Personnel key to moving beyond price cycles to structural prosperity

Can it last?

Can prices stay above $30/bbl for oil and $5/Mcf for natural gas? Can prosperity endure for an industry still smarting from the energy market's most recent wreck?

Will this be the trend that continues? Has something changed about the market that will keep prices of fluid hydrocarbons from returning to the ruinous levels they plumbed in 1998-99?

History says no.

History says present conditions never last forever. History says investments dependent on unwavering extension of current trends always come to grief.

To be guided by history in 2001, therefore, is to be cautious, to invest with restraint, to assume the worst case: another market crash that pulls oil and gas prices to levels that hurt everyone.

Structural change?

It might happen. Eventually, demand will contract under the pressure of unsustainably elevated price, production for various reasons will spurt, storage will fill, and prices-well, no one can forget 1998 and 1999.

Or maybe not. Maybe the market will adjust without crashing again. Maybe, in fact, something has fundamentally changed.

When benchmark prices of crude oil flirted with single digits in the slump just past, industry observers-including some oil company chiefs-speculated that a structural change had occurred that would suppress prices indefinitely. That was the word: structural. And it turned out that if something had indeed structurally devalued oil, the effect couldn't bear up to good old-fashioned production restraint from the Organization of Petroleum Exporting Countries. In less than a year's time, with OPEC exercising unprecedented quota discipline, the price of crude more than tripled.

So does anyone now dare suggest the existence of structural factors keeping oil prices high?

No such recklessness will appear here. Oil and gas are still commodities. Their values still continuously change. They remain subject not only to the unpredictable tugs and pushes of supply and demand but also to changes in interest rates, the values of currencies and nonpetroleum commodities, the news, and traders' moods. As long as this is so, there can be no dependable floors or ceilings, and speculation about structural change overlooks too many contingencies.

It would be a mistake, however, to ignore influences on the industry and its markets that are, while hardly structural, at least resurgent if not altogether new. At the beginning of 2001, several of them are in view.

Physical limits

Most immediately, the oil and gas industry has encountered its physical limits. A business accustomed to surplus now grapples with shortage. Production, refining, and transportation capacities are all tight and likely to stay that way for at least several years.

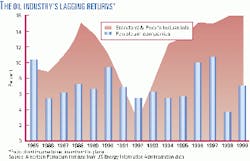

To some extent, this reflects deliberate rationalization undertaken in response to substandard profitability (see figure). But to some extent it reflects another important market influence.

The worldwide economy is surging and carrying demand for energy along for the ride. Privatization, liberalization, globalization-they all work. They fire human ambition and uncork human potential. They are beginning, at last, to force poverty into retreat. And the progress originates in the spreading freedom of people to have and pursue dreams.

For energy, a flowering global economy sends up two powerful signals for the year 2001.

One of the signals is that economies are more resilient to energy prices than they used to be. A tripling of the cost of fluid hydrocarbons did not reverse the vitally important recovery of Asia. It did not block expansion in Europe. And it did not derail the historic US expansion.

High prices have had effects, to be sure. Growth rates for both economic activity and energy demand were slowing at the end of 2000. But the effects remained far from recessionary and had causes beyond energy prices, including political uncertainty.

The other signal radiating from global economic vitality is that the world's need for oil is destined to grow. The US Energy Information Administration recently increased its projection of worldwide demand for oil in 2020 to 117.4 million b/d from the 112.4 million it predicted just 1 year earlier. The new projection represents an increase of 31.9 million b/d over 1999 demand.

To meet 42% demand growth in 20 years, the oil industry needs to get busy. It needs, physically, to grow.

The shareholders

But there's a problem.

"Our shareholders don't want us to grow," says Marianne Kah, chief economist of Conoco Inc., in a succinct statement of another important influence now strongly at work on the industry.

At a conference last month in Oklahoma City, Kah noted how returns on US oil-company investments have fallen below those of general industry since the 1980s, attributing the sluggishness to overbuilding of production and processing capacities encouraged by the price leaps of the 1970s. The record makes investors concerned with profitability more than growth, she said.

Yet the industry must grow if demand projections hold true.

The route out of this dilemma is improved profitability, which requires some combination of lower costs and higher commodity prices. After more than a decade of cost-cutting, the industry can't do much more in this area and grow, too. That leaves price strength, which can last while investor wariness keeps a physically constrained industry from expanding.

The temptation is strong to declare this to be the structural change that alters the course of oil prices-this time on the high side. Yet it's a false hope.

