Re-examining the Metallgesellschaft affair and its implication for oil traders

The Metallgesellschaft AG (MG) affair of 1993-94 conveyed three central messages to the petroleum industry: one pertaining to the relationship between hedging and speculating, one pertaining to corporate governance, and one pertaining to commodity market dynamics.

On the message of hedging vs. speculating, MG's US oil subsidiary, MG Refining & Marketing (MGRM), designed an innovative program aimed at rapid expansion in a mature but evolving business-the marketing of petroleum products. MGRM used a strategy combining over-the-counter (OTC) and futures instruments that contained a speculation on the relationship between near and distant prices. That speculation went against MGRM for a time, causing it to incur very large margin payment requirements and other cash flow disruptions.

Regarding the issue of corporate governance, the extent of MGRM's activities in financial energy markets appears to have caught its parent-and within the German system of corporate finance, its parent's banking shareholders-by surprise. When MGRM's speculation moved against it-for a period of time that may have been short-lived-it suffered large "mark-to-market" losses and large margin payment calls. The mark-to-market losses initially remained paper losses, but the margin calls were a drain on MG's cash flow that were larger than MG's management was willing to tolerate. According to some critics, MGRM's parent terminated the strategy so abruptly as to increase the size of the losses far beyond what would have been incurred with a more-patient unwinding.

On the aspect of market dynamics, MGRM's open interest in the oil financial markets-both exchange-traded and over the counter-became extremely large. When a single company commands such a large share of open interest, markets can become dysfunctional in one of two ways: the company can obtain the power to squeeze other participants, if those participants remain fragmented and disorganized; or the company itself can be squeezed, if other market participants begin to trade against the company in an organized manner. In MGRM's case, the speculative part of its strategy-the reliance on near-month contracts to hedge the bulk of its long-dated positions-required a rollover of its long position in the exchange-traded markets. This rollover was so large that other participants-especially funds that were adept at trading-anticipated its actions and, by "herding" their trades (not by design, but by widespread identification of the rollover), precipitated a change in the market structure from backwardation to contango. The emergence of that contango, in turn, caused the "rolling stock" aspect of MGRM's strategy to go from a source of trading profits to a source of trading losses.

Since MG AG's management terminated the MGRM program in early 1994, much has been written about the affair. In particular, the affair inspired Christopher Culp and Merton H. Miller (the latter adding a special notoriety to his involvement due both to being a Nobel laureate in economics and a defender of MGRM) to publish a valuable collection of analytical essays.1 The essays concentrate almost entirely on the issues of hedging versus speculation and corporate governance, a debate that will be covered subsequently in this article.

The issue of how MGRM's size affected the oil markets has received much less attention. To our knowledge, there have been only two privately circulated reports dealing with this dimension of the problem, one by this author and one by Philip K. Verleger Jr.2 The author's analysis of the relationship among MG's trades, hedge fund reaction to these trades, and the apparent impact on the structure or level of oil prices is also covered in a subsequent section.

Background

In the summer of 1995, MG settled a complaint lodged against it by the Commodities Futures Trading Commission. The settlement allowed the company to escape admissions of guilt and brought to light the basic story of the transactions whereby MG attempted to become a major player in the US oil market.3

According to the CFTC, MG Refining & Marketing (MGRM) "sold illegal off-exchange energy product futures contracts to more than 100 independent gasoline stations and heating oil distributors throughout the United States. The illegal futures contracts were part of MGRM's overall energy contract business, which MGRM hedged barrel-for-barrel with near-term futures contracts, including NYMEX [New York Mercantile Exchange] futures contracts and over-the-counter swaps."

MG was selling financial petroleum products to independent and quasi-independent retail service stations. This group's demand for these services emerged out of the financial distress following US oil market deregulation and commoditization in the early 1980s. The situation of independent gasoline retailers should be seen against a backdrop of a 15-year effort by the large integrated oil companies to retrench to their geographic strongholds and consolidate within them to a smaller number of larger and more-efficient stations.

