Worldwide oil, natural gas deal value plunges

The total transaction value for worldwide upstream corporate and asset deals plunged to $104 billion in 2008 compared with an annual average of nearly $160 billion during 2005-07, consultants said in an annual report.

John S. Herold Inc. and Harrison Lovegrove & Co. Ltd. on Mar. 13 released highlights of their joint 2009 Global Upstream Mergers and Acquisitions Review, an analysis of more than 280 major upstream transactions announced in 2008. They released an analysis of US transactions on Mar. 17.

The analysts said the upstream merger and acquisition market again appears ripe for considerable consolidation. The expectation is that corporate takeover activity will increase this year and into 2010.

“The number of assets coming to the market is expected to increase,” the report said. “However, the buyer universe may be smaller than in the past, at least in the near term, as many of the companies that completed transactions over the last 4 years now lack the resources to remain active in the M&A market.”

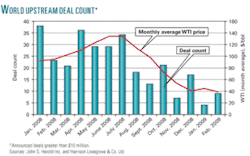

During first-half 2008, deal activity was occurring at a record pace. But the pace slowed dramatically in the second half, particularly in the US and Canada.

The steep second-half decline sent the worldwide deal count to a 4-year low from a record high level in 2007. During 2008, 203 transactions were announced by July 31.

Deals slow on lower oil prices

“Then the market tailed off precipitously to just 79 in the final 5 months of [2008] due to plunging commodity prices and the extreme weakness in equity and credit markets,” the report said. “Activity in November and December was a record low 25 deals, half the historical average.”

The total value for corporate transactions was $34.2 billion in 2008 compared with $64.2 billion in 2007 and $120.2 billion announced in 2005. The corporate deal count was a 5-year low, with no US corporate transactions in the fourth quarter.

The value for transactions involving oil and gas assets dropped during 2008 after rising for 6 consecutive years.

Total worldwide asset transaction value fell to $70.1 billion from the record $88.2 billion in 2007. But 2008 asset transaction values still marked the second highest on record. Asset transactions accounted for a record 67% of total worldwide transaction value and 80% of US transaction value.

Unconventional gas resources in Canada, the US, and the Asia-Pacific region represented nearly 40% of total 2008 global M&A activity.

Buyers competed vigorously for coalseam gas assets in Australia and shale gas interests in the US and Canada. The gas weighting of transacted reserves reached 70%, marking a 10-year high.

The largest 2008 global upstream transaction was ConocoPhillips’s $5.9 billion purchase of 50% interest in the coal seam methane projects from power retailer Origin Energy Ltd., Sydney. That transaction was announced in September.

Other Australia transactions included BG Group’s $2.9 billion acquisition of Queensland Gas Co. and Petronas’s $2 billion investment in the coalseam gas and LNG project of Santos (OGJ, July 14, 2008, p. 42).

Meanwhile in the US, shale gas transactions accounted for more than 35% of 2008 deal value. Gas represented more than 70% of acquired US proved reserves for the third consecutive year.

Chesapeake Energy Corp. sold more than $12 billion of US onshore assets during 2008, including forward-sale volumetric production payment transactions.

Chesapeake’s divestments involved interests in producing properties and leases to form joint ventures with StatoilHydro (Marcellus shale), Plains Exploration & Production Co. (Haynesville shale), and BP PLC (Fayetteville and Woodford shales)(OGJ, July 14, 2008, p. 42).

XTO Energy spent more than $8 billion on nine US transactions, including a $4.2 billion corporate acquisition of Hunt Petroleum Corp., a private company.

Reserves values increased

Worldwide weighted average pricing for proved reserves increased to $11.51/boe, up from $10.01/boe in 2007. In the US, the weighted average pricing for proved reserves soared to $19.11/boe in the second quarter and then retracted in the second half.

The average deal pricing for the US in 2008 was a record $16.56/boe because of the strong first-half performance.

Internationally, national oil companies continued to be active buyers. NOCs and Sovereign Wealth Funds based in Asia, the Middle East, Europe, and Latin America accounted for a record 15% of global open market transaction value during 2008.

NOC transactions included six of the 10 largest asset deals last year. Analysts said NOCs continued to be the most active acquirers in the first quarter, analysts said.

John S. Herold is an IHS company, and Harrison Lovegrove belongs to Standards Chartered Bank.