Rising prices will eventually, perhaps very quickly, wear down investor caution about growth. And external factors of energy demand can change. Much can happen between January 2001 and a 117 million b/d oil market in 2020.

The road to general prosperity, for example, can take unforeseeable turns. Governments can grow weary of privatization and the dispersion of power that accompanies it. Economic growth can stall, as the recent slowdown in the US shows. EIA's 20-year forecast for oil demand increased this year; it can fall next year.

Environmentalist opposition to fossil energy-another important influence-looms over the demand outlook, as well. Pressure groups convince growing numbers of people that the use of oil involves environmental detriments uncompensated by energy benefits.

Inevitably, the pressure takes its toll. Taxation of fossil energy increases. Subsidies materialize for alternative fuels otherwise unable to compete. For these and other reasons, the contributions of energy sources other than petroleum surely will grow in the next 2 decades.

If total energy demand grows as expected, hydrocarbon fuels will maintain commanding market shares, whatever the growth of alternatives. If energy demand shrinks, hydrocarbons will lose ground, and EIA's forecast this year will prove to have been high. In any case, however, the world's need for oil and gas will still be great 2 decades from now.

Technological development

Less certain than the continuing need for hydrocarbon energy is the ability of technological development to maintain the heady pace it set in the oil and gas industry during the 1990s.

Much of that decade's cost-cutting came from new technology, which makes the industry as it enters 2001 much different from the industry as it was a decade earlier. Two differences need mention here because they represent two remaining influences likely to shape this year and the years to follow-and because they bear on the outlook for technology.

One of them is the industry's developing ability to manage its manifold risks within the framework of its growing set of technical and computation tools.

In the 1990s, oil and gas companies learned to use financial instruments to at least lay off price risks, which they can't control. More recently, many of them have begun managing risks of their operating decisions within the context of company-wide portfolios of opportunities and technical skills.

They're using statistical methods to assess probabilities and uncertainties and to interrelate once-isolated decisions in pursuit of maximum company-wide returns. Many of those decisions have to do with apportioning technical resources most profitably within a given set of opportunities and within a range of acceptable risk.

Improvement of industry decision-making through better risk assessment raises hope for a general increase in returns on oil and gas investments. And it would certainly change patterns of decision-making.

The people factor

Or, as management schools would describe the process, broad embrace of quantitative decision analysis and portfolio optimization techniques would change the industry's culture. This subject relates to the final influence with implications for technological progress and the industry's ability to meet growing demand.

People.

Petroleum industry progress of the past 2 decades amounts greatly to the replacement of iron and chance with ideas and control. And ideas come from people.

Thanks to innovations of people, the industry drills wells with ever-improving precision, routinely operates under formerly daunting conditions of weather and water depth, delivers vehicle fuels that burn with ever-diminishing environmental consequence, and pollutes less than ever as it works.

It also functions with a diminishing headcount, especially in the US.

The federal Bureau of Labor Statistics estimates that in 1998, the most recent data year, oil and gas extraction activities employed 339,000 workers in the US. That's less than the amount by which the same labor segment shrunk between the boom year of 1982 and 1995.

BLS expects contraction of the upstream work force to continue. During 1998-2008, it says, US oil and gas extraction payroll will decline by 17% overall. Of that, the employment segment identified as "crude petroleum, natural gas, and natural gas liquids"-generally, operating companies-will contract by 46%. Employment in oil and gas field services will grow by 5%.

Some of the anticipated cutback in the operating segment represents transfer of jobs away from the US rather than a reduction in global headcount. Still, the prospect of further slashing of the US workforce and dispersion of technical development raises questions that deserve attention now.

Can the industry expand its physical operations to the extent demand projections suggest it must with a workforce so lean? Can a sharply smaller and unconcentrated professional contingent replicate the industry-saving innovations of the 1990s? If not, what, if anything, are companies prepared to do about it?

Structural prosperity

High prices for oil and gas cannot last. They never do. Markets adjust swiftly and efficiently, often in unforeseen ways. There is nothing structural about modern petroleum pricing.

Prosperity can be more durable. Companies can improve risk-management and decision-making. They can solve formerly daunting operational and environmental problems. They can profit with prices at levels once deemed too low. Profitability can become structural, or nearly so.

Companies proved as much in the 1990s. They can do it again in the first decade of the 21st century. They need a brain pool in order to do it, though. Against such a need, the population trend BLS extends in its forecast for 2008 looks very unpromising.

Reversing the trend requires nothing more than attention to humanity's long-term craving for energy and commitment to prosperity beyond the next price cycle, about which it is too late to worry.