One can visualize the US gasoline market as a three-by-three matrix (Table 1), with one side identifying the supplier and the other side the dealer. In the matrix shown, the dealers that absorb the greatest price risk are those in Cells 5, 6, 8, and 9.

In previous years, there had been indications that the competition between independent dealers and those affiliated with major oil refiners was stronger than ever. As one review noted:

"Some dealers complain that the market has become so brutal that they can barely pay their bills. They said the 'Wal-Mart syndrome' of huge volumes and low prices is dominating the gasoline business. Mom-and-pop dealers are having trouble surviving."4

Independent and unintegrated gasoline dealers were exposed to variations in the relationship between retail prices in their area of service and the wholesale prices at which they purchased their fuel. While the volatility of wholesale gasoline prices was well-known and thoroughly documented, it was difficult to generalize about the volatility of retail price movements: it varied significantly by region. Suffice it to say that the most vulnerable dealers were those in which the retail price is slow to rise but quick to fall. In those cases, the dealer periodically got his margins squeezed while the integrated dealers enjoyed a measure of financial protection from their parent companies.5

It was the "permanently distressed" segment of the gasoline retail business that MG pursued. It began in 1989, with its purchase of 49% of Castle Refining, which had an 80,000 b/d unit in Lawrenceville, Ill. According to an analysis by Mello and John E. Parsons, MG's program included guaranteeing the margins of that refinery by buying all of its output (46 million bbl/year) at fixed margins. Citing MG's "Business Plan for MG Refining & Marketing Inc.," Mello and Parsons observed, "MGRM's business plan laid out a marketing strategy based on long-term pricing...MGRM's management believed that independent retailers required protection against temporary high spot prices...According to MGRM, spot price movements quickly impacted the wholesale price of refined products but not the retail price. While retailers attached to large integrated companies were able to ride out temporary squeezes on margins, independent retailers often faced a severe liquidity crunch. And while retailers could buy products under contracts protecting them against these temporary price surges, MGRM believed these contract price terms were unnecessarily high, given the recent history of spot prices. This was the central premise of MGRM's strategy. MGRM believed it possible to arbitrage between the spot oil market and the long-term contract market. This arbitrage required skilled use of the futures markets in oil products..."6

Under this strategy, MG tried to create what is in essence a very large swap extending all the way from the downstream gasoline retailer to the WTI crude contract.

MG: hedging or speculation?

MGRM made contracts to sell oil to dealers of gasoline and heating oil at fixed prices for up to 10 years. In the language of traders, MGRM's customers went long. MGRM went short. The buyers had the option to terminate if spot prices rose above fixed prices. This was an embedded liquidity option, of interest to buyers because their deal with MG was an OTC transaction. MGRM hedged its position by going long on near-month futures and rolling them over each month (the so-called "stack-and-roll" strategy).

MG's hedge was necessary because, if prices did rise dramatically, MGRM was faced with customers wanting to cash in their positions. For example, suppose that in 1994, the hypothetical "Wakefield Oil Co." was long with MGRM at $20 for the 1995 strip. That means MGRM was short at $20. If the underlying market went up to $25, and Wakefield wanted to cash in, it would exercise its option to liquidate and make a $5 profit. MGRM would have to pay out $5.

In theory, MGRM should have hedged its long-dated short positions with long instruments with similar maturities. Instead, it went long on the near-month futures. This hedging strategy worked as long as the market was in backwardation. But in September 1993, the NYMEX futures markets for crude oil flipped into contango. MGRM's mark-to-market losses in its long futures position increased. NYMEX issued margin calls MGRM could not meet.

According to a report on MGRM prepared by CFTC, most of MG's contracts with gasoline dealers were 45-day firm, fixed-price agreements.7 These agreements:

- Provided delivery in the future at fixed prices determined at the beginning of the contract.

- Allowed purchasers to obtain delivery upon tendering 45 days notice.

- Did not require any ratable monthly deliveries of petroleum to consumers.

According to Mello and Parsons, the program included a set price and a specified total volume of deliveries over the life of the contract, but it gave the customer extensive right to set the delivery schedule. Terms included:

- Delivery could be deferred up to 5 or even 10 years.

