainty in the banking sector over the lack of transparency in the shipping industry. “If there is no transparency regarding the business risk, it will be difficult for banks to give loans,” Muliaman said.

Ice-breaker tugs for Kashagan planned

Kazakhstan’s JSC Circle Marine Invest has awarded a $113 million contract to STX Europe ASA, the Norwegian unit of South Korea’s STX Group, for the construction of three ice-breaker tugs for use in the Kashagan offshore oil field development.

STX Europe’s subsidiary Aker Arctic will design the three ice-breakers, which will be built largely in the STX RO Offshore shipyard based in Braila, eastern Romania, with delivery scheduled for 2010 and 2011.

JSC Circle Marine Invest subsidiary Caspian Offshore Construction will operate the vessels, which have a length of 65 meters and a beam of 16.4 meters. The tugs will be equipped and designed for other operations such as fire fighting, rescue operation, and towing in shallow waters.

According to Mikko Niini, President of Aker Arctic Technology Inc., the Caspian icebreaker tugs are based on the technology used in the first Aker Arctic DAS icebreakers which have operated for more than 10 years in the Kashagan oil development.

The Kashagan field holds recoverable oil reserves estimated at 13 billion bbl, and is expected to produce as much as 1.5 million b/d of oil at its peak in the next decade.

However, the field’s development has been hindered with delays due to technical difficulties and disputes between the government and foreign firms over costs and profit distribution.

One of the Kashagan consortium partners last month gave assurances that the global economic crisis would not hinder the development of the offshore oilfield and may even help reduce costs.

“The plan is still to have first production as announced, in the fourth quarter of 2012,” said Campbell Keir, Royal Dutch Shell manager for the Caspian region. “The economic situation and the low oil price should allow us to bring the cost down.”