MMS Lease Sale 208 attracts $703 million in high bids

Apparent high bids totaling just over $703 million were offered for 348 tracts in the central Gulf of Mexico at Lease Sale 208, reported the US Department of the Interior’s Minerals Management Service Mar. 18 in New Orleans.

MMS received 476 bids totaling nearly $994 million from 70 companies at the sale. The tracts offered covered nearly 1.9 million acres off Louisiana, Mississippi, and Alabama.

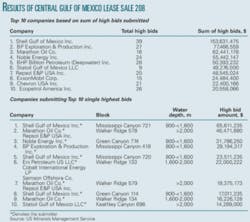

The highest bid received on a tract was $65,611,235 submitted by Shell Gulf of Mexico Inc. for Mississippi Canyon Block 721. The block receiving the greatest number of bids was Walker Ridge Block 134 with 6 bids.

Interior Secretary Ken Salazar, who attended the lease sale and then later toured an offshore production platform in the gulf’s Mississippi Canyon area, told reporters that the number of companies participating in the sale showed a “high level of interest” in the central gulf area, despite a dramatic decline in the total amount bid. Last year, MMS’s Central Gulf Lease Sale 206 attracted $3.7 billion in apparent high bids, which set a record in US leasing history for high bids since area-wide leasing began in 1983 (OGJ, Mar. 24, 2008, p. 38). During that sale, MMS received 1,057 bids from 85 companies on 615 tracts.

During this year’s sale, there was a total of 13 tracts receiving bids in the 181 South Area of the central gulf, Salazar noted, and the high bids for these tracts totaled $6,476,545. Alabama, Mississippi, Louisiana, and Texas will all share in 37.5% of the high bids on these tracts as well as all future revenues generated from this acreage leased in the 181 South Area as mandated by the enhanced revenue sharing program in the Gulf of Mexico Energy Security Act of 2006. Additionally, 12.5% of revenues from the tracts in the 181 South Area will be deposited into the Land and Water Conservation Fund for use by states to enhance parklands and for other conservation projects.

Shortly after bids were announced, American Petroleum Institute Pres. Jack Gerard said in a statement, “The results of Lease Sale 208 underscore that, like most US industries, the domestic oil and natural gas sector faces tough economic challenges, not only with the economy reeling but with oil prices half of what they were a year ago.”

Gerard said, “The Obama administration’s plans to add billions of dollars in new taxes would have a devastating impact on an industry that supports 6 million jobs and contributes billions of dollars to government revenue. These new taxes are ultimately anticonsumer, threatening millions of jobs, the nation’s economic recovery and energy security.”

Sale results, top bidders

The ultradeep water was a big draw at the sale. Of the tracts receiving bids, 106 blocks lie in greater than 2,000 m of water, 39 lie in 1,600-2,000 m of water, and 69 are in 800-1,600 m of water.

The top five companies submitting the highest dollar amount of high bids for Lease Sale 208 included Shell Gulf of Mexico Inc., 39 bids, $153,631,475; BP Exploration & Production Inc., 27 bids, $77,466,559; Marathon Oil Co., 16 bids,$62,441,178; Noble Energy Inc., 24 bids, $55,442,147; and BHP Billiton Petroleum (Deepwater) Inc., 28 bids, $50,393,232.

Norway’s StatoilHydro reported it was the highest bidder on 23 leases.

“The leases we acquired are in deepwater and predominantly in high quality Miocene sands, in which StatoilHydro is participating in several promising discoveries, including Tahiti, Heidelberg, Caesar-Tonga, and Knotty Head,” the company reported.