- The contract could be satisfied with a "blow-out" provision

- There would be a cash payment from MG if the NYMEX price reached a pre-established exit level.

The CFTC made the judgment that virtually all purchasers intended to invoke blow-out. ("Thus, they were speculators.") No product was ever delivered pursuant to 45-day agreements.

MG entered into more than 100 of these fixed-price contracts with gasoline and heating oil dealers. With that, it accumulated a very large short position for itself in the gasoline and heating oil paper markets.

In the physical market, MG made a deal to buy output from Castle Refining at a fixed margin of about $5/bbl8 (we have not tried to establish whether Castle Refining's volume capabilities matched the delivery commitments over time). According to Mello and Parsons, "by September of 1993, MGRM was obligated for a total of 102 million bbl" under these contracts.

In essence, given its commitments to the dealers and to Castle Refining, MG needed to fix the price of the crude needed to fuel the deals, and to that end acquired a large long position in the NYMEX WTI contract. MG absorbed the crude commodity price risk, the gasoline commodity price risk, the heating oil commodity price risk, and the price structure risk-insofar as the structure of MG's deals would create losses if the futures price curves of each of the commodities shifted from mostly backwardation to mostly contango.

Had the individual commodity risks all been short-term, each would have been amenable to "plain-vanilla" risk management programs. But there was a mismatch in the time frames of the various positions. The retail positions tended to be long-term. Indeed, "offering small, retail clients such as individual gas stations the opportunity to buy petroleum at a fixed price for up to 10 years was a 'service' MGRM offered that its competitors did not."9

So far, so good. Where MG ran into trouble is in how it chose to hedge that long-term price exposure. It attempted to profit from the chronic backwardation of (especially crude) oil futures contracts. Apparently, MG's traders believed-as many do-that the NYMEX crude contract was likely to be in backwardation more often than in contango. If so, the monthly rollover required from a practice of hedging the bulk of its contracts in the prompt month(s) would be no problem; to the contrary, it would be a source of additional profits. Each month, a contract that MG initially bought at, say, $18/bbl when that contract was the second month would be worth, say, $18.50, when it became the prompt month and expired. One can criticize this view on various grounds, given 20-20 hindsight. But MG's traders were not naïve; they would certainly have known that they would lose money in the rollover some months.

To manage its growing long gasoline and heating oil commodity price risk, CFTC concluded, "by September 1993, MG had 55,000 contracts [55 million bbl] on NYMEX that it rolled forward as the contract reached expiration." The hedges were spread across the crude, gasoline, and heating oil markets, but most of the contracts were in the prompt months.

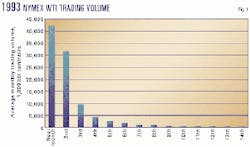

MG hedged most of its requirements in the prompt months of the futures contracts by both design and necessity. The necessity element is illustrated in Fig. 1, which shows the distribution of daily crude oil trading volume across the trading months for the WTI contract. Of the average monthly volume of crude trading, 76% took place in the first 2 contract months, 90% in the first 4 months.

As MG's positions grew, it became by far the largest single trader in the NYMEX contracts. MG's own analysis came to the conclusions shown in Table 2: that by Sept. 30, 1993, MGRM's positions comprised 16% of all the open interest outstanding in the NYMEX oil contracts.

MG's growing presence in the NYMEX markets gradually became the fatal flaw in its entire hedging program. In the extensive debate over MG's program, most of the attention has been given to the mismatch between long and short-term commitments

It seems clear from the records available from MG itself that its US managers believed they could turn backwardation to their advantage. Culp and Miller quote with implicit approval10 an MG document that states: "At any given point in time, certain parts of the commodity market may be overvalued or undervalued relative to that commodity's own forward price curve, to other commodities, or to other markets...That, in turn, provides attractive opportunities from an arbitrage standpoint."

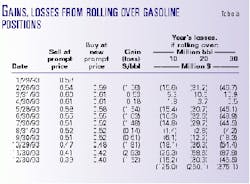

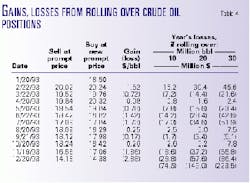

MG's deliberately chose to deploy the "rolling stack" hedging strategy to capture the "hedging gains" that it believed would result from it because MG believed the market would remain in backwardation. In fact, in the early months of 1993, the rolling stack strategy allowed MG to get some rollover gains, as shown in Tables 3-4, which review the opening and closing prices of the prompt-month NYMEX West Texas Intermediate crude and gasoline contracts in 1993.

As 1993 evolved, however, what had been a pattern of typical backwardation gave way to contango, to the detriment of MG's position. As Tables 3-4 indicate, if MG had 30 million-bbl positions in each market throughout the year, then it would have lost $223 million in the WTI rollovers and $375 million in the gasoline contract rollovers for all of 1993.

Corporate governance

In early 1994, Christopher Culp and Merton Miller initiated what became an extensive debate about corporate governance within the corporate community about the implications of the MG affair.11

Culp and Miller strongly defended MGRM, on the basis of the view that the "stack-and-roll" strategy could have worked but that it required very considerable financing on the part of its parent company. When the market flipped from backwardation to contango, the cash-flow requirements in the form of margin calls from NYMEX were not offset by cash inflows and would not be for a long, long time due to the disparate maturities. As noted by other reviewers, MGRM thus disclosed an operational risk in strategies entailing positions of this magnitude: the failure of the parent company (or investors, to use the more recent example of Long-Term Capital Management) to remain committed to the financing strategy. Upon reviewing the mark-to-market losses, the parent MG terminated the financial positions precipitously.

Culp and Miller's view of the merits of MGRM's strategy is strongly conditioned on their belief that backwardation in oil price structures is normal ("average rollover costs will be negative...storage and interest costs will be positive"). That belief indicates that MGRM's strategy would usually work.

The management of MG-in the wake of the termination of MGRM's activities-argued that Culp and Miller were wrong and that MG could have faced a $50 billion loss.12 In November 1994, MG announced a $1.75 billion loss that wiped out its capital and forced it to seek funds from shareholders. In January 1995, auditors released a report accusing MG of inadequate supervision. In February 1995, MG released information on further losses, $2.2 billion, requiring capital write-downs and more infusions of funds.

In the spring of 1995, Mello and Parsons jumped into the debate with a paper that defined the MG rolling stack strategy as speculation.13 In the fall of 1995, Miller and Culp defended MGRM's activities, in essence arguing that-as a skillful participant in oil markets-MGRM was in a position, if anyone was, to exploit backwardation in well-designed hedging programs. In considering Mello and Parsons' criticism of "mismatched maturities," Culp and Miller argued that MG became a market for long-dated oil instruments precisely because there wasn't one. Certainly, Enron Corp. has shown that it is good business to be a market-maker in areas where the exchanges and investment banks have been unable to succeed. If there had been the perfect "strip" and financial counterparties that Mello and Parsons wanted to see, MG's strategy wouldn't have been needed anyway.

The final aspect of the MG affair's contribution to the debate over corporate governance was about how parent MG unwound its position. Quite often, derivative "disasters" that involve a corporate parent suddenly "discovering" that an affiliate or a trader has amassed enormous mark-to-market losses end up with a sudden and precipitous termination of all trading activities. This is not surprising, given that corporate executives may be held liable for failing to act once the "disaster" becomes public knowledge.

In many cases, however, such precipitous action winds up yielding higher losses than if the accounts were unwound more slowly and deliberately. This may well have been the case with MGRM. A key factor in making that judgment is whether MGRM's own strategy-and the sheer size of its position-would have made it difficult for the market to recover from contango in 1994. There is evidence that MGRM, in essence, inadvertently targeted itself for execution.

Inadvertent self-targeting: hedge funds vs. MG

Why did the market slip from its typical pattern of backwardation? The answer to this question is far from self-evident.

There are various schools of thought on what the "normal" price structure of a commodity should be, ranging from John Maynard Keynes's view that contango should dominate (because speculators require a large risk premium to take the long positions in the prompt months of the futures markets) to the view that backwardation should rule because the "convenience yield" of oil is so great.14

While there is as yet no consistently convincing theory of the "proper" structure of oil futures prices, we believe that, in 1993, MG itself became one of the dominant variables in the backwardation-contango equation. There is evidence that MG's need to roll over its large long contracts became a factor that by itself helped to push crude oil prices into contango. As MG entered the market each month to roll over its position-effectively moving paper crude oil demand and supply curves all by itself-its need for counterparties to take the short side of its long positions became more and more transparent:

"According to MG, the position it was rolling over in the market each month was so big that it was distorting the normal equilibrium of supply and demand. The company says its massive position was equivalent to 85 days' worth of the entire output of Kuwait."15

This breathless analogy with Kuwait-a line issued by MG's own report on the situation-reverberates through the coverage of the popular press of the MG case. Even so, the size of MG's positions was an issue, as the analysis of even as thoughtful a journal as Risk conceded:

"Contrary to Miller and Culp's view that MG itself was not affecting the shape of the forward price curve, MG was a big enough factor in the market that the market could have remained in contango for a long time...There would have been monthly rollover losses for several [more] months until the front end of the curve recovered, and these losses could have reached several hundred million dollars.16"

NYMEX WTI prices were in contango for much of 1993. Contango may initially have emerged as a result of factors having little to do with MG. But in the course of the next 12 months, it became more and more obvious that other traders were formulating trading strategies that exploited MG's need to liquidate its expiring long position. At the end of each trading month, as MG tried to liquidate its long positions by buying the offsetting shorts, other traders would add their short positions to MG's, creating the paper market equivalent of a glut in supply that initially exceeded the number of longs, driving prices down until the market reached equilibrium.

There is evidence in the Commitment of Traders reports that speculators jumped into the fray against MG. Fig. 2 shows that the noncommercials systematically took large net short positions in the WTI contract, effectively exploiting MG's position. The combined force of MG's selling its long position in the prompt contract and other traders increasing their short positions was severe downward pressure on crude prices as the prompt-month contract neared expiration. This effect is clearly seen in Fig. 2, which shows how the dips in prompt month prices coincided with the contract expiration dates.

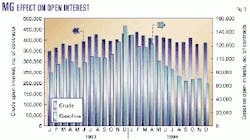

In essence, MG had gotten too big for the market. As evidence for that we have not only MG's own accounts of the size of its positions, but also the post-MG record of the open interest in the NYMEX oil markets. Fig. 3 shows the evolution of the monthly average open interest in the crude and gasoline markets from January 1993 to December 1994. As MG's positions grew in 1993, it raised the open interest in the crude contract from about 350,000 contracts in January 1993 to a peak of 430,000 contracts in August. Similarly, in the gasoline market, MG helped drive open interest to a peak of 140,000 contracts. After MG ceased trading in December 1993, it took the crude and gasoline market 3 years to recover to these levels of open interest.

Conclusions

MG's fiscal year ended on Sept. 30, 1993, and it gradually became evident that the parent company would have to disclose the extent of the US affiliate's paper losses emerging from its massive swaps positions. Press reports began to circulate in early December 1993, and trading of MG's stock was suspended in Frankfurt on Jan. 6, 1994. MG issued an announcement to its shareholders in early January that losses were "nearly $1 billion."17 MGRM's supervisory board had decided in December 1993 to end the forward-sales program and appointed a new management team to unwind its positions.

This decision itself, along with the characterization of MGRM's program as hedging or speculation, would become the major points of controversy in the post-mortems of the MGRM derivatives program. On one side of the debate stand those-such as Merton Miller, whose Nobel Prize in economics assured him a respectful hearing from reporters covering the case-who believed the MGRM program was fundamentally sound and a proper target for the business expansion of a firm with MGRM's financial strength. Essentially, this side argued that firms such as MG should exploit their greater expertise in price relationships (geographic and temporal basis risk) in their business strategy. For these observers, the senior executives of MGRM's parent firm, its financiers and advisers (especially Deutsche Bank) were guilty of incompletely understanding the bold and innovative position of its US affiliate, and in their panic over the size of paper losses, they terminated the program at the worst possible time, locking in the losses.

On the other side stand the more-conservative analysts of corporate finance, such as Mello and Parsons. For them, the temporal mismatch of MGRM's contracts transformed the contracts from hedges to speculation. As such, MGRM's parent company and its banks were justified in terminating a program that, after all, had not been sold to them as a speculative exercise. As Mello and Parsons noted, "A speculation with one's own money is one thing, a speculation with the creditors' several billion dollars is another thing entirely."18

Ironically, the supervisory board made its decision when WTI prices reached their lowest level (less than $14), and when MGRM's ongoing losses were at their peak. As Franklin Edwards and Michael Canter point out in their critique of MGRM's parent company and the supervisory board's actions, "Had MG's supervisory board not ordered the liquidation until sometime later, the situation would be far different today. From Dec. 17, 1993, when the new management team took control, to Aug. 8, 1994, crude oil prices increased from $13.91 to $19.42/bbl...and gasoline prices increased from $16.88 to $25.54/bbl. Given these price increases, MGRM would have had a massive inflow of margin funds on its derivatives positions."19

Miller was more blunt in his criticism of MG's board. A Risk magazine essay on Miller's "intellectual fury" over the case noted that "Miller, a self-professed 'futures man'...could not tolerate any more sloppy attacks on the futures markets, which he had admired for their efficiency so long." The Risk essay went on to note that, "unlike many popular press accounts, Miller and Culp's paper ["Hedging a Flow of Commodity Deliveries with Futures..."] redirects blame for these losses further up the corporate ladder, to MG's supervisory board."20 In yet another newspaper review of the controversy, Miller argued, "They [the MG supervisory board] thought it was an oil bet that had gone sour. But that's not what happened. They cut the hedge off too soon. If they had done things right, they wouldn't have lost $1.3 billion." Miller asserted that Deutsche Bank was the culprit. The bank was both a major shareholder of and lender to MG.

One of the few things the post-mortems seem to have glossed over is the trap that MGRM had gotten itself into by becoming the dominant participant in the futures markets. By the fall of 1993, some traders had come to anticipate the rollovers of MG's positions. At that point, MG had entered into a "can't win" situation. It was big enough to have its needs noticed, but not big enough to impose its will on the market. Thus, each month's rollover invited others in the market to short the outgoing contract.

As long as its huge position was in the market, MG hung there like a big piñata inviting others to hit it each month. The self-entrapping nature of its positions is what is missing from Edwards and Canter's, and even Culp and Miller's, defenses of MG. Had MG remained in the futures markets in such large volumes, the downward pressure on prompt prices would have resurfaced each month, and the price recovery and return to backwardation that did occur likely would have been slower in coming. That is not to say that MG was the only factor in the market. There were many others. But MG probably was the dominant factor at crude and product contract expiration time. Thus, had MG remained in business, even if there had been a fundamentally driven, gradual improvement in the underlying level of crude prices, there would also have been, as each contract expiration date came along, a sharp return to contango resulting from traders' efforts to exploit MG's rollover.

The size of MG's position in the exchange-traded contracts, therefore, became its fatal flaw. That flaw, in turn, was the product of the flaw in MG's theory that backwardation is the normal condition of oil markets. Even though the "convenience yield" provides a powerful theoretical argument in favor of chronic backwardation in oil markets, there remain at least two important practical reasons why the theory often will not apply. The first is the likelihood of "erratic" behavior by the Organization of Petroleum Exporting Countries; the second is the unpredictability of speculators' behavior in the oil markets.

Regarding OPEC, it is important to remember that the most important period of contango prior to the MG case was in the first half of 1990, when an intra-OPEC battle for market share ignited by Kuwait led to a glut in the physical market that in turn caused enormous contango (in excess of $2/bbl between the fourth and prompt WTI contracts). Given that intra-OPEC relations are bad enough now-and will only get worse when Iraq is allowed back into the market-contango is always just a political moment away from returning to the oil market. The price collapse of 1997-98-and OPEC's role in bringing that to an end with its decision to cut production in the spring of 1999-was only the latest example of what is by now a 20-year history of oscillating backwardation and contango.

The second practical argument against relying on crude price backwardation rests on the behavior of the noncommercials. Fig. 4 illustrates that contango and backwardation have been strongly influenced by speculators' net positions: a strong net long position tends to contribute to backwardation, a strong net short position to contango. This has been the rule since 1991, when we believe speculators (organized more and more as hedge funds) became a more and more important force in setting short-term prices. Table 5 illustrates the close connection between the number of days noncommercials were net long and backwardation on the one hand, and the number of days noncommercials were net short and contango on the other hand.

These relationships are intuitively reasonable. If speculators are strongly net long, they are contributing to strong prompt demand for crude, albeit of the paper variety. If they are strongly net short, they are contributing to strong prompt supply. The Commitment of Traders report shows that noncommercials tend to be net long. Moreover, MG itself distorts the picture; without it, the number of days noncommercials were net short would have been fewer. Nevertheless, the comings and goings of noncommercials are not readily amenable to oil market analysis. There is always a chance that exogenous circumstances can lead them to change their position suddenly, throwing the market into a prolonged period of contango.

The argument against chronic backwardation, in other words, rests on the continuing high likelihood that discontinuities will plague the oil market. It is therefore doubly ironic that MG, having structured one of the most innovative derivatives in the history of the oil business, succumbed not from oil's historic source of discontinuities (OPEC), but because it became its own discontinuity.

Epilogue: don't assume MG's an endpoint

Among the most important debates to emerge from MG's experience is how to characterize speculation versus hedging in derivatives transactions. MG's acceptance of temporal basis risk-its embrace of chronic backwardation-obviously rested on flawed market views. That leads some executives and other students of business to characterize taking any basis-risk position-geographic or temporal-as speculation. Hence, there is Mello and Parsons' strong condemnation: "We claim, moreover, that careful examination of MGRM's business plan, as well as the history of its trading activities and most especially the exaggerated size of its stack, all lead one to the conclusion: MGRM's management was speculating...MGRM's decision to run a 'front-to-back' [reliance on backwardation] strategy is just the oil market equivalent of riding the yield curve in the bond market, with all the dangerous consequences that entails."21

But Mello and Parsons have a relatively parsimonious image of the purposes of hedging. Referring back to the seminal work on hedging by Holbrook Working, Culp and Miller point out, "Pure risk-avoidance hedging is only one of several types of real-world hedging Working identifies; MGRM's strategy represents what he would call 'carrying-charge hedging' and what we called 'synthetic storage.' Working explains: 'Whereas the traditional concept [of hedging] implies that hedging is merely a collateral operation that...would influence the [physical inventory or] stockholding only through making it a less-risky business, the main effect of carrying-charge hedging is to transform the operation from one that seeks profit by anticipating changes in price levels to one that seeks profit from anticipating changes in price relations'[emphasis added].

"Carrying-charge hedging, in other words, may be undertaken by value-maximizing corporations to exploit their superior information about price relations, like the basis, while remaining 'market-neutral' with respect to spot prices."22

Here is the debate in a nutshell: MG appears to have given the advocates of parsimonious uses of futures and derivatives plenty of ammunition to tell their clients to go slow, to be careful. And that surely is good, not to mention safe, advice. But Culp and Miller remind us of the value-maximizing purpose of business. And they remind us that futures and derivatives are tools to deploy to maximize value. Thus, students of business should study the MG case not only to derive lessons about the parsimonious use of derivatives and futures, but we should also learn from MG how programs of similar scope and boldness might be structured that do not have MG's fatal self-entrapping characteristics. Thus, we conclude with a cautionary statement of our own: if oil industry executives listen too closely to those with Metallgesellschaft-angst, they may miss the opportunity to participate in-or protect themselves against-the MG deal done right.

References

- Culp, Christopher, and Miller, Merton H., "Corporate Hedging in Theory and Practice: Lessons from Metallgesellschaft" (London: Risk Publications, 1999).

- Both reports were analyses commissioned by clients and thus not published in trade or academic journals.

- From "Order Instituting Proceedings Pursuant to Sections 6 and 8a of the Commodity Exchange Act and Findings and Order Imposing Remedial Sanctions, CFTC Docket No. 95-14," July 21, 1995.

- Southerland, Daniel, "Price Wars Burning Up Gas Profits," in Washington Business (Supplement to the Washington Post), Dec. 18, 1995, p. 1.

- Even this runs the danger of oversimplifying. It is quite likely that gasoline outlets owned by nonrefiners -for example, convenience store chains-are more willing to operate the gasoline outlets as permanent "loss leaders" than oil companies would.

- Mello, Antonio S., and Parsons, John E., "Maturity Structure of a Hedge Matters: Lessons from the Metallgesellschaft Debacle," Journal of Applied Corporate Finance, p. 107.

- CFTC, ibid.

- Jayaraman, Narayanan, and Shrikhande, Milind, "Financial Distress and Recovery at Metallgesellschaft AG: Destruction or Resurrection of Value," (School of Management, Georgia Institute of Technology).

- Culp, C.L., and Hanke, Steve H., "Derivative Dingbats," International Economy, July-August 1994, p. 14.

- By associating MG's trading with the carrying-charge hedging model developed by agricultural economist Holbrook Working in the 1950s and 1960s.

- Culp, C.L., and Miller, M.H., "Hedging a Flow of Commodity Deliveries with Futures: Lessons from MG AG," Derivatives Quarterly, Fall 1994, pp. 7-15.

- Nasar, S., "The Oil-Futures Bloodbath: Is the Bank the Culprit?" New York Times, Oct. 16, 1994.

- Mello, A.S., Parsons, J.E., "Maturity Structure of a Hedge Matters: Lessons from the Metallgesellschaft Debacle," Journal of Applied Corporate Finance, Spring 1995, pp. 106-120.

- For a good general discussion of the oil offer curve, see Jacques Gabillon, "Analyzing the Forward Curve," Managing Energy Price Risk, (London: Risk Publications, 1995).

- Waters, Richard, "Case Study for Business Schools," Financial Times, (special section on derivatives), Nov. 16, 1994, p. 11.

- "MG's Trial by Essay," Risk, October 1994.

- Contemporaneous press reports almost unanimously editorialized about the difficulties of trading "complex," "risky" derivatives. Economist Merton Miller, Christopher Culp, and Steven Hanke would subsequently fault these stories as part of a pattern of overreaction by MG management, NYMEX, and others that caused MG to roll up its positions in a far more costly way than was necessary.

- To which Culp and Miller replied, "MGRM was one subsidiary of a large German conglomerate, MG AG, in which Deutsche Bank, one of the world's biggest banks, was not only the leading creditor but, thanks to multiple cross-holdings with other stockholder firms such as Allianz and Daimler Benz, also the controlling shareholder." "Hedging in the Theory of Corporate Finance: A Reply to our Critics," Journal of Applied Corporate Finance, Spring 1995, p. 121.

- Edwards, Franklin S., and Canter, Michael S., "The Collapse of Metallgesellschaft: Unhedgeable Risks, Poor Hedging, or Just Bad Luck?", The Journal of Futures Markets, 1995, No. 3, pp. 211-264.

- Risk, October 1994, ibid.

- Mello and Parsons, ibid., p. 120.

- Culp and Miller, ibid. p. 122.

The author-

Edward N. Krapels is director for gas and power market services of Energy Security Analysis Inc., an international energy research and analysis firm with clients in every major consuming and producing country. As a commodity trading advisor, he is also managing director of ESAI's sister company, METIS Advisors, which helps energy consumers and producers develop hedging strategies.